I am bullish on the Wisdom Tree Equity Income Fund, which now yields 3.6%. The ticker is NYSEARCA:DHS and the weekly chart is below. DHS has an expense ratio of 0.38%, and the fund's tracking error since June of 2006 is a mere 27 basis points.(Click here to download the tracking error report, and then scroll down to DHS in the sixth row.)

I own DHS for two main reasons:

- Dividend Stocks Are Superior to Bonds: I believe that dividend stocks offer superior risk-adjusted returns vs. long-term U.S. government bonds. Consequently, my baseline asset allocation for conservative investors is underweight bonds, especially compared to asset allocation models that slavishly copy Modern Portfolio Theory. I assume most readers of Seeking Alpha are familiar with the problems of Treasuries, so I'll spare you yet another tale of pending disaster. More importantly, dividend stocks have embedded inflation protection as dividends increase. Looking ahead, I believe the stage is set for rising dividends, given low payout ratios, healthy balance sheets, and moderate long-term earnings growth. Not surprisingly, Wisdom Tree also has a favorable outlook on dividend stocks, as noted here.

- DHS Is Overweight REITs and Underweight Banks: The S&P 500 has a 15.4% weight in financial stocks, with 13.6% in banks/insurance, and the remaining 1.8% in real estate. DHS has a very different mix, with just 4.3% in banks/insurance, and 9.3% in real estate. (These figures are as of 7/29/11. For holdings in DHS as of 8/22/11, click here.) The sector weights of DHS make sense to me, since I'm bearish on banks. I suspect high-yield stocks are a value trap, because I expect fading economic growth to hurt credit quality and bank earnings in the year ahead.

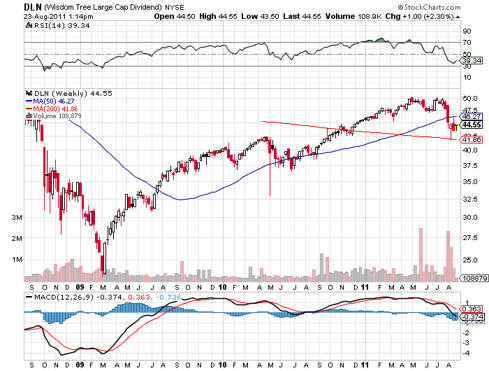

So, for investors who seek inflation protection and who can tolerate the volatility of equities, DHS is a reasonable option. For investors who want a higher exposure to energy and a lower exposure to financials, I'd suggest Wisdom Tree's LargeCap Dividend Fund, which has 11.5% in energy and 8% in financials. This exposure is more economically sensitive, though, since energy prices are likely to fall faster than rents in a global recession.

Two Holdings of DHS: Century Link and Intel

- Century Link Is Not for Me For investors who want a higher yield, I looked at Century Link (CTL), one of the smaller holdings in the Wisdom Tree Dividend Top 100 with a weight of just 0.55% as of August 22, 2011. CTL now yields 8.6%, but I can't recommend it: The debt load is high, the payout ratio is above 100%, and earnings estimates are getting pummeled due to the the integration of Qwest. Maybe CTL will turn out to be a great stock, and maybe not. Personally, I'd rather own DLN, which offers better diversification.

- Intel Is Attractive: Intel (INTC) now has a dividend yield of 4.4%, and the stock is one of the top ten holdings in the Wisdom Tree Equity Income Fund with a weighting of 3%. The company has $9 billion in cash (net of debt) and a payout ratio of about 30%. I also like Intel's exposure to markets outside the U.S., which I believe will will grow faster than Intel's domestic markets (see page 31 of Intel's latest 10-K for the geographic mix). Asia-Pacific accounts for 57% of revenues, and Japan accounts for another 10%. All told, 80% of sales come from outside the Americas. So even though a recession is bearish for the semiconductor cycle, I like Intel as a long-term dividend play.

Disclosure: I am long DHS.