Oculus Innovative Sciences, Inc. (OCLS) recently reported its fiscal Q1 2016 results, ended June 2015. Despite a 37% increase in product revenues led by 122% growth in the United States, the market was not receptive to the company's overall 8% revenue growth even though the negative impacts such as the Euro and Peso decline relative to the U.S. Dollar and the winding down of the revenue stream from the Innovacyn animal healthcare partnership aren't core operating issues, so the stock price took a severe hit. Some investors were left disappointed and sold the stock, which provides an opportunity for others to buy OCLS at a bargain as it progresses towards achieving higher revenue figures as the dermatology business grows.

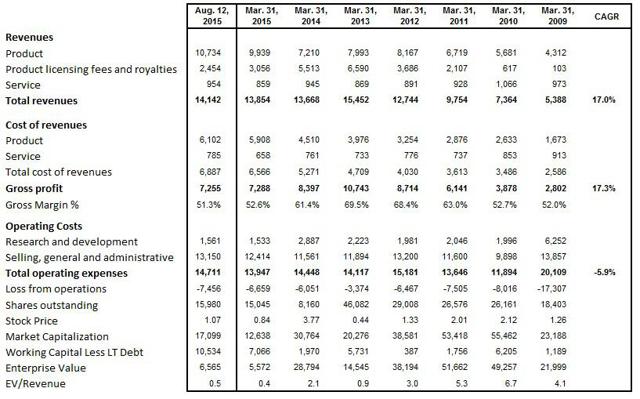

The following chart summarizes the financial performance and valuation metrics of the last seven full years of operations since the company was in its infancy in 2009 until today. The column ended August 12th includes the most recent quarter while dropping off Q1 2015 (ended June 2014):

Reviewing these numbers shows a company which has grown its revenue and gross margin at a solid pace while keeping costs steady since its inception, but has fallen out of favor with the market as its EV/Revenue metric has drastically declined.

From the six years ended March 2009 through 2015, revenues have increased at a 17% compound annual growth rate. Gross margins have increased at a slightly faster 17.3% rate. This shows that Oculus has desirable products that have gained some traction in the markets they have targeted. With the new focus being on dermatology, initial indications suggest that OCLS can once again grow its revenues at the robust pace seen in earlier years and move away from the stagnation it has encountered since 2013. With revenue averaging $3.9 million over the past two quarters, OCLS looks set to surpass the $15.5 million in revenue earned in fiscal 2013.

While revenue returns to a pace of solid growth, OCLS has managed to contain its costs over the years. The six-year CAGR on operating expenses from March 2009 to March 2015 is -5.9%, mainly driven by a large decrease in 2010 with reasonable growth in costs afterwards to support the growing business. The issue some investors may have is that OCLS has yet to pull a profit. It came close in 2013 but has regressed since then. The operating loss for Q1 came in at $2.3 million, which includes $0.4 million in stock based compensation and $0.2 million in banking expenses for the sale of the Ruthigen shares. Excluding those line items leaves OCLS with a $1.7 million quarterly burn rate, which should decline as revenue increases but research and development, sales and administrative costs remain steady. With $8.8 million in cash and $10.5 million in working capital, the company has set itself up well to try to achieve breakeven within the next two years without having to go back to the market for financing.

A company that has an operating loss while twiddling its thumbs is never an ideal investment, but OCLS has accomplished a few things that add to shareholder value even if its not reflected in the stock price yet. It managed to spin out its Ruthigen business which resulted in $4.5 million in cash, it has increased its intellectual property with a U.S. Patent being granted for its Microcyn Technology for atopic dermatitis, hired an experienced sales and marketing team, launched four products in dermatology, developed a strong future product pipeline and shown robust product growth in dermatology over the last three quarters. These events are the fruits of the labor from R&D investment that has been about $2 million a year since 2010. Now it is time for OCLS to justify its $13 million in SG&A costs by continuing to bring in more revenue from its new sales force, product platform and portfolio for the dermatology market in the United States.

OCLS stands out as a highly undervalued opportunity relative to its peers in the dermatology sector as I have shown in my previous article. These companies typically trade or get bought out at a minimum of 3 times and up to 100 times their revenue. OCLS once traded at an EV/Revenue in excess of 5 in 2010 and 2011 when its primary focus was wound and animal health care. Now as a company with a focus on dermatology (with revenue streams still coming in from the legacy businesses), it trades at an EV/Revenue of only 0.5. Q1 was a bump in the road for the company in terms of its stock price, but in terms of its operations it was business as usual. I believe that OCLS can trade at an EV/Revenue of 5 once again as the dermatology and overall U.S. product sales continue to grow, the Euro and Peso stabilize against the U.S. Dollar so international sales don't take a currency translation hit and the royalty revenues dissipate and have less of a negative impact on revenue growth in the future. I maintain my price target on OCLS of at least $5 as these events occur in the coming quarters.

Disclosure: I am long OCLSW, which are warrants on OCLS expiring in 2020 at a strike price of $1.30. They act similar to call options. I believe the warrants are under-priced given the long time to expiry and the volatility on the stock. Warrants represent a leverage opportunity and a risk management tool. For instance, a purchase of warrants at $0.50 when the stock price is $1.60 will result in intrinsic value of $1.90 if the stock price doubles to $3.20. Conversely, the warrants are worthless if the stock is under $1.30 upon expiry in 2020. But warrants can also be used to manage risk because an investor can put up less capital in OCLSW for the same dollar amount of upside compared to an investment in OCLS. Owning warrants is within my risk tolerance. Investors should decide if warrants are within their risk tolerance independently of my recommendation. I have been paid for this article. I purchased OCLSW prior to any contact or relationship to the company and this article is an accurate representation of my opinion on OCLS.