I have largely ignored Box Ships (TEU) since my coverage on August 16 2012, in which I urged a 'sell' due to what I perceived as "rampant dilution and insider transactions."

Since my past coverage ($6.98 at time of submission), TEU has returned a total of -47.7% (-$4.07 market price + 74c dividends) while the S&P returned 29.4% for a net performance spread of 77.1% over 17 months. The chart below highlights performance since the IPO including dividends and my article recommendation (red x) sourced from Google Finance.

For full disclosure, as an aggressive option, I suggested a pair trade with Diana Containerships (DCIX) (short TEU and long DCIX). DCIX has returned -13.7% (-$2.01 market price + $1.20 dividends) since that publication, providing a gain of 34% on the spread.

Revisiting the Original Thesis

I am returning to cover TEU due to several inquiries from readers, usually stemming from my coverage on DCIX. The gist is often something similar to "if DCIX is a decent buy, than TEU must be steal!" However, I always recommend avoiding TEU due to management that appears to value insider dealing over stockholder returns. In my opinion, if the management cannot be trusted, than it doesn't matter what the stock trades at.

The crux of this "insider dealing" was a issuance of above-market yield preferred perpetual shares directly to the CEO, and majority owner, Michael Bodouroglou, along with a follow-on offering used to redeem a majority of these shares a month later. This transaction directly 'robbed' the shareholders while providing 'free' warrants and above-market preferred shares to the CEO. My original article carries a full description along with links to the direct issuance releases.

Management Behavior Since August 2012 - Paragon Shipping (PRGN)

On December 24, 2012 PRGN commenced a private placement of stock valued at $10M (4.9M shares at $2.04/share) directly to "an entity affiliated with Mr. Michael Bodouroglou." Based on previous shares outstanding of just over 5.9M, Bodouroglou essentially seized nearly 45% of the newly capitalized company for just 85% of its previous close ($2.39 on Dec 21) and 19.6% of its yearly high ($10.40 on Feb 15 2012 adjusted for 10-1 reverse split in fall 2012).

While Bodouroglou's investment ultimately stabilized the company, and has led to further equity raises and a current stock price of $6.82 (high of $9.40 on September 10 2013), previous investors were borderline swindled out of an investment that traded for under 14% adjusted NAV (liquidation value). It would be one thing if a private equity firm stepped in and offered liquidity when nobody else would risk it, similar to Fairfax's investments in Blackberry (BBRY) and Icahn's moves with Netflix (NFLX), but this was a direct 'take over' by the CEO without shareholder consent.

Paragon recently completed an additional recapitalization on September 27, 2013 of $34.5M (6M shares at $5.75), practically cementing Bodouroglou's insider dealing gains at $18.18M or a return of 182% (4.9 shares $2.04 to $5.75) in 9 months. Original shareholders (prior to 24 Dec) now owned approximately 1/3 of the original company (5.9M/17.44M outstanding).

Some may debate the virtues of a private related-party placement, but what should be illegal (and likely would be for a US-based company) is the private placement, below-market, during a brief period of all-time lows, and with a price representing nearly 10% of asset values.

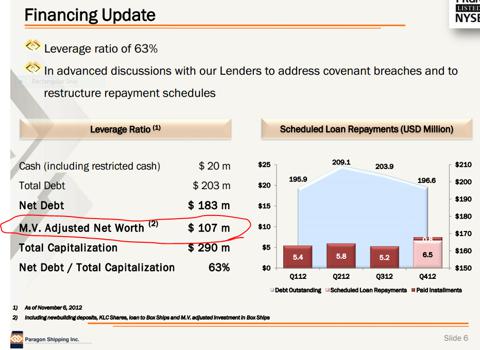

According to Paragon's own publications (Q3-12 presentation), the adjusted net worth of the company was $107M or over $20/share. Thus Bodouroglou issued himself shares at close to 10% of the publicly claimed 'worth.' None of the previously issued statements from the company suggested a recapitalization would be necessary. Regardless- no major public criticism or SEC investigation commenced despite what could be perceived as a clear swindle.

The referenced slide is pasted below (red emphasis added).

Management Behavior Since August 2012 at Box Ships

On July 30 2013, Boxships sold $13.4M of 9% 'Series C' preferred shares, of which Neige International (controlled by Bodouroglou) purchased $5M (over 37%) of the offering. These actions themselves are not unusual, but what is suspect is the use of proceeds to "redeem all of its outstanding Series B-1 Preferred Shares." These are the same preferred shares that I criticized in my original article for insider dealing, stemming from a June 12 2012 issuance.

The 2013 repurchase does not reference what will occur to the warrants to purchase TEU stock at $7.74 book until June 2017. It appears that Bodouroglou will keep these 1.33M warrants, which are worthless today, but had substantial potential value upon issuance.

Besides the wrap-up on the 2012 preferreds and continued cross-party transactions with Paragon Shipping, TEU has not suffered from substantial insider transactions over the past year; however, the PRGN incident alone should send a clear message regarding the trustworthiness and/or shareholder interests possessed by management.

Investment Approach

Investors are truly rolling the dice when they place money in firms controlled by insider focused managements. I plan to completely avoid TEU for the interim despite their appearance of a fairly to cheaply valued equity. I have greater trust in management at DCIX, and would suggest that greater potential long-term returns are possible via that company.

I may submit a financial model of TEU in the future, but for now, I believe it is most prudent for investors to stay away from anything owned or managed by interests connected with Mr. Bodouroglou.

Disclaimer

This coverage should merely be perceived as a personal opinion and not as official investment advice. I do not currently own any investments connected with TEU or PRGN, but I was a previous shareholder in both companies. I am not a registered investment advisor and only participate in article submissions in an effort to boost transparency and discussion. I have filed a complaint with the SEC, but it is doubtful any action will result, as I do not know if any of the aforementioned actions were technically illegal. Investors should place no direct basis on anything stated in the above article beyond their perceived value of the personal opinion of J Mintzmyer through Mintzmyer Investments LLC.

Disclosure: I am long DCIX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.