When we last wrote about European banks (NASDAQ:EUFN), we said that a number of macroeconomic indicators suggested that a short-term correction in the European banking sector could be imminent. Citigroup’s Economic Surprise Index for the European economy was very weak in February, while Germany’s IFO Index, which is one of the most popular leading indicators for economic activity in Germany, unexpectedly declined. In addition, German inflation decreased to its lowest level since 2016, having triggered a notable decline in bond yields.

Since then, the EUFN has fallen by almost 10%. To be fair, while, at the time, a correction looked imminent, it has been much worse than we had expected. In this article, we take a closer look at the factors that have triggered such a sharp sell-off.

Source: Bloomberg

Macroeconomic data could not have been worse

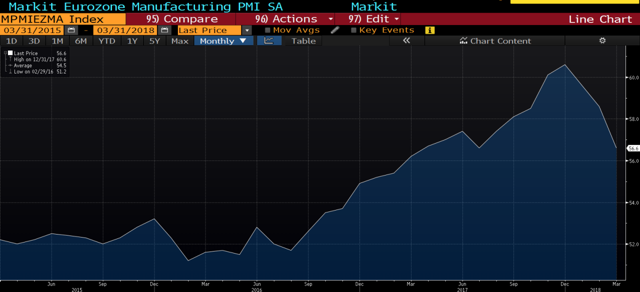

First off, there has been a string of macroeconomic data suggesting that growth in the European Union has been gradually decelerating. As shown below, the region’s PMI, a reliable leading indicator of GDP growth, has fallen sharply since the beginning of the year.

Source: Bloomberg

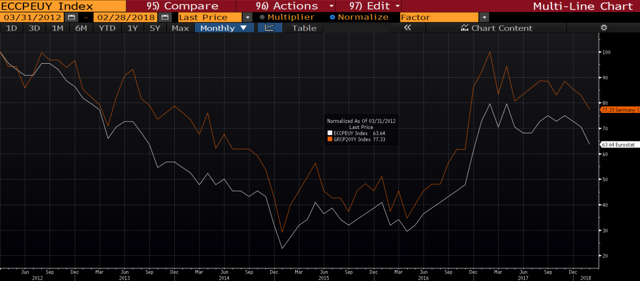

Inflation readings in both the European Union and Germany have been also cooling off lately.

Source: Bloomberg

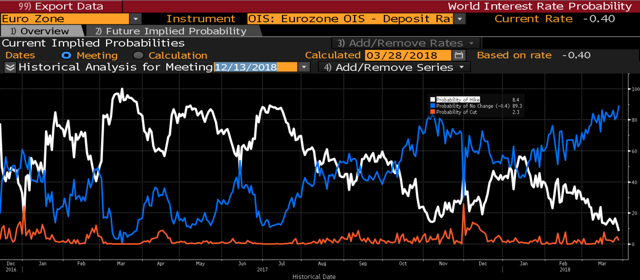

Unsurprisingly, weak inflation figures have decreased the probability of a rate hike by the European Central Bank (the white line). As shown below, it declined to less than 10% in March from almost 60% in mid-January.

Source: Bloomberg

As a result, the yield on the 10-year Germany’s sovereign bond has fallen by almost 30 bps since the beginning of February.

Source: Bloomberg

The chart below plots the yield on the 10-year Germany’s sovereign bond (the white line) and the European banks Index (the orange line). As you can see, there has been a strong positive correlation. In other words, such a sharp sell-off in European banks should not come as a total surprise given falling bond yields.

Source: Bloomberg

Finally, with the euro hovering at 1.25 against USD, European assets are becoming increasingly expensive for non-European investors.

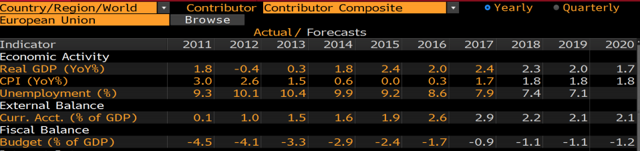

The good news here is that many economists suggest that this economic slowdown in the EU is temporary. What’s more, according to consensus, the European economy is expected to deliver 2.3% GDP growth in 2018, which we view as a very solid growth rate. Most importantly, despite the recent slowdown, the ECB has not changed its official economic forecasts.

