Lies they tell us. If I hear another lie... I think I'm going to explode.

- Naked Aggression

Earlier this week, I reacted to the "scandalous news" that there was public record of a controversial instruction from a senior manager of Barclays to an employee of the bank with a sort of journalistic shrug: "Trust The Bank Of England? The Big Banks Do." The news was that during the Crisis, a Barclays manager told the bank's LIBOR submitter that the LIBOR rate submissions must be reduced due to "pressure from the Bank of England (BofE)."

C'mon. Where is the surprise that during the depths of the Crisis, there was official pressure to provide the world with a fictitiously low version of LIBOR? That duplicitous low version of LIBOR was just realpolitik. We all know that governments regularly require their individual citizens that are privileged insiders to lie to the rest of us for our own good.

This low value of LIBOR was only a white lie. The truthfully more elevated version of LIBOR needed untruthful adjustment, as it was slowing loan growth at a time when the economy could not afford it.

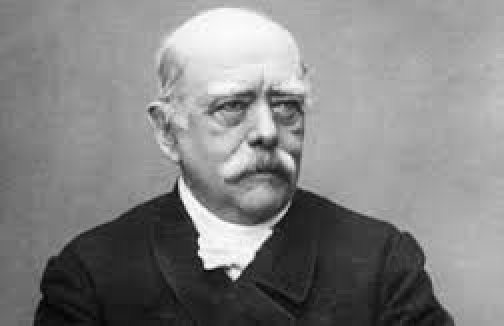

Otto Von Bismarck on realpolitik: Never believe anything in politics until it has been officially denied."

But then, on the following day, British officialdom couldn't help itself. As the above-cited article in The Guardian reports, officials took a swan dive into the Watergate trap. A spokesman for the Bank of England reminded us, "Libor and other global benchmarks were not regulated in the UK or elsewhere during the period in question." That's worse than a lie. Why??

Understanding the British art of regulation

The British compare their understatement and subtlety to American bluntness and a certain American dogged determination to enshrine the rules in written regulation. There's something to this British-drawn distinction. Admittedly, the recent US election has given Americans a president that is not subtle. (I wonder, does Prime Minister Theresa May tweet?) But the important implication of this difference between British and American rules is that the more heavy-handed US regulators sometimes turn to the BofE to avail themselves of British sleight of hand regulation. The two regulators are an odd couple.

But during the Crisis, American regulators needed British regulators to do their back alley regulatory thing - pressure the banks to reduce LIBOR. The big banks would have necessarily ignored any such pressure if LIBOR were not usually above its market yield. Compliance would have been unaffordable. As it is, though, there is no such impediment to the big banks' actions.

But then this week, the BofE crossed a line in the sand of ethics. No British regulator may honestly say that British financial markets have been unregulated. British financial markets have been without written regulation until the Crisis put the end to this centuries-old British informal regulatory style.

Lack of written regulation is the basic source of the BofE's substantial power. The absence of written regulation creates enormous influence with the big banks because the BofE can hide behind its claimed lack of regulatory power, permitting unethical bank behavior, such as London's various daily above-market "fixings," that the Bank of England implicitly condones.

Their invisible set of unwritten rules gives the Bank of England greater power over big bank decision-making than that of any other global regulator, including the Federal Reserve. The banks can do their oligopolistic price-manipulating thing in London. But elsewhere, artificially elevated levels of LIBOR would be crushed like a bug. For a detailed description of London's fixings and the dealer bank's other ways of milking their size to promote their oligopoly, see my series: price index control, OTC derivatives, gold, foreign exchange, interest rate swaps, a second article on interest rate swaps, credit default swaps. But LIBOR especially.

My focus now is this: for British officials to call any financial market with a substantial London presence "unregulated" is no white lie. It is an attempt to divert global attention from the very role of British bank regulation within the global system. The function of bank regulation in Great Britain is obfuscation of the rules. The rules are unwritten - hence subtle and enforced on the down-low. But as one might expect, when a regulator grounds its rules in protection of its banks from the rules of the globe's dominant regulator, the United States, those unwritten rules are more potent than any written regulation could ever be. To disobey them leads to disfavor and the implied threat that the misbehaving bank might be made subject to exposure to US regulators - or worse, to US legal authorities.

