This article was originally published at miningWEALTH.com.

*Note to U.S. investors: Northern Minerals trades on the OTC market under the ticker symbol (OTC:NOURF). Beware there is almost no liquidity in this stock and that investors should transact in this stock on the Australian Stock Exchange (ASX: NTU). Also note that it is called "Northern Uranium" on some finance platforms, as this used to be the name of the company before REEs were in vogue.

Overview: The Northern Minerals Short Thesis

Northern Minerals is in serious trouble. We think its stock can fall far, and that it can fall fast. There are 4 reasons for this:

- It is a non-producing resource company with debt.

- There is a massive stock overhang that is largely insensitive to share price.

- Its Browns Range Project is uneconomical at today's REE-prices.

- It is the most valuable REE-company not in production in spite of all of its problems.

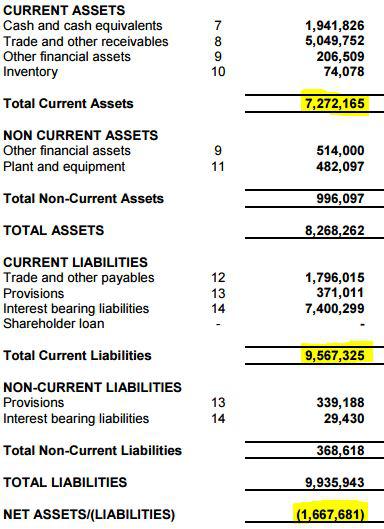

1: A glance at its balance sheet and cash-flow statements show that it had negative working capital as of the end of September, and it would have had negative equity if creditor Jien Mining didn't convert A$5 million of its debt to equity. On November 9th the company announced that it is slashing personnel, director salaries, management salaries...etc., meaning that cash is likely running thin. The company was supposed to receive a critical A$17 million payment (as part of a larger financing package) on November 30th from Jien Mining. It is now December 3rd, and no such financing has been announced: we question whether the company will actually raise it, or any more money for that matter, especially since it has not made a statement to the market since its failure to find financing.

2: On November 2nd--clearly desperate for cash--Northern Minerals entered into a "death spiral financing" arrangement providing it with A$1.5 million (nothing compared with the company's cash-burn rate) The company tries to hide the onerous terms of this miniscule financing behind opaque language describing a "A$4 million financing." Don't be fooled: this is a death spiral financing for a company with a stock that is now at A$0.105/share and has traded ~80k shares per day on average for the past 30 days. We've had three trading days since the formal end of the November 30th-December 1st trading halt(although we saw a couple small, mysterious trades on Dec. 1 when the halt was supposed to end on the 2nd) that followed the company's failure to receive capital, and Northern Minerals' shares haven't fared well: they're down 28%. Reasons for this are: (1) the market is questioning the company's access to capital, as it should, and (2) the barrage of short-selling that comes with a death spiral financing (structured almost risk-free by Lind Partners LLC, we give credit where it's due).

3: We question the value of its flagship project--the Browns Range Heavy REE Project. Given (1) the recent decline in REE prices relative to the proposed economics put forth in the recent definitive feasibility study, and (2) our estimation of the improvements that could come of the optimization research the company has done since releasing the DFS, it is highly unlikely that this can be an economic project.

4: Northern Minerals is the most expensive REE company other than Lynas (OTCQX:LYSDY), which is in production. $36 million may not be a very high valuation for a publicly traded company, but for a resource company with an uneconomical, non-producing asset with limited reserves and complex metallurgy and marketing we think this is a very high price to pay. This last point not only augments the short thesis but introduces the possibility for a pair trade. While we acknowledge the latter this will be the topic of another article.

This short thesis has long-term fundamental drivers, but near-term catalysts as well, and this, we believe, mitigates a key risk facing those looking to short the stock, namely rising REE prices. Nevertheless, the potential for REE prices to rise, especially HREEs which are only produced in China, must be addressed. This risk can be hedged using the aforementioned pair trading strategy, yet we believe that shorts are hedged from this risk given the near-term duration of the trade and the share overhang. However, rising REE prices can bring back interest from Jien Mining, and this would provide Northern Minerals with the cash it needs to cover its development costs, meaning a key aspect of the short thesis could be jeopardized.

