Deal Target Description

Pepco Holdings (POM)is a utility holding company in the mid-Atlantic region engaged in the transmission, distribution, and supply of electricity as well as the distribution and supply of natural gas.

Deal Terms

The retirement of POM's longtime CEO lead to rampant deal speculation. Exelon Corporation (EXC) was the most logical buyer. However, PPL (PPL), FirstEnergy (FE) Public Service Enterprise Group (PEG), and American Electric Power (AEP) were alternative bidders. By April 2014, it was well-known that POM was on the market. On April 30, 2014, EXC and POM announced a definitive agreement under which Pepco shareholders will receive $27.25 per share in cash.

Deal Financing

The deal is not conditioned upon financing. Morgan Stanley (MS) represents the target and Goldman Sachs (GS) represents the acquirer. The transaction is supported by a fully committed $7.2 billion bridge facility with Barclays (BCS) and GS. EXC expects the permanent financing plan to include a combination of EXC equity issuance, long-term debt and corporate cash. The financing for the POM deal is largely coming from up to $1 billion of EXC divestitures of non-core assets. As of February 2015, EXC had divested assets worth about $1.8 billion on a pre-tax basis.

Deal Conditions

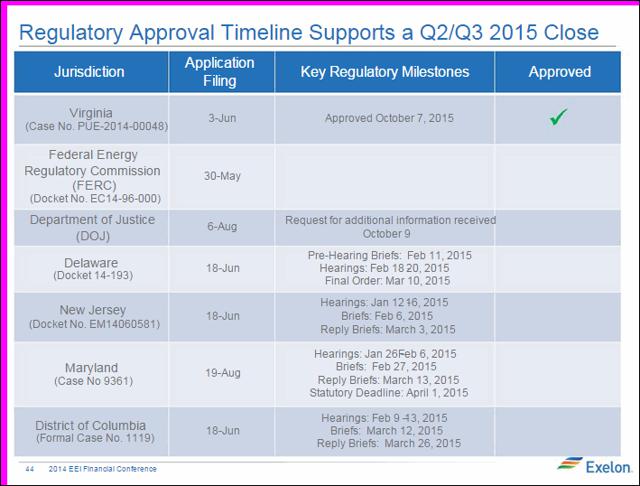

The transaction requires the approval of the stockholders of Pepco Holdings. Completion of the transaction is also conditioned upon approval by the:

- Federal Energy Regulatory Commission/FERC

- District of Columbia Public Service Commission/DC PSC

- Delaware Public Service Commission/DE PSC

- Maryland Public Service Commission/MD PSC and

- New Jersey Board of Public Utilities/NJ BPU

The transaction is also subject to the notification and reporting requirements under the Hart-Scott-Rodino Act/HSR and other customary closing conditions.

As of Thursday, April 30, 2015, the merging companies have made progress towards the deal's completion. They filed their FERC application on May 30, 2014. FERC cleared the deal on November 14, 2014.

On June 14, 2014, they filed their applications with public utility commissions/PUCs in Delaware, New Jersey, and Washington, DC. On August 14, 2015, they filed their PUC application in Maryland, which will probably be the gating item. On September 23, 2014, POM shareholders approved the deal. They secured their first regulatory approval on October 8, 2014 with the Virginia State Corporation Commission approval. On January 14, 2015, the companies reached a settlement with the New Jersey Board of Public Utilities staff. The commissioners approved it on February 11, 2015. In February, they reached a settlement with the Delaware staff. After settling with Delaware staff and securing New Jersey approval, the companies extended the same offers to DC.

The Department of Justice/DOJ issued a second request for additional information on October 9, 2014. The DOJ probed the interconnection process in certain sub-regions. The DOJ also had concerns about the FERC approval. Ultimately the DOJ cleared the deal on December 22, 2014.

As of March 2015, it was clear that the Maryland review would be the gating item. They enhanced their proposed package of merger benefits to help secure that approval. They also settled with the Alliance for Solar Choice, one of the interveners in the Maryland review. In another settlement, the companies came to terms with Montgomery and Prince George's counties. The Maryland Attorney General and the Maryland Office of People's Counsel opposes the deal. The Maryland PSC decision deadline is May 8, 2015.

Deal Price

The deal price is about a 25% premium to the previous market price for POM. There is currently a $1.53 net spread which is worth about a 23% annualized net return to a close around August 1, 2015.

Conclusion

While this is currently a political zoo, the deal will probably be able to close sometime in the third quarter of this year. Relative to the deal risks and the downside if the deal breaks, POM offers an attractive 23% annualized return.