Basic LIBOR vs. episodic LIBOR

I explain basic LIBOR, a rate determined at 11:00 AM London time, in greater detail here. I also explain that it is inevitably higher (designed that way) than the acronym (London InterBank Offered Rate) suggests. In other words, LIBOR is a non-market rate, higher than the rate that an informed banker would pay for a deposit offered by one of her interbank sisters. This LIBOR markup is a source of immense value to bankers, since LIBOR is the basis for dollar-denominated asset yields globally - estimated to be something over $80 trillion. It is also the pricing basis for interest rate swaps - a vast derivatives market, of notional size over $50 trillion. In short, LIBOR is the world's most important number, yet its level is manipulated - in the sense that it is set above the deposit cost it represents.

Importantly, the Crisis communication between the BofE and London banks was unrelated to basic LIBOR. BofE, if it pressured the big banks to reduce basic LIBOR to a representative value, would threaten its London's entire financial franchise, since it would become just another unsubtle, written regulation-based regulator like the Americans. Call this BofE-tweaked manifestation of LIBOR episodic LIBOR.

The Crisis-driven BofE pressure on the banks to reduce LIBOR introduced a new implied rule. To wit: you banks may continue to soak the world's borrowers during normal times, but in times of crisis, you must put LIBOR were we regulators want it.

Are US regulators complicit in the BofE's LIBOR scam?

Yes. How can we tell? In part, the facts betray the hand-in-glove nature of US and British regulators when addressing LIBOR. In part, the complicity is implied.

The facts are as below.

- Former Chairman Arthur Burns' LIBOR letter to the big banks: The thing is, US regulators are not always happy with US regulations. And there is little doubt that most of the US economics profession was very unhappy with the effect of the Fed's Regulation Q ceiling on deposit rates during the early 1970s. This rule denied banks the ability to pay interest on deposits over a very low ceiling during a time when market rates exceeded Reg Q ceilings by more than 10%. This foolish rule provoked the US banks' original flight to London to offer deposits (called Eurodollars) to businesses, both US and foreign, at rates closer to market. Chairman Burns wrote a letter to these wayward banks, requesting that Eurodollar deposits not be made available to retail customers. So the Fed implied that the Eurodollar was now part of the apparatus by which global regulators manage global banks.

- Timothy Geithner has testified that he knew of LIBOR shaving as recently as 2008, when the Fed recommended several reforms to the determination of LIBOR: There is no evidence that the Fed asked the BofE to intervene with the commercial banks to reduce LIBOR. But that the Fed knew that BofE was "discussing" LIBOR reductions with the commercial banks, without commenting on the fact, makes the Fed complicit. A Fed/Treasury call for general reform in the face of a known specific violation is in no way an adequate US response to BofE's actions. There is even the possibility that the reduction began as a suggestion from the Fed to the BofE. Cynical thought.

Conclusion

There is too much scapegoating in the world of LIBOR manipulation. The day-to-day setting of LIBOR above its economic market price is the implied effect of bank regulatory policy in both Great Britain and the United States. To assert that the BofE, and by complicity the Fed, seek to achieve market pricing of the OTC markets in London - LIBOR, in particular - does not fit the facts.

But, on the other hand, to remove the CEO of Barclays, whose sin seems to be that he went public with his concern that LIBOR was a fiction, is simply deflection by bank regulators of attention from the regulators' own culpability.

Nor is it believable that the junior traders that have been convicted of LIBOR manipulation, sacrificed on the altar of public opinion for their role in manipulation of LIBOR, are the highest-ranking commercial bankers involved in the sorry LIBOR scandal.

The reality is that an artificially higher-than-market rate like LIBOR is always going to provide temptation to the traders whose income statements are held hostage to this non-market price. The remedy is to reform the LIBOR market, making deposits negotiable again, so market prices may be reliably extracted from secondary market transactions.

There are complaints that the actual three-month LIBOR rate has become illiquid, and the accompanying suggestion that the world switch to a more liquid benchmark. Naive. Why is three-month LIBOR illiquid? Because it has become the world's benchmark. Too visible to trade. Change the benchmark. The new one will become illiquid.