There are many things wrong with mainstream economics. One of the main fallacies driving the Fed is that there is some sort of imaginary wall between asset prices and consumer prices that liquidity cannot leak through. Rising stock prices is considered a good thing, but rising consumer prices a bad thing. They are also considered different things qualitatively. Rising stock prices is considered a boom, something good for the economy. But rising consumer prices is considered inflation, something to be kept under control. The Fed's job supposedly is to keep the boom going while keeping inflation under control, as if it can keep dollars from leaking from the boom sector into the inflation sector.

In other words, the Fed is trying to be that imaginary wall between asset prices and consumer prices, but try as it might, the money flowing between these two sectors of the economy cannot stay separate for long. The economy, human exchange, doesn't work that way. Money flows all the way through it without stopping for any walls the Fed may try to erect. If we see the economy - the structure of production really - as a pyramid going from land and labor all the way to final consumer, money always flows from the base of the pyramid to the peak. Inflation at the base, what mainstream economists call rising asset prices, will initially make the pyramid look more stable, but at some point that inflation will arrive at the top, in the consumer sector.

In essence, rising asset prices is inflation. It's just not called that. Asset prices can rise for two reasons: either because of rampant speculation, as happened during the Nasdaq bubble, or they can rise because of an increase in the money supply, as I contend they are doing now.

From Rising Stock Prices to Rising Mining Costs

Why are stocks considered to be at the base of the structure of production? Because they are titles to capital, ownership deeds to pieces of capital that produce things. Looked at from this angle, we can say that rising stock prices are a reflection of capital goods becoming more and more expensive in the same way we see inflation as consumer goods becoming more and more expensive. To confirm the view that stocks are getting more and more expensive because of an inflated money supply and not because of rampant speculation limited to stocks only as happened at the turn of the century, there are other places we can look for evidence.

If stocks are rising because of speculation, this should not affect real capital costs. But if they are rising because of inflation (being increased money supply), then real capital costs should rise along with the price of the titles to that capital, AKA stocks.

At the very base of the pyramid is mining. Nearly everything human beings make, manufacture, use, at some point comes from the ground. Whether it's oil, metals, minerals or whatever, production always starts there. Before you can produce anything, you have to dig it up. So if capital in the stock market is getting more and more expensive because of inflation, so should potential capital in the ground, or in other words, mining costs.

And indeed, this is exactly what's happening. Below is a table of the mining costs per gold ounce over the last decade of three of the largest gold miners by market cap, Barrick (ABX), Goldcorp (GG), and Newmont (NEM), followed by the average gold spot price for that year.

2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | |

Barrick | $164 | $287 | $383 | $653 | $753 | |||||

Goldcorp | $115 | $39 | $188 | $391 | $391 | $443 | $632 | $677 | ||

Newmont | $296 | $486 | $548 | $617 | $752 | $1,105 | ||||

Average Gold Price | $410 | $445 | $603 | $695 | $872 | $972 | $1,224 | $1,571 | $1,669 | $1,411 |

During the stock bubble in the late 90s, real capital costs were not moving much. This was evidence that what was happening was a speculative bubble limited to stocks, rather than something driven by inflation of the money supply affecting real prices. In any case, we can see from the table above that the costs of mining gold, and by extension everything else, have risen every year for every company (and these are companies with mines all over the world), with few exceptions. (In 2005-2006, Goldcorp had especially productive mines. 2009 was a period of deflation, so prices dropped across the board relative to 2008.)

So why are real capital and paper capital costs going up together? Because the current rise in stock prices is a monetary phenomenon, rather than a speculative phenomenon. The money supply is being expanded generally by the Fed with QE, therefore, prices are being effected in the real economy as well, just not yet in the consumer sector so much. But that will come.

