At its current share price, Smart Sand (NYSE: NASDAQ:SND), a Midwest producer of Northern White Frac Sand, offers strong upside potential for equity holders willing to subject their portfolio to a considerable amount of commodity price risk.

Of course, there are many readily available reasons for avoiding an investment in a miner like Smart Sand, as a recent Wall Street Journal profile of the Permian Basin Sand Boom brought renewed attention to. The large potential growth in Permian Basin sand production could squeeze industry margins and reconfigure market share, oil prices may swing lower and hinder sand demand. In addition to macro risks, Smart Sand’s equity is made even riskier by the fact that the company’s fortunes are tied entirely to just one production facility.

These risks are not to be ignored. Supply side fundamentals in the market for frac sand suggest the possibility of oversupply, which must be weighed against the company’s own growth opportunities.

The Frac Sand Market

When Smart Sand completed its IPO on November 4, 2016, the market for Northern White Frac Sand seemed poised to deliver robust growth opportunities to Smart Sand for years to come. The trend of oil and gas producers drilling longer laterals and using increased proppant to stimulate hydrocarbon recovery was set to turn the producers of the all-enabling frac sand into champions.

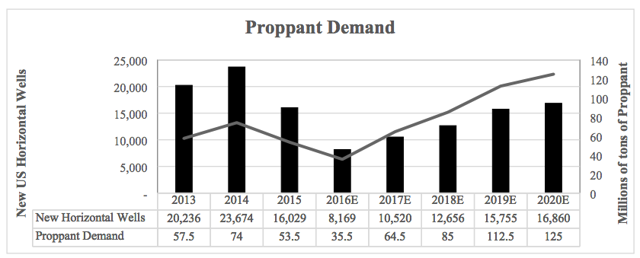

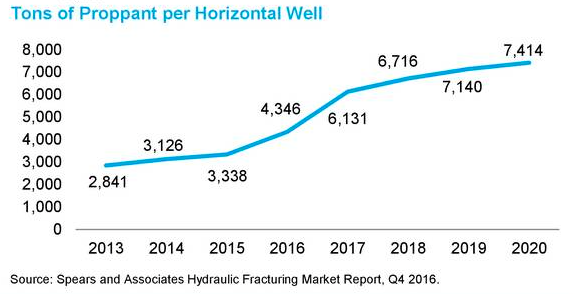

To demonstrate the potential market boom, Smart Sand’s 2016 annual report features the chart below and reference to a study that suggests “from 2016 through 2020 proppant demand is projected to grow by 37.0% per year, from 35.5 million tons per year to 125 million tons per year, representing an increase of approximately 89.5 million tons in annual proppant demand over that time period.”

Source: Smart Sand 2016 Annual Report

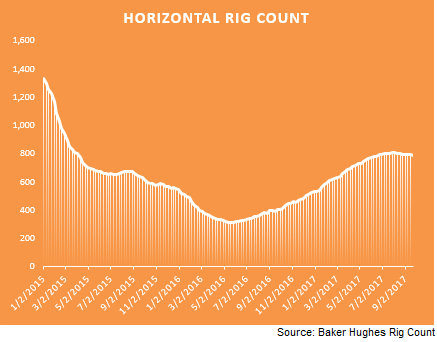

More recently, Smart Sand highlighted the increasing amount of proppant used per horizontal well drilled as another reason to be enthused about market tailwinds.

Graphic Source: Smart Sand, Inc. at the Tudor Pickering Holt & Co. 2017 Energy Conference

This half of the story, taken by itself, creates a terribly misleading picture of the market. Looking only at proppant demand forecasts would lead investors to valuing the stocks of sand miners at tech industry-like multiples. Instead, market participants, in anticipation of large increases in proppant supply, are valuing companies like Smart Sand as though their best days are well in the past. Rather than focusing too much on the demand side, investors have punished sand miners’ stocks due to fears about lower oil prices and expectations for an oversupply of sand as new capacity comes into play.

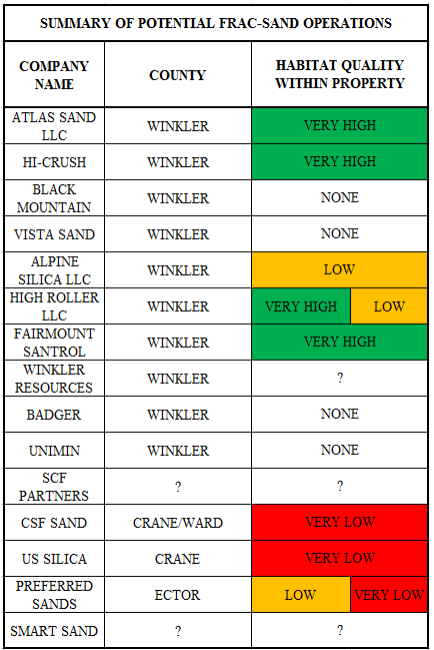

Last week, The Wall Street Journal’s story evoked a sense of doom lurking on the supply side: “The Atlas mine is one of at least 18 under way or proposed for the desert outside Midland, Texas, according to Jefferies analyst Brad Handler. The first, Hi-Crush Partners LP’s 3-million-ton-a-year facility, began operations in July. More than a dozen plan to open over the next year.”

