As all investors in silver (SLV) including myself know, the last year has been particularly rough, with the white metal whipsawing wildly for no apparent reason and failing to keep pace with gold (GLD). While the yellow metal is up by 12% YTD, silver has only risen by 7%.

In an attempt to identify the reasons as to why silver is failing to perform, in a series of articles of which this is the concluding one, I have taken a closer look at a range of theories as to why it can't catch a break.

Key among these theories, which I explored in detail in the first article, are claims of market manipulation which, along with the tremendous volumes of paper silver, is distorting the price. This, it is alleged, has triggered a disconnect between the fundamentals of supply, demand and the price of silver. Another theory is that the rise of cryptocurrencies such as Bitcoin and Ethereum has attracted investors that would have traditionally invested in silver which I covered in the second article in this series.

While there was certainly some evidence that both of these factors are weighing on the price of silver, they failed to completely account for silver's recent poor performance. There are, in fact, some more arcane and fundamental reasons for silver's poor performance in recent months.

To understand this, investors need to understand what silver is, its relationship to gold and whether it truly is a precious metal.

What is the relationship between silver and gold?

What many investors don’t understand is that the relationship between gold and silver is not as rock-solid or as closely correlated as many believe. This is because both metals have very different qualities which have separate and distinct influences on their prices. To understand this, it is important to come to grips with silver's role as a precious metal and its relationship to gold.

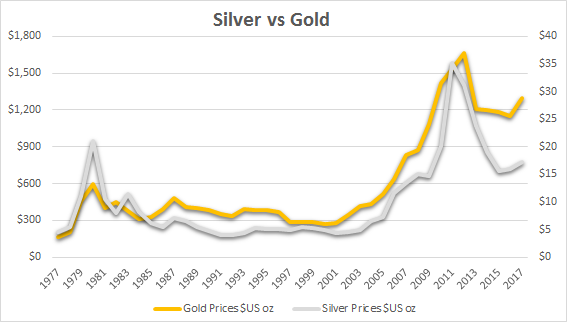

As the chart shows, silver and gold have both shared a closely correlated relationship, but in recent years, the closeness of that relationship has declined.

Source: World Gold Institute, The Silver Institute.

While silver is considered to be a precious metal, a currency of last resort and an unerodable store of value like gold, there are some important differences, with the key being that gold remains the most marketable asset for large transactions. That, coupled with it being the ultimate store of value of which there is a finite supply, means that it is a staple investment for central banks and governments.

You see, central banks buy gold to reduce risk, support and stablize their fiat currencies and enhance the stability of their financial systems while hedging against a weaker dollar as well as inflation. That ensures that there is a steady demand for gold which increases during times of financial distress. This becomes apparent when reviewing central bank gold purchases over the course of the second quarter 2017.

During that period, central banks bought 94.5t of gold which represents a significant 20% increase compared to a year earlier. One of the biggest buyers was the Russian central bank which is battling to stabilize the Russian ruble and an economy suffering from deep structural issues as well as the impact of the prolonged slump in crude.

The importance of gold to central banks is underscored by the fact that it is the third largest reserve currency globally after the U.S. dollar and euro.

In stark contrast, silver has no equivalent role, and for this reason, its price is more volatile than gold and subject to greater fluctuations triggered by what could be perceived to be rather innocuous events such as manipulation or the rise of alternate assets that draw investors away from silver.

Why is silver more volatile than gold?

Another characteristic which contributes to silver's significant volatility is that, unlike gold, it possesses considerable utility. Silver is widely used in a range of industrial processes because of its conductive properties.

