Cowen Group, Inc. (NASDAQ: COWN)

Executive Summary

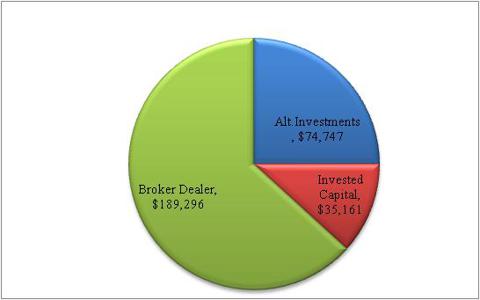

Cowen Group, Inc. ("Cowen," "COWN" or the "Company") is a leading diversified financial services business. The Company has a market cap of $423.0MM and a tangible net worth of $456MM. As of TTM 6/30/13, the Company derived 63.3% of revenues from its broker dealer segment, 25% from its alternative asset management segment (Ramius) and 11.8% from its invested capital.

Mr. Market, the manic depressive, is currently offering a proven diversified alternative asset management business, a growing growth/middle market oriented broker dealer and $404.0MM of net invested capital at a ~10% discount to tangible book value. Importantly, the undemanding multiples are associated with a business that has grown invested capital at a 16.2% CAGR from 1999 to present and an attractive asset management franchise. Why does this opportunity exist and why isn't everyone "backing up the truck" to this opportunity? (1) Cowen is controlled by its management team, (owner of over ~25% of shares) who have focused on building a firm to participate in the consolidation of the financial services industry; (2) the merger with Cowen (the investment bank), which produced steady losses it required extensive investment in people and infrastructure.

However, Cowen's valuation and operating metrics will rebound as the broker-dealer reaches profitability (which has begun as of the latest quarter). The following attributes make the Company a highly attractive investment at current prices:

- Diversified Business Model with a Growing Market Share: Cowen's broker dealer is the #1 non-bulge equity underwriter in Life Sciences and the #2 high yield placement agent in the sub-$200.0MM debt offering space. Cowen has invested in both Equity Capital Markets and Debt Capital Markets capabilities and is well positioned to benefit from tailwinds such as increased M&A activity.

- Experienced Management Team with "Skin in the Game": Management collectively are the largest shareholders of Cowen, with over ~25% stake, aligning interests with shareholders. Importantly, compensation is low compared to other firms, with the largest all-in compensation totaling $2.0MM. Further, management has taken a long-term mindset with the Company, viewing the combined entity as a vehicle for consolidation within the asset management and broker dealer industry. Management is well incentivized to increase the Company's net worth over the long term.

- Lucrative Asset Management Business: Alternative asset managers can be characterized as businesses that generate abnormal returns on invested capital (in excess of 30%), while requiring very little invested capital. Ramius's funds are attractive as they include a wide range of unique strategies with much upside in terms of hurdle fees.

- Attractive Valuation Which is Priced Below a Highly Liquid Tangible Book Value: Cowen Common shares currently trade at a ~10% discount to tangible book value, which should serve as a floor. Investors are neglecting the Company as the attractive asset manager and liquid balance sheet are being overlooked by a growing broker dealer in a transition. We estimate that the common stock is conservatively worth between $3.88 to $5.80 per share.

- Strong Financial Position: Cowen operates with a very low level of leverage for a financial institution. At 2Q13, equity to assets stood at 32%. Cowen has no debt beyond repurchase agreements.

- Scalable Fee Based Business Model, which Has the Potential to Generate High Returns on Invested Capital: Cowen's businesses are highly scalable, given its fixed cost structure model. As the Company gains scale, fixed costs such as comp/revenue decline, with incremental dollars falling to the bottom line.

- Multiple Value Creating Opportunities - The Company has multiple options available to create shareholder value, such as (1) accretive stock repurchases; (2) utilization of NOLs for cash generating businesses and (3) spin-off of either Ramius or the broker dealer, which would potentially rerate each segment.

