PIMCO CEFs: A Post-Carnage Review

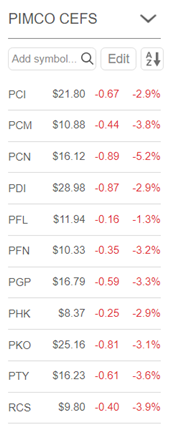

PIMCO's CEFs took a real beating on Thursday, along with virtually every other CEFs that doesn't have "municipal bond" in its name. Here's what the PIMCO lineup looked like at Thursday's close.

Seasoned observers of CEFs accepted those drops in stride and began looking at the losses as looming buying opportunities. Several commenters in yesterday's article on PCI (PCI Remains PIMCO's Best-Buy CEF) told us they had already begun adding to positions. The losses certainly looked to be out of line with the quality of this set of funds and, for a buyer, they could even have been seen as a welcome attack on the unreasonable premiums most of the PIMCO CEFs have been selling for.

As I noted yesterday, I decided to take a wait-and-see approach. If another day of losses followed, I would also be a buyer, at least of PCI, which - as yesterday's headline stated - I view as PIMCO's best buy at the moment. At yesterday's close, PCI had a -5.55% discount, a level not seen for several months, and was paying over 9%. Furthermore, its NAV had been turning in some impressive numbers and at NAV, yesterday's loss was only $0.2, less than one percent.

I decided to come back to the funds mid-day today (Friday, Aug 11) and make some decisions. Had the drop continued I was prepared to start adding to my positions. Turns out my wait-and-see approach was not necessarily a good call, at least in this short term. All but three of the fund have put in a nice bounce this morning.

Price | Change | % Change | |

PCI | 22.22 | 0.42 | 1.93% |

11.01 | 0.13 | 1.16% | |

16.5 | 0.38 | 2.36% | |

29.09 | 0.11 | 0.38% | |

11.9 | -0.04 | -0.34% | |

10.31 | -0.02 | -0.19% | |

16.83 | 0.04 | 0.24% | |

8.47 | 0.11 | 1.26% | |

PKO | 25.44 | 0.28 | 1.11% |

16.48 | 0.25 | 1.54% | |

9.79 | -0.01 | -0.10% |

Notable winners this morning are PCN (2.36%) and PCI (1.93%). This moves PCI's discount to -3.73% which puts me right back into wait-and-see mode. But I have a large position in PCI and I'm not eager to add to it at this time. If I were not holding such a large position I would be looking at these numbers and considering a buy of the fund.

I continue to think that PCI is the top buy in the set. It is, as I've noted, the only one of them that is priced at a discount. This despite it having turned in the second best NAV performance among them all. The only fund that beat PCI for NAV return year to date is PDI (PDI, 16.83%; PCI, 15.23%). At -3.73%, PCI is more discounted than it has been since the end of February of this year. If one assumes that the CEF carnage has run its course (not that I'm suggesting it has, mind you), PCI looks very attractive at this price. Sure yesterday's -5.55% discount was better, but today still looks pretty good.

What about the top NAV gainer for the year, PDI? At midday, PDI has picked up some of yesterday's losses, but it's only up 0.4%. At yesterday's close the premium had fallen three percentage points to 2.37%. A week ago it was at 8.23%. It hasn't been this low since the post-election sell-off at the end of 2016. Anyone who has been waiting for a big downward move in PDI's premium will want to be paying attention. While I consider PCI, PIMCO's best buy, I think it's fair to say that PDI has been PIMCO's best fund. About a year ago I sold most of my position in PDI because the premium/discount differential between it and its near-sibling, PCI, was simply too great to pass up. So I purchased PCI with the proceeds. My intention was to wait and watch PDI for a decay of that premium. Well, I think we're getting as close as we are going to get. On yesterday's NAV, PDI is now at a 2.76% premium. That ranks it fourth best over the eleven PIMCO taxable CEFs. This for PIMCO's best CEF. I added to my PDI position this morning and expect to continue doing so if the premium moves downward over the next few weeks.

The Caveat: As I noted yesterday, PDI, PCI and all but one of the PIMCO CEFs have been struggling to cover their distributions since the beginning of 2017. This is nearly certainly the primary driver of market price declines for the funds. We have multiple authors here at Seeking Alpha telling readers the bottom is ready to fall out on these funds. While I strongly disagree, this is a cause for real concern.

Obviously, I'm not cheered by the falling coverage, but I'm looking at the NAV gains (remember, PDI has gained 16.8% on its NAV total return this year!) and feeling very confident that management will work through the distribution coverage issues. I have a lot of confidence in the PDI/PCI management team. So, it's my view that the coverage issues truly are opening buying opportunities for both of these funds.