On March 10, 2014, I published an article here on SA laying out the 5 principal reasons for which I was short shares of Plug Power (NASDAQ:PLUG). Fortuitously, the very next day, Andrew Left of Citron Research published similar thoughts, but presented in a much more colorful and impactful way, resulting in the stock plunging more than 50% from its highs.

Given the violent price swings recently, I've traded around my short position, but now, a month later, the question becomes: where does the short thesis currently stand? At least three major events have occurred since I wrote my original article, so I believe it's worthwhile to reconsider the short thesis in light of these.

Development #1: PLUG released its 10-K

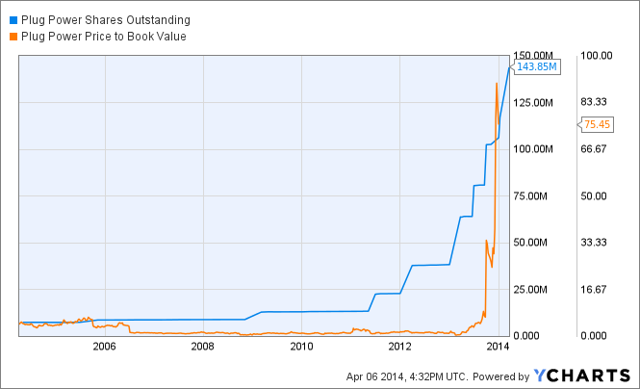

On Mar 13th, PLUG released its fourth-quarter and year-end financial results. However, it waited until the absolute last minute to publish its 10-K (almost three weeks later on Mar 31). Why? Well, one possible reason is that it was trying to avoid discussing the dilution it had undergone over the past several months. Indeed, historical and prospective dilution was one of the factors which had me short the stock, but even I was surprised to learn that the number of shares outstanding had risen ~40% since the previous 10-Q; going from 102,602,414 to 143,848,173 shares outstanding! While many sources used by investors (e.g. Yahoo Finance) haven't yet been updated to reflect the vastly larger share count (and the concomitant increase in valuation metrics, such as P/S and P/B), YCharts does have the new numbers. The graph below should be frightening to any longs who wish to maintain their proportion of the company, rather than having it constantly diluted.

PLUG Shares Outstanding data by YCharts

Moreover, as a result of wanton share issuances, the current market valuation is at 10-year highs - this despite PLUG no longer being involved in major markets like stationary and backup power solutions.

PLUG Market Cap data by YCharts

Now of course longs expect future developments to justify the current stock price, but it's worth noting that nothing in the 10-K shows 2013 to have been part of PLUG's resurgence. For example, here's the table of shipments for 2013 vs. 2012 (note too that PLUG never mentions in any of its press releases that orders are subject to cancellation, yet apparently 4% of 2012 orders were cancelled or "adjusted").

Another reason to publish the earnings PR and hold the conference call well ahead of issuing the 10-K is for the company to push its preferred valuation metric: EBITDAS. On this point, recall Warren Buffett's sage advice: "When Wall Streeters tout EBITDA as a valuation guide, button your wallet."

I might add: "The attack on your wallet only gets worse when companies also omit costs paid in stock!" Yet, that's what PLUG wants investors to focus on. Indeed, it's now convinced many bullish authors and proponents that it will be "profitable" in 2014, but profitability is in EBITDAS terms - it's not on any real, i.e. GAAP, basis. A cynic might wonder if pushing off the 10-K's publication to the 11th hour might be to engrain the EBITDAS fantasy, rather than have investors focus on facts and risks such as (emphasis added):

We have incurred losses, anticipate continuing to incur losses and might never achieve or maintain profitability.

We have not achieved profitability in any quarter since our formation and we will continue to incur net losses until we can produce sufficient revenue to cover our costs. Our net losses attributable to the Company were approximately $62.7 million in 2013, $31.9 million in 2012, $27.5 million in 2011, $47.0 million in 2010, and $40.7 million in 2009. As of December 31, 2013, we had an accumulated deficit of $849.4 million. We anticipate that we will continue to incur losses until we can produce and sell our products on a large-scale and cost-effective basis. Substantially all of our losses resulted from costs incurred in connection with our manufacturing operations, research and development expenses and from general and administrative costs associated with our operations. We cannot guarantee when we will operate profitably, if ever. In order to achieve profitability, among other factors, management must successfully execute our planned path to profitability in the early adoption markets on which we are focused, the hydrogen infrastructure that is needed to support our growth readiness and cost efficiency must be available and cost efficient, we must continue to shorten the cycles in our product roadmap with respect to product reliability and performance that our customers expect and successful introduction of our products into the market, we must accurately evaluate our markets for, and react to, competitive threats in both other technologies (such as advanced batteries) and our technology field, and we must continue to lower our products' build costs and lifetime service costs.

