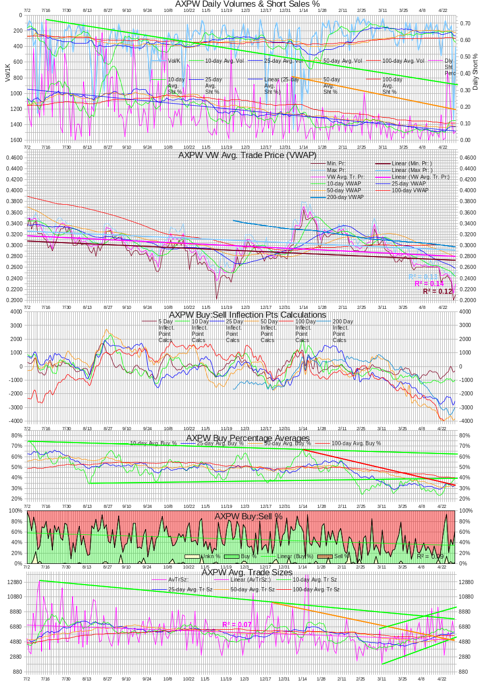

AXPW: Intra-Day Trade & Buy:Sell Inflection Point Charting 3/1/2013

I've been manually collecting this data for a year now while volume was low and it was therefore reasonable to do so. I'll stop when it gets too large unless I can craft a mechanized capture of most of the stuff.

I've captured enough data now that I can reasonably expect to be able to detect patterns on the charts that may signal, somewhat reliably, when price moves are about to occur. To help more easily identify any useful patterns, I've made an instablog,

Axion Power International (AXPW) 2/13/2012 And Forward One Year Experimental Charts Snapshots. I've also added some lines to them that may assist in this. For anybody with an interest, I welcome any suggestions and/or help.I've also put up AXPW Fails-to-deliver Charts 2/11/2013, which I hope will convince folks that John has been correct in asserting the "big uglies" are out of our lives, at least for now.

I'll update this instablog daily as long as I can for anybody that might find it useful. The charts will stay near the top and the text updates expressing my most recent thoughts will follow after the charts.

I've arranged the chart segments in this instablog to put what I think are related stuff close together.

This is the eighth installment of the original "AXPW: Some Intra-Day Trade Charting" instablogs I've started doing on Seeking Alpha. The others grew, as I added daily commentary and FINRA data, to the point I was afraid the load time might become an irritant for folks that have less internet bandwidth or older computing equipment so I've started rolling to a new one aperiodically.

Versions subsequent to the original (latest to oldest) can be found here.

AXPW: Intra-Day Trade & Buy:Sell Inflection Point Charting 02/01/2013

AXPW: Intra-Day Trade & Buy:Sell Inflection Point Charting 12/15/2012

AXPW: Intra-Day Trade & Buy:Sell Inflection Point Charting 11/14/2012

AXPW: Intra-Day Trade & Buy:Sell Inflection Point Charting

AXPW: Intra-Day Trade Charting 9/6/2012 - Xx/xx/2012

AXPW: Intra-Day Trade Charting 7/7/2012 - 9/5/2012

In the below chart note that the volume is inverted to enhance readability! Be aware when you view it!

(right-click and open in new tab, position cursor over image to be able to zoom and scroll)

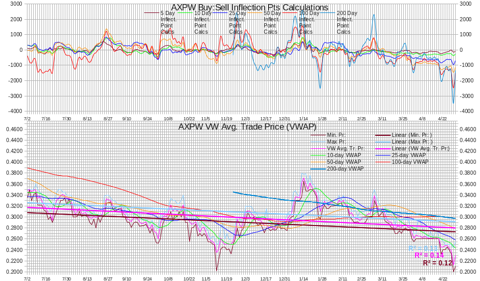

The following is a modified inflection point calculation with a price chart for comparison. Note that the false bullish moves and contrary moves of the 5-day on my original has been eliminated.

The inflection points are calculated differently from the original above. More work to do, this is a start, hopefully.

I've identified some changes I want to try on the new inflection point calculations but haven't had time to implement them yet. I'll work them in over time after a little experimentation.

Comments and further suggestions welcome.

(right-click and open in new tab, position cursor over image to be able to zoom and scroll)

In all the charts above I had to:

- estimate 3/27 buy:sell ratio because I couldn't get ADVFN screen-shots that day,

- omit 3/28 data due to garbage from the ADVFN feed.

- estimate the buy:sell for the first 28 trades of 11/26 as the ADVFN feed did not properly classify then because the bid/ask was missing. I put all the $0.26xx trades below $0.2650 as sells and ones at or above $0.2650 as buys. This was 41% of the days volume, 227,698 shares.

Continuing tracking the "Dly Sht % of 'sells'" and inflection point calculations values are now only in the latest daily comment - attempting to keep things shorter for faster loading.

04/30/2013: EOD stuff partially copied to the concentrator.

# Trds: 67, MinTrSz: 200, MaxTrSz: 101000, Vol 407902, AvTrSz: 6088

Min. Pr: 0.2101, Max Pr: 0.2549, VW Avg. Tr. Pr:0.2300

# Buys, Shares: 39 244035, VW Avg Buy Pr: 0.2312

# Sells, Shares: 25 155867, VW Avg Sell Pr: 0.2287

# Unkn, Shares: 3 8000, VW Avg Unk. Pr: 0.2210

Buy:Sell 1.57:1 (59.8% "buys"), DlyShts 21880 (5.36%), Dly Sht % of 'sells' 14.04%

Well, a good day for several reasons. First, it appears that the combination of the quarterly reporting announcement, apparent near exhaustion of the bigger sellers and low price encouraged investors and/or traders to buy as prices began to recover, being up as much as ~20% intra-day. Even with some typical late-day weakness and maybe at least one big seller (a 101K "buy" made from that seller at $0.23), we saw decent volume, decent buy:sell, decent activity in "negotiation" on the bid/ask and a close of +12.79%.

Along with the 101K "buy", we had a 50K "sell" at $0.24. These two order combined skewed several metrics. The average trade size without them would be 3,834, at the lower range of what I think is retail trading areas. The buy:sell would drop to 1.35:1 (55.7% "buys") and my VWAP would hit $0.2281. But all this is just for a little context and doesn't change my view of a good day. One reason is ...

I captured 24 peeks at changes in the bids and 16 looks at the asks. Nineteen bids were moves up, some due to one price level exhaustion uncovering hidden ones from a particular market-maker. Only 4 were moves lower. On the asks eight were up and 4 were moves lower. In aggregate, a nice change from so many recent days.

The other thing that made it nice is that we got what I expected, which always gives me the "warm fuzzies". Price rebounded to hit above $0.25 during the day and the evidence of big sellers was, at least temporarily, reduced. We still have someone either taking profits or cutting losses or ... but the daily short sales moved back down to what's been more common recently. Since I believed the spike in that during the last few days was linked to one particular seller, I think this says at least that one was not active today.

Another "as expected" (or at least should've been) is topping at previous points of significance during down trends and during churn - $0.25 (12/29/11) , $0.253 (9/28/12), $0.252 (10/1/12), $0.255 (10/22/12, 4/2/13). This tells us that we do have some traders in the market. I'll be looking for signs of more investors in the market going forward.

I'm running late, so I'll stop here and get this and the charts up in the instablog later today.

Details of "Dly Sht % of 'sells'" and inflection points omitted from the concentrator.

Rolling 5-day inflection point calculation aggregate percentage change (now abbreviated):

