This basket was last updated here: Update For Regional Bank Basket Strategy As Of 3/17/16 - South Gent | Seeking Alpha

This basket has a minimum out-of-pocket exposure of $40K and a maximum of $80K. For the last six months or so of 2015, I was hovering around $4K to $6 below my minimum level for the reasons discussed here:

Update On Regional Bank Basket Strategy As Of 7/17/15 - South Gent | Seeking Alpha

With several recent and small adds, I have moved $6K+ over my $40K minimum level.

My net realized gain in this basket strategy currently stands at $25,554.91 (small lot trades): REGIONAL BANK BASKET STRATEGY GATEWAY POST I started to build this basket in the 2009 Spring.

Snapshots of round trip trades can be found at the end of that post.

Over the life of this basket strategy, I anticipate that dividends will generate about 40% of my total return. Over the past 4 years ending 12/31/15, dividends have averaged $1,939.37 per year.

The dividend yield of this basket is significantly in excess of the yields provided by regional bank ETFs that include a large number of low yielding stocks and several that pay no dividends.

I am doing most of my small odd lot trades in my IB account where my commission rate is $1.

There is a theme running through my recent regional bank buys:

(1) Low 1 Year Anticipated P.E.G. ratios

(2) Well Below Market Forward P/Es, and

(3) Above Average Dividend Yields

Charge-offs for regional banks are near historical lows in the aggregate and NPL's are trending below 1% for the banks that I will buy as part of this basket strategy. Loans and deposits are increasing at favorable percentages. The problem remains NIM contraction which is showing signs of stabilization but no hope yet on the horizon for a meaningful improvement.

FRB: FEDS Notes: Why Are Net Interest Margins of Large Banks So Compressed?

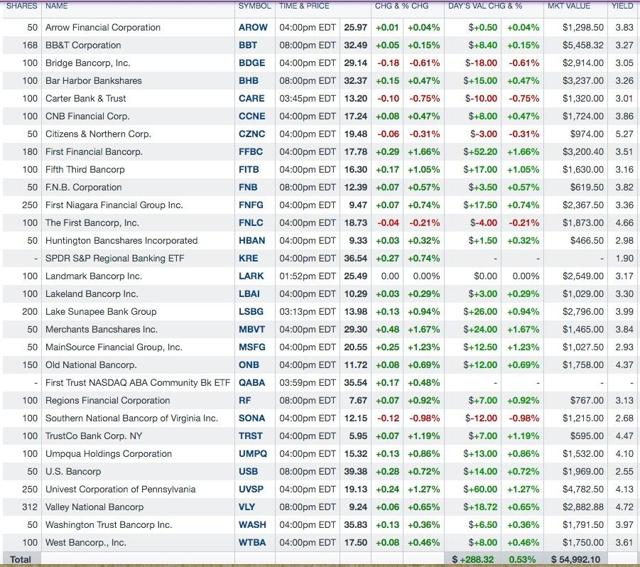

Basket as of 4/8/16

+++++++++++

I lost my National Penn shares due to its acquisition by BBT. I received 68 BBT shares plus cash.

BB&T closes National Penn acquisition

+++++++

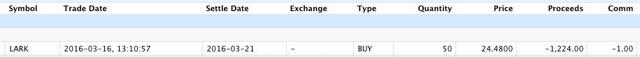

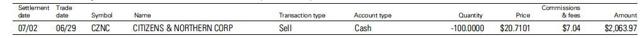

1. Bought Back LARK at $24.48 and $24.15: This is another stock where I would have been better off stopping Left Brain's incessant profit taking after the first purchase at $16.6.

LARK has a $91.12M market cap at last Friday's closing price:

LARK: $25.49 0.00 (0.00%): Landmark Bancorp Inc.

The bid/ask differential is typically large with only a few shares traded daily. LARK Historical Prices

Trade Snapshots:

Company Description:

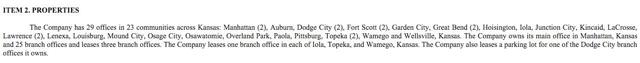

Landmark Bancorp Inc. (LARK) is a bank holding company that operates through its wholly owned subsidiary Landmark National Bank.Landmark National Bank has 29 branches in 23 Kansas communities. Corporate Profile

LARK owns its main office building and 25 of its branches:

The market cap at a $25 share price is just $87+M.