- Net Operating Loss Carry-forwards - After the acquisition of LaBranche, Cowen had significant operating net operating losses or NOLs in the U.S. estimated at ~$366.0MM. The associated gross deferred tax asset currently amounts to $147.0MM. There was a 100% valuation allowance against that asset, however as the firm turns the corner profitability wise within the broker dealer segment, NOLs will add significant value.

Company Overview

Introduction

The present day Cowen Group was founded in 2009 as Cowen & Company merged with the alternative asset manager, Ramius. Ramius's management (led by Peter Cohen) assumed control of the combined entity with a ~25% ownership stake. Ramius is an alternative asset management firm founded in 1994 by a team of former top-level investment bankers. Cowen & Company, a broker dealer focuses on growth sectors, was spun out of Societe General in 2006.

The key drivers for the original deal primarily revolved around Ramius's management team utilizing the new platform in which they controlled to consolidate other middle-market/smaller broker dealers and other complementary businesses.

TTM 6/30/13 Economic Revenue by Segment ($ in Millions) |

Ramius/Alternative Investment ($74.7MM TTM 6/30/13 Revenue)

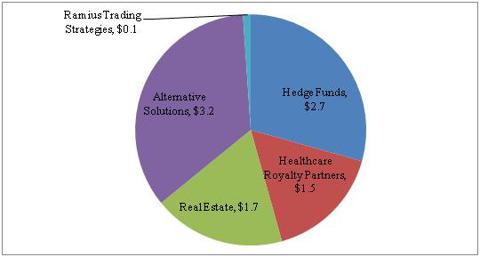

Founded in 1994 by the current Cowen management team, Ramius is an alternative investment manager focused on providing clients with access to differentiated public market and private investment strategies. The alternative asset management business has approximately $9.2 billion of assets under management as of May 1, 2013. Alternative investment management product offerings include hedge funds, replication products, mutual funds, managed futures funds, fund of funds, real estate and healthcare royalty funds. Ramius primarily targets institutional investors, which include pension funds, insurance companies, banks, foundations and endowments, wealth management organizations and family offices.

Ramius AUM Breakdown ($ in Billions) |

Ramius has transformed itself over the past few years from a multi-strategy approach to offering a diversified array of alternative products. Since hiring Michael Singer as CEO of Ramius, the unit has focused on profitable products and eliminated low margined unprofitable lines such as cash management.

Ramius's strategy is to (1) increase AUM in revenues within existing investment capabilities; (2) reorganize distribution efforts; (3) realigning the expense base (49% comp/revenue FYTD 6/30/13 versus 52% FYTD 6/30/12) and (4) creating bolt-on products for existing capabilities and introducing new investment capabilities to the platform.

Management continues to expand the range of products offered within their core capabilities, with the launch of three new vehicles as of 6/30/13 and three more to be expected by year end.

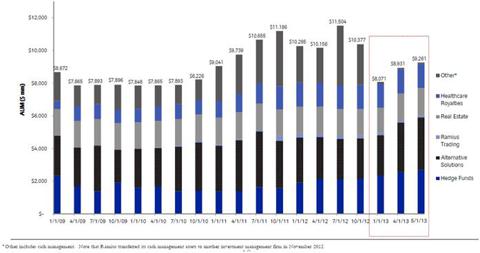

AUM Trends

The new strategy implemented by Michael Singer has been successful within his first six months on the job. AUM has grown ~$1.2B from 1/1/13 to 5/1/13. The decrease from FY2012 to FY2013 is primarily due to the exiting of the unprofitable cash management business.

Growth in AUM |

Differentiation

Ramius differentiates itself versus its competitors primarily by:

- Recognized brand name with roughly ~19 years in the industry.

- Broadened suite of differentiated & strong performing products & capabilities (Starboard for example)

- Institutional quality infrastructure at reasonable price.

- Industry know-how and customization.

- Wrapper sophistication.

- Coordinated & collaborative generalist/specialist sales force focused on various channels.

