This morning I used Barchart to sort the S&P 600 Small Cap Index stocks first for the most frequent number of new highs in the last month then again for technical buy signals of 80% or more. I used the Flipchart feature to review the charts for consistency. Today's watch list includes:

Ligand Pharmaceuticals (LGND), Kraton Performance Polymers (KRA), Olympic Steel (ZEUS), Vasco Data Security (VDSI) and Examworks(EXAM)

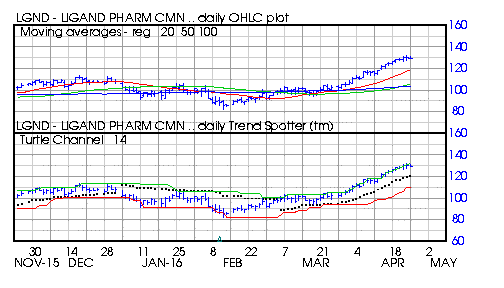

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 16 new highs and up 26.19% in the last month

- Relative Strength Index 79.24%

- Technical support level at 125.16

- Recently traded at 129.58 with a 50 day moving average of 105.50

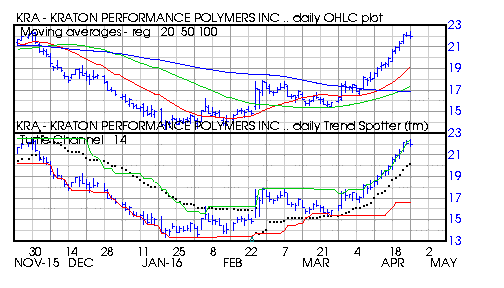

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 16 new highs and up 38.58% in the last month

- Relative Strength Index 80.31%

- Technical support level at 21.75

- Recently traded at 22.01 with a 50 day moving average of 17.34

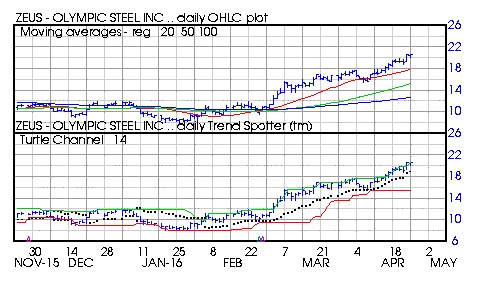

Barchart technical indicators:

- 100% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 15 new highs and up 23.98% in the last month

- Relative Strength Index 77.97%

- Technical support level at 18.78

- Recently traded at 20.71 with a 50 day moving average of 15.25

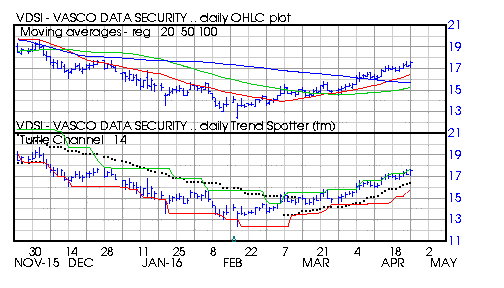

Barchatrt technical indicators:

- 80% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 an d100 day moving averages

- 15 new highs and up 17.51% in the last month

- Relative Strength Index 72.53%

- Technical support level at 16.87

- Recently traded at 17.34 with a 50 day moving average of 15.25

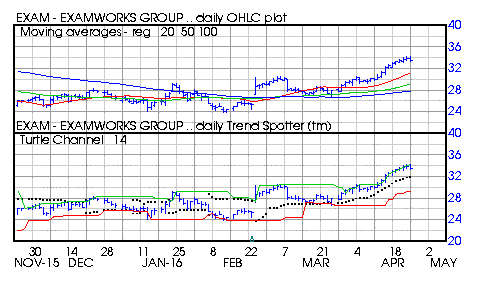

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 an d100 day moving averages

- 15 new highs and up 20.05% in the last month

- Relative Strength Index 75.52%

- Technical support level at 33.12

- Recently traded at 33.43 with a 50 day moving average of 29.13