If you just looked at your portfolio return since the November 2 election, you might think that nothing has really happened. From November 2 to December 10, 2012, the S&P 500 has returned 0.31%. While long-term investors really should avoid short-term noise, major media's Fiscal Cliff countdown makes even the best behaved investor think twice about their current strategy. Just in case you missed it, looking at daily pricing, we see that the post election low for the S&P 500 was on November 15, which put the S&P 500 down 4.3% from November 2. After that, the market rebounded. It seems that market volatility is a given as the 2012 year-end approaches.

So what is an investor to do? Moving to cash means that you earn -2% on your money (0.2% from a savings account less 2% inflation). Adding new money to bonds seems a bit risky with treasuries potentially forming a bubble, munis dropping in yield and quality, and TIPS priced rather high. Gold has done fairly well since the election, up 1.5%, but that does not generate income that you can live on today.

The first thing that we often tell our clients is that fear is not an investment strategy. Fear makes you do crazy things that ultimately have a negative impact on your portfolio. If you continually sell at the bottom and buy at the top, your portfolio will eventually check you into the poor house. You say that you just want to stop the losses. I ask, was your portfolio built right in the first place?

In any market, your portfolio should be constructed to meet your risk tolerance. But what does this really mean? Advisors should know the historical volatility of their portfolios; many on the selling side of this business don't have a clue, they just want to sell you a product. For the individual investor, there are tools to measure portfolio volatility. Morningstar.com is a great resource.

Portfolio volatility is most often measured by standard deviation. If you remember back to math class, standard deviation is the variation from the average. If the S&P 500 averaged 4% over the last 10 years with a standard deviation of 21, this simply means that on average your rate of return could vary between 21% above (for a total of 25%) or 21% below (for a total of -17%) the average 4% return.

Each investment will have its own historical standard deviation, or risk. Mixing bonds and stocks from different asset classes will create an overall portfolio rate of return and risk. Stocks will have a historically higher standard deviation than most bonds. I believe that your portfolio allocation should be set for the best of times as well as the surprises that seem to bring about the worst of times. Rather than try to time the market, you should hold on to your risk allocation that was built correctly from the start. It is better to ride out the storm at times vs. jumping out and testing new strategies in volatile markets. There are copious amounts of research showing how bad behavior and feel-good active portfolio strategies fail to work.

Building your own risk profile is fairly straight forward, especially using index funds such as Exchange Traded Funds (ETFs). S&P Dow Jones Indices offers risk-based models. These simple models are put to work in the iShares product line under the tickers AOK, AOM, AOR and AOA. These are great portfolios for small accounts that need to be properly allocated. For the do-it-yourself investors, these are very basic risk based allocations that can be used as a benchmark in regards to allocation vs. risk.

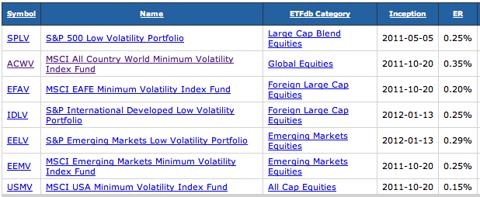

For more advanced asset allocations, we considered seven ETFs designed to lower portfolio volatility on the equity side of your portfolio. Adding low volatility stocks to a portfolio is not a new concept. What is relatively new is the low volatility concept wrapped into an ETF. These ETFs could be core holdings, or added to an actively managed portfolio during times of anticipated volatility while still keeping the portfolio invested.

From the list above, an investor can add a low volatility strategy in the asset classes of US large cap (SPLV), US all cap (USMV), foreign developed markets (EFAV & IDLV) as well as emerging markets (EEMV & EELV). ACWV covers the developed US, Europe and emerging markets. The expenses related to holding these funds are very reasonable.

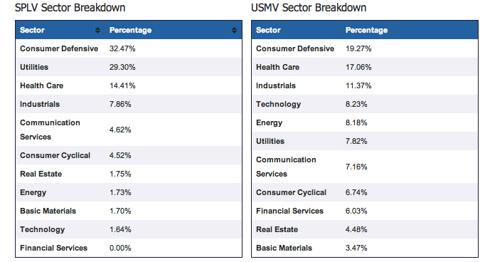

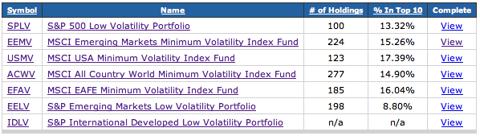

As with any ETF, you must understand the methodology of the index that it tracks. There are two ways to construct a low volatility index. The MSCI indexes use a mean-variance optimized approach, meaning they construct the index by accessing an individual stock's volatility compared to the broad market and other stocks within the index. This approach appears to diversify the portfolio a bit more vs. the S&P approach. Using the comparison tool on ETFbd.com, we can see the sector allocation differences between the SPLV and USMV. Consumer defensive and utilities make up half of the SPLV allocation.