- Client sales and support staff

Invested Capital ($35.1MM 6/30/13 TTM Revenues)

The Company invests a significant portion of its capital ($404MM net value/$684.3MM long value as of 6/30/13) to help drive results and facilitate the growth of its alternative investment and broker dealer businesses. Management allocates capital to three primary investment categories:

(I) Trading Strategies - Includes liquid investment strategies such as corporate credit, event driven (small cap activist) and macro trading among others. Total net amount invested totaled $235.0MM as of 6/30/13.

(II) Merchant Banking - Long-term investments directly into public and private companies, such as the Company's healthcare royalty funds. Total net amount invested totaled $110.9MM as of 6/30/13.

(III) Real Estate - Investments alongside the Company's various real estate platforms. Total net amount invested totaled $59.9MM as of 6/30/13.

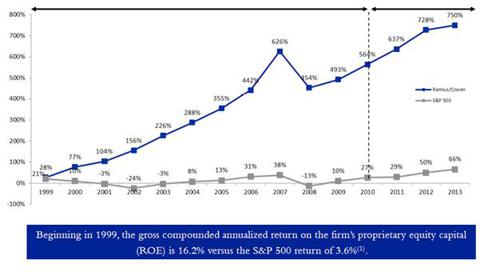

Approximately 80% or $404.0MM (net value) of Cowen's equity is actively invested utilizing the Company's various strategies. Importantly, Cowen has compounded capital at a gross ~16.2% CAGR over the long term, compared to a 3.6% return for the S&P 500.

Compound Annualized Return on Invested Equity Capital |

Although, the Company has successfully grown its invested capital and utilized it to seed various funds, we feel a better use of the capital would have been to opportunistically repurchase shares at a wide discount to tangible book value. Management has stressed the importance of growing net worth in the long term and currently have a ~$19MM share repurchase program in place.

Broker-Dealer ($189.2MM 6/30/13 TTM Revenues )

Cowen's broker dealer is a research driven, growth oriented investment bank with full suite of advisory, capital markets execution capabilities and equity sales across strategic industry verticals. The broker dealer services include research, brokerage (trading/cash equities/electronic) and investment banking services to companies and institutional investor clients primarily in the healthcare, technology, media and telecommunications, consumer, aerospace and defense, industrials, REITs and clean technology sectors. Importantly Cowen provides research and brokerage services to over 1,000 domestic and international clients.

Cowen recently enhanced its industry specialty by acquiring Dahlman Rose (discussed further in the "Acquisitions" section), an investment bank focused on serving the energy, transportation and infrastructure industries.

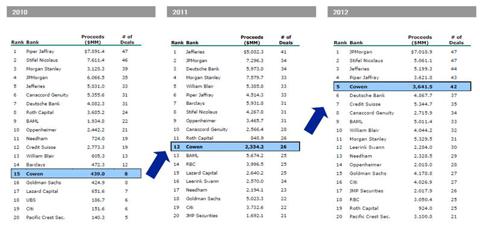

Cowen's investment into infrastructure and talent has started to pay off, as evident by the latest league tables for growth sectors and debt capital markets. FY2012, Cowen completed 74 transactions across various verticals and all product groups, raising $7.4B in capital for clients (excluding Facebook) and served as book runner/lead manager on 44% of the public equity underwriting deals. Overall, the above mentioned factors have continued to decrease the economic loss in the unit from a $81.6MM loss in FY2011 to a $36.1MM loss in FY2012.

Cowen YoY Rise in Growth Sector League Tables |

* Source: Cowen 2013 Sandler Conference Presentation

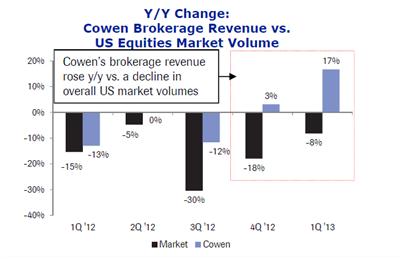

Debt Capital Market Capabilities Growing | Brokerage bolt-on(s) Contributing to Cowen's Top Line |

|

|

* Source: Cowen 2013 Sandler Conference Presentation

Cowen's broker dealer segment differentiates itself by:

- Market research and understanding - The ability to provide quality research will attract more investors to buy securities.