******* ******* *5 Day** *10 Day * * 25Day ** 50 Day **100Day* 200 Day

04/02 5 Day -0272.87 -0013.47 -0289.62 -1136.10 -0560.90 -0324.10

04/03 5 Day -0459.16 +0049.98 -0390.46 -0597.84 -0417.88 -0260.85

04/04 5 Day -0524.33 -0105.07 -0582.60 -0603.25 -0349.86 -0122.43

04/05 5 Day -0678.86 -0440.28 -0751.67 -1530.15 -0400.68 -0508.48

04/08 5 Day -0112.76 -0515.05 -0542.01 -0370.79 -0068.54 -0383.27

04/09 5 Day -0051.64 -0324.51 -0723.52 -0184.13 +0174.38 -0700.78

04/10 5 Day -0090.99 -0550.15 -0663.32 -0363.83 -0276.88 -0818.75

04/11 5 Day +0217.47 -0306.86 -0415.28 -0254.67 -0174.37 -1000.07

04/12 5 Day +0592.58 -0086.28 -0214.43 -0070.91 -0084.02 -0855.51

04/15 5 Day +0307.69 +0194.93 -0262.98 -0278.18 -0329.85 -0953.90

04/16 5 Day +0197.89 +0146.25 -0064.73 -0434.10 -0615.84 -0938.44

04/17 5 Day +0231.94 +0140.95 -0103.53 -0467.08 -0620.02 -0882.06

04/18 5 Day -0146.72 +0070.75 -0278.12 -0585.89 -1042.04 -1017.25

04/19 5 Day -0613.33 -0020.75 -0553.59 -0911.74 -1351.48 -1101.66

04/22 5 Day -0359.22 -0051.53 -0331.69 -0772.92 -1252.81 -1062.81

04/23 5 Day -0261.83 -0063.94 -0129.06 -0778.07 -1350.62 -0886.95

04/24 5 Day -0053.44 +0178.49 +0137.49 -0482.27 -1148.30 -0722.72

04/25 5 Day +0298.25 +0151.54 +0263.94 -0187.49 -0641.81 -0796.42

04/26 5 Day +0915.23 +0301.90 +0454.21 +0277.98 -0383.99 -0542.97

04/29 5 Day +0388.09 +0028.87 -0178.50 +0026.88 -0829.93 -0157.20

04/30 5 Day +0349.95 +0088.12 -0038.51 +0144.53 -0463.40 +0170.18

Average % change/day, 5 days

____ **5 Day *10 Day *25 Day *50 Day 100 Day 200 Day

03/26 +160.72 +167.40 +203.92 -483.04 +114.61 -187.97

03/27 +132.61 +140.63 +139.70 -511.08 +125.85 -195.90

03/28 +066.23 +102.55 +046.37 -328.58 +061.72 -184.64

04/01 -127.44 -022.35 -118.79 -094.56 -085.50 -191.34

04/02 -106.45 -015.07 -094.53 -004.99 -035.75 -128.62

04/03 -193.66 -032.94 -158.06 +132.16 -062.88 -025.01

04/04 -188.72 -056.10 -165.93 +098.00 -041.49 +032.74

04/05 -183.49 -117.26 -161.45 -255.93 -024.44 -040.47

04/08 +057.91 -069.53 -030.69 +195.60 +114.66 +072.11

04/09 +044.25 -062.21 -086.78 +190.39 +147.05 -075.34

04/10 +073.64 -120.03 -054.57 +046.80 +028.20 -111.58

04/11 +148.36 -040.36 +033.46 +069.71 +035.10 -175.53

04/12 +254.29 +070.80 +107.45 +291.85 +063.33 -069.41

04/15 +084.09 +141.99 +055.81 +018.52 -052.26 -114.13

04/16 +049.90 +094.15 +131.76 -049.99 -158.04 -047.53

04/17 +064.58 +138.22 +111.96 -020.65 -068.63 -012.66

04/18 -072.84 +075.52 +027.43 -066.24 -173.54 -003.44

04/19 -241.18 +013.11 -067.83 -168.17 -253.49 -049.23

04/22 -133.38 -049.29 -013.74 -098.95 -184.59 -021.78

04/23 -091.94 -042.04 -012.86 -068.79 -146.96 +010.30

04/24 -057.08 +007.51 +048.20 -003.04 -105.66 +031.87

04/25 +088.99 +016.16 +108.41 +079.68 +080.05 +044.17

04/26 +305.71 +064.53 +201.56 +237.94 +193.50 +111.74

04/29 +149.46 +016.08 +030.64 +159.96 +084.58 +181.12

04/30 +122.35 +030.41 +018.11 +184.52 +177.44 +211.43

I encourage those with an interest to look at the charts and notice the prior patterns similar to the current one and the resulting price activity.

Dly Sht % of 'sells' values JIC it turns out to be useful...

Wed., 8/01: 2.37% 46.91% 0.00%

Mon., 8/06: 19.99% 33.11% 3.34% 73.89% 33.88%

Mon., 8/13: 25.13% 3.06% 71.64% 50.47% 393.87%

Mon., 8/20: 129.14% 155.71% 899.39% 137.13% 209.19%

Mon., 8/27: 34.71% 61.1% 107.48% 24.28% 104.22%

Tue., 9/4 148.07% 28.40% 16.32% 3.01%

Mon. 9/10: 23.65% 50.20% 26.05% 252.39% 185.99%

Mon. 9/17: 32.74% 12.62% 12.85% 42.25% 42.89%

Mon. 9/24: 5.08% 50.67% 89.56% 9.24% 44.74%

Mon. 10/1: 74.24% 67.10% 517.63% 102.93%

Mon. 10/8: 28.10% 27.40% 11.45% 27.48% 25.32%

Mon. 10/15: 44.06% 17.09% 71.49% 40.64% 139.27%

Mon. 10/22: 194.20% 19.54% 25.53% 15.21% 15.17%

Wed. 10/31: 62.24% 149.46% 39.90%

Mon. 11/05: 30.92% 7.61% 6.98% 3.53% 10.10%

Mon. 11/12: 4.01% 116.57% 30.19% 16.71% 39.58%

Mon. 11/19: 14.90% 3.88% 259.67% T'gvg Day 8.97% (1/2 day)

Mon. 11/26: 65.57% 142.31% 59.83% 11.20% 69.26%

Mon. 12/03: 29.97% 13.19% 10.55% 15.57% 40.42%

Mon. 12/10: 3.59% 9.24% 135.35% 6.19% 12.73%

Mon. 12/17: 26.17% 8.82% 44.97% 3.63% 15.11%

Mon. 12/24: 258.33% 92.71% 31.98% 1.54%

Mon. 12/31: 14.36% H'lday 262.58% 6.39% 131.03%

Mon. 01/07: 45.09% 77.18% 52.53% 36.35% 52.72%

Mon. 01/14: 27.99% 0.70% 48.48% 11.09% 11.21%

Tues. 01/22: 00.26% 23.79% 12.89% 8.36%

Mon. 01/28: 69.26% 42.03% 7.96% 0.00% 28.33%

Mon. 02/04: 17.36% 28.73% 18.53% 12.68% 39.65%

Mon. 02/11: 25.67% 5.99% 16.57% 17.04% 8.23%

Tues. 02/19: 19.57% 19.88% 10.17% 30.54%

Mon. 02/25: 2.88% 55.65% 28.57% 6.95% 0.28%

Mon. 03/04: 100.79% 18.46% 11.55% 21.97% 3.61%

Mon. 03/11: 25.81% 9.64% 1.35% 13.40% 0.00%

Mon. 03/18: 7.10% 5.65% 9.26% 25.15% 9.02%

Mon. 03/25: 1.47% 14.69% 4.15% 25.64%

Mon. 04/01: 4.74% 11.82% 19.85% 3.42% 0.59%

Mon. 04/08: 8.01% 9.51% 13.54% 0.00% 6.62%

Mon. 04/15: 2.68% 8.94% 5.64% 1.67% 18.45%

Mon. 04/22: 0.42% 4.90% 690.95% 39.86% 22.22%

Mon. 04/29: 5.98% 14.04%

Feb Avg: 54.68%, min: 0.35%, max: 200.89%

Mar Avg: 49.86%, min: 0.70%, max: 252.30%

Apr Avg: 31.50%, min: 0.00%, max: 74.35%

May Avg: 62.73%, min: 0.00%, max: 398.94%

Then the Mega-C shares entered market? Note the hefty change in both the averages and maximums.

Jun Avg: Avg: 183.48%, min: 5.05%, max: 1607.50%

Jul Avg: 176.07%, min: 7.75%, max: 1273.20%

Sometime in August I began stating that I thought the larger sellers might be getting exhausted.