In closing this point, note the mention of "advanced batteries" above. When bulls tell the story, PLUG's system improvements compete against a stagnant competitive background; yet, in reality, battery technology is advancing at a rapid clip too, such that even with improvements, PLUG can find itself falling behind competitively. Moreover, as discussed below and previously, there are other powerful competitors waiting in the wings, should this market ever really take off.

Development #2: Richard Pearson publishes on undisclosed paid stock promotion

In what may prove to be a pair of seminal articles, Richard Pearson tore the covers off of a sordid promotional scheme in which supposedly unaffiliated, independent, and honest authors were being paid by promotional firms to do their clients' bidding. Among the companies associated with these paid authors, Mr. Pearson identified PLUG as having received unusually persistent and bullish articles. Presumably, these "independent" articles were intended to rile up the bulls (and to get unsophisticated mom and pops into the stock). While Mr. Pearson's second article didn't directly accuse PLUG of being party to this practice, the seven articles which he lists as pumping PLUG have been pulled by SA, so one might be justified in thinking that SA had a strong suspicion - if not indisputable proof - that the articles were not what they claimed to be.

In my original article, I suggested that PLUG didn't deserve its meteoric rise on any fundamental basis, instead, the stock had taken a life of its own due to becoming a daytrader's "plaything". Such flavors of the month normally retreat to their pre-hysteria price levels, as daytraders gradually spot new shiny toys to play with. If and when such a price rise is occasioned by the efforts of writers whose articles have since been pulled, we might expect the price and trading volumes to drop much more quickly than normal.

Development #3: PLUG bought a competitor

On April 2, PLUG bought ReliOn, "a developer of hydrogen fuel cell stack technology based in Spokane, Washington" for $4M. Bulls lauded the purchase as helping break Ballard Power's (BLDP) exclusive lock on the supply of the company's most important component. While this is probably true, there are two other points that should also be considered in conjunction with the purchase, viz. competition and technology valuation.

By purchasing ReliOn, PLUG puts BLDP on notice that eventually it may no longer need Ballard's fuel stacks. This incentivizes BLDP to consider creating competing products, or more likely in supporting other companies which are already in the off-road or materials handling markets. I'd previously discussed Toyota as a potential killer competitor, but now, BLDP can also work with firms such as Oorja, Hydrogenics, Nuvera or other emerging companies to enhance competitive products.

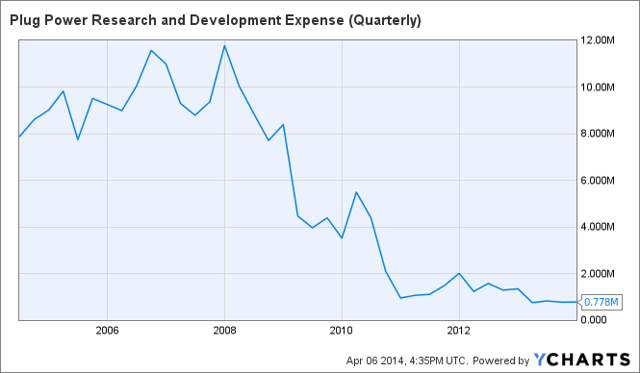

Moreover, in my original article, I observed that PLUG didn't deserve its premium valuation, because rather than being a true innovator, it was simply a systems integrator. One way to see this is to look at the company's R&D expenditures. As shown in the chart below, its R&D spending is paltry, certainly not presenting any moat or obstacle to potential competitors.

PLUG Research and Development Expense (Quarterly) data by YCharts

PLUG's purchase of ReliOn allows us to look at the same issue from another angle. From the PR, we learn that:

Currently, Plug Power owns a large portfolio of intellectual property including more than 150 US patents related to fuel cell stack design, fuel cell system design, fuel processing, fuel dispensing, energy storage and controls. This includes patents relating to the safe dispensing of hydrogen and the use of a fuel cell system as a direct battery replacement in material handling applications. The acquisition adds 34 additional US fuel cell patents to the company's portfolio.

Presumably, most of the value of ReliOn lies in its productive assets: machinery, inventories, systems and know-how; but even if we generously (i.e. conservatively) ascribe the entire purchase price to be on the basis of the patents alone, we come up with a value for each patent of $117,647. Applying this to the 150 patents PLUG already has gives us a value of $17.65M for PLUG's patent portfolio. Remember that this is a very generous valuation, and yet, even it jibes with the idea that the value of PLUG's technology is minimal, as suggested by its meager R&D spending.

Finally, that PLUG chose to make the ReliOn purchase entirely in stock - despite having relatively full corporate coffers - implies that management thinks the company's stock is overvalued at $7.54 (the effective price used in the transaction).

Given everything I'd previously written about the company, and everything we've learned since, I have to emphatically agree. I remain short the stock, with an ultimate price target of sub-$2.

Disclosure: I am short PLUG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.