The S&P low volatility construction is built on dividing a universe of stocks (say the S&P 500, 400 or 600) into quartiles by a measure of volatility using beta or standard deviation. This approach is more transparent and simpler to calculate than the MSCI approach. There is also academic research supporting that the S&P approach is equally as effective at reducing volatility. SPLV is the largest player in the ETF low volatility category, which holds the 100 least volatile stocks within the S&P 500 for the last year. The fund rebalances annually.

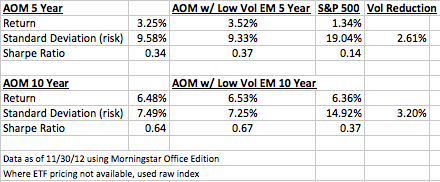

Of the three low volatility asset classes, the emerging market low volatility caught my eye first. In many portfolio allocations, emerging markets are looked to as inflation beaters. The rapid growth of this asset class is worth the occasional fallouts, right? To test this assumption, we took the allocation for AOM, the iShares S&P moderate risk allocation, and ran four scenarios - AOM with its 5- and 10-year traditional allocation, and AOM using the S&P Emerging Market Low Volatility Index as a substitute over the same two time periods. AOM holds a 3% allocation to emerging markets. Some of the ETFs within the AOM allocation have not been around for ten years, so we substituted the ETF with its assigned index when necessary.

What we are seeing here is that by substituting classic emerging market exposure with EM low volatility, in this case the S&P based EELV, we find that over a 5- and 10-year time period, we get a respective 2.6% and 3.2% reduction in volatility with an increase in overall portfolio return for both time periods. This is what we all want, right? Less risk and higher returns? However, this brings up a new question - does taking more portfolio risk pay off? The answer is not necessarily, at least within emerging markets using these data sets.

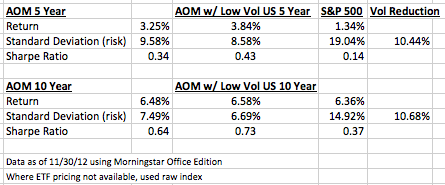

Next we reset our portfolio back to the traditional AOM allocation and looked at the effect of replacing the S&P 500 with the MSCI US Minimum Volatility Index. There is a noticeable reduction in portfolio volatility. Over the 5- and 10-year periods, we see a 10% reduction. Portfolio returns were up in both cases.

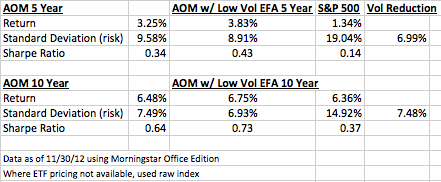

In the next back-tested portfolio, we substituted foreign developed with its low volatility option. In this portfolio, we used the MSCI based index for EFAV. As you can see below, this substitution has the same effect as the emerging market and large cap US low volatility indexes.

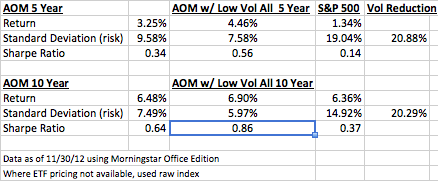

The next obvious question is what if an entire portfolio was built around low volatility indexes as core holdings? As you see below, volatility was reduced by a large 20%. The rate of return increased as well.

This whole exercise certainly shows that using low volatility strategies over 5- and 10-year periods has historically worked well using either the S&P or the MSCI based indexes. It should be noted that during large market upswings, these low volatility strategies have not participated with the same gains as in the core index. It is in a volatile sideways, down or even slightly up markets that we see the best results from this strategy.

Choosing which ETF to deploy has a lot to do with what sectors are used within the asset class that you are looking for. Low volatility stocks often pay a respectable dividend, thus the ETF that you choose might be focused on yield. Whatever your take is on low volatility, remember that data mining easily generates perfect portfolios for the past. The future may be very different, but certainly since 2002, a low volatility strategy would have worked well for you.

Disclosure: I am long AOA, AOM, AOR, AOK, USMV, EEMV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.