By Bob Ciura

Changing consumer trends are making it very difficult for large packaged food companies to grow. In this climate, "center-aisle" products are falling out of favor. On September 20, General Mills (NYSE:GIS) released fiscal first-quarter earnings. Revenue and earnings both missed analyst expectations, which sent the stock down over 5% after reporting.

On the bright side, General Mills has paid a dividend for more than 100 years. And, thanks to General Mills’ declining share price, the dividend yield has risen to an attractive 3.7%. The combination of a 3%-plus yield and more than 100 years in business means

This will discuss General Mills’ recent earnings report, and why the stock could still hold a place in a dividend growth investor’s portfolio.

News Overview

General Mills missed analyst expectations on both the top and bottom line. Revenue of $3.77 billion missed by $20 million, and represented a 3.6% year-over-year decline. Earnings per share fell 9% to $0.71, which was below expectations by $0.05 per share.

Organic revenue, which excludes the impact of currency fluctuations, fell by 4%. Pricing and product mix held steady, but volumes fell 4% for the quarter. Gross margin fell 230 basis points, to 35.1%, below analyst expectations of 37.1%. Margins are eroding, not just because of declining sales, but also because of higher raw materials costs.

Results were particularly weak in North America. Total sales fell 5% last quarter, driven by cereal and yogurt, which were down 7% and 22%, respectively.

Source: Earnings Presentation, page 7

Organic sales also fell 8% in Latin America and Asia. These declines more than offset 2.8% sales growth in Europe and Australia, and a 0.2% increase in convenience stores and foodservice sales.

The good news is General Mills remains highly profitable. For fiscal 2018, management sees organic sales falling 1% to 2%. Adjusted earnings-per-share are expected in a range of $3.12 to $3.15. Earnings are expected to increase 1% to 2% for the year, thanks to cost cuts.

Such a strong level of profitability allows General Mills to invest in new products, acquisitions, repurchase stock, and pay dividends to shareholders.

Growth Prospects

General Mills’ declining revenue last quarter was not an isolated event. It has had difficulty growing sales, going back several quarters. Total sales declined by 6% in fiscal 2017. Cost reductions drove 6% growth in adjusted earnings-per-share last year.

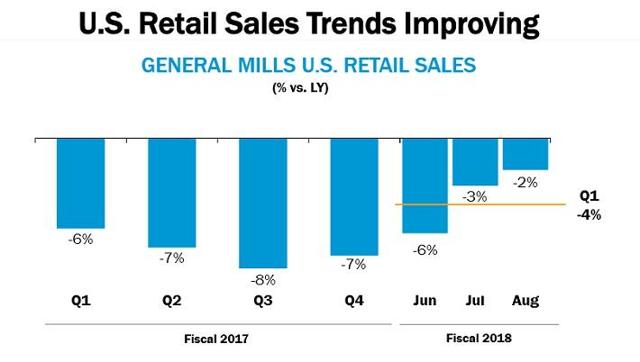

One positive sign is that the rate of decline in the U.S. is moderating with each passing quarter.

Source: Earnings Presentation, page 20

This is a good step towards an eventual return to growth, since the U.S. is General Mills’ largest and most important geographic region. It has the No. 2 market share in cereal, with 3 of the top 5 brands in the U.S.

Cereal sales fell 3.5% in fiscal 2017, but declined 1.4% last quarter. Some positive momentum is noticeable, as cereal sales were down just 0.4% in August. Management is hoping for a return to sales growth in cereal in the coming quarters. General Mills is changing its cereal to better align with consumer tastes. For example, it has eliminated artificial flavoring and colors from many brands.

In response to recent sales declines, the company also is investing more heavily in its snacks and ice cream brands. General Mills still has growth brands in these areas, such as snack bars and ice cream.

Haagen-Dazs is a very strong performer for General Mills, with 20% sales growth in the past 12 weeks.

Source: Earnings Presentation, page 29

In addition, General Mills is making a big push in natural and organics. It accomplished this by acquiring Annie’s for $820 million. Annie’s is a high-growth brand. Sales doubled from 2010 to 2014, and General Mills expects sales to double again from 2014 to 2017. Led by Annie’s, General Mills expects its natural and organic product sales to reach $1 billion by fiscal 2019.

Investments in new products that cater to changing consumer preferences could help General Mills’ earnings growth remain intact.

Valuation and Expected Total Returns

General Mills had adjusted earnings per share of $3.08 in fiscal 2017. The stock has a price-to-earnings ratio of 16.9. General Mills trades significantly below the average S&P 500 Index price-to-earnings ratio of 25.

The stock has declined 15% year-to-date, which has resulted in a cheaper valuation multiple. If General Mills can engineer a successful turnaround, the stock could be undervalued at its current multiple. In addition, the dividend yield is up to 3.7%.

The benefit of a declining share price is that future return potential improves, particularly when earnings continue to grow, as is the case with General Mills. A potential breakdown of future returns could be as follows:

- 1%-2% revenue growth

- 1% margin expansion

- 3%-4% share repurchases

- 3.7% dividend yield

If General Mills can return to modest revenue growth, total returns could reach approximately 8%-11% per year. Cash returns represent a significant portion of total returns. Last quarter, General Mills reduced its share count by 4% from the same quarter last year. And there is still room for General Mills to increase its dividend.

The company has a dividend payout ratio of 64%, based on fiscal 2017 adjusted earnings per share. Assuming earnings at least stay flat, General Mills should still be able to pass along dividend increases in the low single-digits each year.

Final Thoughts

The earnings results from General Mills have not been good for several quarters in a row. This is to be expected, as the company is forced to adapt to changing consumer demands. It will likely take time before General Mills returns to sales growth.

Fortunately, earnings continue to grow, thanks to cost controls and share repurchases. As a result, General Mills should continue to raise its dividend each year. With a modest valuation and a 3.7% dividend yield, the stock could be attractive for value and income investors.

Looking for undervalued stocks with even longer histories of dividend growth? Our exclusive service Undervalued Aristocrats provides actionable buy and sell recommendations on some of the most undervalued dividend growth stocks around. Click here to learn more.