Choice Hotels International (NYSE:CHH) is one of the world's largest lodging company with 6,514 hotels open and 775 hotels under construction, representing 516,122 rooms open and 62,547 rooms under construction. Choice franchises lodging properties under the following proprietary brand names: Comfort Inn, Comfort Suites, Quality, Clarion, Sleep Inn, Econo Lodge, Rodeway Inn, MainStay Suites, Suburban Extended Stay Hotel, Cambria hotels & suites, and Ascend Hotel Collection. Around 99% of the Company's total revenues are generated by asset-light franchise contracts.

The global hotel industry comprises approximately 16.4 million rooms (o/w Choice's market share is around 3.1%), broadly segmented into branded (multiple hotels under the same brand) and independent (non-branded) hotels. The branded hotel market accounts for 53% of total rooms supply globally. Despite recent industry consolidation, the market remains fragmented with five of the leading players (Marriott, Hilton, IHG, Wyndham and Accor Hotels) accounting for only 24% of total open rooms and 61% of the overall development pipeline.

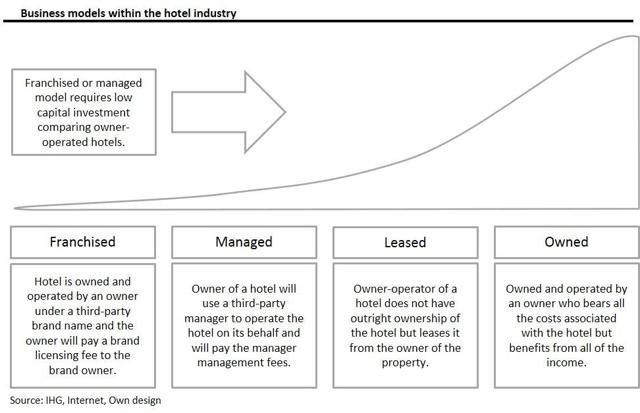

Depending on whether a hotel is branded or independent, there are different business models it can adopt. The four models typically seen in the industry are franchised, managed, owned and leased.

Whilst an owner-operated hotel enables the owner to have full control over hotel operations, it requires high capital investment. In contrast, for hotel-brand owners, franchised or managed model enables quicker rooms growth due to lower capital investment, but this requires strong relationships with the third-party hotel owners.

As a rule of thumb, franchising business model depends on:

- the number and mix of franchised hotel rooms,

- growth in the number of hotel rooms under franchise,

- occupancy and room rates achieved by the hotels under franchise,

- the effective royalty rate achieved,

- the level of franchise sales and relicensing activity,

- and ability to manage costs.

But in short, franchise fees = RevPAR x rooms x royalty rate.

The competitive advantages of Choice are based largely on the brand name with pricing power, recurring fee business model, significant switching costs for its property owners, long dating contracts and scale in a very fragmented industry (5 leading branded hotel companies' account for around 25% of total market).

Industry overview

In the long term, growth in the global hotel industry is driven by strong economic, demographic and social drivers. Long-term macroeconomic growth substantially benefits the hotel industry and drives both the corporate and leisure segments of demand. GDP is forecast to grow at 2.6% per annum for the next 10 years. In addition to worldwide population growth, changes to the world's demographic profile mean there are more people with the desire and means to travel, such as those aged over 60 - 12% of the world's population in 2015, and forecast to increase to 21% by 2050. Social factors, such as the arrival of low-cost airline carriers and the relaxation of travel restrictions, continue to make travel more viable. International tourist travel is expected to increase from 1.2 billion to 1.9 billion tourist arrivals by 2026.

There are many metrics which are used to track the performance of the tourism industry, but the main two include revenue per available room (RevPAR) and rooms supply growth. In the last 5y, global industry RevPAR has averaged 3.9% growth per year, underpinned by high levels of demand and below-average increases in supply. In 2016, total industry RevPAR has continued to grow, albeit at a slower pace, following a record seven years of sustained growth in demand. This trend reflects the cyclical nature of the hotel industry, where longer-term fluctuations in RevPAR tend to reflect the interplay between demand and hotel supply, and the general economic environment. There is going to be many bumps on the road like terrorism attacks, recessions, political crises but overall industry should grow because long-term structural factors are in favor of the industry.

Risks to business model

Lodging industry experiences both positive and negative operating cycles. Positive cycles are characterized by periods of sustained occupancy growth, increasing room rates and hotel development. These cycles usually continue until either the economy sustains a prolonged downturn, excess supply conditions exist or some external factor occurs such as war, terrorism or natural resource shortages. Negative cycles are characterized by hoteliers reducing room rates to stimulate occupancy and a reduction of hotel development. Industry recovery usually begins with an increase in occupancy followed by hoteliers increasing room rates. As demand begins to exceed room supply, occupancies and rates continue to improve.

A combination of low-interest rates and high hotel asset values has sparked an expansion of hotel-room capacity. Industry estimates put overall hotel-room capacity growth in the U.S. at 2.1% this year and 2.5% in 2018, levels that have historically set alarm bells ringing in a market where demand grows quite consistently over time at a 1.6% to 1.8% annual rate. The most impacted companies are the ones which are most exposed to the economy, mid-tier "upscale" and "upper-upscale" sectors of the market where room capacity is growing at more than twice the industry rate. Approximately, 49% of the new rooms opened during the last year were positioned in the Upper Midscale, Midscale and Economy chain scale segments in which Choice primarily operate. Furthermore, here is competition from Airbnb most acute.

Valuation and conclusion

As a franchisor, Choice is well positioned in any stage of the lodging cycle. Franchisors normally benefit from higher industry supply growth, because unit growth usually outpaces lower RevPAR resulting from excess supply. As a result, franchisors benefit from both RevPAR growth and supply increases which aid in reducing the impact of lodging industry economic cycles.

The asset-light business model can deliver a better return on capital, lower profit volatility, greater flexibility, and higher scale-driven cost savings than asset-heavy models. Choice remains committed to its asset-light franchise strategy, which should continue to yield significant cash returns to shareholders over time.

Furthermore, it is not easy to find a company which has high returns on capital and at the same time opportunity to reinvest its capital in the core business (Choice has nearly 63k rooms in the pipeline). Choice operates in a highly fragmented industry with a strong tendency of consolidation. To sum up, in the long run, this is a great cash generative business with ample of reinvestment opportunities coupled with favorable fundamental characteristics.

I believe the best ideas can be done on the back of an envelope, therefore I'm not a big proponent of detailed financial modeling. According to FY2016 results, free cash flow is USD 124m. Putting that into perspective (M.Cap around USD 3.52bn), it generates FCF yield of 3.5%. In this extra accommodative monetary environment that yield is satisfactory, but for me, as a value investor it is not enough to provide me with an adequate margin of safety, thus I would wait for a better entry point.