A number of macro trends have proven fortuitous for the Federal Reserve's implementation of quantitative easing (QE). The European financial crisis and recession, as well as the depreciation of the yen, have driven global investors to dollar-denominated assets as a safe haven. The relatively strong dollar has kept input prices down, giving the Fed greater leeway to be extremely accommodative in tackling the unemployment problem without stoking inflation.

As evidenced in today's Congressional Joint Economic Committee hearing, the Fed is facing increasing scrutiny over potential exit strategies for its asset purchase program and has been making an effort to communicate clearly with the markets to avoid surprises. One of the more attractive options for the Fed appears to be to let its portfolio wind down over an extended period, instead of selling assets. If the Fed takes this route, it could increase bank reserve requirements to opportunistically restrict money growth, or engage in reverse repurchase agreements to drain liquidity out of the system as needed.

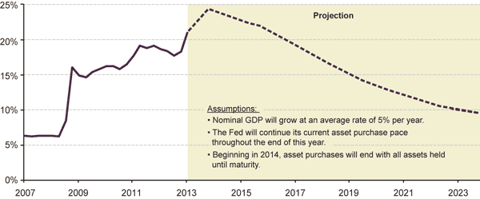

Selling Not Required

If the Fed continues its current pace of asset purchases through the rest of 2013, the total amount of assets on its balance sheet will reach approximately 24% of GDP by the end of the year. When the Fed changes its monetary policy, it can do so by either selling its current assets or simply letting the bonds mature by holding them to maturity. If the Fed holds its bonds to maturity, its total assets to GDP ratio could fall to below 10% by 2023.

FED'S BALANCE SHEET ASSETS AS PERCENT OF GDP PROJECTION*

Source: Federal Reserve Bank of New York, Bloomberg, Guggenheim Investments. *Note: We assume the nominal GDP will grow at an average rate of 5% per year. We also assume the Fed will continue its current asset purchase pace throughout the end of this year but