Recap of Q3:

It has been a quiet quarter for my portfolio, I did sell one position and added to another but aside from that I haven’t had much time to analyze new stocks. That said I am fairly happy with how things went. Specifically, I sold the small position I had in T Rowe Price (TROW) in my Roth IRA at a small gain and re-allocated the funds into Altria (MO). In my Q2 article I had an action item to fill out my position in Altria, thanks to the government and some proposed new regulations in the tobacco industry Altria dropped quite a bit and I was able to load up as you can see below, thanks to this investment I currently have 9,315.76, so it is just shy of my $10,000 goal for a full position.

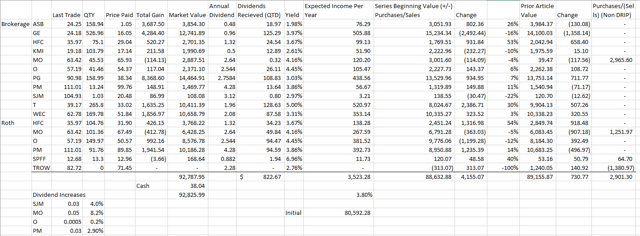

As you can see from the table, I earned $822.67 in dividends during Q3 which when combined with my Q1 and Q2 dividends of $638.86 and $776.80 respectively puts me at 2,238.33 YTD and right on pace for earning just over $3,000 over the course of the year.

Over the course of the quarter, my overall portfolio increased in value about 1% from investment gains and about 3% including purchases. This doesn’t surprise me as Altria dropped significantly, providing a buying opportunity, and GE (GE) also dropped about $2,500 which was a drag on the total returns. All things considered I am fairly pleased with the result and am happy I was able to buy some Altria on the dip.

I got a couple dividend increases during the quarter .03 per share for JM Smucker Company (SJM) (4%), .05 per share for Altria (8.2%), .0005 per share for Realty Income (O) (.2%), and .03 per share for Philip Morris International (PM) (2.9%).

Plans Going Forward:

As always, I am watching the markets and looking for stocks that I feel represent a good value so I can start new positions. As well as filling out existing positions. With the purchases I made in Altria during Q3 I can now say that my “core” portfolio of stocks is slowly approaching all full positions. I think I will add a little more to MO to get it above the 10k mark but then I only have 4 positions that are under the 10k mark. Associated Bank (ASB), Hollyfrontier Corporation (HFC), Kinder Morgan (KMI), and JM Smucker. Each of these have a bit of a different story.

SJM I own just over 1 share, this was the remnant of a DRIP that my grand- mother gave to me, I have held it because there isn’t much sense in selling it as it is almost all profit anyway. In the long-run I think I will probably add a bit to this position if it looks cheap.

ASB is another stock I received from my grandmother that she had held for decades (the original basis in it was 48 cents per share). So, this is also almost all profit. I have been dripping into the position and will probably add to it as well. Unfortunately, ASB has risen substantially in the past year so I am hoping for a bit of a pullback to buy.

HFC is a stock I have been watching a lot for the past few years and was one of the first stocks I bought as I started investing after college. My combined positions sit at about $6,500 and I intend to add to it to get it to the $10,000 mark over time, but it is also a bit richly valued at least relative to the rest of the oil and gas market.

KMI was another stock I bought, I have made a little bit of money off of it, bought some before the dividend cut and then bought a bunch more on the way down until I was at break-even, then I sold some to lock in a profit after it partially re-bounded. In the long-term I am bullish on energy in general and will probably buy some more but I haven’t made up my mind yet.

I am also continuing to watch for new positions, although I haven’t had much time to do any research recently, hopefully once my job slows down a bit I will have a chance to get back to it.

Action items:

At the end of June, I had just moved into a new role at work, on top of that my department has had some significant turnover so I have been helping get things finished and helping to update new staff as well. So, I have been quite busy. Nevertheless, this was a good exercise for me to see how things are going and my portfolio is chugging along. This also continues to keep myself accountable by putting these results out there for all to see.

Over the next quarter, I hope to:

- Fill out my positions in ASB and HFC to $10,000, if valuations look right.

- Initiate at least one new position if valuations look good.

- Finish saving for a down-payment on a house ($2,500 to go).

As always, thanks for reading, and please leave any comments, questions or suggestions below.