Introduction

The upward move in WTI Crude Oil since mid-2017 has been relentless, pummeling short-sellers along the way. Since breaking past resistance near the 200 week moving average, WTI is up nearly $7/bbl since mid-December.

A Bull In A China Shop

The phrase “bull in a china shop” refers to someone who is aggressive and clumsy in a situation that requires delicacy and care. In this case, the play on words is intended to describe oil bullishness due to Chinese demand and the pending launch of a yuan-denominated oil futures contract.

While I don’t believe that the launch of the yuan-based oil futures contract will spark calamity in the dollar, it does appear that we are embarking on a new road. And the yuan-based futures contract is an important signpost along that road. Alasdair Macleod recently wrote an excellent article related to this entitled: Will the Dollar Survive the Rise of the Yuan and the End of the Petrodollar?

On Friday, the dollar index fell to a low not seen since late 2014. This is a big deal, particularly if the dollar slide continues. This would lead to inflation in all dollar-based commodities like gold, oil and agriculture.

While the trend for crude oil is undoubtedly upward, even bulls need to stop and take a breath every now and then. The time to take a breath could be this week, with option expiration on January 17th, and the futures contract expiration to follow on January 22nd.

Crude Oil Charts

WTI crude oil continues to push higher, and is now at its highest levels since 2014. It isn’t a coincidence that crude oil achieves a 3-year high the same time that the US dollar falls to a 3-year low.

After stalling at the 200 week moving average for a few weeks, WTI powered higher and powered over its 2015 year highs this week. However, crude oil is over-bought on the weekly RSI.

On the daily chart, we see that crude oil moved above a high probability trend channel and is over-bought on a few different indicators. Crude oil prices reached and overtook the Fibonacci extension that I had highlighted for my subscribers as a potential target. WTI would need to fall below $60 to be out of its daily uptrend channel. This is bullish long-term in my view, but perhaps is cautionary short-term.

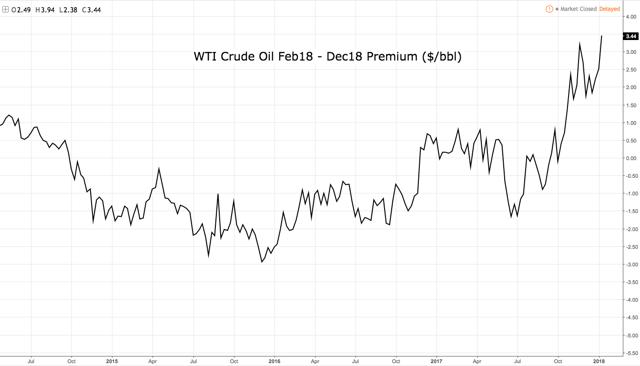

WTI Relative Value

The front-month Brent-WTI spread has fallen in recent weeks, which lessens upward arbitrage pressure on the WTI price. The current spread near $5.50 is favorable for WTI and above recent averages.

The front-month Feb 2018 contract settled Friday at new highs versus the Dec 2018 contract. Forward curve backwardation is generally viewed as favorable for prices.

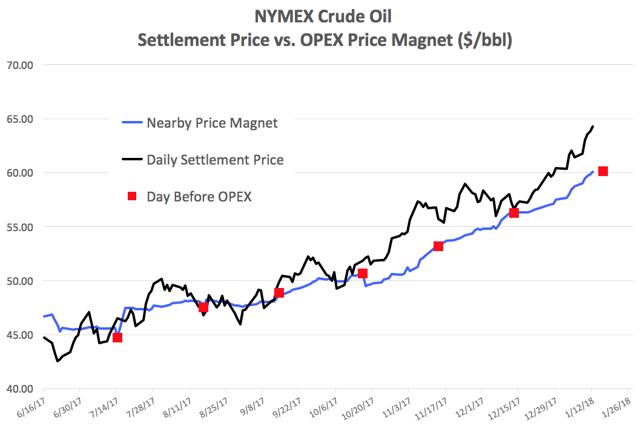

Crude Oil OPEX Magnet

Here is the crude oil OPEX magnet since mid-June. Crude oil option expiration will be this week, on January 17th, and the last day of trading for the February futures contract is Feb 22nd.

Since June 2017, the futures and OPEX price magnets have tended to converge on or before the options expiration date, which is scheduled for January 17th.

The OPEX price magnets that I developed are related to the “max pain” theory. This Youtube video does a good job at describing the “max pain” theory. There are free max pain calculators online for publicly traded stocks; however, the OPEX price magnets are in my view more relevant and are calculated on individual futures contracts.

Disclaimer

This article was written for information purposes, and is not a recommendation to buy or sell any securities. I never intend to give personal financial advice in any of my articles. All my articles are subject to the disclaimer found here.

This article is similar to information that I post daily and weekly in my subscription service. If you are interested in research like this, you might consider Commodity Conquest. In addition to coverage of gold, silver and crude oil, I also conduct in-depth coverage of many energy and commodity firms.

Since I launched the service in June 2017 and through January 12th, the stock coverage trades I have posted have earned an average 11% return with an average holding period of 27 days. I have averaged two coverage trades per month, and have a win rate of 89%.

I am currently offering a two week free trial. In addition to my daily content, I also have good input from my subscribers in the chat section. Come and check it out.