- Access to highly skilled workforce - Experienced and highly trained staff handle deals in this industry. Clients are attracted to individuals and teams that have successfully raised debt and equity.

- Having a high profile in the market - For institutional brokers and investment banks, a significant presence such as panel memberships and strong dealings can increase one's profile in the marketplace.

- Production of premium goods/services - It is essential to have the right mix of product offerings that raise sufficient funds on the sell side to maximize returns on the buy side.

- Provision of a related range of goods/services ("one stop shop") - Provision of a related range of investment products and services can reduce the number of parties involved in a transaction.

- Having a good reputation - A strong brand name, detailed company research and a reputation for customer service are important factors for success.

Management's strategy

Cowen's management team succinctly summarized their strategy going forward in the Q2 2013 conference call:

"As seen by the consolidation occurring within the broker dealer and asset management industries, the current environment has made it increasingly difficult for firms both small and large to compete effectively without scale or a competitive edge. While we face similar headwinds as our peers, we expect to be a beneficiary of the consolidation trend. As evidenced by our recent acquisition of Dahlman Rose, we are building scale within our core competencies while leveraging our cost structure and maintaining a solid balance sheet. Just as important, we are building a franchise where we deliver differentiated alpha and intellectual capital that are critical to our clients and customers."

Acquisitions

Since 2009, Cowen has made numerous bolt-on acquisitions.

LaBranche

The Company acquired LaBranche, a broker dealer with expertise in technology and electronic trading, in June 2011 for $160.0MM, in a stock for stock transaction below book value. Cowen essentially acquired cash and NOL(s) as Management decided to exit the business segments associated with LaBranche.

Dahlman Rose

Cowen Group, Inc. agreed to acquire Dahlman Rose & Co. on February 1, 2013 (closed in March 11, 2013) in an all stock deal. Dahlman Rose is a research-driven investment bank focused on energy, transportation, infrastructure, and industries that compose the global supply chain. The Company provides institutional sales and trading, equity and fixed income research, mergers and acquisitions advice, and underwriting services. Dahlman Rose's sector specialties include marine shipping, surface freight transportation, air transportation, petroleum exploration and production, offshore and oilfield services, metals and mining, coal mining, agriculture and chemicals, and independent power producers. Although the purchase price was not released, as it was a stock for stock transaction we can roughly pinpoint a purchase price. From FY2012 to Q1/2013, share count increased from 95.5MM shares to 114.4 shares for a net increase of 18.9MM shares. Applying the March 11th share price ($2.66), we can estimate the purchase price at ~$50MM.

The acquisition was crucial for the broker dealer as it gave Cowen increased scale and access to important sectors of the economy which are projected to be active areas for capital raising over the foreseeable future. Additionally, it has allowed Cowen to grow productively and create a stronger platform by adding depth to their research, sales and trading and investment banking bench while leveraging the broker dealer's fixed cost structure.

Importantly, Cowen smoothly integrated Dahlman into the platform. Cowen completed the integration on schedule with quarterly results suggesting that the bank has benefited both by quality and pay per client.

Additional recent acquisitions include KDC Securities, a securities lending business. KDC was the broker-dealer, which was renamed Cowen Equity Finance . The Company also acquired Algo Trading Management Inc., a provider of global, multi-asset class algorithmic execution trading models.

Executive Management

Cowen has an experienced management team, who not only have experience leading investment banks such as Lehman Brothers and Solomon Brothers, but fit the category as owner-operators. The management team's large ownership stake theoretically implies a common interest with outside passive minority investors in growing intrinsic value.