The fear is that these new facilities will produce sand that will go on to replace Smart Sand’s bread and butter (Northern White Frac Sand) product, since it is cheaper to source locally than to transport sand from the Midwest via rail.

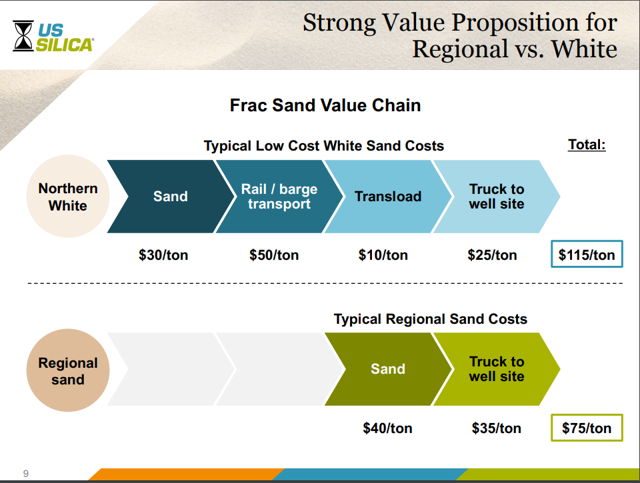

These fears seem overblown. For one, Smart Sand believes it derives its advantage from the geologic characteristics of its sand reserves. The same Wall Street Journal article that cast the oversupply fears also reported on these characteristics, describing Northern White Frac Sand as “prized for its uniformity, crush strength and grain size.” If the favorable geology of Northern White enables drillers to unlock more gas or oil, the cost savings from Permian sand may be moot. While determining the economics of this comparison poses many challenges at present, it remains a critical comparison for Smart Sand shareholders to understand. The estimated cost savings for producers opting to use the West Texas sand are, at present, quite significant; shown below, US Silica estimates a $40/ton difference for Permian operators when sourcing sanding locally.

Source: Goldman Sachs Permian Tour Presentation

It is far too soon to determine what E&P’s will ultimately decide on: sourcing sand locally and slash the rail costs, or choosing Northern White, which comes with its own unique set of advantages. Such uncertainty is baked into the conservative valuation placed on companies like Smart Sand.

The debate over the future of frac sand continues to rage on. In a recent LinkedIn post summarizing a speech he gave to the American Institute of Professional Geologists, Professor and Consultant Kent Syverson wrote that:

“Sand from Brady, Texas, can be trucked directly to the Permian Basin — a major cost advantage. However, one logistics person told me it required 5 hours to truck sand one way from Brady to his drilling pad. He preferred to use Northern White sand transported by rail into the middle of the basin where trucking times were only one hour one way.”

He went on to cover the favorable characteristics of Northern White:

“Northern White sand has one major advantage over Texas sands — higher crush strengths. Companies in Wisconsin where I do much consulting work report 8K to 11K crush strengths for 40/70-mesh sand. Companies producing sand near Brady, TX, report a 6K crush strength for 40/70-mesh sand. Black Mountain Sand is proposing two sand mines in the Permian Basin, and they report a 7K crush strength for 40/70-mesh sand. Higher crush strength means Northern White sand can be used to hydraulically fracture deeper shale zones than Texas sand.”

The full slide deck can be found here, but Syverson’s words leave us with still no way of knowing how producers will make decisions. Shareholders can be comforted by the extent to which Smart Sand has mitigated this risk because a large portion of Smart Sand’s production is already contracted out fairly deep into the future. According to Smart Sand’s Q2 Earnings Call, “Once we assign additional railcars to this contract, our current annual capacity will be 74% contracted, with long-term take-or-pay contracts that have a weighted average term of just under 3 years.”

