The obvious continues…

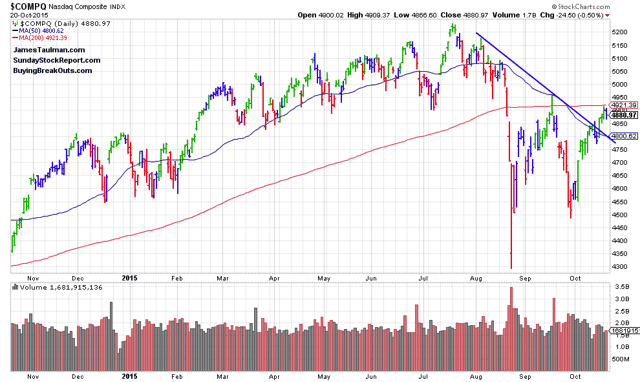

The market remains overbought, extended, and at formidable resistance.

The Nasdaq was not able to break above its 200-day moving average yesterday.

It does remain in a short-term uptrend.

We will just have to wait and see if it can break above there or finally turn back considerably.

Not much in today's report as you can see.

However, that in itself says something.

If I can not find any high raked stocks setting up in bullish technical bases, then there is nothing to do.

Best to just wait it out in cash for the time being.

On Monday we had what looked like a great breakout. Actually if you include the stocks at my other site BuyingBreakOuts.com then we had several breakouts that morning.

CMN, CALM, and GLOB

CMN - Not doing horrible, but between closing off of the highs on Monday and yesterday's loss it is getting back into its base.

CALM- Sold off yesterday with volume, on what was a relative calm day in the market.

GLOB - Major fail. Down -4% yesterday, and that is off the day lows. I sent a BUY: TradeTicker Alert in the AM and then a SELL: TradeTicket Alert in the PM just before the close.

Odds; not even 1 out of 3. Not what we are use to dealing with.

I will continue screening for potential LONGS or SHORTS as I do several times a day.

If I feel real good about getting into anything, I will let you know via email.