Landmark operates in Kansas and its headquarters is located in Manhattan, Kansas.

When looking at small banks, I will view any pictures of the main office and branches provided at the bank's website.

If no pictures are provided, I will use Google maps to view the main office and to drive around town. Manhattan, Kansas looks like a prosperous small community and the bank's headquarters is not ostentatious.

I do not like to see a small bank with an ornate and large main office. A Taj Mahal kind of structure is merely a monument to the CEO's ego.

2015 Annual Report: SEC Form 10-K (risk factors discussed starting at page 25)

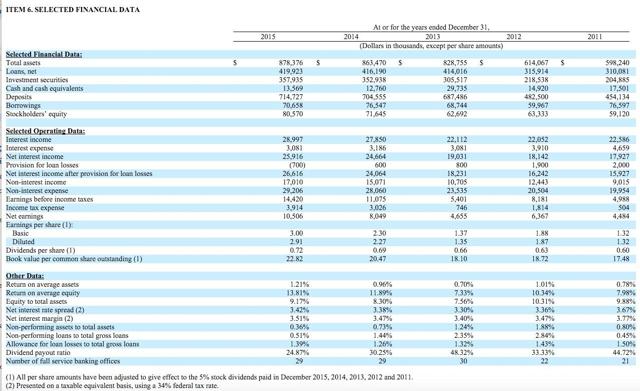

5 Year Historical Financial Numbers: Over a five year period, financial metrics, other than NIM which is to be expected, are in an uptrend.

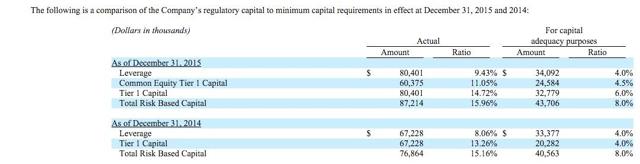

Capital Ratios: LARK's capital ratios are fine and better than average:

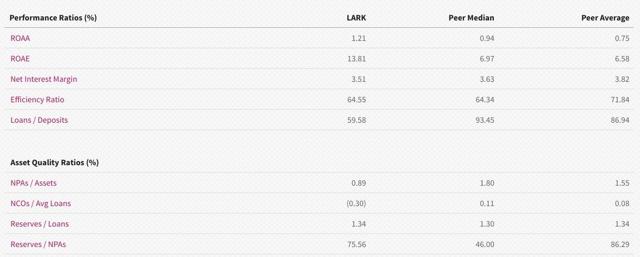

Peer Comparisons:

Dividends and Stock Dividends: LARK raised its quarterly dividend to $.2 effective for the 2016 first quarter. The prior rate was $.18 per share. The increase was 10.5% "adjusted to give effect to the 5% stock dividend paid during December 2015."

At the current penny rate, the dividend yield is about 3.31% at $24.15 and 3.27% at $24.48.

The bank has been paying an annual 5% stock dividend, so historical dividend information needs to be adjusted to account for those stock dividends.

Dividends - Landmark National Bank

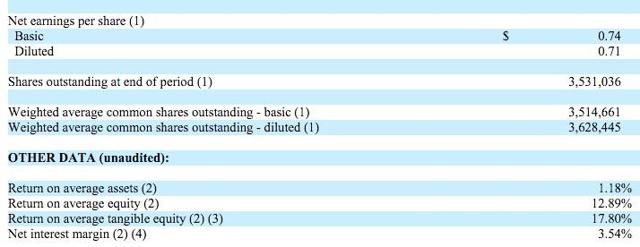

Recent Earnings Report: For the 4th quarter of 2015, LARK reported "net earnings of $2.6 million ($0.71 per diluted share) for the quarter ended December 31, 2015, compared to $2.1 million ($0.59 per diluted share) for the fourth quarter of 2014. For the year ended December 31, 2015, Landmark reported record net earnings of $10.5 million ($2.91 per diluted share), compared to $8.0 million ($2.27 per diluted share) in 2014."