This three-year period, in which customers have reserved almost ¾ of Smart Sand’s capacity, is crucial in the analysis of an investment in Smart Sand: even if expectations of the Texas takeover become reality, Smart Sand’s contracts afford the company the breathing room it needs to navigate a complicated, challenging future. In fact, Smart Sand itself is one of the many players considering entering the Permian in some form. In the company’s last Earnings Call, CEO Charles Young touched on this possibility, saying, “we're actively looking to acquire or get committed access of logistical assets both in the Permian and other basins, such as the Marcellus and the Bakken.”

An analysis of supply and demand fundamentals would be incomplete without covering the extensive barriers to entry for sand miners. Capacity increases are extensive across the industry: by Smart Sand’s estimates, “15 million to 20 million tons will come online over the next 12 to 18 months. That would not meet the demand in the Permian basin as currently foreseen.” Nevertheless, timing issues remain abundant for operators desiring to gain market share in the Permian. US Silica, in its Goldman Sach Permian Tour Presentation, included “water, infrastructure, trucking, threatened species, labor, [and] reserve quality” as challenges within the Permian.

Not to be lost among these is the ever-so-important Dunes Sagebrush Lizard, a threatened species with a long history with the oil industry. After industry and landowners came together to fight putting the lizard on the endangered species list, U.S. officials decided against listing the lizard as endangered in 2012. The decision reportedly brought increased attention to the lizard and its habitat, creating problems for sand miners attempting to stake operations in the lizard’s habitat today.

That is, the Dunes Sagebrush Lizard and potential Texas sand miners each call the same area home. As a result, miners are tasked with a unique set of environmental issues they must consider in pursuit of new projects. In an August report, the office of the Texas Comptroller of Public Accounts reached a troubling conclusion:

“Frac-sand operations could significantly impact DSL Habitat, including habitat in or near areas where lizards have been found in recent surveys. Moreover, the destruction of that habitat has already begun. The CPA has no authority to stop the development of frac-sand operations of nonparticipants in the TCP. Nonetheless, CPA will continue to urge frac-sand companies to avoid and minimize any impacts to DSL Habitat and buffer.”

Though the office itself will not move to prevent habitat destruction, the environmental issue will create another hurdle in the permitting process and could catalyze a renewed effort by environmentalists to protect the lizard. Smart Sand CEO Charles Young touched on this in the company’s most recent earnings call, suggesting customers are paying attention to actions impacting the lizard’s habitat:

“And we want to make sure that wherever we're in, it's not been mapped by the state, is a higher probability habitat area for the lizard. And I don't think that, that's what's been occurring in the industry, and I think it's a major issue. And I think a lot of the petroleum producers are really starting to get a little nervous about the some of the activities that are occurring down there."

There is significant overlap between locations of potential frac sand operations and lizard habitat, as shown below.

Source: Texas Comptroller of Public Accounts Supplement to Monthly Report

Clearly, significant barriers to entry exist for those looking to turn sand mining dreams into reality in the Permian. As a result, market fears appear to be overblown. Sure, new capacity possibilities (both real and imagined) run rampant, but demand growth remains robust, especially since recent developments of West Texas Intermediate Crude regaining the $50 mark and horizontal rig count resuming growth (shown below).

Smart Sand: Balanced Risk-Reward Profile

Of the many companies providing frac sand to energy producers, Smart Sand sparked my intrigue due to its unique financial position, strong margins, and lack of diversification. There are, of course, a deluge of potential investments within the frac sand industry, as demonstrated by aforementioned supply glut worries, but Smart Sand stands out as a company with underpriced opportunity, net of the various risks outlined above.

For those unfamiliar, Smart Sand derives all of its business from its Oakdale Wisconsin Facility which produces high-quality Northern White raw frac sand. The purpose of frac send is to increase recovery rates in hydraulically fractured oil and gas wells. The Oakdale facility has approximately 332 million tons of proven recoverable sand reserves, with 3.3 million tons of annual capacity — up considerably from 1.1 million in 2012 — and plans to increase capacity to 4.4 million by year-end.

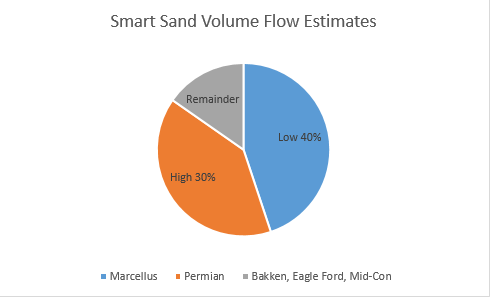

This means that the performance of Smart Sand is hinged upon the performance of one plant and demand for Northern White raw frac sand. Last quarter, this proved problematic as tons sold decreased sequentially primarily “due to unplanned downtime at the Oakdale facility, availability of railcars to support spot sales and railcar capacity at our Oakdale facility.” Unlike the company’s production, the actual end use of Smart Sand’s volumes are relatively diverse, as shown below.