Ultimately, however, we have a distressed company with a questionable project that had to resort to an onerous form of financing in order to keep its minimal day-to-day operations going. It did this out of desperation, but when it agreed to these terms management was also under the impression that additional capital was coming. It hasn't, and we contend that there can't be very much equity value in Northern shares, if any.

1--Northern's Balance Sheet and Cash-Flows

Northern has one of the fastest cash-burn rates of any junior mining company, especially in the junior REE-space where capital has grown extremely scarce. The company's A$25 million in exploration and feasibility-related expenses over the past two years (ended June 30th) is extremely high, despite the fact that one of the company's main selling points was that its Browns Range Project should have relatively simple hydrometallurgy given that it is a xenotime deposit, and xenotime is a mineral that is processed for its REEs in Brazil, Malaysia and China with a straightforward flowsheet that has been used for decades. Simplicity tacitly implies low cost, but this clearly wasn't the case.

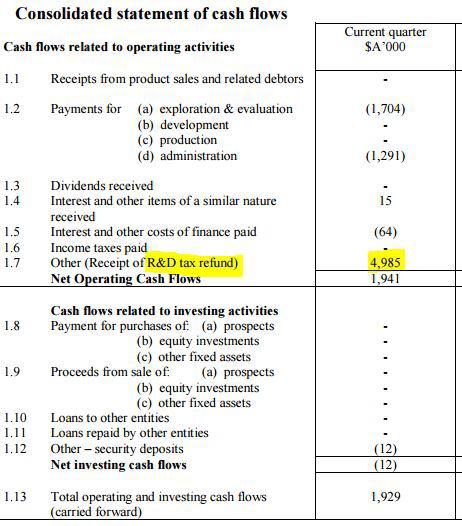

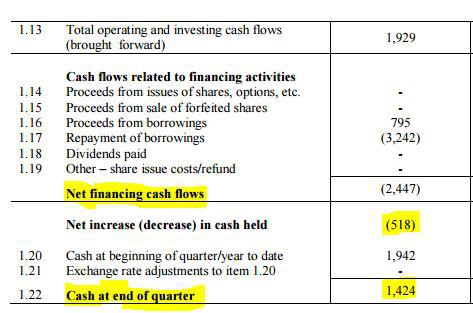

In all, over the past two years the company saw operating cash-flow of (A$36 million). The company's quarter ended (September 30th) saw a rapid outflow of cash, which was fortunately met by a research tax rebate of nearly A$5 million. Even with this the company saw a A$0.5 million cash outflow, and as of September 30th the company had a mere A$1.4 million in cash.

Based on recent cash-burn rates this is roughly one month's worth of cash, so it makes sense that Northern did the financing when it did--a month and two days after the end of the first month of the quarter. Remember, this was an onerous financing that could only be undertaken by a desperate company, especially with the stock being illiquid. It also makes sense that the company cut its expenses when it did--a week later.

One thing we neglected to mention above is that on the same day of the death spiral financing Jien Mining converted its $5 million convertible 6% note to equity. This further supports the thesis that the company was literally down to its last bit of cash going into November, and Jien Mining converted to equity as a hail Mary to protect what it could of its investment without starting a credit situation. The A$0.20/share conversion rate compares with the then recent share price of A$0.16-A$0.18/share, meaning the company effectively agreed to a haircut of 10-20% just to start. Of course at 80,000 shares per day it is impossible to unload 25 million shares, so the cash-equivalent value of the stock was considerably less than this. Note that we've seen a near 30% decline and this is on less than 1 million shares. So the real magnitude of the "haircut" is much more severe.

It is only because of this debt conversion that Northern Minerals might have positive shareholder equity. The company's June 30th balance sheet shows negative working capital and negative equity.

