With inflation figures in Japan having come in lower than anticipated, the Bank of Japan has advised that inflation for 2017 is expected to come in at 1.1 percent, which is lower than the 1.4 percent previously forecasted.

It is no secret that since Japan is a highly export-oriented economy, as the yen falls the Nikkei 225 tends to rise in return. However, is that relationship necessarily a given this time?

It helps to look at historical trends when it comes to answering this question.

For instance, we saw that inflation rates in Japan had hit significant lows last year, but the yen still continued to climb significantly against the USD due to growth concerns in the United States and Brexit fears, making JPY a safe haven:

(Source: Trading Economics)

In this regard, it is not necessarily a given that falling inflation means a falling yen - especially if risk sentiment in the market changes and we see the yen rise as risk appetite wanes on the part of investors. This could be the case depending on 1) whether an increased reluctance for rate hikes in the United States, coupled with 2) stalling of negotiations on Brexit lead markets to take a risk-off approach.

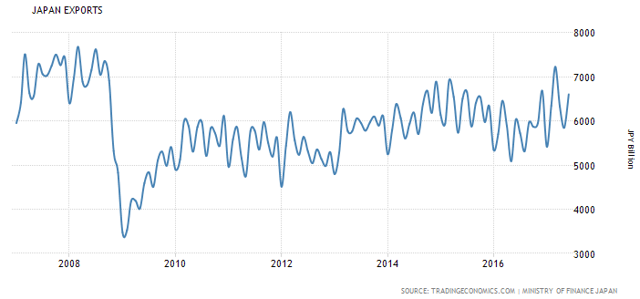

Moreover, a falling yen does not necessarily mean exports will rise significantly as a result. For instance, while in 2016 the yen was trading at significantly stronger levels than today, we see only a slight rise in export levels in 2017:

Additionally, when looking at the monthly chart, we see that the Nikkei 225 is already trading near the peak of 2100:

In this regard, the yen is already testing highs at the current level, and it is unclear whether a falling yen could necessarily push this much higher, especially considering the currency is already quite weak against the USD in the context of a 10-year period:

The message in all this? Don't get overly excited about a rising Nikkei 225 simply because the yen (could) fall. The index is already trading at significant highs, and I do not see the recent news on inflation as sufficient reason to push the index beyond the highs seen in 2015.