Source: Bloomberg

Fundamentals remain intact

Without any doubt, it is notoriously difficult to predict short-term macroeconomic trends. As such, we prefer to focus on longer-term forecasts and fundamental metrics, which largely remain intact. European banks are in a much better situation compared to the 2011-2012 European sovereign crisis. For instance, the chart below demonstrates CDS spreads on Banco Santander’s (SAN), which is currently the largest bank in the eurozone by market cap. As a recap, a CDS spread is a good early indicator of default risks.

Source: Bloomberg

European banks now have a safer risk profile and a stronger balance sheet, thanks to better asset quality and higher capital ratios.

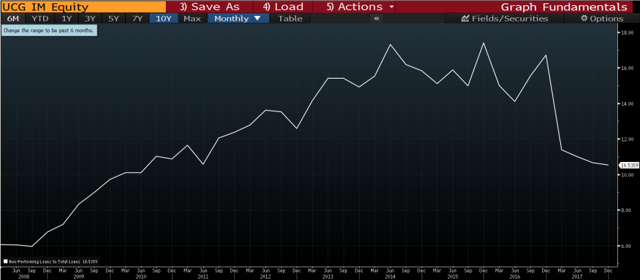

For instance, the chart below shows the headline NPL (non-performing loans) ratio of UniCredit (OTCPK:UNCFF), which has been viewed as the most troubled European lender for many years. As you can see, the bank has done an excellent a job of cleaning up its balance sheet.

Source: Bloomberg

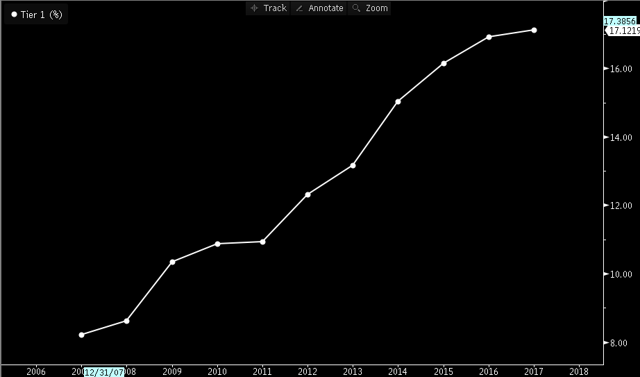

European banks have also improved their capital positions. The chart below plots the Tier1 capital ratio of the European banking sector.

Source: Bloomberg

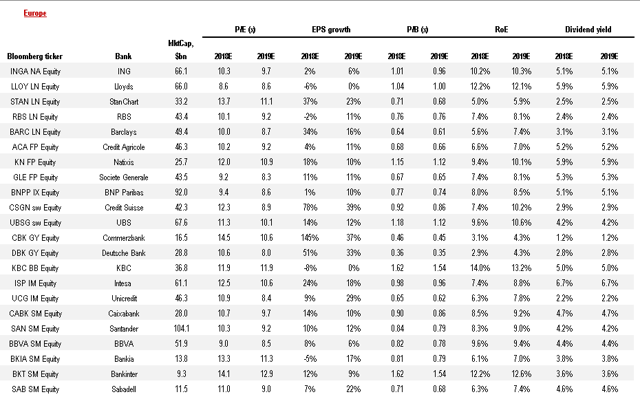

Valuations are very reasonable

Source: Bloomberg, Renaissance Research estimates

Final thoughts

We believe it is important to note that European banks remain value stocks. To be fair, value investing has been a bad strategy over the past several years as value stocks has significantly underperformed their growth counterparts. For instance, as shown below, the ratio between the S&P Growth Index (SGX Index) and the S&P Value Index (SVX Index) has reached its maximum since the dot-com bubble.

Source: Bloomberg

With that being said, the nature of value investing suggests that investors should be prepared for sharp sell-offs as value stocks are clearly much more volatile than their growth peers. As such, we remain bullish on European banks.

If you would like to receive our articles as soon as they are published, consider following us by clicking the "Follow" button beside our name at the top of the page. Thank you for reading.