Peter Cohen: Mr. Cohen is the chairman, and CEO of Cowen Group, Inc. Mr. Cohen was a Co-Founder at Ramius, LLC since 1994. Prior experience includes a long tenor on Wall Street, notably as the CEO of Shearson, where he led the acquisitions of Lehman Brothers and E.F. Hutton.

Jeffrey Marc Solomon: Mr. Solomon is the CEO of Cowen's broker dealer segment. Previously Mr. Solomon was a co-founder at Ramius, LLC.

Michael Singer: Mr. Singer is the CEO of Cowen's asset manager arm, Ramius. Mr. Singer recently joined Ramius on December 2012. Prior to joining Ramius, he served as the Head of Alternative Investments at Third Avenue Management, LLC. In that role Mr. Singer was responsible for overseeing the development of Third Avenue's alternative products business. Prior to that, he was a Co-President at Ivy Asset Management Corporation, where Mr. Singer established Ivy's strategic plan and ran the firm's day to day activities.

Industry

According to IBISWorld, over the next five years, it has been forecasted that broker dealer/investment banking revenue will grow slowly at a 3.2% annualized rate to about $174.7B. The industry is expected to decline through 2014 as it deals with complying with costly regulations that will require investment banks to de-leverage, hold higher capital reserves and limit certain trading practices (Cowen already has a solid financial position with equity/assets at 32%) However, rebounds in corporate profit and general improvements in the US economy will potentially spur a recovery by increasing underlying business (debt capital markets, underwriting ,etc.) and trading activity, although the industry is expected to remain below 2007 levels.

Asset management on the other hand has enjoyed strong prior performance through the last cycle and is expected to grow through the next five years. According to IBISWorld in the past five years, alternative asset management/hedge fund revenue grew at a 6.5% CAGR to ~$89.2 billion. The primary growth driver was increasing institutional investor demand for exposure to alternative asset classes. Going forward, the industry is expected to grow over the next five years by at least a 3.8% CAGR, supported by institutional investors diversifying across asset classes.

Consolidation

Over the past years since the last downturn, consolidation within the investment banking and broker dealer fields have intensified. Consolidation has been the result of increased regulations, a recent decline in trading volumes, reduce in pay for external research (sell-side) and finally the necessity to obtain scale in order to compete with other larger broker dealers and investment banks.

Recent mergers have been widespread, for instance Cowen's own acquisition of niche investment bank Dahlman Rose, Stifel Financial's (SF) acquisition of KBW and Leucadia's (LUK) merger with Jefferies. In each case, the above mentioned parties gained enhanced scale such as (1) new niches or markets, which can be costly to build out and (2) merchant banking and secured future funding i.e. Jefferies/Leucadia. Additionally, smaller firms, which have not merged, have started to exit the industry, with Gleacher (GLCH), Ticonderoga, and WJB Capital among others

Consolidation is not exclusive only to the broker dealer/investment banking realm. As demonstrated below in the "private market valuation" section, asset managers have consolidated and have been acquired due to their (1) high returns on invested capital; (2) asset-light scalable business model and (3) diversified, stable customer base, which enables the acquirer (per se a bank), smooth out earnings in rougher times.

Competitive Landscape

Within the investment bank/broker dealer segment, Cowen competes against a wide variety of investment banks, ranging from single sector boutiques to well established bulge bracket firms. In order to differentiate itself, industry competitors must focus and become experts in specific niches/sectors, have a wide range of capabilities (i.e. DCM, advisory, etc.) and ultimately be able to attract the right talent, as relationships do matter.

Ramius competes against numerous hedge funds and alternative investment vehicles, both well established and start ups. The number of competitors tends to be higher as barriers to entry are lower within the space, however scale, specifically growth in assets under management along with performance are crucial in order to maintain and grow a brand name.