Aug Avg: 113.91%, min: 0.00%, max: 899.39%

Sep Avg: 56.67%, min: 3.01%, max: 252.39%

Oct Avg: 85.05%, min: 11.45%, max: 565.73%

Nov Avg: 51.96%, min: 3.53%, max: 259.67%

Dec Avg: 38.72%, min: 1.54%, max: 258.33%

============ 2013 ===============

Jan Avg: 44.20%, min: 0.00%, max: 262.58%

Feb Avg: 20.90%, min: 2.88%, max: 55.65%

Mar Avg: 15.42%, min: 0.00%, max: 100.79%

Apr Avg: 40.63%, min: 0.00%, max: 690.95%

0430 Vol 0407902, Sht 0021880 05.36% LHC 0.2101 0.2549 0.2390 b:s 1.57:10

0429 Vol 1332379, Sht 0051500 03.87% LHC 0.2001 0.2440 0.2119 b:s 1:1.83

0426 Vol 0133648, Sht 0016000 11.97% LHC 0.2324 0.2499 0.2449 b:s 1:1.27

0425 Vol 0191550, Sht 0061000 31.85% LHC 0.2400 0.2500 0.2400 b:s 1:3.97

0424 Vol 0161622, Sht 0067022 41.47% LHC 0.2450 0.2500 0.2500 b:s 13.29:1

0423 Vol 0070533, Sht 0000833 01.18% LHC 0.2401 0.2500 0.2500 b:s 3.15:1

0422 Vol 0240850, Sht 0000550 00.23% LHC 0.2400 0.2559 0.2401 b:s 1:1.20

0419 Vol 0515507, Sht 0078791 15.28% LHC 0.2321 0.2603 0.2450 b:s 1:4.83

0418 Vol 0375500, Sht 0004500 01.20% LHC 0.2600 0.2625 0.2600 b:s 1:136.86

0417 Vol 0115060, Sht 0005275 04.58% LHC 0.2600 0.2750 0.2600 b:s 1:4.35

0416 Vol 0161636, Sht 0009600 05.94% LHC 0.2601 0.2700 0.2601 b:s 1:1.98

0415 Vol 0253015, Sht 0005800 02.29% LHC 0.2600 0.2629 0.2601 b:s 1:5.89

0412 Vol 0091300, Sht 0004500 04.93% LHC 0.2601 0.2739 0.2622 b:s 1:2.92

0411 Vol 0146890, Sht 0000000 00.00% LHC 0.2600 0.2629 0.2604 b:s 1:2.08[60]

0410 Vol 0106016, Sht 0010900 10.28% LHC 0.2605 0.2669 0.2639 b:s 1:3.15

0409 Vol 0217371, Sht 0012500 05.75% LHC 0.2611 0.2725 0.2650 b:s 1:1.53

0408 Vol 0196151, Sht 0011200 05.71% LHC 0.2600 0.2800 0.2600 b:s 1:2.48

0405 Vol 0360500, Sht 0001700 00.47% LHC 0.2600 0.2960 0.2648 b:s 1:4.04

0404 Vol 0446792, Sht 0011884 02.66% LHC 0.2602 0.2950 0.2855 b:s 1:3.52

0403 Vol 0100000, Sht 0010300 10.30% LHC 0.2600 0.2699 0.2675 b:s 1:1.08

0402 Vol 0262385, Sht 0024245 09.24% LHC 0.2550 0.2699 0.2650 b:s 1:3.58

0401 Vol 0323220, Sht 0014100 04.36% LHC 0.2600 0.2849 0.2800 b:s 1:11.63

0328 Vol 0101815, Sht 0015000 14.73% LHC 0.2760 0.2850 0.2849 b:s 1:1.35

0327 Vol 0192540, Sht 0006500 03.38% LHC 0.2751 0.3000 0.2889 b:s 1:4.37

0326 Vol 0089377, Sht 0005977 06.69% LHC 0.2800 0.2950 0.2899 b:s 1.20:1

0325 Vol 0355680, Sht 0004000 01.12% LHC 0.2771 0.3000 0.2800 b:s 1:3.26

0322 Vol 0197489, Sht 0003700 01.87% LHC 0.2700 0.2895 0.2890 b:s 3.57:1

0321 Vol 0314345, Sht 0035494 11.29% LHC 0.2750 0.2979 0.2750 b:s 1.23:1

0320 Vol 0399349, Sht 0021150 05.30% LHC 0.2700 0.3000 0.2939 b:s 1:1.34

0319 Vol 0357598, Sht 0014793 04.14% LHC 0.2700 0.2851 0.2750 b:s 1:2.74

0318 Vol 0204330, Sht 0010830 05.30% LHC 0.2800 0.2999 0.2894 b:s 1:2.94

0315 Vol 0210470, Sht 0000000 00.00% LHC 0.2810 0.3039 0.2950 b:s 1:7.02

0314 Vol 0183300, Sht 0019000 10.37% LHC 0.2880 0.3040 0.2880 b:s 1:3.42

0312 Vol 0193325, Sht 0013720 07.10% LHC 0.2931 0.3194 0.3000 b:s 1:2.79

0311 Vol 0043325, Sht 0004000 09.23% LHC 0.3100 0.3197 0.3195 b:s 1.80:1

0308 Vol 0136805, Sht 0004160 03.04% LHC 0.3050 0.3198 0.3198 b:s 1:5.39

0307 Vol 0170660, Sht 0029125 17.07% LHC 0.3010 0.3250 0.3050 b:s 1:2.62[59]

0306 Vol 0143208, Sht 0010604 07.40% LHC 0.3200 0.3369 0.3200 b:s 1:2.92

0305 Vol 0225324, Sht 0030291 13.44% LHC 0.3300 0.3500 0.3345 b:s 1:2.68

0304 Vol 0304233, Sht 0043363 14.25% LHC 0.3000 0.3100 0.3099 b:s 1:2.80

0301 Vol 0097540, Sht 0000200 00.21% LHC 0.3002 0.3400 0.3350 b:s 6.07:1

0228 Vol 0077100, Sht 0004550 05.90% LHC 0.3000 0.3200 0.3001 b:s 1:5.65

0227 Vol 0132545, Sht 0020429 15.41% LHC 0.2926 0.3109 0.3100 b:s 1:1.17

0226 Vol 0044241, Sht 0012740 28.80% LHC 0.2880 0.3095 0.2926 b:s 1:1.07

0225 Vol 0073600, Sht 0002000 02.72% LHC 0.2890 0.3089 0.2900 b:s 1:17.38

0222 Vol 0115700, Sht 0020000 17.29% LHC 0.2880 0.3108 0.2990 b:s 1:1.63

0221 Vol 0020650, Sht 0002100 10.17% LHC 0.2911 0.3001 0.3001 b:s 0:20650

0220 Vol 0108250, Sht 0016350 15.10% LHC 0.2910 0.3109 0.2910 b:s 1:3.16

0219 Vol 0255826, Sht 0033217 12.98% LHC 0.2910 0.3109 0.3000 b:s 1:2.14

0215 Vol 0114625, Sht 0005030 04.39% LHC 0.2970 0.3100 0.3100 b:s 1:1.14

0214 Vol 0450402, Sht 0037600 08.35% LHC 0.2990 0.3240 0.3000 b:s 1:1.71

0213 Vol 0247690, Sht 0033300 13.44% LHC 0.3200 0.3270 0.3200 b:s 1:5.48

0212 Vol 0269141, Sht 0012439 04.62% LHC 0.3200 0.3300 0.3200 b:s 1:3.37

0211 Vol 0262950, Sht 0039950 15.19% LHC 0.3200 0.3395 0.3300 b:s 1:1.45

0208 Vol 0170389, Sht 0022205 13.03% LHC 0.3246 0.3289 0.3260 b:s 2.04:1

0207 Vol 0147700, Sht 0007700 05.21% LHC 0.3250 0.3395 0.3269 b:s 1.43:1

0206 Vol 0078900, Sht 0009350 11.85% LHC 0.3210 0.3300 0.3300 b:s 1:1.77

0205 Vol 0075565, Sht 0011465 15.17% LHC 0.3204 0.3300 0.3235 b:s 1:1.12

0204 Vol 0211835, Sht 0013500 06.37% LHC 0.3200 0.3289 0.3288 b:s 1.72:1

0201 Vol 0247850, Sht 0026400 10.65% LHC 0.3200 0.3295 0.3245 b:s 1.66:1

0131 Vol 0063453, Sht 0000000 00.00% LHC 0.3156 0.3240 0.3200 b:s 1.29:1

0130 Vol 0159470, Sht 0008500 05.33% LHC 0.3155 0.3300 0.3199 b:s 1:2.02

0129 Vol 0145105, Sht 0014627 10.08% LHC 0.3216 0.3311 0.3290 b:s 3.17:1

0128 Vol 0094400, Sht 0018700 19.81% LHC 0.3140 0.3300 0.3250 b:s 2.50:1

0125 Vol 0473350, Sht 0027500 05.81% LHC 0.2960 0.3220 0.3140 b:s 1:2.28

0124 Vol 0416640, Sht 0033450 13.76% LHC 0.3000 0.3440 0.3222 b:s 1:1.67

0123 Vol 0210763, Sht 0029000 13.76% LHC 0.3380 0.3500 0.3440 b:s 1:1.55

0122 Vol 0257760, Sht 0000660 00.26% LHC 0.3456 0.3579 0.3500 b:s 1.04:1

0118 Vol 0278075, Sht 0020530 07.38% LHC 0.3500 0.3600 0.3585 b:s 1:1.93

0117 Vol 0439978, Sht 0029800 0.0677% LHC 0.3505 0.3757 0.3600 b:s 1:1.60

0116 Vol 1005050, Sht 0033500 03.33% LHC 0.3475 0.3600 0.3550 b:s 13.5:1

0115 Vol 0943341, Sht 0005957 05.96% LHC 0.3470 0.3789 0.3551 b:s 1:9.74

[59] Two pre-market trades totaling 12.5K are not included in FINRA-reported data. Adding these to the day's volume yields a short percentage of 15.9%. If it's also added to the short sales, the percentage goes to 22.73%.

[60] An AH 50K trade is not included in the FINRA data. Including that in the volume has no effect because reported short sales were zero. If we also include it in short sales, the short percentage moves to 25.39%. However, with the recent daily short sales so low, there's no reason to believe these were a short sale.

04/29/2013: EOD stuff partially copied to the concentrator.

# Trds: 174, MinTrSz: 300, MaxTrSz: 185191, Vol 1332379, AvTrSz: 7657

Min. Pr: 0.2001, Max Pr: 0.3440, VW Avg. Tr. Pr: 0.2125

# Buys, Shares: 78 470674, VW Avg Buy Pr: 0.2149

# Sells, Shares: 96 861705, VW Avg Sell Pr: 0.2112

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 1:1.83 (35.3% "buys"), DlyShts 51500 (3.87%), Dly Sht % of 'sells' 5.98%

Daily short sales were again relatively high, compared to the trend of the last couple months, at 51.5K. Because of the high trade volume, the percentage was quite low though. I'm guessing that the source of the daily short sales were what I guessed previously - some shares from a bigger seller that were traded through a market-maker not controlled by the broker at which the shares were held.

Just for some context, average trade size, which is near the high end of what I believe is typical retail trading, was influenced by a single trade of ~185.2K (13.9%, ~1/7th, of day's volume). Removing this trade would give us 6,631 average trade size, which I think is at the high side of the retail mid-range. That would also put the buy:sell to 1:1.44 (41% "buys") and move average trade price to $0.2143.

We managed to penetrate the low from 11/12/12, $0.2018. We also had more than triple the volume. In November, we had an immediate rebound and began our grind up. But this time we do have concerns about financing, the possibility that our big sellers are not yet done, and disgruntlement with managements (lack of) managing investors' expectations.

Thinking of the larger offers seen recently, the volume spike today, the price action and EOM, I suspect the selling pressure will abate today or tomorrow. I could be wrong, but the likelihood seems high to me.

With today's exceptional volume, there's no point in looking at my experimental stuff - weakness shown all around on the experimental inflection point calculations. The only positive is that average trades size, using either number above, is still within the up trend.

Details of "Dly Sht % of 'sells'" and inflection points included in the latest daily post above.

04/26/2013: EOD stuff partially copied to the concentrator.

# Trds: 25, MinTrSz: 448, MaxTrSz: 16000, Vol 133648, AvTrSz: 5346

Min. Pr: 0.2324, Max Pr: 0.2499, VW Avg. Tr. Pr:0.2382

# Buys, Shares: 14 56648, VW Avg Buy Pr: 0.2400

# Sells, Shares: 10 72000, VW Avg Sell Pr: 0.2366

# Unkn, Shares: 1 5000, VW Avg Unk. Pr: 0.2400

Buy:Sell 1:1.27 (42.4% "buys"), DlyShts 16000 (11.97%), Dly Sht % of 'sells' 22.22%

As we know from recent comments in the APC, assuming no subterfuge, one of our bigger sellers (apparently) was out Friday and will be out today (update: maybe not out today - posted a comment in the APC). As I suggested, the short volume and percentage dropped. I suspect this is because those shares that caused the spike in the daily short sales were sold through a market-maker that was not affiliated with the broker that held the shares. So I expect low daily short sales again today, maybe along with continued-low volume. A nice side-effect was seeing the buy percentage come somewhere near normal again although I suspect it will again plummet Tuesday, unless there's some nice PR issued.

Meanwhile, the average trade size continues its trend of creeping up and "trying" to stay in the trend of increasing back to normal ranges. Today finished within the up trend and right in the middle of what I think is retail sizes.

Since we have at least one apparently known big seller that will return tomorrow and one (at least?) still active through ATDF (and maybe other MMs), I don't see much value in even commenting beyond what I stated above, so no more today.

Details of "Dly Sht % of 'sells'" and inflection points are in the latest daily post above.

04/25/2013: EOD stuff partially copied to the concentrator.

# Trds: 31, MinTrSz: 500, MaxTrSz: 50000, Vol 191550, AvTrSz: 6179

Min. Pr: 0.2400, Max Pr: 0.2500, VW Avg. Tr. Pr: 0.2431

# Buys, Shares: 17 38527, VW Avg Buy Pr: 0.2482

# Sells, Shares: 14 153023, VW Avg Sell Pr: 0.2418

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 1:3.97 (20.1% "buys"), DlyShts 61000 (31.85%), Dly Sht % of 'sells' 39.86%

As we all know by know, there's one or more sellers with a relatively large position they are trying to exit. Today saw continued evidence of this in both a normal and somewhat abnormal (relative to prior recent behavior) behavior.

