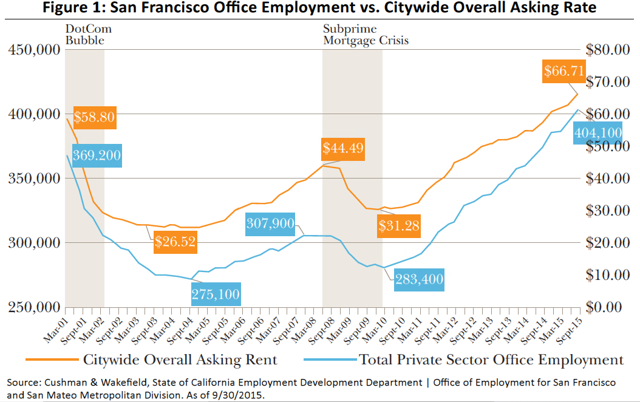

Recently there have been concerns in California of another tech crash like the state experienced in 2000. During that time, California's private sector lost 25% of its jobs - jobs that have only just been recovered. As a result, tech-focused real estate fundamentals followed suit. Fast forward fifteen years (Figure 1), and San Francisco office rents are finally above their 2000 peak and vacancy is at 5.5%.

California and tech are synonymous. The state accounts for almost one-fifth of the country's tech jobs. The industry has become so engrained into California's culture that entire markets and even cities are adapting to accommodate them. New, lively submarkets are being created, and an emphasis has been placed on more efficient and sustainable space. Real estate owners who have acknowledged this trend have seen rents rise, occupancies increase, and space being leased before it is even completed.

All Work, Live, and Play

Over the next 10 years, there is expected to be intense competition for talent, especially within STEM (science, technology, engineering, and math) jobs. According to the Deloitte Center for Financial Services, there will be surplus demand for over 23 million STEM workers in the US by 2025, making anyone with experience and education highly sought after. To fill positions with the talent required, companies will need to be located in areas preferred by the largest segment of the country's employment base: Millennials (the generation born between 1982 and 2004).

As a "knowledge-based" economy, California is the ideal market for attracting STEM and millennial talent. According to the recruiting platform Jobvite, eight out of the top 10 universities for tech hiring are located within the state. Palo Alto, home to the number four school Stanford University, has traditionally been known as the "tech capital". The suburban nature of Palo Alto and the surrounding peninsula area has allowed