If we are to assume that the gold price has been rising for over a decade because of an expanded money supply generally, then gold was never really in a bull market in the classic sense at all. It was just following the cost of mining gold. Silver never even reached its 1980 highs of over $50, so it is very doubtful that the last 13 years have been a bull market in the sense of people valuing something more highly than they did in the past, other things equal.

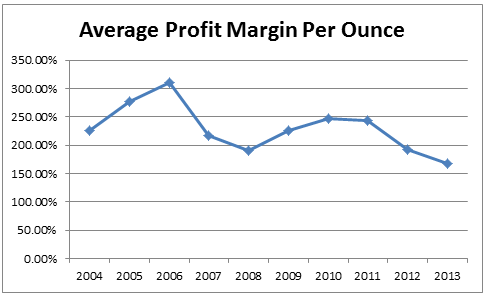

Below is a chart of the profitability of gold mining, consisting of the average profit margins of Barrick, Goldcorp, and Newmont from the data table above. As you can see, despite the spectacular increases in the gold price over the last 13 years, gold is becoming less and less profitable to mine, with last year being the lowest profit margins in 10 years.

Of course, the margins calculated here don't include taxes or balance sheet impairments. Bottom line, Barrick lost over $10.6B (page 6) in 2013. Goldcorp lost $2.7B (page 5). Newmont lost $2.5B. Clearly, if gold prices stay at current levels or lower, the gold mining industry will simply go bankrupt. This is precisely why gold mining ETFs like GDX and GDXJ have fallen so drastically since late 2012. The current gold price simply cannot sustain gold mining companies.

There is nowhere for gold prices to go but up

This puts future gold prices between a rock and a hard place, with nowhere to go but up. Even if we were to assume that the incredible increases in the cost of mining have come simply because all firms are being run by drunken sailors opening grossly inefficient mines compared with 10-13 years ago, with the situation worsening every year - a big stretch of an assumption - in order to achieve profitability at current prices, gold companies will still need to drastically cut supply, if long-term profitability is even possible at current gold prices. A cut in supply will force gold prices up in the end anyway, bringing mining stocks up along with it.

The implications of this are that far from being in a bubble, if we judge simply by the profitability of the industry, gold prices are far below what they should be at equilibrium. The question is timing. How can we know when the market will figure this out? We can't know for certain, but we can guess. Here's one more chart, and to me, it screams that the time is now.

Image Source: Yahoo! Finance

This is a comparative chart of the HUI Gold Bugs index, which measures gold stocks, versus the S&P 500. As you can see here, the HUI bottomed out around late 2000, with the S&P topping at around the same time. From that point until the S&P bear market bottom in 2002, the HUI and the S&P traded inversely, with the HUI rising as stocks fell. From 2002 until 2013, the two trended together, with the HUI outperforming the S&P. In 2013, when gold mining suddenly became unprofitable, the two crossed each other again and began trading in opposite directions.

The HUI crashed once before in 2008. From there, it gained more than 200% in 3 years. The setup we have now is even more powerful, as gold was not as undervalued as it was back in 2008 when it was falling sharply but mining was still profitable. Gold mining is no longer profitable, not at these prices, and that simply cannot last.

Conclusion

What we've seen for the last 10-plus years has not been a bull market in the sense of people valuing gold more than they used to. It has simply been the logical response to inflation in the cost of mining, strong evidence that the current bull market in stocks has simply been inflation that will soon leak, or even burst out into the CPI. The real bull is still ahead of us, and it will begin when the public actually wants gold just like they wanted tech stocks in the late 90s. That hasn't happened yet at any point in the last 13 years. Very few people have any awareness of the price of gold at all. But it will happen when all the inflation stored up at the base of the pyramid in both the stock market and the mining sector becomes unleashed into the consumer sector and the average Joe starts to lose confidence in the dollar. Once that happens, it will make the 13 year-old "gold bull" look like a mouse with horns.

You'll want to get in before that happens.

Disclosure: I am long GDX, GDXJ, SLV, PSLV, SIL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I own physical silver.