Data Source: Earnings Call

With a plethora of risks elsewhere, investors can gain confidence in the fact that Smart Sand’s fortunes are not too hinged to developments in any individual shale play, and the company’s growing capacity cements its opportunity to gain space in any basin that sees increased drilling activity.

The prevailing paradigm in financial markets holds that diversification is inherently a desirable thing. This is precisely because diversification enables a company, or an investor, to mitigate risk. But here's the paradox: Smart Sand’s lack of diversification, when matched by the company's strong financial position, makes Smart Sand nimbler and less committed to the future of any individual basin. Plus, the company is priced as if its future growth projections are unlikely to be achieved. With cash on the balance sheet, the Hixton site — a potential second facility with 100 million tons of proven recoverable reserves, and essentially no debt, Smart Sand is well positioned to let various markets develop and respond accordingly.

That is, Smart Sand's lack of diversification in production paired with the company’s ability to acquire new facilities means the company is not yet overextended in any one area. The company has a commitment to acquire new assets — a Smart Sand presentation said “increased liquidity from our IPO and follow on offering allows us to explore strategic alternatives to diversify operations and strengthen logistic capabilities.” The firm also has the financial means to do so. In light of this, it will be able to position itself in the most lucrative corners of the market once E&P companies provide clarity regarding their future preferences.

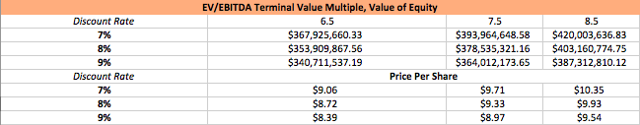

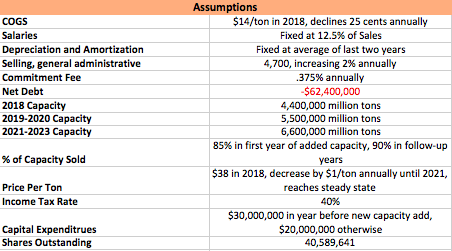

In the meantime, establishing the value of Smart Sand’s present operations and equity of the company is a necessity. To do this, I took fairly modest assumptions and forecasted out the company’s unleveraged free cash flows through 2023. The assumptions utilized are listed below; most notable of these is the $38/ton price of sand used in 2018, followed by annual decreases of $1/ton until 2021. This assumption is colored by the analysis above that concluded the sand market is closer to equilibrium than many suspect, but allowing for a degree of conservatism for future capacity increases that send prices marginally lower in the model. The most challenging aspect of the model is the Capital Expenditures figure, which could be modestly overstated or severely understated, depending on a range of development costs. Compared to data sources like S&P Capital IQ and Wall Street Research Reports, the model I created yields more conservative revenue estimates; it also focuses only on sales of sand produced at the Oakdale facility and ignores revenue earned from logistics operations. The point of doing this is to isolate the value of present production to illustrate that the company’s underlying operations are attractively priced, even if accretive acquisitions do not occur.

The model above yields price per share values well in excess of Friday's close of $7.10, revealing that investors are receiving discounted shares with a decent margin of safety. This analysis leaves out future facilities as well, meaning the potential upside is even greater than the price targets in the model.

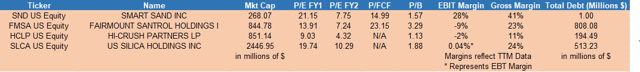

Lastly, I’ve compared Smart Sand to a few competitors. Again, Smart Sand stands out due to its margins and financial position, holding much fewer debt than competitors after Smart Sand utilized its IPO proceeds. On basic price-to-book and price-to-earnings ratios, Smart Sand falls just about in line with the peer group, even with Smart Sand’s well-documented potential upside.

This analysis colors my opinion that the risks associated with Smart Sand are appropriately compensated for and attractively valued. As new capacity takes longer to come into the market than anticipated, Smart Sand shares will grow proportionally if the company successfully executes its own capacity growth plans.

Conclusion

At the present share price, Smart Sand’s risk-reward profile seems favorable for potential investors. I am mildly concerned about how well management will be able to execute in a quickly evolving market, but the company’s attractive valuation provides a margin of safety should capacity issues at the Oakdale facility or other risks wreak havoc on the company’s operations. Smart Sand is a perfect example of the idea that there are investments that fit only certain investors’ criteria. Those looking for a diversified company with little exposure to commodity prices ought to steer clear of Smart Sand; it is only those willing to tolerate the risks associated with a company in its very early stages that should begin to consider investing in Smart Sand.