When people talk mega-caps, first thoughts inevitably turn to the Dow, and then turn to the Dogs of Dow Strategy. There is so much more to stock valuation than dividend yield: we see a flaw in a strategy based purely on dividend yield. The Dow is actually a wonderful selection of stocks. The Dow includes global leaders in their fields. It includes great innovators, very powerful brands, large liquid stocks, well researched stocks and stocks with the very best price discovery. And then they go and spoil it all by using a largely senseless price weighting system for the index!

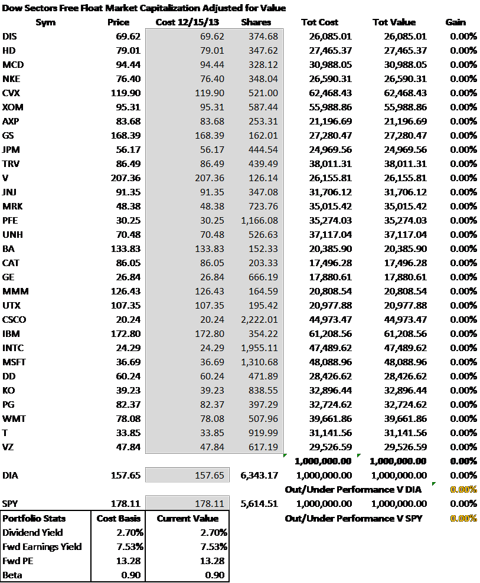

I thought I'd try my hand at designing a Dow strategy with an aim of outperforming the SPDR S&P 500 (SPY) and SPDR Dow Jones Industrial Average (DIA). What I do like about the strategy output is a portfolio β of 0.90, which is well lower than the S&P 500 β of 1. I like even better the dividend yield of 2.70%, which is well ahead of the dividend yield on the SPDR S&P 500 and SPDR Dow Jones Industrial Average. But what I like best of all is the portfolio Forward PE ratio of below 13.28. You can see the portfolio right at the end of this post. Keep in mind that I have no idea whether the strategy will work or not, but here is the thinking behind it.

The question to contemplate is whether Fama (Markets are efficient) & Schiller (Markets are inefficient), both Nobel Prize winners, are correct. Can it be that the market is both efficient and inefficient? Markets are forward-looking. Markets are in a constant state of flux. Markets are chaotic. Are markets are in a constant state of disequilibrium in the journey towards equilibrium? Do inefficient markets tend to efficiency? And if yes, how can we follow the path to efficiency, or the journey to equilibrium? Can time, stock selection and capital allocation help keep us from wandering too far from the path to market efficiency? And will a value bias allow us to address market inefficiency caused by the constant disequilibrium in markets? I suspect that the answer to all the above questions is yes.

The Dow strategy I am evolving here first allocates capital using what I call the "Sectors Free Float Market Capitalization Adjusted for Value" method.

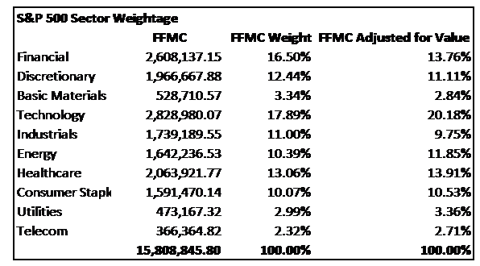

In the Sectors Free Float Market Capitalization Adjusted for Value method we allocate Capital to each sector based on the sectors Free Float Market Capitalization (FFMC) in the S&P 500 in the first instance, and then adjust it upwards or downwards, depending on the valuation of the sector. Capital allocated to the sector, is then allocated to each stock in the sector, equal weighted in the first instance, and then adjusted upwards or downwards depending on the value of each stock in the sector.

What on earth does Sectors Free Float Market Capitalization Adjusted for Value mean? Suppose you wish to invest in only Healthcare and Technology. The stocks you select within Healthcare have a FFMC of $1,000,000, and those in Technology have a FFMC of $2,000,000. The Value Score for the Healthcare selection is 75%, and for the Technology selection it is 100%. Allocating $100,000 based on FFMC would lead to $33,333 committed to Healthcare, and $66,667 committed to Technology. When you adjust FFMC for Value (FFMC multiplied by Value Score), Healthcare is $750,000, while Technology is $2,000,000. As a result when you allocate by FFMC Adjusted for Value, you will commit $ 27,273 to Healthcare ($100,000 {available capital} Multiplied by 750,000 {FFMC multiplied by Value Score for Healthcare} Divided by [Sum off FFMC multiplied by Value Score for Healthcare and FFMC multiplied by Value Score for Technology]), and $72,727 to Technology. We allocate the $27,273 committed to Healthcare to the chosen Healthcare stocks using the Equal Weight Adjusted for Value method.

What on earth does Equal Weight Adjusted for Value mean? Suppose you have $100,000 and wish to buy Stock A and Stock B. Equal Weighting would mean you invest $50,000 in each. That is "Total Capital Divided by Number of Stocks". Now supposing you believe Stock A (Value Score 100%) is cheaper than Stock B (Value Score 75%), the natural instinct is to buy only Stock A. But you want the diversification. And so you allocate more money to Stock A, with less being allocated to Stock B. You allocate $ 57,143 to Stock A ($50,000 plus [25 {Difference between Value Score of Stock A and Stock B} divided by 175 {Sum of Value Score of Stock A and Stock B} multiplied by $50,000]). We allocate the remaining $ 47,857 to Stock B.

In the Capital Allocation Method, there is little exercise of judgment in terms of allocation using the Sectors Free Float Market Capitalization Adjusted for Value method. It is a purely mathematical exercise.

However, valuing of stocks and sectors does need the exercise of judgment. We determine valuation using an algorithm to which the strategies carry exposure. The algorithm draws on principles of Gordon's Growth Model to form long-term payout expectations. We use a Cyclically Adjusted Equity Risk Premium and the Capital Asset Pricing Model to compute the discount rate. As a result, the discount rate estimates market and stock specific risk, and computes required rates of return to price β. Because risk aversion levels vary over time, we vary payout expectations and discount rates to arrive at a range of exuberance to despair prices which could prevail at the present point in time. We make adjustments to valuation based on a comparison of the range of values versus current market price.

The table which follows displays how we allocate capital to various sectors. On this table, by comparing the free float market capitalization weighting (FFMC weightomg) and the free float market capitalization adjusted for value weighting, you will be able to see which sectors are over or under weighted.

And further below you will find how we allocate capital to each Dow stock using the Sectors Free Float Market Capitalization Adjusted for Value strategy.

Disclosure: I am long JNJ, MRK, PFE, GE, CSCO, INTC, MSFT, PG, WMT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.