The company improved its net assets with the debt to equity conversion, although we believe it continues to have negative working capital given the A$2.3 million shortfall in June, the A$500,000 net burn through September, and the estimated burn of A$1.5 million in October. This, added to the A$1.5 million from the death spiral financing still leaves it with (A$2.8 million) in working capital minus whatever it burnt in November.

As for cash, we suspect the A$1.5 million burn in October pretty much wiped the company out given its September 30th cash position. The death spiral replenished this and the burn rate is down, so the company still has some cash, but we suspect it is very little.

While the slowdown in the cash burn rate might be good for the balance sheet it is bad for project development and value-creation. Many employees have been let go, and many of the remaining employees will be subject to a "stand down period" until Jien Mining financing comes in. So the company can preserve its remaining cash by reducing its burn rate to a bare minimum, but this means it stops developing Browns Range in the process.

This means you have a company with no marketable assets, negative cash-flow, and a dead-money mining asset.

The Death Spiral Financing

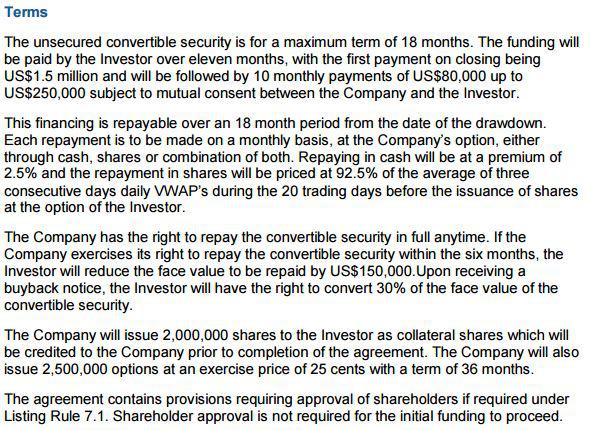

Here are the terms of the financing with Lind Capital.

First, note that this is really a A$1.5 million deal, not a A$4 million deal as the headline says. After the A$1.5 million was transferred to Northern it owed money (payable in stock or cash) back to Lind in monthly payments. Meanwhile, Lind makes a monthly payments to Northern, but the amount is range-bound, with the upper bound--A$250,000--multiplied by the number of payments (months)--10--added to A$1.5 million giving us the headline figure. The lower bound is A$80,000. Northern will be making payments in either cash or stock, but given the company's financial situation this means stock.

So Lind will be acquiring stock, but what the PR doesn't tell you is that this stock will be used to cover short positions. The Lind payments to Northern will be dependent upon how much capital it can raise by shorting Northern shares because it will only want payment from Northern reflecting its short position. Of course Northern has to make the share payment no matter what the share price is, and the more Lind shorts Northern stock into the market (in dollar amounts) the bigger its payment (it gets stock for 92.5% of the recent value so it is profiting from a spread). It gets better--for Lind. The share price on which the 92.5% figure is based is determined by the VWAP over any three consecutive days Lind chooses from the 20 trading days prior to the payment. So Lind can pick the lowest VWAP out of a possible 18 3-day periods! If the stock were to spike on a REE shortage in the West then Lind would be able to get stock at the pre-spike price and cover any shorts without reason for concern. It also holds 2 million shares and 2.5 million warrants at A$0.25/share to protect it from a share price spike. It can easily sell more stock into the market than it makes available to Northern without leaving itself exposed heavily on the short side, if at all.

We further note the convertibility of the A$1.5 million note, and conversion from debt to equity will be used to cover Lind's short positions.

In effect, Lind is lending Northern money for the right to short Northern stock with minimal risk at the expense of Northern shareholders. This isn't the worst sort of arrangement in the world assuming the shares are liquid, since it basically amounts to an at-the-market offering, but Northern's lack of liquidity makes this form of financing extremely dangerous, and we've seen how Lind can drive the price down without assuming much risk, and how it has incentive to sell Northern shares ever lower, so long as the arrangement is in effect. Hence, "death spiral financing."

Nobody would agree to such terms unless they were desperate, and we have good reason to believe that Northern is desperate. It is also quite possible that Northern's management believed it would get the Jien Mining money so it would be able to pay back the loan.

