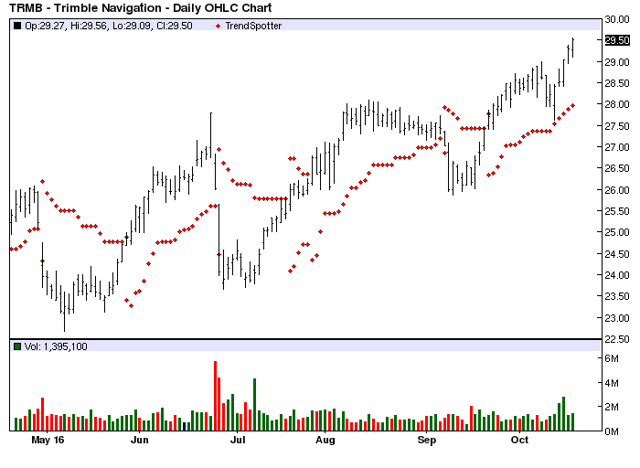

The Chart of the Day belongs to Trimble Navigation (TRMB). I found the electronic devices stock by using Barcart to sort the Russell 3000 Index stocks first by the highest number of new highs in the last month, then again for technical buy signals of 80% or better, Since the Trend Spotter signaled a buy on 9/29 the stock gained 6.50%.

Trimble applies technology to make field and mobile workers in businesses and government significantly more productive. Solutions are focused on applications requiring position or location-including surveying, construction, agriculture, fleet and asset management, public safety and mapping. In addition to utilizing positioning technologies, such as GPS, lasers and optics, Trimble solutions may include software content specific to the needs of the user. Wireless technologies are utilized to deliver the solution to the user and to ensure a tight coupling of the field and the back office.

The status of Barchart's Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read this report.

Barchart technical indicators:

- 100% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 15 new highs and up 10.57% in the last month

- Relative Strength Index 68.90%

- Technical support level at 28.91

- Recently traded at 29.50 with a 50 day moving average of 27.74

Fundamental factors:

- Market Cap $7.41 billion

- P/E 30.24

- Revenue expected to grow 4.60% this year and another 6.40% next year

- Earnings estimated to increase by 4.40% this year, an additional 18.60% next year and continue to compound at an annual rate of 12.50% for the last 5 years

- Wall Street analysts issued 6 strong buy, 3 buy and 4 hold recommendation on the stock