The abnormal behavior was that on ATDF we saw the 100K seller jostling with another seller that works in 10K increments to be first on the ask. This had the predictable effect of acting like yesterday (4/24): pushing the asks lower throughout the day until finally the bids began to respond to that. Ask started the day at $0.25 and eventually worked down to $0.245 at 14:17, where it stayed until after 15:00 when it was back up to $0.25 at 15:39 when I took another peek. The bids yesterday responded appropriately, starting in the $0.245x range and hit $0.2402 at 12:37, when I peeked, rose back into the $0.245-$0.246 area, where they stayed until my peeks at 14:17 ($0.2401) and 15:39 ($0.2401). Recall that at 15:39 we had 98.8K @ VWAP of $0.2488, all "sells" or "unknowns".

Today the asks began better, starting at $0.2499 and holding there (likely due to the very low volume until ...), rising to $0.2573 around 14:10 (very briefly) and dropped to $0.2498 when I peeked at 14:53. The the battle of the offers began in earnest with $0.2497 offered at 15:05 followed by steps down relatively quickly to hit $0.245 and $0.246 around 15:30, after which it held at $0.2489 for the last 15 minutes of the day. In 15 seconds, 15:45:52 to 15:46:07, 106.7K shares traded at a VWAP of $0.2402, just off the day's low of $0.24.

The normal behavior, regardless of the presence of the 100K seller, was the late-day weakness in price. We've been seeing this for months now. A lack of this for a few days running might signal some chance for appreciation, as would not seeing ATDF constantly battling for a front row seat on the offering side.

This is also the second day with a much larger than recently normal volume, and percentage, of daily short sales. Me current belief is that the 100K seller has shares at a broker that feeds them to ATDF, likely because they don't have their own captive MM desk or ...

When will it end? Here's a swag if you want to get some shares while the price is low. Recall that recently (last week?) we had an early glimpse of 400K on the offer side (at much higher prices then too!) on ATDF. We can't tell if this was a single seller or an aggregate of multiple sellers that had the same price. I'm assuming that there's at least 400K still in one or more hands that want to be out around EOM. So I think there's a good chance that it ends next week (maybe Tuesday or Wednesday?). One of the acknowledged sellers stated they would be out of pocket until Tuesday, at which time I assume his selling would resume. There's also an emotional component now, if his commentary is reflecting how he will behave. So that could bring even lower prices.

I have a little dry powder not working other areas and I will pull the trigger if I see the mentioned $0.15. I consider that unlikely unless the bottom-feeders here enter a near-hibernation state. There's just too many folks that will see excellent risk/reward with prices down in these areas and hibernators will be stepped over on the way to the buying window. But it will not be a rush while the sellers remain relatively undisciplined.

Meanwhile, back at the ranch. Average trade size remains up in the middle of what I think is retail (two days in a row near the middle) and buy:sell dropped as buyers recognized the sellers' fingerprints and properly worked the "crime scene".

My original experimental inflection point calculations still suggest that downward pressure is slowly weakening (but based on the above, you can see that could change rapidly) and the newer version is still suggesting "flat", but with some weakness in the longer-term calculations as the volume weakens in combination with other things and can't influence the longer-term trends as strongly. This could break the pattern that suggested "flat". So keep an eye out for that.

Details of "Dly Sht % of 'sells'" and inflection points are in the latest daily post above.

04/24/2013: EOD stuff partially copied to the concentrator.

# Trds: 30, MinTrSz: 200, MaxTrSz: 64522, Vol 161622, AvTrSz: 5387

Min. Pr: 0.2450, Max Pr: 0.2500, VW Avg. Tr. Pr: 0.2478

# Buys, Shares: 23 128922, VW Avg Buy Pr: 0.2485

# Sells, Shares: 4 9700, VW Avg Sell Pr: 0.2453

# Unkn, Shares: 3 23000, VW Avg Unk. Pr: 0.2450

Buy:Sell 13.29:1 (79.8% "buys"), DlyShts 67022 (41.47%), Dly Sht % of 'sells' 690.95%

Things of note today, other than we indeed seem to be doing "flat": short volume and percentage; buy:sell says lots of folks see this as low-risk entry point and/or expect very good news; "Dly Sht % of 'sells'" is in an area not seen for months (the "big seller(s)" today were shorting to buyers, not hitting the bid), the short volume was very close to the largest block trade today of 64.5K (a "buy" @ $0.25); price spread is very narrow; volume more than doubled yesterday's; average trade size (affected by that big trade) moved back into the rising trend range I've been noting, today it's at mid-range of what I think is retail.

The fourth consecutive day of improving buy percentage has begun to affect the 5 and 10-day averages. I'm expecting this to continue, likely haltingly.

My original experimental inflection point calculations continue to show a reduction in the weakness. Patterns are starting to form that may lead to an indication of price moving up. As usual, it's early though and the patterns haven't formed up yet. On the newer version, which considers additional factors, it's even more so. However, it's still just a "flat" indication until the patterns form up a bit better over time.

Details of "Dly Sht % of 'sells'" and inflection points are in the latest daily post above.

04/23/2013: EOD stuff partially copied to the concentrator.

# Trds: 23, MinTrSz: 150, MaxTrSz: 9300, Vol 70533, AvTrSz: 3067

Min. Pr: 0.2401, Max Pr: 0.2500, VW Avg. Tr. Pr: 0.2484

# Buys, Shares: 18 53533, VW Avg Buy Pr: 0.2499

# Sells, Shares: 5 17000, VW Avg Sell Pr: 0.2437

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 3.15:1 (75.9% "buys"), DlyShts 833 (01.18%), Dly Sht % of 'sells' 4.90%

Average trade size dropped to the very lower end of what I think is retail today, but after the price and volume action of the prior two days, I wouldn't consider this a break in the generally rising trend ... yet. This seems reasonable, too, in light of what I think is relatively good price and buy:sell action after the step down we just came through.

I also see support in the movement of the bids and asks throughout the day. Yes, the trades were few and the volume was low, but the tendency looked quite positive to me. Of the ten changes in bids that I caught from pre-market (8:02) to the close, seven were increases in the bid and three were down (keep in mind that at the close many bids are withdrawn and lower bid are exposed - maybe two reduced instances would be a better number). The asks were really very stable today. Only three changes were noted in the same period, with one an increase in ask price, one a decrease and one unchanged.

Buy:sell has made enough of a recovery over the last three days such that the 10 and 25-day buy percentage averages have begun to show improvement. Of course, those values were so low and far out of trend that we shouldn't start doing any handsprings yet. Small improvement have out-sized effects under these conditions.

If this sort of behavior in the bids and asks continues, and the buy:sell stays in more normal ranges, I think we can look forward to some price increase. However, I would not make that judgment on one day's action and low number of trades and volume, especially since my newer inflection point calculations began formation of a pattern yesterday that, if it continues, suggested "flat" action in the past. I think today is just a start of some consolidation. But it's still positive compared to what we've been seeing. The key will be the action as we exit it, of course. And there's a possibility we won't exit it until some announcement from Axion appears. In light of recent action, having the fire doors locked may be a really good thing.

My original inflection point calculations, as we could expect from the above, has the three shortest periods indicating a reduction in weakness while the longer ones just go "ho-hum - keep on keepin' on". The newer version, as mentioned, shows the same and continues a pattern formation that has suggested flat action in the past.

Details of "Dly Sht % of 'sells'" and inflection points are in the latest daily post above.

04/22/2013: EOD stuff partially copied to the concentrator.

# Trds: 30, MinTrSz: 500, MaxTrSz: 84500, Vol 240850, AvTrSz: 8028

Min. Pr: 0.2400, Max Pr: 0.2559, VW Avg. Tr. Pr: 0.2448

# Buys, Shares: 15 109550, VW Avg Buy Pr: 0.2499

# Sells, Shares: 15 131300, VW Avg Sell Pr: 0.2405

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 1:1.20 (45.5% "buys"), DlyShts 550 (00.23%), Dly Sht % of 'sells' 0.42%

Average trades size was influenced by an 84.5K trade, 31.5% of day's volume. With this trade, it put us in what I think is the upper range of retail. Without it, we would have been at 5391, what I think is mid-range of retail. Even with this latter value, it continues the trend of generally increasing average trade size within the trend lines on my chart, which may bode well for price appreciation a bit down the road.

Since this trade, and the other two associated with it (they were RuggedDC's trades) were "sells", they also influenced the buy:sell ratio. Just removing them from the "sell" total moves buy:sell to 3.50:1. Nice to think about, but I don't think a one-day improvement of that magnitude for that reason should be given any weight. Just nice to know some context is all.

On my original experimental inflection point calculations, nothing to comment on, really. As we could expect from today's action, the five-day stops it's descent while the longer-term ones, except one, continue to show weakness, Interestingly, to me, is that the newer version, which was intended to ameliorate the "flakiness" of the original and consider other factors to get better reliability, has all periods making a "flip up". In this particular configuration it doesn't, based on minimal experience so far, suggest an up trend, but does suggest going sideways. My quick perusal of that chart suggests it is fairly reliable in this suggestion. It doesn't suggest duration though, AFAICT.

Details of "Dly Sht % of 'sells'" and inflection points are in the latest daily pot above.

04/19/2013: EOD stuff partially copied to the concentrator.

# Trds: 80, MinTrSz: 150, MaxTrSz: 57165, Vol 515507, AvTrSz: 6444

Min. Pr: 0.2321, Max Pr: 0.2603, VW Avg. Tr. Pr: 0.2455

# Buys, Shares: 22 88495, VW Avg Buy Pr: 0.2455

# Sells, Shares: 58 427012, VW Avg Sell Pr: 0.2456

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 1:4.83 (17.2% "buys"), DlyShts 78791 (15.28%), Dly Sht % of 'sells' 18.45%

Yesterday I said "If I was doing good old traditional TA, which I'm not. I would be watching to see if this was "end of trend" suggested by the volume and long flat price trend. But in light of recent behavior, no such guess is forthcoming from me right now".