But now the Lind arrangement could be longer-term, and this means at least A$80,000 worth of stock coming onto the market every month from one source. That may not sound like a lot, but over the past month Northern's trading volume has averaged ~80k shares per day at ~A$0.14, meaning monthly trade is ~A$340,000, or just 4X higher than the A$80,000 minimum. True, volume is rising, but this is a result of short-selling.

The Browns Range Project

The Browns Range Project is arguably the best known hard rock xenotime deposit in the world. Xenotime is a REE-bearing element comprised of REE-phosphates. Xenotime is the only major REE-source that contains primarily heavy REEs (by "major" we mean a very distant third). REE mixtures with mostly HREEs are between 2-3X more valuable than your more typical REE basket that is extracted from more common minerals--basnaesite and monazite. Furthermore, aside from small xenotime operations in Malaysia and Brazil--where the xenotime comes as a by-product of other mining operations--there is essentially no HREE production outside of China. This is in part why the DoD has decided to stockpile two HREEs--yttrium and dysprosium.

So a major xenotime deposit seems to be critical, and long-term we think it is. But for now the numbers simply don't add up to anything more than optionality value, and this isn't worth much considering the company's ticking fiscal clock. As we will see the potential for optionality value deteriorates further when we provide a cash-flow assessment of the project best on today's prices. In fact we get negative NPVs and IRRs in each of our scenarios, including our most optimistic ones, which are more optimistic than the company's own assumptions.

The DFS (warning, big PDF) shows extremely robust economics, although that shouldn't matter considering we don't know when this isn't the case for critical material junior miners.

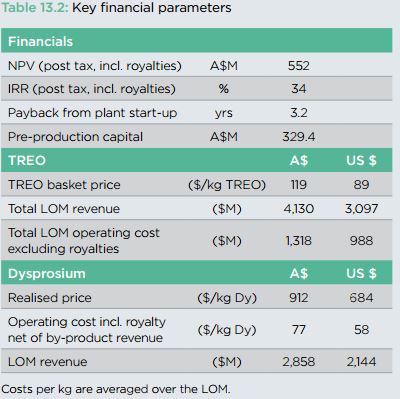

Despite low REE prices at the time of the release--March 2nd--Northern used much higher prices in its DFS.

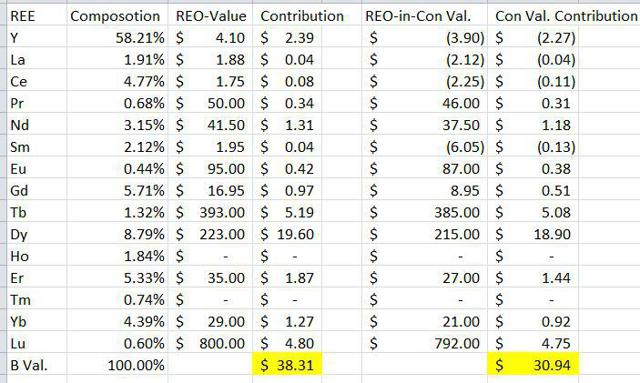

By comparison, today's dysprosium price is $223/kg, or <1/3 of the price assumed in the DFS. We have estimated our basket value based on current prices and have included prices for elements we believe to be most likely marketable. For those metals for which we were unsure, namely ytterbium and lutetium, we gave Northern the benefit of the doubt. We will see that this last favor dramatically improves the company's economics, although the amounts of these elements that Northern can sell at their "market" values is unknown and not bankable at this point in time.

While Northern estimates its basket to be worth $89/kg. we estimate it to be worth $38/kg. But we have to keep in mind that the company is only planning on producing a RE-concentrate with all of the REEs mixed together; the basket price assumes these REEs are separated. So we need to subtract the cost of separation. Based on various conversations and estimates we are using $4/kg. for lanthanum, cerium, praseodymium and neodymium, and $8/kg. for the remainder. This brings the company's basket value--i.e. the value it can receive for its REEs--to $31/kg.

