A close observation of Twitter's (TWTR) recent price action points to pressurized valuation multiples towards more upside as the market is split between upholding new bullish narratives in the face of a shifting playing field and growing competition.

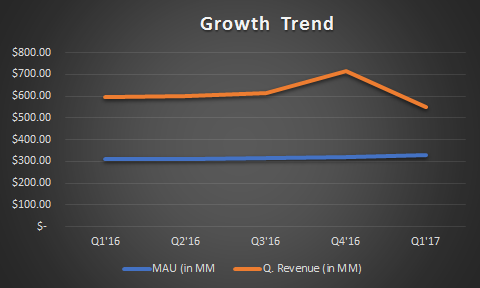

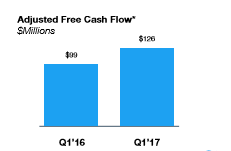

Ideally, a growth stock experiences massive multiples compression when key growth drivers like revenue and MAU are not strongly indicative of sustainable momentum and FCF growth.

However, Twitter's recent price action suggests a shifting narrative, which might be partly driven by uncertainty and market euphoria. This can be initially explained by the massive spike in investors' willingness to dole out more capital at a growing risk premium to uphold the fundamental thesis of the company's business model. Ideally, regardless of threats from competition, the potential to grow TAM in a fast-growing space is enough catalyst for investors to expand valuation multiples of a big tech firm like Twitter.

Prior to the recent earnings announcement, investors have been hesitant to uphold the growing cost of capital required to increase market share and profitability ratios. The skepticism has revolved around the ability of the leadership team to execute on value-generating ideas. This narrative is straightforward, given that the leadership has witnessed a number of talents exiting the door at crucial moments. This, coupled with the split duties of the CEO, was enough to cast more doubt on the competitive prowess of the social media company.

With the death of the strongest bearish thesis, downside price catalysts have no sauce in them. The market is increasingly compelled to overlook negative trends in fundamental growth drivers, while seeking drivers for more multiples expansion. This isn't a bad thing by itself, given that investors will eventually have no choice but to raise their risk appetite, while doling out more in cost of capital to sustain market share.