Well, missed my chance to look like a genius I guess because the flat trend was decisively broken today. With "feeling" too - volume was above all my averages, 10, 25, 50 and 100-day, in thousands: 215, 243, 204 and 292 respectively. And just for fun, I did a 200-day SMA which came in at ~324.6K. Today's volume is the highest since the 1MM+ of 1/16!

Average trades size was right in the high-middle of what I think is retail and above all but the 10-day average, where it was almost exactly a match to that 6,473. This was influenced by six larger trades accounting for 175,257 shares, 34% of the days volume. Excluding those yielded an average size of 4,598, what I think is mid-range for retail.

Since our peak VWAP of $0.3710 1/14 at the end of our grind up, and the start of our grind down, we have traded 15,305,660 shares. Interesting is that the number of shares traded during our grind up, which began when the VWAP nadir of $0.2352 on 11/12/2012 occurred, is 15,899,640.

Hm? Coinky-dink? 15.3MM vs 15.9MM? Methinks no coinky-dink exists there!

Anybody got the guts to call the start of a grind up now? I don't! How 'bout the near-term bottom? Anyone? From this I draw the conclusion that we had lots of traders in the stock and/or not near as many "strong hands" as we had envisioned. Makes me feel somewhat foolish for only trading a few small trading blocks I had allocated. And maybe for sharing my data and thoughts so easily too.

I'm going to have to consider that last item.

Another interesting, to me, item is the start of the reduced daily short sales. This was brought to mind by today's relatively large (compared to recent values) percentage. Looking at my charts we see the drop off in daily short sales appeared around the 1/14 time-frame. Another coinky-dink? Maybe. But I tend to side with Leroy Jethro Gibbs here too. It may be nothing, but ...

Wrapping up, my original inflection point calculations which I mentioned were suggesting flat and/or weakening and were disorganized, are no longer disorganized. They achieved the state now where I watch for signals of an uptrend to start. My newer version is in the same state - now I watch for a turn.

Details of "Dly Sht % of 'sells'" and inflection points in the latest daily post above.

04/18/2013: EOD stuff partially copied to the concentrator.

# Trds: 31, MinTrSz: 80, MaxTrSz: 30000, Vol 295580, AvTrSz: 9535

Min. Pr: 0.2600, Max Pr: 0.2625, VW Avg. Tr. Pr: 0.2604

# Buys, Shares: 1 1970, VW Avg Buy Pr: 0.2600

# Sells, Shares: 29 269610, VW Avg Sell Pr: 0.2602

# Unkn, Shares: 1 24000, VW Avg Unk. Pr: 0.2625

Buy:Sell 1:136.86 (00.67% "buys"), DlyShts 4500 (1.20%), Dly Sht % of 'sells' 1.67%

One trade today was a "buy". Three of the last six days have had increasingly larger average trade sizes. We are still in a trend of increasing sizes, as evident on my chart. Today the average trade size is at the high side of what I consider to be typical retail range. This is explained by the following trades, all but the one priced at $0.2625 being "sells" and that one being "unknown". All after 11:56 A.M.:

$0.2600 10000, $0.2600 16920, $0.2602 22500, $0.2600 23030, $0.2600 23100, $0.2625 24000, $0.2602 24900, $0.2602 24900, $0.2605 25000, $0.2600 25000 and $0.2610 30000.

These trades were 84.36% of the day's volume and 35.5% of the number of trades for the day. You can see this also explains the "buy" percentage being less than 1%. All but two trades "hit the bid", representing 269,610 shares released into and taken from the market. Under this scenario I assume price was not a major factor in the sellers' decisions, continuing the trend we've been watching.

The movement of bids and asks during the day were balanced with about half up and half down on both at the times I peeked.

If I was doing good old traditional TA, which I'm not. I would be watching to see if this was "end of trend" suggested by the volume and long flat price trend. But in light of recent behavior, no such guess is forthcoming from me right now.

Details of "Dly Sht % of 'sells'" and inflection points omitted from the concentrator.

04/16/2013: EOD stuff partially copied to the concentrator.

# Trds: 31, MinTrSz: 371, MaxTrSz: 40000, Vol 161636, AvTrSz: 5214

Min. Pr: 0.2601, Max Pr: 0.2700, VW Avg. Tr. Pr:0.2634

# Buys, Shares: 16 54196, VW Avg Buy Pr: 0.2659

# Sells, Shares: 15 107440, VW Avg Sell Pr: 0.2621

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 1:1.98 (33.5% "buys"), DlyShts 9600 (05.94%), Dly Sht % of 'sells' 8.94%

Average trade size continues to be in an upward trend and with only one larger trade today - our 3 largest trades were 40K, 23K and 10K. Today we're smack in the middle of what I think is retail size and in the area of all the averages and the long-term calculated trend. If this keeps up, I might have to read something into it.

You can see from the number of buy and sell trades, and their VWAPs and volumes, that the sellers and buyers were not far out of balance today. This seems supported by the bid ticks up and down, at the times I checked today, being fairly balanced - 4:3 in favor of up ticks. Asks favored down ticks - five down, three up and one unchanged.

VWAP is holding steady: $0.2647, $0.2630, $0.2610, $0.2620, $0.2610 and $0.2634. Our five and 10-day averages are $0.2621 and $0.2635 respectively. Note too the buy and sell five-day VWAPs vs. their averages: $0.2642 and $0.2613 respectively. The daily values have been hanging right around their five-day averages, slightly up and down, for the last week or so.

All of the above, combined with low volume, makes me think of "basing". The trouble is we don't yet see strong trend evidence of the sellers being exhausted with the buy and sell five-day average percentages running at 26.02% and 73.98% respectively.

Details of "Dly Sht % of 'sells'" and inflection points are in the latest daily post above.

04/15/2013: EOD stuff partially copied to the concentrator.

# Trds: 27, MinTrSz: 100, MaxTrSz: 67000, Vol 253015, AvTrSz: 9371

Min. Pr: 0.2600, Max Pr: 0.2629, VW Avg. Tr. Pr:0.2610

# Buys, Shares: 5 36700, VW Avg Buy Pr: 0.2629

# Sells, Shares: 22 216315, VW Avg Sell Pr: 0.2607

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 1:5.89 (14.5% "buys"), DlyShts 5800 (2.29%), Dly Sht % of 'sells' 2.68%

Since today's average trade size is above what I believe to be "retail", I wanted to highlight that we had one really abnormally large trade and a few more abnormally large trades today, just to provide a little context. If you don't want to read the comments, we had 5 trades (out of 27 for the day) totaling 169.1K, 66.8% of day's volume, at a VWAP of $0.2609. Excluding those, which is not reasonable of course, we had 83915 shares traded at a VWAP of $0.2613.

I wanted to note that our asks and bids have been holding fairly steady, overall, the last many days and the price weakness is almost exclusively the result of sellers hitting the bids. This can be seen in the recent high "sell" percentages since 3/20: 57.22, 44.82, 20.78, 76.55, 45.52, 81.38, 57.46, 92.08, 78.17, 51.90, 77.89, 80.17, 71.25, 60.50, 75.92, 67.55, 74.48 and 85.49. As to the effect of the bids holding up recently, this appears in the VWAPs from 4/2 onward: $0.2610, $0.2669, $0.2655, $0.2653, $0.2620, $0.2647, $0.2630, $0.2610, $0.2620 and $0.2610. The average over this 10-day period is $0.2632. We mustn't overlook that some of this is from folks hitting the ask too.

Which way we'll break from this trend is unpredictable, IMO, because of the apparently common feeling that everybody, except the sellers, is awaiting the capital raise news. Some feel the longer we go, the more positive because management wouldn't cut it too close and must have a decent deal in-hand. Others are much less positive and are expecting a raise yet to come that will be geared to some period's average price of some type, with a discount applied.

My original experimental inflection point calculations continue to be disorganized, suggesting noting but more of the same for now. The newer version is better with the three near-term calculations saying "flat" and the longer-term ones showing a slight weakening at the moment.

Details of "Dly Sht % of 'sells'" and inflection points are in the latest daily post above.

04/12/2013: EOD stuff partially copied to the concentrator.

# Trds: 17, MinTrSz: 300, MaxTrSz: 19500, Vol 91300, AvTrSz: 5371

Min. Pr: 0.2601, Max Pr: 0.2739, VW Avg. Tr. Pr: 0.2620

# Buys, Shares: 6 23300, VW Avg Buy Pr: 0.2658

# Sells, Shares: 11 68000, VW Avg Sell Pr: 0.2607

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 1:2.92 (25.5% "buys"), 4500 (4.93%), Dly Sht % of 'sells' 6.62%

Average trade size continues to be in a rising trend, seen on the instablog charts. Today it was smack in the middle of what I believe to be average retail size. Do keep in mind though that volume was very low, second only to the 89.38K of 3/26 in recent trading, and there were only 17 trades for the day. This means we can't really evaluate whether or not it is saying anything today.

The buy percentage continues low but has not yet broken the slowly rising trend it has been in. How slowly rising? Even though it has been "trending" for nine days, not one of the averages I plot are ticking up with authority yet. The best is the 25-day average, which has been essentially flat for 3 whole days.

I've already mentioned the low volume. Add in that VWAP could be charitably described as weakening in a range of flat: $0.2707, $0.2610, $0.2669, $0.2655, $0.2653, $0.2620, $0.2647, $0.2630, $0.2610 and $0.2620. For some context, intra-day VWAP averages for 5, 10, 25 and 50-day periods respectively: $0.2625, $0.2642, $0.2797 and $0.2971. Not positive, to say the least.

The bids trended up throughout the day, but the low volume, again, suggests we should not place a lot of weight on this activity. Anyway, from before market open when bid was $0.25 through the last peek at 14:43, the bid stepped up 6 of the eight instances I recorded, with the remaining two unchanged. Asks were mixed with the BMO (before market open) offer seen of $0.275 going to $0.2605 at the open and moving up three more times and down four more times during the day and ending at $0.2629 on my last intra-day peek at 14:43. The high seen, and it was traded for 300 shares, was $0.2739 at 12:17.

