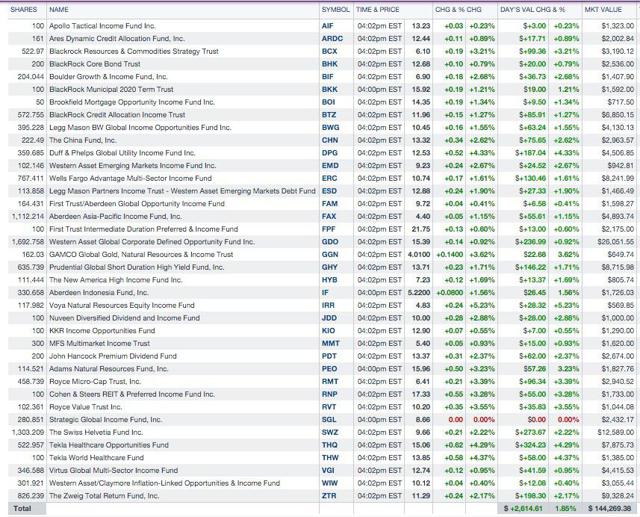

I have now combined the inherited CEF positions into this basket. I really had to it simply to form an opinion about weightings in sectors and in individual CEFs. There will be more CEFs added when the probate process is completed later this year. I am including only those CEFs acquired as a residuary beneficiary of a testamentary trust.

I have too much now in GDO and ZTR, and will soon have more. I will at some point lighten up.

I have one new position which was inherited:

Adams Natural Resources Fund (PEO). I last eliminated that one at $27.06 and happy that I did: Item # 1 Sold 104+ PEO at $27.06 (8/10/13 Post) PEO used to be called Petroleum & Resources and has been joined at the hip with Adams Express (now known as Adams Diversified Equity) since their respective formations shortly before the 1929 crash. ADX owned 39.711+M shares of PEO as of 9/30/15. PEO closed last Friday at a 16.58% discount to its net asset value per share. CEFConnect. Exxon and Chevron were weighted at 27% as of 9/30/15. ADAMS NATURAL RESOURCES FUND FORM N-QThis topic was last updated here: Update For CEF Basket Strategy As Of 12/30/15 - South Gent | Seeking Alpha

Table as of 1/22/16

I view the closed end portfolio to be a balanced worldwide portfolio within a larger portfolio that includes individual stock and bond selections.

I place an emphasis on income generation and own a number of CEFs that pay monthly dividends.

I will change the weightings in the CEF portfolio based on my opinions about the balance between risks and rewards.

I have a lengthy discussion of bond CEF risks in the Appendix section to an earlier post:Update For Closed End Fund Basket Strategy As Of 8/14/15 - South Gent | Seeking Alpha(scroll to "General Risk Discussion for Leveraged Bond CEFs") I also discussed those risks here. I will not be repeating those discussions.

I discussed the factors impacting the dividend payout for leveraged closed end funds here: Update For CEF Basket Strategy As Of 10/14/15 - South Gent | Seeking Alpha (Scroll to APPENDIX: 1. Factors Impacting a Dividend Payout for Leveraged Closed End Bond Funds Using VKQ as an Example)

The CEF risk associated with a forced reduction in leverage at the most inopportune time, sort of like a margin call during a huge downdraft, is discussed in this post. Update For REIT Basket Strategy As Of 9/17/15 (scroll to RNP Presents a Good Historical Example of One Risk Inherent in Using Leverage)

For the remainder of this year, I will not make an open market purchase of a leveraged bond CEF that has less than 50% weighting in investment grade bonds. I have quit reinvesting the dividend in any CEF with a greater than 30% weighting in junk rated bonds except as noted in the next paragraph.