Sourced: SEC Filed Press Release

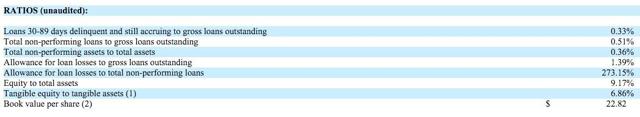

The ratios are good:

Prior Trades:

Item # 3 SOLD 52 LARK at $18.75 (1/9/2012 Post)(profit +$91.89)-Item # 5 Bought 50 LARK @ 16.6 (5/2/2011 Post)

Item # 4 Sold: 50 LARK at $23.5 (6/28/14 Post)(+$174.07 Post)-Item # 3 Bought 50 LARK at $19.7 (1/13/14 Post)

Sold 50 LARK at $22.42 (9/14/2014 Post)(Profit $117.08)-Bought 50 LARK at $19.76 (7/28/14 Post)

Trading Profits To Date: $383.04 (three short term 50 share flips)

2. Added 50 SONA at $12.24:

Trade Snapshot ($1 Commission):

I discussed Southern National Bancorp of Virginia (SONA) in my last regional bank update and have nothing new to add:

Scroll to 2. Bought Back 50 SONA at $12.6: Update For Regional Bank Basket Strategy As Of 3/17/16 - South Gent | Seeking Alpha

I may add another 50 at below $11.8 and then sell the highest cost lot when and if I can do so profitably.

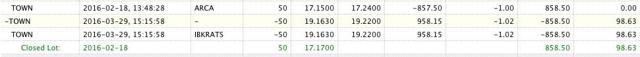

3. Sold 50 TOWN at $19.16:

Trade Snapshot ($1 Commission):

Profit Snapshot: +$98.63

Scroll to 2. Bought Back 50 of 100 TOWN at $17.15: Update For Regional Bank Basket Strategy As Of 2/20/16 - South Gent | Seeking Alpha

Rationale: The analyst estimates have gone done since my purchase.

The current estimates for this year, provided by only 2 analysts, is $1.26 this year and $1.6 next year. TOWN Analyst Estimates | Towne Bank As I noted when discussing this purchase, it takes a leap of faith to accept a projected 26.98% Y-O-Y increase in E.P.S. The 2016 consensus estimate basically reflects a modest increase from the actual $1.22 E.P.S. reported in 2015. TowneBank Reports Full Year and Fourth Quarter Financial Results for 2015

Possibly, the big jump between 2016 to 2017 is due to an accounting convention for acquired loans that juices net interest margin for awhile. (see explanation at Regional Banks That Face EPS Headwinds - Barron's) Basically, when loans are purchased at a discount through a bank acquisition, the discount on acquired loans to future value is accreted back to interest income over the loan's life which increases the net interest margin and E.P.S. That benefit is short lived. The investor will typically see several quarters where the NIM is higher than normal until the loans run off.

I decided to harvest the profit for a second time given the relatively low dividend yield compared to other banks that I own and the questionable earnings forecast.

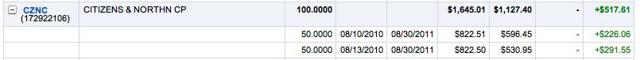

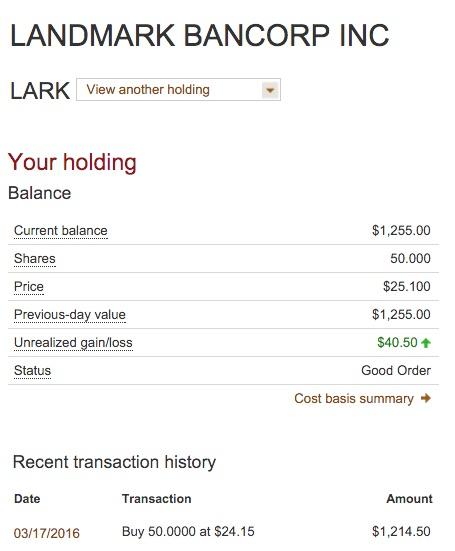

4. Bought Back 50 CZNC at $19.74:

Trade Snapshot ($1 Commission):

Last Discussion of a Purchase: Scroll to 1. Bought 50 CZNC at $19.52: Update For Regional Bank Basket Strategy As Of 10/2/15 - South Gent | Seeking Alpha

That odd lot was sold at $21.09: Scroll to 1. Sold 50 CZNC at $21.09: Update For Regional Bank Basket Strategy As Of 12/4/15 - South Gent | Seeking Alpha

Company Description: The Citizens & Northern (NASDAQ:CZNC) is a small regional bank holding company headquartered in Wellsboro, Pennsylvania (HQ picture at Google Maps)

At a $19.74 market price, the market capitalization is $239+M.