On my original experimental inflection point calculations, the short-term (5, 10 and 25-day periods) continue to suggest a reduction in the rate of weakening of the buy:sell ratio. The longer-term ones are suggesting the opposite. This is what I call disorganized. On my newer version, intended to be less flaky and to be sensitive to other factors as well, all periods are going "flat", suggesting a reduction in the weakening. The conditions are best comprehended looking at the charts. For both the original and newer versions though, keep the volume in mind. Both are volume-sensitive and smaller volumes make what they show much less reliable.

Details of "Dly Sht % of 'sells'" and inflection points are in the latest daily post above.

04/11/2013: EOD stuff partially copied to the concentrator.

# Trds: 23, MinTrSz: 400, MaxTrSz: 50000, Vol 196890, AvTrSz: 8560

Min. Pr: 0.2600, Max Pr: 0.2629, VW Avg. Tr. Pr: 0.2610

# Buys, Shares: 12 63900, VW Avg Buy Pr: 0.2622

# Sells, Shares: 11 132990,VW Avg Sell Pr: 0.2605

# Unkn, Shares: 0 0,VW Avg Unk. Pr: 0.0000

Buy:Sell 1:2.08 (32.5% "buys"), DlyShts 0 (00.00%), Dly Sht % of 'sells' 0.00%

An AH 50K trade is not included in the FINRA data. Including that in the volume has no effect because reported short sales were zero. If we also include it in short sales, the short percentage moves to 25.39%. However, with the recent daily short sales so low, there's no reason to believe these were a short sale.

Without that trade, buy:sell would be 43.5% "buys" and the average trade size would be in the upper-mid range of what I believe is "retail". With it the average trade size is above what I believe to be typical retail sizes. Is all this a result of the "last gasp" exit by the sellers? Recall yesterday I suspected we might hit $0.25xx today. Didn't quite make it, but not from lack of trying. You can see from the buys and sells lines above that the sellers hit the bids with large trades, as compared to the buys. The sells alone is sufficient to take 2/3rds of the 188K asks we espied from ATDF today. I'd like to think that ends it, but we did see a 39K, and maybe a 120K, offer from UBSS alone today. They may still be out there in the $0.2625/$0.2629 area.

Details of "Dly Sht % of 'sells'" and inflection points are in the latest daily post above.

04/10/2013: EOD stuff partially copied to the concentrator.

# Trds: 27, MinTrSz: 630, MaxTrSz: 20000, Vol 106016, AvTrSz: 3927

Min. Pr: 0.2605, Max Pr: 0.2669, VW Avg. Tr. Pr: 0.2630

# Buys, Shares: 10 25530, VW Avg Buy Pr: 0.2641

# Sells, Shares: 17 80486, VW Avg Sell Pr: 0.2626

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 1:3.15 (24.1% "buys"), DlyShts 10900 (10.28%), Dly Sht % of 'sells' 13.54%

Still in the same boat. We're getting reducing volume again, VWAP a bit weaker but still "flat", buy percentage retreating a bit again as sellers continue unabated dumping. Average trade size at the lower end of what I think is retail. But it is still in the uptrend denoted by the trend lines I added to my chart, so there's a glimmer of hope there.

My original inflection point calculations gave up a little of the improvement in the shorter-term calculations, but can't say if the improving trend is broken yet or this is just normal variation within trend that started a few days ago. My newer versions are about the same but show slightly less deterioration, as would be expected since one of its purposes was to be a bit less "flaky" than the original.

Of the bids and ask changes I happened to capture, after the open the up and down moves on the bids were evenly split at five each with one unchanged. On the asks it was similar at three each way and four cases of unchanged. The overall trend on the bids was up through around 11:15 and then weakening thereafter. The asks were similar through about 11:00 and then went flat at $0.2639 for almost the whole rest of the day. So today's slight weakening of price came from a change in buyer behavior: they didn't push bids up while the sellers continued to be willing to satisfy folks at reduced prices.

I saw my first signs, after market close, that we might hit $0.25xx today. Nothing strong, but the best bid for a while was in the $0.25 range. Those bids have been there for a long time, but generally the better bids left after close have been above those. This is very ephemeral as far as "signs" go, so I don't know if it deserves any true consideration or not.

Details of "Dly Sht % of 'sells'" and inflection points are in the latest daily post above.

04/09/2013: EOD stuff partially copied to the concentrator.

# Trds: 35, MinTrSz: 741, MaxTrSz: 25000, Vol 217371, AvTrSz: 6211

Min. Pr: 0.2611, Max Pr: 0.2725, VW Avg. Tr. Pr: 0.2647

# Buys, Shares: 18 85871, VW Avg Buy Pr: 0.2672

# Sells, Shares: 17 131500, VW Avg Sell Pr: 0.2631

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 1:1.53 (39.5% "buys"), DlyShts 12500 (05.75%), Dly Sht % of 'sells' 9.51%

Just want to note that average trade size continues in its uptrend, as I mentioned couple days back. Today end in the mid-high side of what I believe to be "retail". This is more easily discernible on my charts - been moving that way since 3/11. It's not been a really reliable predictor of action going forward, but if you peek at my one-year snapshot, you'll see that our grind up that began last November was accompanied by an improvement in this metric. Not strongly correlated with prior behavior though.

We've now been in this price range long enough that my original inflection point calculations are beginning to show a reduction in the rate of weakening. My newer version indicates this even more strongly.

With VWAP essentially flat the last seven days - $0.2707, $0.2610, $0.2669, $0.2655, $0.2653, $0.2620 and $0.2647 - it's tempting to think we've bottomed. But I'm cautious on that because our determined sellers seem to have an unlimited supply of shares they consider worth much less than current market price.

There's other points that are improving, but we don't know yet if they are a trend or one-day aberrations.

Details of "Dly Sht % of 'sells'" and inflection points in the latest daily post above.

04/08/2013: EOD stuff partially copied to the concentrator.

# Trds: 37, MinTrSz: 100, MaxTrSz: 40000, Vol 196151, AvTrSz: 5301

Min. Pr: 0.2600, Max Pr: 0.2800, VW Avg. Tr. Pr:0.2620

# Buys, Shares: 17 56391, VW Avg Buy Pr: 0.2659

# Sells, Shares: 20 139760, VW Avg Sell Pr: 0.2604

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 1:2.48 (28.7% "buys"), DlyShts 11200 (5.71%), Dly Sht % of 'sells' 8.01%

Well, I thought maybe we would turn a corner today. Bid ask stayed relatively stable most of the day. The fly in the ointment spoiled my hope: a "big" trade of 37.5K, a "sell" at 11:49 at $0.2602 and two trades late in the day, 10K @ $0.2603 and 40K @ $0.26. Both at 15:59. The other "big" trades today, 13K and 15K, both were also sells at $0.2602. So I'm still awaiting the exhaustion of these folks before diving into any serious analysis and thought.

Details of "Dly Sht % of 'sells'" and inflection points are in the latest daily post above.

04/05/2013: EOD stuff partially copied to the concentrator.

# Trds: 48, MinTrSz: 100, MaxTrSz: 25000, Vol 360500, AvTrSz: 7510

Min. Pr: 0.2600, Max Pr: 0.2960, VW Avg. Tr. Pr: 0.2653

# Buys, Shares: 16 71500, VW Avg Buy Pr: 0.2705

# Sells, Shares: 32 289000, VW Avg Sell Pr: 0.2640

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 1:4.04 (19.8% "buys"), DlyShts 1700 (00.47%), Dly Sht % of 'sells' 0.59%

Well, we didn't get any follow-through from yesterday's apparent improvement. There was a mild weakening in VWAP, "buys" percentage and volume (this is the "good" part of this action). The big difference today is that buyers did not step up as strongly as yesterday. We opened at $0.2750 and immediately started weakening, hitting $0.2610 on the third trade. I guess buyers saw no reason to increase the bids with that going on. We did come back to $0.2749, but from 10:24 on we never saw a $0.27 handle again.

From then through EOD we traded 262.2K at a (falling) VWAP that ended at $0.2632. During this stretch we had 14 consecutive trades at generally weakening prices, eventually going to $0.2605, that were all "sells".

Of the seventeen instances of bid changes I caught, ten were lowered bids. Over half the rest were improvements only into the low $0.26 area. On the asks nine were lowered offers and only three were raised.

As usual, ATDF was an important part of this action, with others joining in, out of necessity I guess.

I mentioned the volume as the "good" part: falling volume does suggest that some portion of the sellers at these prices are getting exhausted. However with a seeming wellspring of sellers at ever-lower prices, I wonder if they can ever be exhausted.

Details of "Dly Sht % of 'sells'" and inflection points are in the latest daily post above.

04/04/2013: EOD stuff partially copied to the concentrator.

# Trds: 70, MinTrSz: 100, MaxTrSz: 28400, Vol 446792, AvTrSz: 6383

Min. Pr: 0.2602, Max Pr: 0.2950, VW Avg. Tr. Pr: 0.2655

# Buys, Shares: 20 98800, VW Avg Buy Pr: 0.2747

# Sells, Shares: 50 347992, VW Avg Sell Pr: 0.2628

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 1:3.52 (22.1% "buys"), DlyShts 11884 (02.66%), Dly Sht % of 'sells' 3.42%

Regardless that we got our predicted "death cross" today, with the 50-day SMA at $0.3058 and the 200-day at $0.3063, I'm starting to get optimistic. All the oscillators I watch are suggesting this possibility as well. Regardless, I'm not yet ready to again step deep into the traditional TA.

I've noted the last several days that it looked like things were improving. Today continues that ... to the point that I think our unrelenting selling down may be either ended or very near so. This due to a combination of volume, volatility, strength into the close and no late-day weakness, among other things.

First, we had a strong close. In the last 30 minutes of the day we had VWAP of $0.2703, above our previous short-term support of $0.27 when we churned sideways for a bit, and we had a close of $0.27 if we throw out our wizard's EOD $0.2855 trade. This was on 70K shares too. You might say that this wasn't strength because the VWAP and close were much lower than the day's higher ranges. You'll see in the brackets below that this wasn't bad.

There was some trading action that makes me somewhat optimistic ...

I wondered during the earlier part of the day if we were seeing distribution of that ATDF ~143K offer that WTB(?) and I previously noted.