The largest position is currently the leveraged

Western Asset Global Corp Defined Opportunity Fund (GDO) that is held in three accounts. I am reinvesting the dividend only in my Schwab account. I am not reinvesting the dividend on over 1,000 shares held in two other accounts including a Roth IRA. GDO's share price closed at an 11.75% discount to its net asset value per share last Friday: CEFConnect As of 9/30/15, the fund sponsor noted a 33.67% weighting in junk bond exposure at 33.67% and a 15.38% weighting in emerging market debt. There would be some overlap in those weightings (i.e. junk emerging market debt). Both of those categories have contributed to a downdraft in net asset value per share and the market price. This fund is scheduled to liquidate in 2024. So I am betting that there will be a recovery in those categories before the liquidation date. The current monthly dividend is $.1135 per share with a slight ROC support. The annual dividend payments would be about $2,305 based on that penny rate and the existing share position.1. Sold 150 BBN:

Quote:

BlackRock Taxable Municipal Bond Trust Stock Price Today (BBN)BBN is a leveraged closed end fund that owns taxable municipal bonds issued under the expired Build America Bond program. This CEF is particularly risky IMO since it borrows a lot of money at short term rates to buy long duration bonds.

Effective Duration as of 12/31/15: 11.64 years

Leverage as of 30-Nov-2015= $728,440,271.00

% Leveraged as of 30-Nov-2015=35.93%

A 2% rise in interest rates at this duration number would result in about a 23.28+% loss in value. That would be a serious loss of principal with a rise to an historically low interest rate level from an extremely low one. The discount to net asset value would expand as that scenario unfolds, creating the infamous Triple Whammy.

Conversely, a 2% decline in rates would result in about a 23.38+% gain.

This kind of CEF is a leveraged play on short term rates remaining low and long term rates remaining flat to down. It would be a terrible investment when both short and long term rates are rising significantly. And that downside risk makes the Old Geezer nervous, so there is a lot of darting into and out of this kind of security.

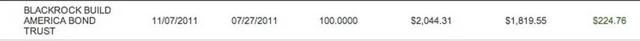

Profit Snapshots:

50 Shares +$86.98 ($1 Commission)

I last discussed this leveraged CEF here: Update For CEF Basket Strategy As Of 10/14/15 - South Gent | Seeking Alpha (Scroll to 1. Bought 50 BBN at $20.26)

Closing Data as of 1/22/16:

Closing Net Asset Value Per Share: $22.72

Closing Market Price: $22.18

Discount: -2.38%

(when I last bought shares on 10/9/15, the discount closed at -8.97% and the closing net asset value per share was then $22.19. The hoped for result is a narrowing of the discount after purchase plus an increase in net asset value per share unadjusted for several monthly dividend payments)

Historical Discounts:

1 Yr: -7.83%

3 Yrs: -7.68%

5 Yrs: -6.37%

Sourced CEFConnect

BlackRock Taxable Municipal Bond Trust: Schedule of Holdings as of 10/31/15

Sponsor's Website: Taxable Municipal Bond Trust | BBN

Prior Trade: Item # 5 Sold 100 BBN at $20.51-ROTH IRA (11/10/11 Post)-Item # 4 Bought 100 of the Bond CEF BBN at $18.15 (7/29/11 Post)

Total Trading Profit To Date: $460.9

Disclaimer: I am not a financial advisor but simply an individual investor who has been managing my own money since I was a teenager. In this post, I am acting solely as a financial journalist focusing on my own investments. The information contained in this post is not intended to be a complete description or summary of all available data relevant to making an investment decision. Instead, I am merely expressing some of the reasons underlying the purchase or sell of securities. Nothing in this post is intended to constitute investment or legal advice or a recommendation to buy or to sell. All investors need to perform their own due diligence before making any financial decision which requires at a minimum reading original source material available at the SEC and elsewhere. A failure to perform due diligence only increases what I call "error creep". Stocks, Bonds & Politics:ERROR CREEP and the INVESTING PROCESS. Each investor needs to assess a potential investment taking into account their personal risk tolerances, goals and situational risks. I can only make that kind of assessment for myself and family members.