Micron (NASDAQ:MU) has been in partnership with Intel (INTC) to develop the 3D XPoint technology. This is a disruptive new type of memory system that will provide a new positive growth catalyst for both companies. I see Micron as the better potential investment due to its lower valuation and strong expected revenue and earnings growth.

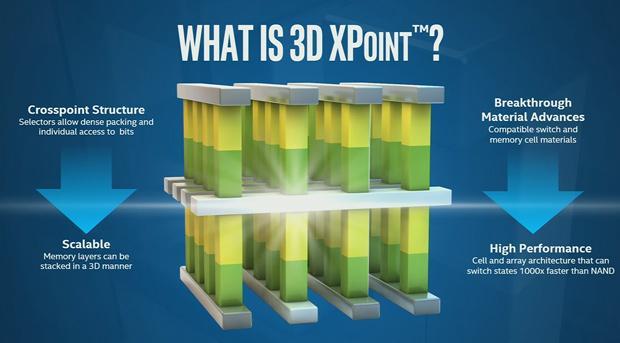

3D XPoint technology is the first new technology for memory and storage devices since NAND flash was developed 2.5 decades ago. 3D XPoint is considered a game changer for 4 main reasons:

1. It is 1000X faster than NAND flash technology.

2. It is about ½ the cost of DRAM.

3. It has 1000X more endurance than NAND.

4. It is 10X denser than conventional memory.

The benefits of 3D XPoint could be used for various applications such as: gaming, media production, genome sequencing, financial services transactions, and personalized medicine. Those are just a few examples. However, that gives us a good idea of the strong potential for this technology.

Image source: techreport.com

Micron stated the company will see its first revenue from 3D XPoint in 2017. However, Micron did not elaborate on how much revenue it expects to generate in 2017 from this technology. The company also didn't mention the customers that it was communicating with regarding 3D XPoint. So, I would expect this technology to take a while to roll out. The revenue from 3D XPoint may not be significant in 2017, but I expect the technology to be a long-term driver of growth over many years.

In the meantime, Micron is experiencing strong growth for its other technology. The Compute and Networking business unit increased 18% in FQ1 over the previous quarter. The Mobile business unit increased 54% Q/Q, while the Embedded business unit increased 13% Q/Q and the Storage business unit increased 13% Q/Q. The growth was attributed to cloud