Regarding prices these come from Asian Metals with the exception of Gd, Er, Yb, and Lu, which are rarely traded. These come from slightly outdated (by a few weeks at most) confidential sources.

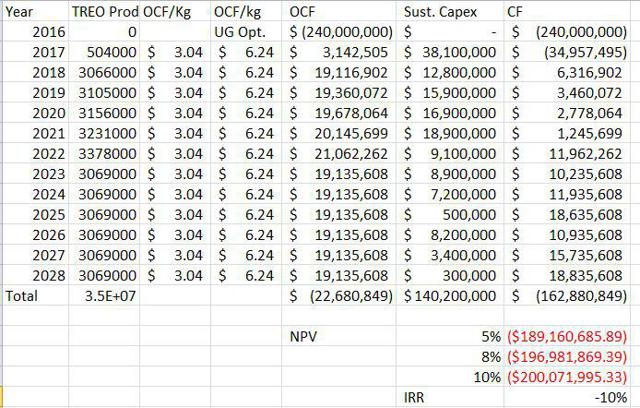

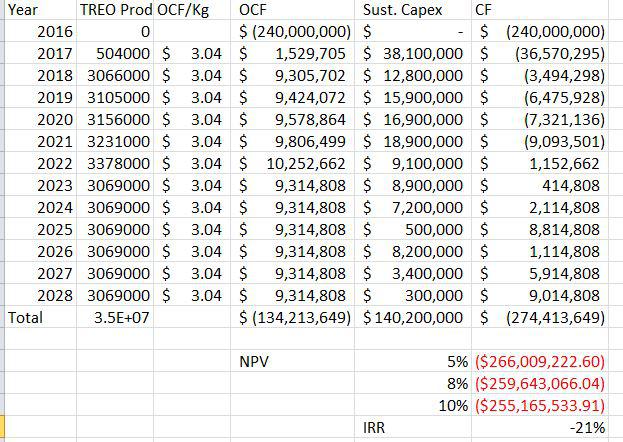

Northern estimates that it will have production costs of A$38/kg. (US$27.9). This leaves $3/kg. for profit. Given the company's estimated $240 million in capex and sustaining capex estimates found in the DFS summary, we get the following cash-flow, NPV and IRR estimates.

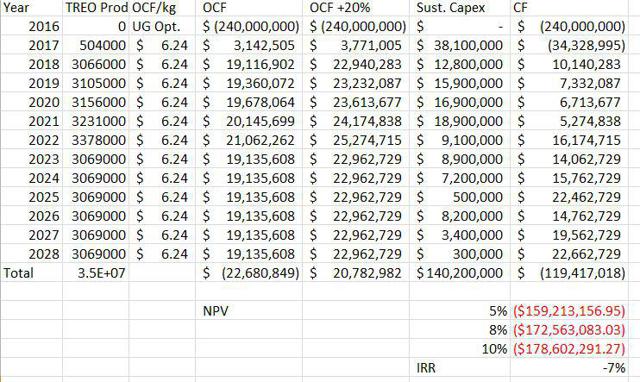

Management has not sat still while REE-prices have fallen, and it has done several things to optimize the project. The first is that it has reworked the underground mine so that its costs will come down up to 40%. The company does not tell us how this will be accomplished, and so naturally we remain skeptical. Note that 40% of "mining" costs comes to ~11.5% of opex before separation: ~$3.20/kg. or ~$10 million per year, more than doubling the company's operating cash-flow at current REE prices. Based on this adjustment alone we came up with the following revision.

The second is that the company is changing the mining sequence so that it mines higher grade ore first, increases annual TREO production by ~20%, and reduces the mine's life to 7-8 years. We're left in the dark on too many issues to accurately calculate the value: initial capex changes, sustaining capex changes, opex changes...etc. We're giving them credit for the 20% increase in production, plus credit for the full 11-year mine-life with no additional capex or opex (that's a >$50 million gift). We still get horrific numbers.