This seems possible from the stuff I saw through 14:32: buy:sell 1:6.90 (12.65% "buys" -> 87.35% "sells") and VWAP $0.2617, very near the day's low. We've seen this sort of stuff several times before. The difference is in the late-day action. Subsequent to that time, our buy:sell was 1:1.18 (45.9% "buys") with a VWAP of $0.2750. Our typical behavior has been one of late-day weakness and today it was not. This doesn't prove anything, but ...

Although ATDF is only one market-maker (and its clients?), it is so active (and somewhat dominate due to the willingness to always move to best ask and best bid positions, apparently regardless of price) in our market that I felt it was a good proxy for the overall tenor of things. This made me think it was worth noting that a) I had no glimpse on the ask of the ~143K from ATDF today, b) this made me wonder if they were just "hitting the bid" without competing on the asks, and c) the action today might be signaling the end of our extended weakness. I do suspect that ATDF, and some other folks, spent a good part of the day hitting the bid.

Breaking down the action may answer the "just hitting the bid" question (you can derive the "sells"):

$0.2602-$0.2630: 277392 shares, 62.09% of volume, VWAP $0.2608, "buys" 03.61%

$0.2650-$0.2699: 078150 shares, 17.49% of volume, VWAP $0.2674, "buys" 57.65%

$0.2700-$0.2722: 050150 shares, 11.22% of volume, VWAP $0.2714, "buys" 05.28%

$0.2819-$0.2950: 041100 shares, 09.20% of volume, VWAP $0.2861, "buys" 100%

In that first bracket, only 12,200 shares in four trades went off after 14:30. Showing a little strength into EOD, the third bracket, except for one trade, all went off after 15:28 and into the close. The last bracket trades were after 14:42 and continued into the close.

The potential for the end of the downward pressure seems somewhat supported by the ask behavior today. With one brief exception, the asks stayed pretty much in the upper range of the $0.26xx and above area, including some periods in $0.28xx range, running from the low to the high areas of that range. We didn't see anywhere near the usual amount of constant stepping down by various MMs trying to get to the front of the ask. On the bid side, during most of the day the bids stayed in the low-$0.26xx area. But later in the day (after 15:00) we saw some bids move into the high-$0.26xx range and even a couple stints in the low-$0.27xx area. This is a change from the most commonly observed late-day behavior.

Volume of ~437K is more than double the 25-day average of ~211K and well above the 10-day average of ~237K. It's more than four times yesterday's 100K as well. Although my judgment hasn't always been correct on this, it does often suggest the end of a trend is near.

The volatility seen may also suggest this. Even if we throw out bracket four above, we had an intra-day price range of 4.6%. Including bracket four gives a ridiculous 13.5%.

Details of "Dly Sht % of 'sells'" and inflection points included in the latest daily post above.

04/03/2013: EOD stuff partially copied to the concentrator.

# Trds: 29, MinTrSz: 200, MaxTrSz: 10000, Vol 100000, AvTrSz: 3448

Min. Pr: 0.2600, Max Pr: 0.2699, VW Avg. Tr. Pr: 0.2669

# Buys, Shares: 13 48100, VW Avg Buy Pr: 0.2694

# Sells, Shares: 16 51900, VW Avg Sell Pr: 0.2647

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 1:1.08 (48.1% "buys"), DlyShts 10300 (10.30%), Dly Sht % of 'sells' 19.85%

For those contemplating the possible financing round, here's some VWA closing averages and 10% haircuts: 30 day $0.2934, $0.2641; 40 day $0.2997, $0.2697; 60 day $0.3249, $0.2924.

Things keep improving, but I'm still leery of any postulation based on what's gone on so far. We had a higher low but our high was constrained by the $0.27 brief support we saw, which is now resistance. Maybe the nasty trend is over now as volume continues to taper off and "buy" percentages look to be trending towards normal ranges. Here's the last few days' "buy" readings: 54.5%, 18.6%, 42.5%, 07.9%, 21.8% and 48.1%. For the most part, after the open today the bids moved up a bit and stayed slightly up. The asks dropped a bit after the open and stayed tightly constrained in a narrow range of variation. For now, at least, the wholesale hitting the bids by heavy sellers has abated.

There's nothing bullish here yet, but the intra-day behavior is beginning to look less severely bearish and look much more normal in trading behavior. We should still be somewhat cautious as the volume is low and the average trade size is well down from what I think is the middle of "retail".

My original inflection point calculations show signs of improvement, as does the newer version.

Details of "Dly Sht % of 'sells'" and inflection points are in the latest daily post above.

04/02/2013: EOD stuff partially copied to the concentrator.

# Trds: 48, MinTrSz: 385, MaxTrSz: 20000, Vol 262385, AvTrSz: 5466

Min. Pr: 0.2550, Max Pr: 0.2699, VW Avg. Tr. Pr: 0.2610

# Buys, Shares: 16 57285, VW Avg Buy Pr: 0.2632

# Sells, Shares: 32 205100, VW Avg Sell Pr: 0.2604

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 1:3.58 (21.8% "buys"), DlyShts 24245 (09.24%), Dly Sht % of 'sells' 11.82%

For those thinking of the financing, here's some volume-weighted closing price and a 10% discount for some periods: 30 day $0.2942, $0.2648; 40 day $0.3009, $0.2708; 60 day $0.3248, $0.2923.

I'm still waiting for something looking like real trading and investing before wading back into the TA stuff. Today looked better, but I'm soured on one-day improvements for now.

The only thing I'll note today is in the next few days we will get a "death cross" as the 50-day SMA crosses below the 200-day SMA.

Details of "Dly Sht % of 'sells'" and inflection points are in the latest daily post above.

04/01/2013: EOD stuff partially copied to the concentrator.

# Trds: 48, MinTrSz: 100, MaxTrSz: 39700, Vol 323220, AvTrSz: 6734

Min. Pr: 0.2600, Max Pr: 0.2849, VW Avg. Tr. Pr: 0.2707

# Buys, Shares: 11 25600, VW Avg Buy Pr: 0.2800

# Sells, Shares: 37 297620, VW Avg Sell Pr: 0.2699

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 1:11.63 (7.9% "buys"),DlyShts 14100 (04.36%), Dly Sht % of 'sells' 4.74%

For those concerned with a share issuance based on closing prices, here's a few periods with VWA close and a 10% discount through today: 30 day 0.2960, 0.2664; 40 day 0.3030, 0.2727; 60 day 0.3256, 0.2930.

We held up pretty good, price-wise, through 14:45 with a buy:sell of 1:5.39 (15.65% "buys) and A VWAP of $0.2747 on volume of 162820, ~50.4% of day's final volume. Then we went over an hour with no trades and little movement in the bids and asks. At 15:53 it looks like some LARGER seller decided to take whatever bids were stacked up and, through 15:59, soaked up 160.3K shares (~49.6% of day's volume) at a VWAP of $0.2668, all "sells". The disturbing thing was it started taking bids at $0.27 on "normal" trade sizes and just took everything one after the other on increasing trade sizes (hitting 39.7K on the last $0.27 trade) and then took the $0.26xx trades on 61.7K shares.

Nothing like dedicated participants to make sure the job gets done, huh? This was one of the better "late-day weakness" episodes as it took out bids at $0.27 that had been standing in line for several days with volume increased a bit over that time, and most of the $0.26 bids too.

Fortunately our LDWOO (Late Day Wizard Of OZ) came in for 100 shares at $0.28, leaving us down only 1.72% from Thursday's close instead of the -->> (8.74%) <<-- that is reality.

AS others have expressed, ISTM that other than regular investors are engaging in this sort of price-destructive behavior.

So I think I'll just quit right here until I see signs that any sort of TA at all, which is intended to reflect investor sentiment, along with some trader sentiment, might actually be useful again, as when we could see the signs of the beginning of our grind up from November.

Details of "Dly Sht % of 'sells'" and inflection points are in the latest daily post above.

03/28/2013: EOD stuff partially copied to the concentrator.

# Trds: 22, MinTrSz: 800, MaxTrSz: 14000, Vol 101815, AvTrSz: 4628

Min. Pr: 0.2760, Max Pr: 0.2850, VW Avg. Tr. Pr: 0.2805

# Buys, Shares: 11 43315, VW Avg Buy Pr: 0.2831

# Sells, Shares: 11 58500, VW Avg Sell Pr: 0.2786

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 1:1.35 (42.5% "buys"), DlyShts 15000 (14.73%), Dly Sht % of 'sells' 25.64%

I'm pretty pleased with today's behavior because it was as expected - always a comfort to me. Although I expressed some concerns yesterday, I wrapped up with "... it appears a move is less likely right now than before. Since we have entered short-term consolidation, we have a shortened week, ... we might easily get into the early part of April before this "log jam" is broken". And I mentioned "... Continued consolidation behavior seems supported by the oscillators I watch doing what they've been doing - up a little, down a little, up a little, ... All more or less around fairly neutral readings ...".

We were actually looking better than expected through 14:37: buy:sell was 1.90:1 and VWAP was $0.2821 on 53.7K shares volume. And this was even with everybody, sort of, trying to participate on the sell side: ATDF, NITE, UBSS, CDEL all spent some time at the top of the "leader board" on the ask side. But the typical late-day weakness began, led by ATDF, and we ended as you see above - still not too bad IMO.

Anyway, with a narrowing price spread and reducing volume continuing, it appears that at least a few more days of consolidation might be in store unless ...

We are on our way to a medium-term or longer consolidation, which I think is possible as we await financing news, or some of our action was EOQ-related and the new quarter frees some folks to do things not related to EOQ (I have no idea if this affects AXPW or not), or financing news hits relatively quickly and provides impetus for a move based on either a sigh of relief or disappointment.

On the traditional TA front there is some support for continued consolidation ATM. The oscillators I watch continue mixed with most around neutral readings. My experimental 13-period Bollinger limits ($0.3053 and $0.2721) are converging more quickly now and have moved inside of some potentially key points, the upper below the 50 and 200-day SMA and the lower above $0.27 support line. The nice thing about the lower right now is that price lows are not pushing the lower; rather the lower Bollinger is rising to catch up with the low, which has risen marginally.