Porter's Five Forces Analysis

Risk | Severity | Mitigant |

Threat of New Entrants | High |

|

Threat of Substitute Products | Moderate |

|

Bargaining Power of Suppliers | Low |

|

Bargaining Power of Customers | Moderate |

|

Rivalry | High |

|

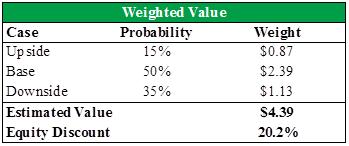

Intrinsic Valuation

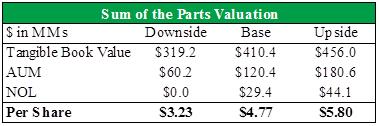

A weighted sum of the parts ("SOTP") valuation was used to determine the intrinsic value for Cowen. The Company's per share value was calculated by applying 10% discount to tangible book value, 2% of Ramius's AUM less $684MM of Cowen's capital (total AUM net of other interests and invested capital of $6.0B) and 20% of the gross deferred tax asset associated with the NOL of $147.0MM, respectively, for the base case. For the upside case, value per share was calculated using Cowen's tangible book value, 30% of the above mentioned NOL and 3% of estimated fee paying AUM. For the downside case, we estimated per share value by applying a 30% discount to Cowen's tangible book value, 1% of fee paying AUM and assigning no value to the above mentioned DTA/NOL.

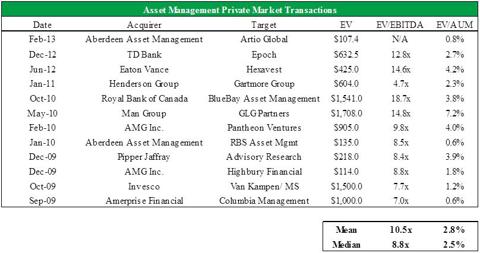

Private Market Valuation

Asset Managers

The 1% - 3% of AUM rate used for estimating Ramius's private market value is in line with previous transactions, as the asset management M&A market has been active since 2009. Buyers are attracted to the low capital requirements, annuity like revenue streams, high returns on capital and scalability obtained from the business. Historically, asset managers and asset management arms have sold for between 1.0% and 3.0% of assets under management, depending on the platform and product (mutual funds, SMAs, bond funds, etc.) mix. For instance, fixed income funds would generally attract lower prices as fees collected are usually lower than equity products.

Broker-Dealers

As demonstrated in the above chart, middle market investment banks have recently traded hands at multiples above tangible book value. We feel it is prudent to discount tangible book value in base and downside sum of the parts scenarios, given Cowen's broker dealer has not yet demonstrated consistent profitability.

Finally, as a floor valuation, we believe tangible book value serves as a solid proxy given its highly liquid assets which are either understated or not reflected on the balance sheet (NOLs, AUM and 9.7% interest in CBOE, for instance).

Catalysts to Value Realization

Catalyst | Description |

Buyback of Shares |

|

Enhanced Analyst Coverage |

|

Attractive Valuation |

|

Spin-Off of either Segment |

|

Risks & Mitigants

Risk | Impact | Mitigant |

Threat from Larger Asset Managers and Broker Dealers | Decline in revenues and profitability. |

|

Continued "Empire Building" | Decline in GAAP Tangible Net Asset Value |

|

Underperformance or losses from the Company's invested capital. | Decline in Tangible Net Asset Value |

|

Conclusion

In conclusion, Cowen Group is an undervalued business based upon current tangible equity and a conservative sum of the parts valuation of $4.39 (~20% discount from current equity prices). The Company is well positioned to benefit from consolidation within the financial services industry, given its expertise and strong financial position. With a differentiated asset manager and growing broker dealer (which is evident through core AUM growth and league tables), the business is attractive especially at a time when few businesses trade at discounts to a liquid book value. Further, the Company has multiple levers to pull (i.e. monetization of NOLs, accretive share repurchases below book value and the spin-off of the broker dealer segment, the shares could be worth as much as $5.80.

*Please, always do your own research before making an investment decision.

Disclosure: I am long COWN, LUK. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please always do your own research!