This is what I wrote my clients on Friday Night

This morning we had a new jobs report where the numbers came in short of estimates, but not short enough to make Wall Street believe that the Fed will not raise rates in December and thus the markets were all over the board. Instead of me going into detail on the report, I will let everyone benefit by having my fellow CEI Advisor Equity Analyst Mark Bern explain it all to you.

http://askfriedrichbern.com/new-blog/2016/10/7/the-reality-of-the-employment-report

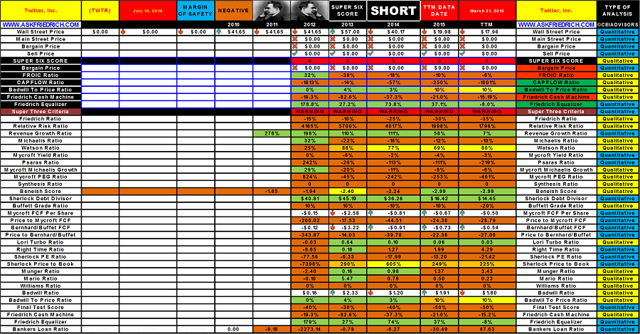

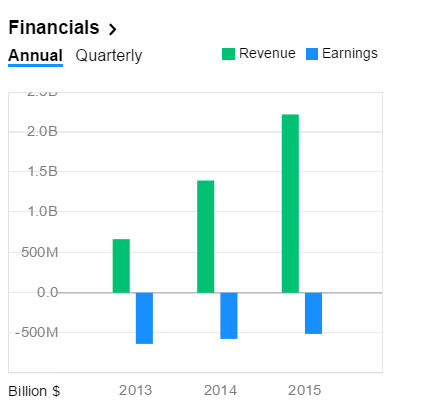

Since everyone seems to love when I rant, I will do so by talking about the manipulation on Wall Street in regards to Twitter (TWTR). Now I mentioned before that Twitter has lost about $1.8 billion in the last three years and that it is a dog with fleas where even the fleas have fleas. as you can see below, but that did not stop the Den of Thieves on Wall Street from trying to "Pump and Dump" it over the last two weeks and make $millions of dollars from Wall Street's outright criminal, unethical and immoral behavior.

Since most investors basically believe everything that comes out of Analysts mouths and thus believed the absolute lies and rumors that Google (GOOG), Disney (DIS), Apple (AAPL) or Salesforce (CRM) might buy Twitter and they were mentioning figures of $31 a share. The stock was trading around $17.50 and then shot up to $25.40 and made these manipulators and thieves about $8 per share in just a week and they got to $25.40 and if anyone bothered to look that the numbers you would have noticed that Twitter was losing $500+ million a year.

Now why would profitable companies like those mentioned above want to buy a company that is losing $500 million a year? Obviously when each of the so called buyers was asked if they wanted to buy Twitter or not, most said a resounding NO!!!! As a result those who got suckered into the PUMP suddenly found themselves DUMPED on big time.

Well if anyone just bothered to look at what Friedrich had to say they would have seen this:

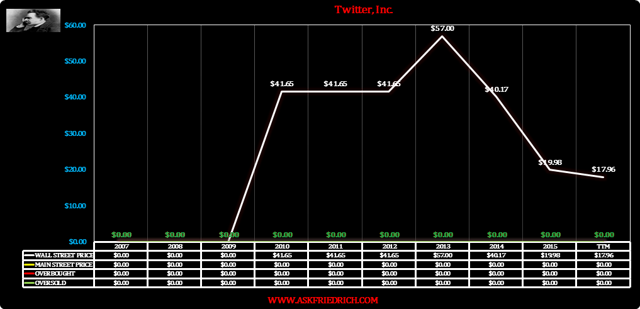

Whenever a company has negative free cash flow I immediately have Friedrich assign it a zero price across the board as I don't want anyone ever buying it. Thus here is its Friedrich Chart as well.

Twitter went public at about $44.90 in November 2013 and Friedrich immediately had it as a short. Then stock then went up to $69 as everyone and their mother was in it as part of the Pump and Dump IPO panic to the upside. So Friedrich did not look very smart for the first two months the stock was trading, but Friedrich is a long term indicator and tells you what is happening on Main Street and clearly the company is a dog with fleas. Well eventually Friedrich was proven right as the stock fell from $69 to a low of $14.30 in May. So the whole story here is to always practice patience when investing as the Main Street truth will always show up eventually. Main Street always trumps Wall Street in the end, so your short on November 2013 would have been a big winner even though it did not look good in the first two months, but facts are facts and GAAP numbers don't lie, so sometimes it takes time for companies fortunes on Wall Street to turn around.