Using a standard 20-period Bollinger band, it's not quite as rosy: the upper limit is around $0.34 and "flattish" while the lower limit is $0.26 and falling. If a move to mid-point was attempted again at today's readings we'd hit our good old friend, $0.30. Anyway, the standard one is not showing convergence, and so is not suggesting an imminent move. But do keep in mind that a move to mid-point is not the only option - the bands suggest that movement to the limits is possible without violating two standard deviations. I seldom mention this, but it is a possible near-term move.

On my experimental charts stuff, average trade size finished in what I think is the lower range of typical "retail" size. With the low volume today, this is to be expected. Buy:sell is still weak, but the short-term averages are showing improvement, suggesting that we are progressing towards more normal readings. Daily short sales "spiked" up today, with percentage breaking through a descending trend line and above all the averages I track for it. However, with the low volume and it being, essentially, a one-day event I wouldn't read much into it. It is worth noting that we do have a very short-term trend higher though, so we might want to keep an eye on it to see if it turns into something notable. Right now I'm not expecting any sustained change.

On my original experimental inflection point calculations, I still interpret them as "flattish". On my newer version, the three near-term calculations, 5, 10 and 25-day, are flat and the longer-term calculations, 50, 100 and 200-day, are beginning to curl up. For now, these should also be read as "flattish".

Details of "Dly Sht % of 'sells'" and inflection points are in the latest daily post above.

03/27/2013: EOD stuff partially copied to the concentrator.

# Trds: 26, MinTrSz: 100, MaxTrSz: 54000, Vol 192540, AvTrSz: 7405

Min. Pr: 0.2751, Max Pr: 0.3000, VW Avg. Tr. Pr: 0.2815

# Buys, Shares: 10 35850, VW Avg Buy Pr: 0.2879

# Sells, Shares: 16 156690, VW Avg Sell Pr: 0.2801

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 1:4.37 (18.6% "buys"), DlyShts 6500 (03.38%), Dly Sht % of 'sells' 4.15%

Since we are concerned about financing and don't know if we'll get a strategic investor or not, I thought I'd add, for now, the 30, 40 and 60-day volume-weighted average closing prices, and discounted 10%, which ought to give us some clue where financing might go if we happen to be close to matching the measurement period.

30 day 0.3451 0.3106, 40 day 0.3405 0.3064, 60 day 0.3402 0.3062

I'm wondering if the financing might be agreed to already and they are just closing it after the EOQ? For bookkeeping purposes, that seems a reasonable thing to do.

My summary is it does look like we have entered short-term consolidation as we have highs stuck at $0.30, mentioned as one of our resistance points, and have lows staying, so far, at or above $0.27 for the last six days. Volume has trended slowly and erratically lower. I suggested a few days back that a move was looking more likely than not. With the increasing price spread, I can't say this is off the table yet. With the return today of "hitting the bid", indicated by the buy:sell, while the asks remained relatively stable in the mid-to-high $0.28xx range and bids holding >= $0.275, it appears a move is less likely right now than before. Since we have entered short-term consolidation, we have a shortened week, we have EOQ coming, ... we might easily get into the early part of April before this "log jam" is broken.

OTOH, anybody that's trying to "clean up" before EOQ that's not done it yet might dump today.

Continued consolidation behavior seems supported by the oscillators I watch doing what they've been doing - up a little, down a little, up a little, ... All more or less around fairly neutral readings. Price is pretty much in the middle of my experimental 13-period Bollinger limits, which are converging, and the 50-day SMA is beginning to pick up steam downward.

BTW, I just got reminded that our price activity is right around the mid-point of the $0.2018 low to the $0.38 high range. "Reversion to the mean" seems alive and well.

A couple of notable trades today, reminded by Occam's_Razor's comment today about big bids. These "hit the bid" and were all "sells". I can't say all were part of a single trade, but the close proximity of time and price make me suspect some of them were: 11:37-11:41 $0.2800 x 12990, $0.2803 x 5100, $0.2810 x 35000 and $0.2811 x 10000; 13:51-13:52 $0.2800 x 54000 and $0.2801 x 10000.

Because of that first group, at 11:58 we had a buy:sell of 1:32.26, with 74840 shares traded. That first group accounted for 84.3% of shares traded to that time. It's worth noting that even with that larger group in the afternoon, our buy:sell improved substantially from this point, but is still in weak territory.

On my experimental charts stuff, those large trades moved the average trade size into the high area of what I suspect is retail and above all the averages. Volume ended above the 25-day average and below all the others and daily short sales continued very low.

Most of the periods on my original inflection point calculations got "flipped" again, so they show less strength. Over the last few days it looks like the would net-out to "flattening". My newer version is much better at reflecting the reality ATM: the three shorter periods leave no doubt that we are "flattening" and the three longer-term periods reflect the weakening relative to those time-frame calculations.

Details of "Dly Sht % of 'sells'" and inflection points omitted from the concentrator.

03/26/2013: EOD stuff partially copied to the concentrator.

# Trds: 33, MinTrSz: 100, MaxTrSz: 10000, Vol 89377, AvTrSz: 2708

Min. Pr: 0.2800, Max Pr: 0.2950, VW Avg. Tr. Pr: 0.2875

# Buys, Shares: 19 48693, VW Avg Buy Pr: 0.2915

# Sells, Shares: 14 40684, VW Avg Sell Pr: 0.2827

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 1.20:1 (54.5% "buys"), DlyShts 5977 (06.69%), Dly Sht % of 'sells' 14.69%

In summary, I believe we are seeing signs of entering short-term consolidation. Right now, buyers and sellers seem well-balanced, with sellers being less aggressive on the pricing and hitting the bids, and buyers seemingly willing to take a little more risk at these price levels. I think both sides of the market are assessing the likelihood of big negative moves as unlikely and feel that appreciation in a reasonable time-frame seems more likely.

The bids action today was generally a very positive one - stayed >= $0.28 all day and had several excursions into the $0.29 area. The asks were similar, with bids >= $0.29 all day. When you combine this with the big improvement in the buy:sell, you can see a lot of bullish sentiment surfacing.

This also answers my concern about exhaustion of sellers at the price level - it seems that those willing to release shares down in the $0.27 range have been indeed exhausted while the buyers have not been exhausted at these slightly higher prices and do have some powder to deploy. A snapshot of recent VWAPs might be useful here.

$0.3161, $0.3062, $0.2945, $, $0.2913, $0.2907, $0.2833, $0.2780, $0.2835, $0.2819, $0.2813, $0.2850 and $0.2875 today.

Unfortunately, volume was very weak here - not what we'd like to see on price rising - so we need to temper our bullish assessment a bit until volume supports the bullishness.

This leads to thinking we are entering a short-term consolidation ATM. Traditional TA seems to support that as we see price spread narrowing with a lower high and higher low on reduced volume.

On a change in trend this low volume would be common as folks await confirmation that a change has come - consolidation likely in progress. This supported by converging Bollinger limits, now $0.2662 and $0.3213, and our mid-point is ~$0.2938. Additionally, all the oscillators I watch showed small improvement and all are pretty much at neutral readings. Most are showing signs of continued rising, but I expect this to taper off if we remain in consolidation.

We also have a "northern doji" candlestick, typically thought to be a bearish reversal indicator. But Bulkowski notes that 51% of the time it acts as a continuation. The uptrend is a very short one, thus far, so I don't know just how much significance should be given to this candlestick. Add in that it's really an almost random action following this ... Regardless, it's a short-term indicator of indecision, another consolidation indicator.

Last, the MACD histogram also supports a consolidation view as it continues to show improvement. It's still in negative territory, but not by much and should move to neutral in just a few days.

On a decidedly concerning issue, that darn 50-day SMA, $0.3154, is accelerating downward much faster than the 200-day, $0.3077, and will start going parabolic down in three days unless some price movement up, to a substantial degree, is seen. The risk, of course, is that a "death cross" will occur soon and some folks may respond to that. Unfortunately, if I'm assessing things correctly, we will be continuing to consolidate, which means no substantial price rise is likely. Even if I'm off, we'll encounter resistance at $0.30, which would likely prevent the degree of appreciation that is needed. That resistance might be weaker now, due to both a reduction of sellers left at that level and the effect of the quarterly results report.

On my experimental charts stuff, we see the average trade size has dropped below what I consider normal retail range - more consolidation suggestion. As mentioned, the buy:sell did move back into a normal range, but it is neutral ATM at that near-50% reading. Volume is below all the averages again.

My original experimental inflection point calculations did begin to recover, as I suggested was possible, near-term. We're now in a waiting mode again as the patterns develop. My newer version, which you may recall reacted in a less dramatic fashion by just "flattening" some, has also begun to make small moves towards its prior trend, which was strengthening. In terms of short-term results, it seems this one more accurately predicted the price action, being "flattish", than the original did.

Details of "Dly Sht % of 'sells'" and inflection points are in the latest daily post above.

03/25/2013: EOD stuff partially copied to the concentrator.

# Trds: 58, MinTrSz: 400, MaxTrSz: 83600, Vol 355680, AvTrSz: 6132

Min. Pr: 0.2771, Max Pr: 0.3000, VW Avg. Tr. Pr: 0.2850

# Buys, Shares: 19 83400, VW Avg Buy Pr: 0.2960

# Sells, Shares: 39 272280, VW Avg Sell Pr: 0.2817

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 1:3.26 (23.4% "buys"), DlyShts 4000 (01.12%), Dly Sht % of 'sells' 1.47%

Summary: lots of sellers offset, to a large degree, by lots of bullish buyers. A good sign, IMO. The only real question, for "what's next", is whether the sellers, that started selling many days ago and continued today, are near exhaustion at this price level. The late-day recovery from some seriously horrible looking action early on makes me think this may be the case. A minor concern is whether the bullish folks still have the wherewithal to continue adding at or above current levels. If we have new buyers entering, it seems likely. If most buying was the "old guard", I suspect not.

I'll be watching the next several days for continuation of strength or loss of it.

The day started roughly. Through 13:09 we had a buy:sell of 1:19.42 with a VWAP of $0.2820. As seen by the EOD metrics above, we improved quiet a bit thereafter. Because I believe a lot of today's behavior was a continuation of sellers that had previously decided to exit, and saw nothing in the CC that made them change their mind, I won't do too much TA today.