If you were to drop a frog in a pot of boiling water, the frog will immediately flee from its scalding death. However, if the frog were to be placed in a similar pot of water where the temperature is tepid and slowly increased, the amphibian would appear aloof to the change and surely meet his maker. When it comes to the Euro some investors appear to suffer the same fate as a frog in water that is slowly culminating to steam. They fail to recognize that a pick-up in global economic activity is around the corner and the progress that has been made in the midst of the European crisis. As a result strength would be seen in the Euro as the European economy improves. Furthermore they only recognize the study of historical price movements as witchcraft and refuse to acknowledge the bullish price pattern forming in the Euro versus the US dollar. By taking this balanced approach of both fundamental and technical analysis investors can determine that the Euro has the potential to rise approximately 11% from current price levels, near the 1.45 mark over the next 6 to 9 months. With that being said investors can take advantage of this upward move by either acquiring a long forex spot position in EURUSD, purchase euro denominated assets or the ETF FXE.

As indicated in an EU factsheet, the EU and China form the second largest economic cooperation in the world. Bilateral trade in goods approached 428.3Bn Euros in 2011. Also China has become the fastest growing market for European exports. In 2011 exports to China increased by 20.3% to reach a record 136.2Bn Euros. The EU is also China's biggest export destination with goods and services amounting to 292.5Bn Euros. Based on these facts, any improving economic activity in China will also have a positive effect on the EU. This would lead to growing European economic activity which is expected to strengthen the purchasing power of the EU, thus strengthen the Euro.

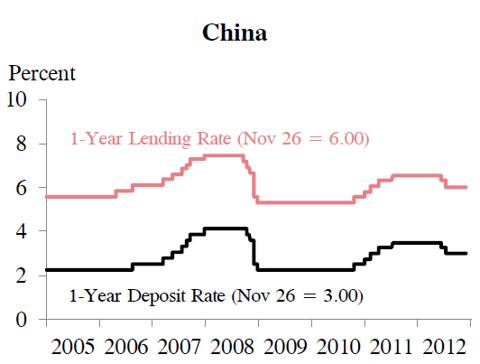

However these positive European economic expectations begin with the 2nd largest economy in the world, China. During the years 2010 and 2011 China enjoyed a growth rate substantially higher than any developed nation but faced increased challenges when it came to inflation. As a result of this effect of increasing prices, the fiscal and monetary authorities took the steps to curb inflation by increasing lending rates and reserve requirements. The chart below shows China's 1 year lending rates over the past decade.

One detriment of curbing inflation is contracting growth. This was seen for the most of 2012, where GDP growth in China, while above 7%, was below its previous growth trend. As inflation tempered the authorities set to return growth on the right path. The Chinese fiscal authorities constructed a stimulus program comprising the building of roads and the creation of subways. The stimulus package was the largest since 2008. Also the Chinese monetary authorities dropped lending rates and the reserve requirements to stimulate credit demand.

These stimulus measures from both the fiscal and monetary scope are beginning to steam the economy. Chinese industrial production rose 9.6% in October from a year earlier, the most in five months. Retail sales picked up at a 14.5% growth rate, higher than September's 14.2% rate and the highest since March 2012. Also fixed-asset investment excluding rural areas increased 20.7% in the first 10 months of 2012 from a year earlier. Furthermore spending on central government-invested projects rose 5.1% in the 10 month period from a year earlier, more than double the January-September pace. Pickup in private sector activity is also observed. China's services industries rebounded from the slowest expansion in at least 19 months, the PMI rose to 55.5 in October from 53.7 the previous month. Another point of note was industrial companies' profits in China in September recorded the first year on year increase since March.

Frogs stuck in heating water fail to realize that the global economy does not work in silos, as noted during the global financial crisis, decoupling is a myth. Already we are seeing some signs of global growth with Chinese imports in October increasing by 2.8% from a year earlier and exports in October rose by more than 11%. As trading activity picks up between China and its largest regional trading partner, Europe, economic activity is also expected to grow as well. Strong exports were seen in Germany in the third quarter of 2012. German exports expanded 1.4%. Also, sentiment in Germany also picked up. These better than expected levels were attributed to demand from China, as the country executes on its stimulus program. The Euro, which represents the value and strength of that region, a guarantee of credit by the EU should increase in value versus the US dollar as Eurozone economic activity increases (through improvements in trading activity with China). Estimates are for the Euro to increase to 1.45 within 9 months versus the US Dollar.

This is not to say that the Eurozone is the best thing since sliced bread - the region is in a technical recession. Euro area GDP in the third quarter of 2012 came in at -0.1% (although France and Germany posted 0.2% quarter over quarter). Nonetheless expectations for growth in the region are geared for improvement, propelling the Euro to the 1.45 mark. Reasons for this optimism are the actions taken by the ECB, led by the President of the ECB Mario Draghi. Not only did the ECB drop their benchmark rate to the historically low rate of 0.75%, they also created the OMT (Outright Monetary Transaction) program, which provides unlimited bond purchases to sovereigns that require it. Some argue that the increase in Euro money supply should weaken the Euro.

However, improving sentiment on European debt is seen through the decline of Italian and Spanish credit default swaps (CDS). Falling Italian and Spanish CDS, similar to the VIX Index, show that investors' fears of European credit turmoil have been alleviated. It now seems that the demand for European denominated assets at discounted levels overcome the dilution of the Euro in the medium term. The chart below shows Spanish and Italian CDS over the past year.

Funny enough the increase in supply is to facilitate the capital requirements for European banks rather than stimulate credit demand. With fear of a European collapse on the decline and European stability appearing the most probable outcome, improved sentiment should create demand for Euros versus the US dollar, increasing the EURUSD.

Apart from global fundamentals, what has compounded the economic and financial market argument for a stronger Euro has been the recent price pattern formation in EURUSD. EURUSD is currently in a reverse head and shoulders setup, with the left shoulder forming in mid January 2012 around the 1.263 price level, the head at the end of July 2012 around the 1.20 price level and the right shoulder in mid November at the 1.266 price level. Confirmation for this pattern is the breaking of the sloping neck line estimated around the 1.30 price level. Once confirmed EURUSD has the potential to reach the 1.45 price level. The chart below annotates the weekly price movement of EURUSD.

By looking at the Euro from a balanced approach, investors can stay clear from frogs and boiling water. On the fundamental side the Euro should enjoy an uptick in economic activity, which would flow from China to Europe and also the extremely accommodative monetary policy from the ECB. Technically EURUSD is signaling for much more upside in the medium term. As such investors should consider a long EURUSD FX spot position, or if leverage is not included in your tool kit, a Euro denominated short term fixed income security or the ETF FXE which is a securitized JP Morgan fixed deposit.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.