*Note we didn't include the production change in the production column, but only in the cash-flow column where we multiplied each figure by 20%.

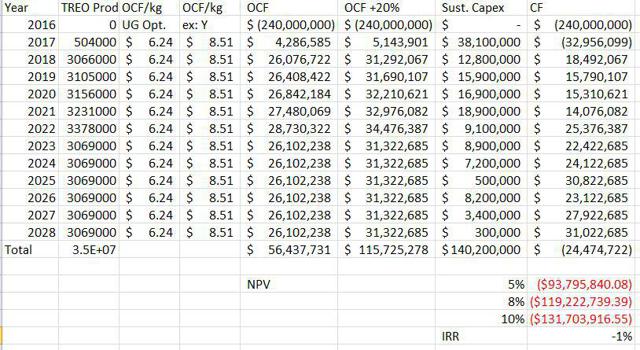

The third is early removal of 90% of the concentrate's yttrium (which accompanies cerium and lanthanum removal, not factored in but marginal given that xenotime contains very little of these metals). We've seen that yttrium has effectively become a waste product since the cost of preparing it for the market costs more than its market price. Rather than subjecting a product worth $4.10/kg. to an $8/kg. separation process (making it worth ($3.9/kg)) it makes more sense to just spend a couple dollars to get rid of the yttrium before toll separation. The company will lose the yttrium revenue (although it could stockpile the impure yttrium for potential future purification and sale) but improve the project's economics. We don't know how expensive it will be to remove the 90% yttrium that the company says it will, especially since we don't know how it will carry this out. Regardless the savings won't be a lot. Even if Y removal were free the savings would be $3.90/kg. ($2.27 on a savings per kg. of TREO basis) or ~$7 million per year. We are assuming an ideal situation--perfect efficiency with respect to 100% Y removal--thereby subtracting $2.27 from our opex. We also combine this with the two other savings discussed above.

We still get negative net cash-flow for the life of mine, a negative IRR, and negative valuations at all NPVs.

Before moving one we want to briefly discuss two metals that add notable value to Northern's basket--ytterbium ($0.92/kg in the mixed con) and lutetium ($4.75/kg in the mixed con). We doubt that any company can get financing based on the posted market values of these materials because their markets are so small and opaque. It would require some sort of hard offtake agreement whereby project financing is based on, in part, the projected revenues from these two materials.

That isn't to say there aren't uses for these materials. Rather, the lack of a consistent supply forces product engineers to omit them in their designs. Northern Minerals claims to be marketing lutetium and discusses its end-use in PET scanners.

Lutetium can also be used in lutetium-aluminum-garnets for specialty high-power lasers.

Because the company is marketing lutetium we've given it credit for the material in our estimates. However, we note that just because a product is superior doesn't mean that inferior versions will immediately be upgraded. We think that marketing lutetium will be complex and require dealing with several different companies who combined might use the company's 21 tonnes. With this being the case lutetium sales during the early years could be considerably less than this.

Ytterbium is an even more opaque market than lutetium. The only reason we are giving the company credit for it is because the Defense Logistic Agencywants it. We don't know the quantity or the end-products, although we suspect that they want to test heat resistant ytterbium-aluminum alloys and Yb-doped yttrium-aluminum-garnet lasers. This is a tenuous reason to give Northern full credit for ytterbium, and ytterbium revenues will not be bankable barring the same conditions discussed above regarding lutetium.

Holmium is a very tiny market and we hardly see traces of holmium trading. It can be used as a substitute for dysprosium in permanent magnets in some cases, but there is no stable supply and no transparent market. It can also be used to dope yttrium-aluminum-garnet lasers. So it isn't worthless, but holmium will likely be a complex marketing project. Thulium is probably the worst in this regard, although it, too, can be used in lasers.

Northern's Valuation

Northern has traded at a premium valuation for quite some time based on a couple of things. The first is that this is the highest grade and most advanced xenotime project in the West (compared with Lofdal (Namibia Rare Earths (OTCPK:NMREF)) and Oslerum (Tasman Metals (NYSEMKT:TAS))). Xenotime is the most commonly produced HREE mineral and the only one that has any substantial history of being processed commercially. Furthermore, HREEs are almost exclusively produced in China, meaning if there were a trade war the West could conceivably find itself without HREEs. Heavies also have a higher value.