The operating subsidiary, Citizens & Northern Bank, currently has 26branches in PA and 1 in Steuben County, NY. Citizens & Northern Corporate Profile | Citizens & Northern Bank

Virtually all of the bank's offices are located in the Marcellus Shale region. CZNC noted that a significant portion of its lending opportunities, trust and other services were tied directly or indirectly to from Marcellus Shale related activities: 2015 Annual Report The bank discusses risks incident to its business starting at page 3 of that Annual Report.

As noted at page 6 of that report, the bank owns all of its banking offices free and clear except for 2 locations that are leased.

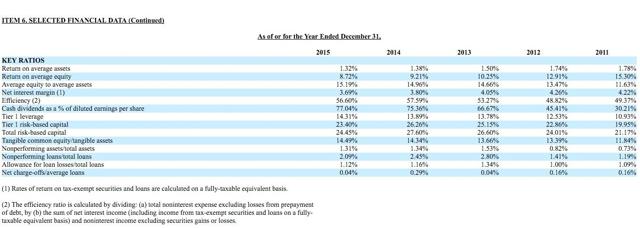

Historical Ratios 2011 through 2015: Page 11

Positives and negatives are revealed in that chart. The charge-offs to total average loan ratio is consistently good. The capital ratios are excellent. The efficiency ratio is good but has been trending up. The return on average assets last year was good at 1.32%, but has been trending down as has the net interest margin which is currently above the national average notwithstanding that trend. NPLs are too high IMO and have increased to over 2% for the past three years after being below 1.5%. For small banks, one bad commercial loan can have a large impact on that number.

A major negative is that E.P.S. has been trending down:

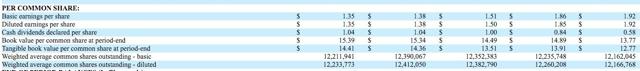

EPS and Book Value Numbers- Left to Right 2015 to 2011:

E.P.S. started to decelerate for this bank after it reported an E.P.S. of $1.53 in 2005. 2009 Annual Report at page 12. A large loss of $4.4 per share was reported in 2009. That loss was triggered by an after tax impairment charge of $55.849M in securities held for sale. In other words, the loss was caused primarily by bad investment decisions rather than loan decisions. The biggest problem was in something called "pooled trust preferred securities-mezzanine tranches" (page 14). This issue highlights just one of the many things that can go wrong at a bank. I did not follow up on what happened to those securities in the following years. This write-down in 2009 reduced the value by $73.674M bringing the cost basis down to $11.383M.

Several of the negative trends need to reverse before this stock can regain upward price momentum. An increasing NIM would help along with fewer non-performing loans and an improvement in the efficiency back toward 50.

Even a prudent bank will suffer an increase in loan losses during a recession. The ones making improvident loans will generally be exposed during those economic downturns, with many being seized by the FDIC.

CITIZENS AND NORTHERN BANK Review: 4 Star Rating Bankrate.com

Potential Acquisition Target: BBT has recently acquired two PA based bank, Susquehanna and National Penn. I owned both of those banks when BBT made the acquisition announcement. I sold SUSQ for a profit and received BBT shares for my NPBC stake.

Given its size, CZNC would be easily digestible by a number of banks wishing to expand into its territory.

Chart: I would call the long term chart as erratic with several trading opportunities presenting themselves over since 1996. CZNC Interactive Stock Chart Two buying opportunities occurred during the savings and loan debacle (2000) and the Near Depression. The chart also shows that it really does not pay to be a long term shareholder. A buyer in 1998 would have a loss in the shares now.

Dividends: This bank did slash its dividend rate starting in the 2010 first quarter, going from $.24 per share to $.08 and then started to gradually raise it again to the current rate of $.26 per share or $1.04 annually. Dividend cuts are always a distinct possibility for banks during or soon after a recession. Citizens & Northern Corp (CZNC) Dividend History

Effective for the 2014 first quarter, CZNC raised its quarterly dividend to $.26 per share from $.25. The $.26 per share penny rate is still in effect. SEC Filed Press Release

At the current rate, the dividend yield is about 5.27% at a total cost of $19.74 per share. The dividend yield, and its capture through trading, is one reason why I continue to buy this stock.

Recent Earnings Announcement: For the 2015 4th quarter, net income per share was reported at $.33, down from $.35 in the 2014 4th quarter. SEC Filed Press Release

This quarter included "realized gains from securities of $1,776,000 and recognized a loss from prepayment of a borrowing of $1,663,000".

