Overall the US digital games market totaled $1.01 billion in sales in March, a 2% increase year-over-year. The free-to-play MMO market reached $136 million in revenues, translating to 9.6% growth compared to the same month last year. A string of announcements, including a release date for Infinite Crisis from Warner Bros. subsidiary Turbine (NYSE: TWX) and Magic Duels: Origins from Wizards of the Coast (NASDAQ: HAS) continues the momentum in the free-to-play segment. Spending on mobile games was flat (-0.4%) compared to March 2014, but has been steadily improving following the seasonal dip during the first quarter. Following its earlier success, Glu Mobile (NASDAQ: GLUU) doubled down on the Kardashian family by signing a licensing agreement with Kim's half-sisters Kendall and Kylie Jenner, hoping to target mobile gamers in their teens and early 20s. Meanwhile, the social games segment appears to be in a free fall, dropping almost 10% in revenues during that same period. Despite new releases by Kabam, the enthusiasm for social games is waning in favor of games on tablets and smartphones. and smartphones.

SONY HITS HOME WITH BLOODBORNE, SELLING 155K DIGITAL UNITS WORLDWIDE

After the release of the beautiful but terribly short game The Order: 1886 proved somewhat of a disappointment, the March release ofBloodborne has the makings of a hit for Sony (NYSE: SNE). The combined sell-through of over a million units just twelve days after release is a remarkable success. (It is important to note that 'sell through' refers to units sold to consumers.) By comparison the game's spiritual predecessor Dark Souls 2, published by Bandai Namco (7832), managed to ship 1.5 million units in its first month, but this was across three platforms and a much larger install base. As consumers grow accustomed to downloading games directly to their consoles, publishers have started to notice an increase in demand coming through digital distribution. The latest installment of the Battlefield franchise published by Electronic Arts (NASDAQ: EA,Battlefield: Hardline, performed well, too, selling just under 425,000 digital units across platforms in March. Overall the digital console market in the US increased 20% in March compared to the same month last year, totalling $84 million in sales.

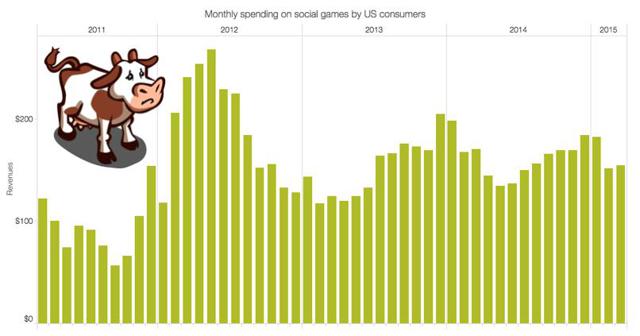

PINCUS TAKES BACK THE WHEEL AS SOCIAL GAMING MARKET DROPS 10%

Following the announcement of Don Mattrick's sudden departure from his position as CEO at Zynga (ZNGA), investors responded with a wave of questions regarding the company's future. It's not been an easy job, of course. During Mattrick's tenure the overall social games market dropped 6% in size and the monthly active user base has been largely stagnant, hovering around 188 million. Under his leadership, Zynga's strongest franchise, FarmVille, was unable to counteract the softening of the market and dropped more than $9 million in monthly revenues to just over $2 million. By comparison, King (KING) has managed to offset a similar decline in revenues and its Candy Crush Saga on Facebook still operates at the same monthly earnings from two years ago. Overall, the social games segment totaled $154 million (March 2015), 42% lower compared to May 2012, when the market was at its peak. And things are not looking up: current spending patterns indicate a year-over-year decline of 7% in social gaming for 2015E.

NINTENDO MOVES TO CLAIM STAKE IN $22.3 BILLION MOBILE GAMES MARKET

The announcement of a partnership with DeNA (2432), a $2 billion a-year mobile games company in Japan, proved welcome news for worldwide gaming audiences. Initially hoping to generate a modest $15 million in monthly revenues by leveraging its best-known properties, Nintendo (7974) has finally made a clear commitment to the mobile games market, which is on track to reach $22.3 billion in worldwide revenues this year (2015E). As a growing number of mobile game companies set their sights on Asia, and specifically China, building a strong presence in Japan may yet be the more convincing strategy on tackling this market as mobile revenue per paying user is more than three times higher there than in China. If nothing else, it will help offset the never-ending increase in marketing expenses, especially now that TV commercials are becoming the next frontier in user acquisition wars. It is to be expected that Nintendo's existing franchises will continue to drive sales, as is the case of Super Smash Brothers on the Wii U. But it demands a sufficient adaptation to mobile platforms: one of the company's more recent releases, Pokémon Shuffle, did manage to accumulate over a million players but still stands clearly in the shadows of titles like Puzzle & Dragons by Gungho Online Entertainment (3765) despite their apparent similarities.