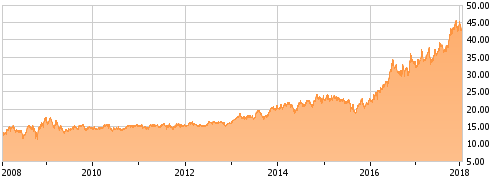

California Water Service Group (NYSE:CWT) has, like other water utilities such as American States Water Co. (AWR), seen its valuation increase exponentially over the past few years. This makes water utilities expensive even by the standards of a historically expensive market.

Why have water utilities such as the California Water Services Group become so overvalued? Simply put, people need water to live. Utilities that can supply fresh water for drinking and bathing, and that can take wastewater for treatment, are extremely stable investment opportunities that can reliably pay their shareholders cash.

That is certainly true of the California Water Services Group, which is the third largest publicly traded water utility operating in the U.S. It has paid consecutively rising dividends since 1968, a fifty-year record that has allowed it to be classed as a Dividend King alongside American States Water.

The company is able to reward its shareholders so consistently because of its six wholly-owned subsidiaries operating in California, Hawaii, New Mexico, and Washington. Combined, these subsidiaries have generated steady revenue and net income, as figures for the past eight years show.

| Year | Revenue ($) | Net Income ($) |

| 2009 | 449.37 million | 40.55 million |

| 2010 | 460.4 million | 37.66 million |

| 2011 | 501.8 million | 37.71 million |

| 2012 | 559.97 million | 48.83 million |

| 2013 | 584.1 million | 47.25 million |

| 2014 | 597.5 million | 56.74 million |

| 2015 | 588.37 million | 45.02 million |

| 2016 | 609.37 million | 48.68 million |

Quarterly figures for 2017 have also been promising, and the Q4 2017 results due at the end of this month are unlikely to vary wildly from what has been posted thus far.

| Quarter | Revenue ($) | Net Income ($) |

| Q1 | 121.7 million | 1.1 million |

| Q2 | 171.1 million | 18.5 million |

| Q3 | 211.7 million | 33.8 million |

Steady income is what one would expect from a well-run utility, as they are not high-growth companies. And income investors have noted the performance of the California Water Service Group, which has bid the shares up to their present level. Currently, the stock trades in the low-to-mid $40 range with a price-to-earnings ratio of 30.65, a forward P/E ratio of 30.87, and offers a dividend yield of 1.64% with a sustainable payout ratio of 49.90%.

The current P/E ratio is higher than the S&P 500 (SPY) average of 25.85, the water utilities average of 24.75, and the company's own five-year P/E average of 25.7. Furthermore, the current dividend yield is lower than the company's five-year average yield of 2.4%. All this suggests that the California Water Service Group is overvalued at this time. Is that the case?

The current P/E ratio is higher than the S&P 500 (SPY) average of 25.85, the water utilities average of 24.75, and the company's own five-year P/E average of 25.7. Furthermore, the current dividend yield is lower than the company's five-year average yield of 2.4%. All this suggests that the California Water Service Group is overvalued at this time. Is that the case?

Earnings per share over the past twelve months was $1.43, and EPS growth over the next five years is expected to be 9.8% annually, leveling off to 5% thereafter. Using an 11% discount rate - the stock market average - I calculate fair value for the California Water Service Group to be $30.62. The stock is currently overvalued by 43%.

Water utilities do tend to trade at a premium anyway, due to the aforementioned fact of how vital water is to people's lives. Nonetheless, the current valuation of the California Water Service Group is too high to recommend as a buy at this time. However, it is a hold if you have it, and one to keep an eye on in the event of a correction going forward, due to its reliability as an income provider - which entitles it to be classed as a Dividend King.

DISCLAIMER: The author is not a financial professional and accepts no responsibility for any investment decisions a reader makes. This article is presented for information purposes only. Furthermore, the figures cited are the product of the author's own research and may differ from those of other analysts. Always do your own due diligence when researching prospective investments.