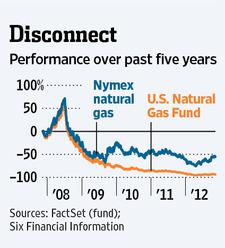

Today the Wall Street Journal ran an article describing why commodities ETFs are terrible instruments with which to make long-term commodities plays. The crux is that, largely because of the roll yield, ETFs do not actually track the prices of the commodities they purport. Readers of this blog may remember that I wrote a functionally identical article nearly three years ago, first at HardAssetsInvestor, and a bit later right on my own blog AssetPrime.

|

| Chart taken from WSJ.com |

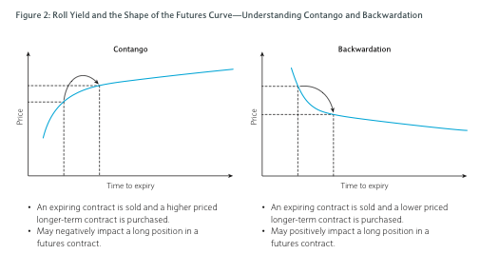

Briefly, the vast majority of commodities markets follow a normal futures curve, wherein the prices for contracts of a commodity further out are more expensive than the contracts closer to expiration. That is, in February of a given year, the price for March widgets would be cheaper than the price for July widgets. (People usually call this situation "contango"; and while that's not technically correct, it's not worth getting into the semantic distinction in this article, other than to acknowledge that people are going to be using that word to describe a normal futures curve.) Most commodities ETFs work by holding the front month contract of a given commodity, then selling that contract shortly before expiration and replacing it with the next month in the futures chain. If, indeed, the market is in a normal futures curve, the next month contract in the chain will be more expensive than the contract approaching expiration. Selling low and buying high does not typically a profit make. Hence, even when the price of a commodity is increasing over time, much of that value may be lost to the monthly roll-yield penalty.

This is important, because the entire purpose of a commodities ETF is to track the price of a commodity, thereby providing investors exposure to those markets. Significantly, most commodities ETFs do not do this. At all. Commodities ETFs do not do the one thing they were created to do. Commodities ETFs are terrible.

|

| Roll yield explained, from iPath ETN prospectus |

Some banks, of course, have gotten wise to this problem and have implemented funds that attempt to avoid the pitfalls of the standard roll yield. The United States 12 Month Oil Fund (USL), for instance (cousin to the much more popular USO fund), holds all twelve futures contracts for the upcoming year (one for each month) rather than just the front month contract. iPath (mentioned above) offers a series of Commodities ETNs that use a proprietary algorithm to select which contract a fund should hold. The basics of the strategy are overviewed in their document, "Basics of iPath Pure Beta Commodity ETNs" on the iPath website. I examined USL in the aforementioned HardAssetInvestor article and found a much better statistical correlation between that fund and the price of oil compared to similar funds. I haven't had a chance to dig into the iPath Pure Beta ETNs (having just learned about them), but I'm very curious to know how good they actually are at mitigating the roll yield. You can be sure I'll report back here with any and all findings.

Even if it's coming three years too late, I'm glad to see folks are finally waking up to this. Most commodities ETFs that hold futures contracts simply don't do a good job tracking the prices of commodities.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.