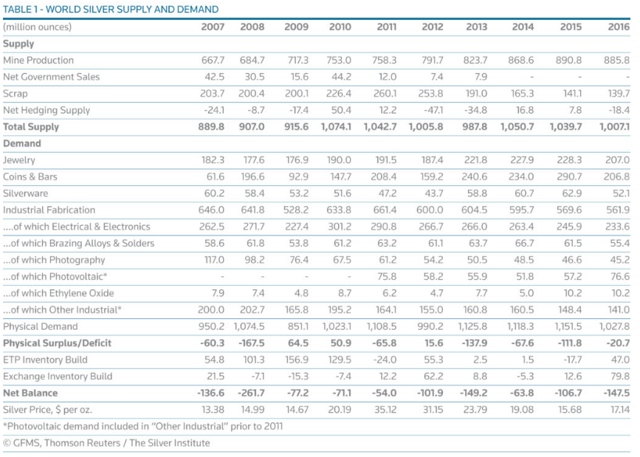

According to data from The Silver Institute, which is set out in the table below, industrial demand accounts for just over half of all consumption of silver, whereas it only comes to 17% for gold.

Source: The Silver Institute.

For that reason, industrial demand can have a considerable influence upon its price, and as can be seen from the table, industrial demand has tapered off significantly in recent years. Between 2011 and 2016, it declined by 13% and much of that can be attributed to the marked drop in silver used in photography, it is this factor which is weighing heavily on the price of silver.

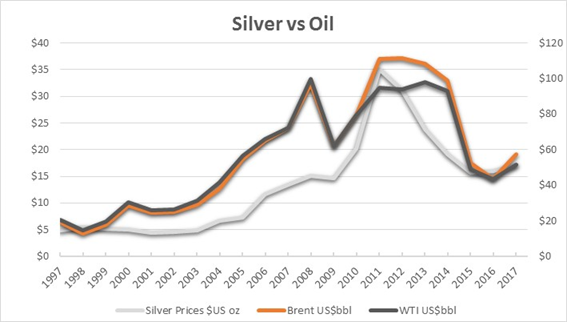

What is even more startling is that silver is closely correlated to other commodities with economic inputs, meaning that they only rise in value during times of economic growth. If we take a look at the relationship between silver and crude, it becomes apparent that there is a positive correlation as the chart illustrates.

Source: U.S. EIA, The Silver Institute.

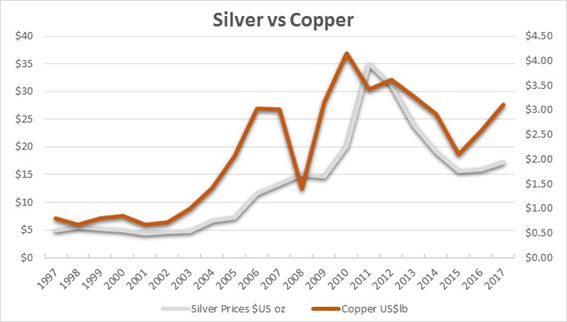

That is further emphasized by the relationship between silver and copper which is set out in the chart below.

Source: The Silver Institute, London Metals Exchange.

Both oil and copper are widely recognized as key gauges as to the health and performance of the global economy. To find that silver shares a positive correlation with both commodities implies that higher demand is also reliant upon global economic growth.

For these reasons, it is easy to see that silver's role as an industrial metal plays an important role in determining its value. This means the marked downturn in industrial demand, along with uncertainty over the outlook for the global economy, is weighing heavily on its price.

What does this mean for investors?

Clearly, while a confluence of factors, including manipulation and the rise of other alternate cryptocurrencies, is causing silver's weakness, it would appear that the key culprit is declining industrial demand for the white metal. When the ambiguity concerning the outlook for the global economy is considered, it is easy to see why silver is failing to perform. Each of those factors is being magnified by the confusion surrounding the direction of gold because of silver's dual role as both an industrial and precious metal.

This has created an opportunity for investors. Weaker silver is not here to stay and there is every sign that silver will continue to firm over coming months because a stronger global economy will drive greater industrial demand. That will be enhanced by the secular trend to renewable energy which has sparked a surge in the use of solar and hence photovoltaic cells in which silver is a key component.

Moves to reduce the manipulation of silver, as discussed in my first article, through additional regulation will also help to restore the market mechanism which over time will lead to lower volatility. The demand for silver will also be bouyed by rising geopolitical tensions in Iran, North Korea and Iraq because of its role as a precious metal.

For the short term, silver will remain especially volatile and it will take some time for long-term fundamentals to drive its price higher, but it is quite feasible that over the next 12 months silver will top $20 per ounce once again.