What types of investments do we make? Last month, we offered prospective members four investment examples. Two of them, Informatica and Magnetek, have been exited (both acquired for premiums) and two, Altera and Digirad, are current positions.

What happened next?

Altera

Altera (ALTR) returned over 25% since first on Sifting the World.

Since this idea was first disclosed on StW, the company announced a definitive deal to be acquired by Intel (INTC) for $54 per share in cash. The deal will probably close by the end of the first quarter of 2016. The net $1.60 merger arbitrage spread still offers a 7% annual return between now and then.

Digirad

Digirad (DRAD) returned over 70% since first on StW.

Since then, the company announced a financially attractive deal and a strong quarter. Digirad returned over 35% since this opportunity was recently disclosed to prospective StW members. This offers a sense of the ideas we offer.

So what?

So I have invested millions of dollars in these four and the others presented in our forum while members have made a multiple of their annual membership dues on ideas such as these. You could, too. If you would like to join us, you would be welcome to become a member. Here are some second opinions.

Akorn

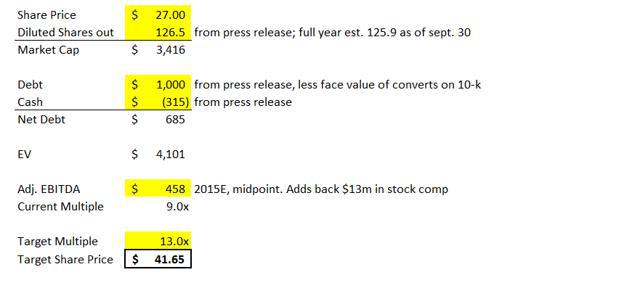

Akorn (AKRX) is a new StW idea. It is our best mid-cap idea for November. It is a specialty generics company that sold off because of accounting issues. Its weakness was compounded by a general selloff in the specialty pharmaceuticals. At the same time, the company has been growing. It is also likely to benefit from a buyout within the next few years. These factors make it a compelling risk versus reward. Today, you can buy the shares for under $30. They are worth over $40. That value could be revealed within the next quarter by resolving their accounting issues. By this time in 2017, it will probably be acquired. It is worth over $50 to a strategic acquirer. There are a number of buyers that would make logical fits. The solvable accounting problems offer a window to build up a position before that happens.

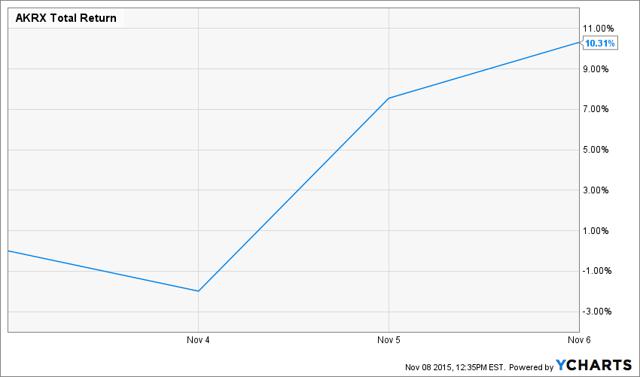

It has already offered StW members the opportunity to capture a 10% return.

It could return around 40% from here if it reaches the price that we believe reflects its intrinsic value.

Want more? Join us today.