"The borrowing that was paid off in the fourth quarter 2015 was a $24 million repurchase agreement with a maturity date of December 20, 2017 and an interest rate of 4.265%. C&N opted to prepay the borrowing and has funded the prepayment with a series of short-term borrowings at an average rate of 0.86%. C&N sold a significant portion of its investments in stocks of banks and bank holding companies in the fourth quarter 2015, generating realized gains totaling $1,744,000. Management has estimated the combined result of the debt prepayment and reinvestment of proceeds from sales of the stocks will make a positive contribution in 2016 to fully taxable net interest income of approximately $524,000." (emphasis added)

"Net loans outstanding (excluding mortgage loans held for sale) were $696,991,000 at December 31, 2015, up from $672,449,000 at September 30, 2015 and up 11.8% from $623,209,000 at December 31, 2014."

Earnings Estimates: Only one analyst provides earnings estimates. That estimate is for $1.34 this year and $1.43 in 2017. CZNC Analyst Estimates

Using the 2016 estimate, the P/E would be 14.73 at a total cost per share of $19.74 which declines to 13.8 using the 2017 estimate.

Rationale: This purchase is primarily part of a dividend capture strategy where I attempt to generate anywhere from 2% to 5% more total return over the dividend yield. The bank has a sufficient number of negatives to keep my involvement small, while also having enough positives to make it at least a potentially worthwhile trade from time to time.

Prior Trades:

Satellite Taxable Account: 100 Shares +$517.61

Item # 1 Sold 100 CZNC at $16.53 (9/2/11 Post)-Item # 1 Added 50 CZNC at $10.46 (8/17/2010 Post) and Item # 1 Bought 50 CZNC at $11.77 (8/12/2010 Post)

Satellite Taxable Account: 100 Shares +$48.5

Sold 100 CZNE at $19.52 (8/25/14 Post)-Item # 3 Bought 50 CZNC at $19.15 (6/29/13 Post) and Item # 7 Bought 50 CZNC at $18.5 (5/17/14 Post)

I had one 50 share flip in a Roth IRA earlier this year=+$38.08

I also had a 100 share flip in a satellite taxable account: +$81.97

Both of foregoing 50 and 100 share lots were sold at $20.71, which is viewed as the upper end of a fair valuation for this stock:

Last Trade: +$76.48

CZNC Total Trading Profits = +$762.64

Appendix:

Comparative Data From the St. Louis Federal Reserve:

Net Interest Margin for all U.S. Banks (abbreviated to "NIM")

Net Interest Margin for U.S. Banks with average assets under $1B

Net Interest Margin for U.S. Banks with average assets between $1B and $15B

Return on Average Equity for all U.S. Banks (abbreviated to "ROE")

Return on Average Assets for all U.S. Banks (abbreviated to "ROA")

Nonperforming Loans (past due 90+ days plus nonaccrual) to Total Loans for all U.S. Banks (abbreviated to "NPL Ratio")

Charge-Off Rate On All Loans, All Commercial Banks

Net Percentage of Domestic Banks Tightening Standards on Consumer Loans, Credit Cards-St. Louis Fed (trending toward zero)

Net Percentage of Domestic Banks Tightening Standards for Commercial and Industrial Loans to Large and Middle-Market Firms-St. Louis Fed (recently increased over zero)

Net Percentage of Domestic Banks Tightening Standards for Commercial and Industrial Loans to Small Firms-St. Louis Fed (recently increased over zero)

Disclaimer: I am not a financial advisor but simply an individual investor who has been managing my own money since I was a teenager. In this post, I am acting solely as a financial journalist focusing on my own investments. The information contained in this post is not intended to be a complete description or summary of all available data relevant to making an investment decision. Instead, I am merely expressing some of the reasons underlying the purchase or sell of securities. Nothing in this post is intended to constitute investment or legal advice or a recommendation to buy or to sell. All investors need to perform their own due diligence before making any financial decision which requires at a minimum reading original source material available at the SEC and elsewhere. A failure to perform due diligence only increases what I call "error creep". Stocks, Bonds & Politics:ERROR CREEP and the INVESTING PROCESS. Each investor needs to assess a potential investment taking into account their personal risk tolerances, goals and situational risks. I can only make that kind of assessment for myself and family members.