First there was the internet, then the advent of smartphones, now investors have started to take notice of what's flying in the sky…or rather, what's about to. Unmanned aircraft systems promise to achieve a more significant aspect of commercial market presence.

Army Unmanned Aircraft Systems flying some 3 million flight hours gives drones some market credibility but just like the origination of the Internet, the Army's brainchild has now been adopted by the mainstream with action sports and weekend warriors now taking advantage of this new industry.

The deep pockets of Silicon Valley's venture capitalists are dumping cash into the drone industry right now. During the first half of 2015, venture capitalists have invested over $170 million into drone companies, according to CB Insights. That's up from $107 million for all of 2014.

Companies are not waiting to jump into this space any longer especially since the civilian sector for drones has become a much larger area of focus as compared to military markets. Wearable camera company, GoPro (GPRO) confirmed plans this past May that the company would be making a push to enter the market. Though it may be playing catch-up to China-based Dajiang Innovation Technology who's just been given an $8 billion valuation following its last raise, $75 million with Accel Partners; an early investor in Dropbox and Facebook. GoPro's CEO, Nick Woodman finds that even though shares of GPRO are up significantly from the IPO price ($24), this move is hoped to reignite interest in its stock after having fallen from highs in 2014 of nearly $100.

Companies like 3D Robotics make drones specifically for the GoPro so this move would seem natural for the Company. 3D Robotics CEO Chris Anderson told Forbes, "What GoPro allows is for people to shoot their lives in cinematic styles, and that's exactly what drones can offer."

Unmanned aerial systems markets -- at $609 million in 2014 -- are forecast to reach $4.8 billion dollars worldwide by 2021 according to market research firm, Radiant Insight. This is sizable as far as market growth is concerned. Oil and gas mapping, utility line inspection, package delivery, and agricultural applications account for virtually all the unit sales while there is a total emergence of a new niche market for action sports and civilian use just beginning to grow.

AeroVironment (AVAV) generated over $259 million in revenue for its fiscal 2015 with gross margin of 40% and an increase of roughly 3% and 11% respectively from the same period in the previous year. Unmanned aircraft systems accounted for more than $220 million of these revenues. AeroVironment is best known for building the "Nano Hummingbird", which can fit in the palm of your hand and was named one of the best inventions of 2011 by Time.

Raymond Cook was named senior VP and CFO in July and brings nearly 30 years of financial experience to the table during a period of year over year growth for the company. Having prior experience in data connectivity and imaging it would stand to reason that his experience is valid to fill such a position. Though the stock has seen a recent decline in price since hitting highs of over $40 last year.

Research company The Teal Group believes spending on drones will double over the next 10 years, totaling more than $91 billion in the process. Drones can provide more information with less cost than a human inspection team can and they've also become a more efficient means of recording life's exciting events.

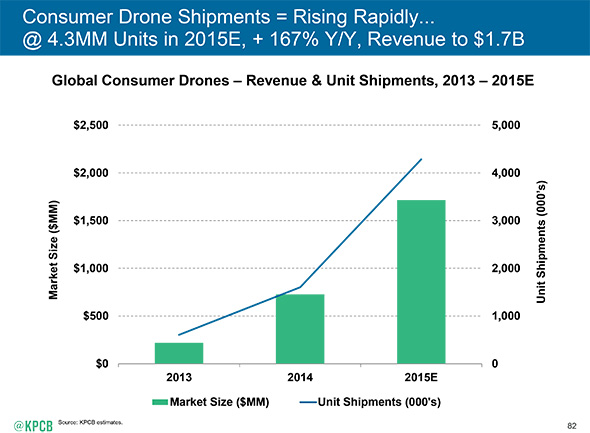

"The worldwide market for consumer drones could reach 4.3 million units this year, a 167% increase from 2014, and revenue from such devices is expected to climb to $1.7 billion, from approximately $750 million a year ago."

Mary Meeker, Analyst, Kleiner Perkins

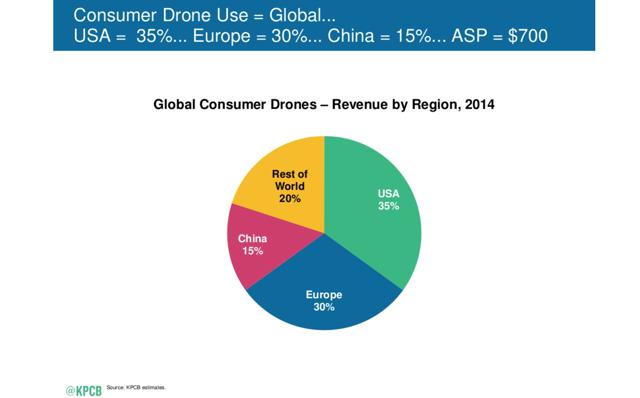

According to analysts at Kleiner Perkins, the market for consumer drones could exceed 4 million units in 2015…a near 200% increase compared to that of 2014. Reports from Business Insider state that the market for commercial/civilian drones will grow at a compound annual growth rate (OTC:CAGR) of 19% between 2015 and 2020, compared with 5% growth on the military side.

