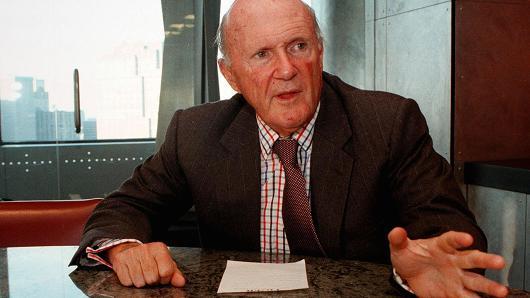

Julian Robertson was the 800 pound gorilla of the hedge fund world in the 1980s and 1990s. Sadly he left the business in the late 1990s when the tech bubble was in full swing and his value investing style was temporarily out of favor.

Robertson wasn't just a great investor, he trained great investors. Former employees of Robertson left his firm Tiger Management when it shut down and started their own funds. Many were given seed money from Robertson himself.

Several of these "Tiger Cubs" are amongst the best performing hedge funds of the past 15 years.

Robertson himself recently sat down with CNBC and revealed three stocks that he currently likes. He named Air Canada (OTCQX:ACDVF) which is trading at 3 times earnings and doing "all of the right things", Microsoft (MSFT) where he thinks the cloud strategy is working and Celgene (CELG) which he thinks is too cheap because of exaggerated Hillary Clinton concerns.

Readers can access the entire interview below:

About The Superinvestor Bulletin

Our subscriber service is off to a good start with 7 of 9 ideas ahead of the S&P 500. The complete portfolio is ahead of the S&P by 11.63%. Our latest pick is a major position in the portfolio of one of Robertson's Tiger Cubs.

We are currently offering a free trial of our service for anyone interested. Just follow this link if you are interested.