In essence, it is very easy to fall into the trap that Browns Range is the best HREE project and that HREE projects are superior to LREE projects, when these believes contain but bits and pieces of the truth. We've seen these advantages are offset by: (1) the observation that many aren't readily marketable and (2) they are more expensive to process than LREEs. More importantly, any value that we might perceive in Browns Range--and we've seen there isn't much--needs to be considered in the context of Northern's dwindling cash-flow and the stock overhang.

We aren't going to provide a detailed comparative analysis since the short thesis doesn't rest upon Northern's relative valuation. It does, however, show us the magnitude of the downside if this company falls into the unfavorable group at the bottom of the valuation totem pole. We note that this doesn't necessarily reflect project fundamentals but rather perception and market forces, both of which look bad for Northern Minerals.

What If The HREE Market Soars?

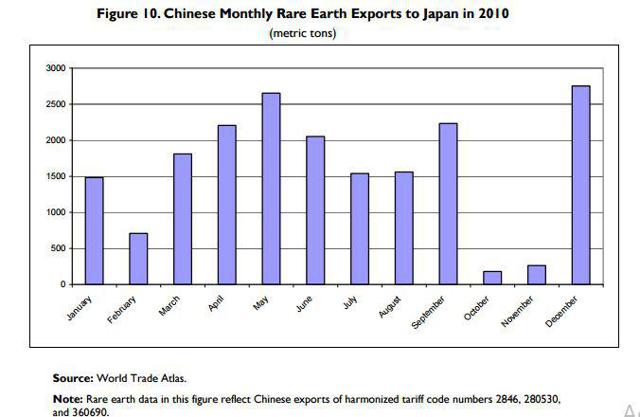

Back when REEs were considered newsworthy the market soared as investors and material procureers feared that the Chinese might severely limit the REE-supply. The Chinese actually did limit supply to Japan for a short period of time.

Since then Lynas has gotten into production. Molycorp (OTCPK:MCPIQ) got into production as well although its Mountain Pass Mine is on care and maintenance. These mines have helped mitigate the potential for a shortage for LREEs but have done little to mitigate the potential for an HREE shortage.

The good news is that there are mitigatign factors. Successful efforts have led to the reduction of dysprosium used in REE magnets. Dysprosium remains critical, and effots to substitute dysprosium out of magnets might subside now that the price is down (although it is still considerably higher than neodymium and praseodymium.

We have also seen a sharp decline in yttrium demand as the phosphor market is in decline. While yttrium has other uses it has essentially lost all of its value. It is in a unique situation where it is so cheap that it costs money to get it even using the most efficient processies known, yet it faces the risk of a supply shortage. More importantly, just the risk that the Chinese will cut off supply--properly placed in the limelight--could send REE-stocks roaring higher.

The good news is that this would have to happen in a relatively short window of time as Northern's cash is running out. However it remains a small, yet not insignificant risk to the short thesis.

The Bottom Line

We've seen that Northern Minerals is a highly flawed company from many different angles. It's working capital position is negative, it is involved in a death spiral finance and its project is uneconomic at today's REE prices even if we grant Northern all of its proposed optimizations and then some. On top of all of this Northern's valuation is higher than any other junior miner in the industry.

With an aggressive seller immune to price, an illiquid market, and a new downtrend in the stock, we wonder where the buyers will come from. We suspect that retail investors haven't caught on to the deleterious nature of the deal with Lind Partners (e.g. there's almost no mention of it on the various message boards or on news sites that cover the space). Who knows what will happen when the market wakes up, but we can't imagine anybody wanting to buy--even long-term bulls--in the face of the stock overhang.

Given these points combined with the company's weak fundamentals and high valuation we think Northern Minerals is a "sell."

**This article was originally published at miningWEALTH.com.