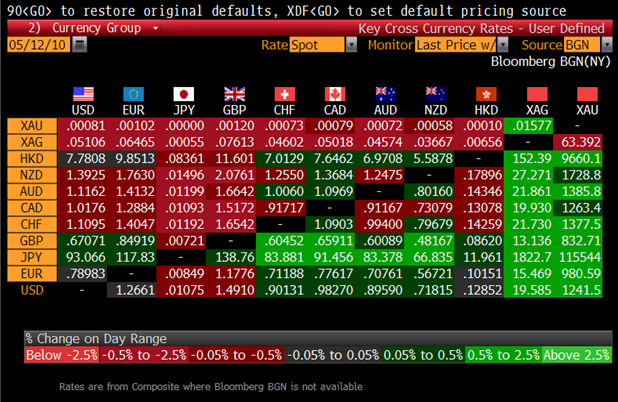

Gold: Gold has rallied to a new record high ($1,244.80/oz) on continuing concerns about sovereign debt contagion and the risk posed to the single currency. Gold rose to $1,224/oz early in New York yesterday, it then fell off slightly before closing with a new record closing high and a gain of 1.61%. It has range traded from $1,228/oz to $1,234/oz in Asian and early European trading this morning prior to rising to new record highs in dollars, Swiss francs, pounds and euros. Gold is currently trading at $1,231/oz and in euro and GBP terms, at €968/oz and £820/oz respectively.

images

Silver has surged to $19.62 an ounce, the highest price since March 18, 2008 (see chart above). Silver thus breached resistance at $19.24/oz and looks set to challenge $20 per ounce in the coming days. Silver remains under the radar of investors despite its sterling performance in recent years and strong fundamentals. Silver remains undervalued versus gold and could rise to over $25 per ounce in the coming months. A close above resistance near the high of March 18th, 2008 at $21/oz could see silver go parabolic as it did in the 1970s when conditions were far more benign than they are today.

Gold for immediate delivery climbed to a record 1,375.2462 Swiss francs an ounce. The price of gold in euros, British pounds and Swiss francs jumped to a record as the currencies slumped, prompting investors to buy bullion as a store of value. Futures of the metal in Shanghai reached an all-time high.

Gold and Silver Up vs. All Currencies Today

Inflation concerns due to the use of printing presses are rising as seen in the comments of Jean Claude Trichet who said "our goal is stability of prices on the medium and long term" and "we will not turn