Over the past year shares of Advanced Accelerator Applications (AAAP) have struggled to maintain positive momentum.

AAAP data by YCharts

This small biotech company, part of the IPO class of 2015, portrays itself as a leader in the molecular nuclear medicine market. Its operations are composed of two parts, a steadily growing diagnostic drug business and a therapeutics pipeline that provides considerably more upside.

The company already has 7 products marketed in the European Union and 1 in the United States. Adding more validation to the story, the company also manufactures and distributes two PET Alzheimer products for Eli Lilly (LLY) and General Electric (GE).

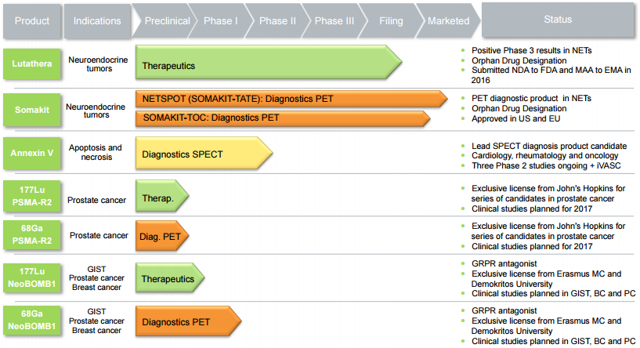

Figure 2: Pipeline (source: corporate presentation)

Management has continually shown themselves to be both capable and focused on growing the business. In 2016 alone they grew to over 500 employees globally in 13 countries and possessing 21 cGMP production facilities.

While the share price might not reflect achievements made in 2016, I expect 2017 to be a year of substantial appreciation for shareholders.

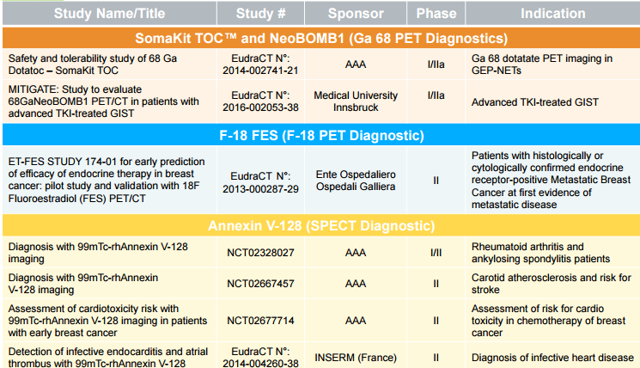

The company continues to push forward with its diagnostic pipeline, with several early and midstage trials in cancer, arthritis, heart disease, and other indications.

Figure 3: Ongoing diagnostic trials (source: corporate presentation)

Lead therapeutic candidate Lutathera is involved in quite a few ongoing trials, including five phase 2 studies in a variety of indications involving neuro endocrine tumors (NETs) or neuroblastoma.

Management believes there are 232,000 patients with NETs in the US and Europe. These particular tumors are slow growing and patients often do not display symptoms- instead they are discovered during unrelated surgery or medical exams.

As around 80% of NETs overexpress somatostatin receptors, treatment with SSAs (somatostatin analogs) is the most common treatment option. The leader in this market is Novartis' (NVS) Sandostatin LAR, which racked up $1.63