Companies that were not traditionally focused on the space have begun to take notice of this obvious market growth. Google (GOOG) for example, has taken a stab at the space and has another purpose for drones. They plan to deploy drones to help expand Internet coverage by way of a solar powered drone. Last year the company acquired Titan Aerospace, which Titan claims that its drones can help deliver data at speeds of up to one gigabit a second using special communications equipment. In a statement to CNN Google said, "Titan Aerospace and Google share a profound optimism about the potential for technology to improve the world…It's still early days, but atmospheric satellites could help bring internet access to millions of people, and help solve other problems, including disaster relief and environmental damage like deforestation."

Of course in response to Google, Facebook (FB) has also thrown a hat into the ring for Drones and is focused on the same "internet everywhere" initiative. The social media giant scooped up U.K. based Ascenta at a price of $20m to become part of the company's not-for-profit Internet.org program. Facebook goes head to head with Google and boasts that its solar powered Internet delivery drones can run for days, months, or even years.

Outside of the push for universal Internet, it's been no secret that Amazon (AMZN) has also been intent on jumping into the space. The multi-billion dollar online retail giant wants to focus on using drones for, among other things, shipping. Branded as "Amazon Prime Air" the company is designing a system to safely deliver packages to its customers' hands "in 30 minutes or less". In a letter to The Federal Aviation Administration, Amazon states that its drones will travel over 50 miles per hour, and will carry 5‐ pound payloads, which cover 86% of products sold on Amazon.

Since making the move, Golden Star enterprises has successfully received new shipments of their drones for an online marketing campaign. Similar to GoPro, Golden Star focuses on the expanding action sports and civilian customer base by offering smaller, more affordable and have a low learning curve for the avid weekend warrior or action sports enthusiast. Their X-factor and Kasper models are targeted toward this group and this being the early stages of development, Golden Star has begun to rollout this new marketing plan by focusing on contracts with alpine resorts.

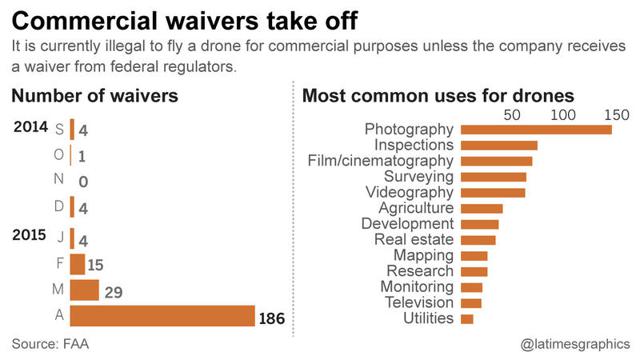

Though this is just the early phases for development, this doesn't go without risk. This, of course, is outside that of general market risk. There are a slew of federal guidelines and regulations in place that these companies are subject to. These include the Federal Acquisition Regulations, Defense Federal Acquisitions Regulations, Truth in Negotiations Act, Foreign Corrupt Practices Act, and the False Claims Act just to name a few. In 2006, the FAA issued a clarification of its existing policies stating that, "in order to engage in public use of small UAS in the U.S. National Airspace System, a public operator must obtain a Certificate of Authorization, or COA, from the FAA or fly in restricted airspace.

The FAA's COA approval process requires that the public operator certify the airworthiness of the aircraft for its intended purpose, that a collision with another aircraft or other airspace user is extremely improbable, that the small unmanned aircraft system complies with appropriate cloud and terrain clearances and that the operator or spotter of the small unmanned aircraft system is generally within one half-mile laterally and 400 feet vertically of the small unmanned aircraft system while in operation".

Furthermore, the FAA's clarification of existing policy states that the rules for radio-controlled hobby aircraft do not apply to public or commercial use of small UAS. In 2012, the U.S. Congress mandated that the FAA develop rules that provide for the integration of small UAS into the U.S. National Airspace System by September 30, 2015. On September 25, 2014 the FAA began issuing case-by-case authorization for certain unmanned aircraft to perform commercial operations prior to the finalization of the rules providing for the integration of small UAS into the U.S. National Airspace System.

There is risk involved that the government could amend any rules currently in place while there are also scenarios that certain certifications or requirements may not met by companies during their submission period.

Despite these risks, the market for action sport and general civilian use of drone is becoming more popular as guidelines become more clearly outlined. As this market has begun to progress, it would be prudent to have a game plan on taking advantage of not only the market growth but also the potential growth that many of these companies offer during the primary phases of expansion within that market.