Summary

What follows is an analysis of Lowe’s (NYSE:LOW) as well as a trade idea to play Lowe’s future stock price.

Source: Fidelity Investments

A Review of Lowe's 1Q 2018 Earnings

Citing unfavorable weather which lead to a delayed spring season, the company reported 1Q 2018 net earnings of $988M and Earnings Per Share (EPS) of $1.19. First quarter 2017 net earnings and EPS were $602M and $0.70, respectively. Consensus for 1Q 2018 EPS was $1.21-$1.27.

Sales for 1Q 2018 increased 3.0% to $17.4B from $16.9B in the 1Q 2017. Consensus for revenue was $17.7B. Same store sales increased 0.6% which missed expectations of a 3.2% rise.

However, the company was upbeat for the remainder of the year estimating sales growth of 5% versus consensus of 3.8%; they also projected a same-store sales increase of 3.5%, compared with expectations of 3.3%.

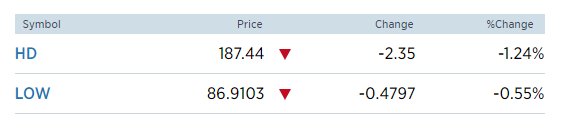

Lowe’s and Home Depot Comparison

Home Depot (HD) reported Q1 2018 results on May 15, with EPS of $2.08 which beat the consensus estimate of $2.05. While total revenue increased 4.4% year over year to $24.95B, they missed the consensus estimate of $25.15B. Comparable-store sales (comps) in the quarter rose 4.2% (forecasted at 5.4%), while U.S. comps increased 3.9%. Home Depot expects sales growth of nearly 6.7% with a 5% increase in comps. They anticipate EPS to increase about 28% to $9.31 in fiscal 2018.

Home Depot pointed to the top line miss due to weather – the cold winter extended into April in many parts of the USA. This appeared to negatively affect HD’s northern division the most.

As can be seen below on the chart comparing HD and LOW, LOW has under performed its major peer for the last three months. This was mainly a result of lower than expected 4Q 2017 earnings and a softer 2018 forecast. Consensus estimates for LOW had been trending down for 1Q 2018 release mainly due to the poor weather seen across the USA and reported in HD’s 1Q numbers. A positive for LOW is the buyout of Maintenance Supply Headquarters as it strengthens its relationship with Pro customers (LowesForPros.com) to gain a larger foothold in that segment vs the Do-It-Yourself (DIY) segment.

LOW’s gross margins came under pressure in 2017 due to competition; this might continue to be an issue for the retailer in 2018. In addition, as discussed below, higher oil prices may negatively affect discretionary spending.

LOW currently has a Price/Earnings (P/E) ratio of 21.31 and a dividend yield of 1.88% while HD has P/E ratio of 24.68 and a yield of 2.17%.

Home Depot is a larger operation than LOW. However, for the most part, they are very similar. Home Depot relies more on contractors while LOW generally generates its business from DIYers.

Source: Fidelity Investments

Source: Fidelity Investments

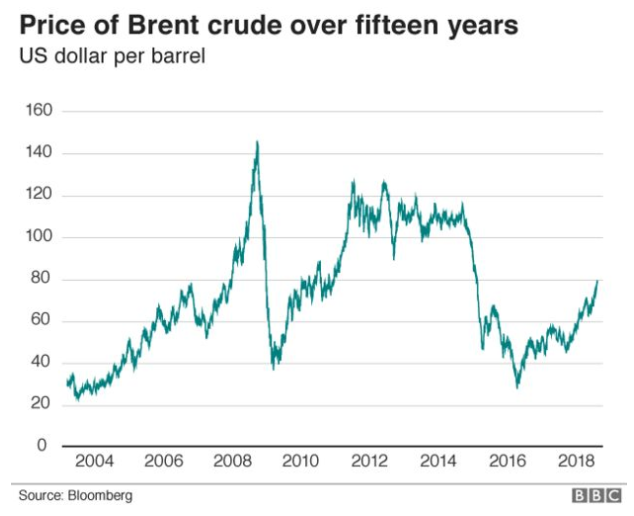

Oil Prices

Brent crude oil spot prices hit $80 per barrel last week - their highest levels since November 2014 and West Texas Intermediate (WTI) is now trading over 72. There has also been a rally of 11% in the five-year Brent forward price which signals that crude prices have more room to run. Spot prices generally are driven more by geopolitics while the five-year forward contract usually trades based on longer term views relating to future supply and demand.

While consumer spending appears to be strong for now, rising oil prices (which translate into higher gas prices) could slow discretionary spending as more of household income is going to pay for gas and not to improve the hone. High oil prices also negatively effect the performance of retailers' shares such as Walmart (WMT), Home Depot, and Lowe’s due to higher shipping costs.

A New CEO

J.C. Penney's (JCP) Chief Executive Officer Marvin Ellison is leaving the struggling retailer to join LOW. While this is terrible news for JCP (more on this in a future article), in the long-term it might be perceived to be positive for Lowe’s. The stock jumped on the news, only to give up most of the gain. Ellison spent 12 years at Home Depot before joining JCP in 2014.

To be fair, he had a huge job to do at JCP in effecting a turnaround of a sinking ship. He appeared to do a very good job at HD running their USA stores. It also appeared that he was going to use some of the same techniques that lead HD to new heights; namely, shorter shipping times, more customer help and more robust online sales.

It's going to be exciting times to have the person that knows what's in the secret sauce at HD now driving change at LOW.

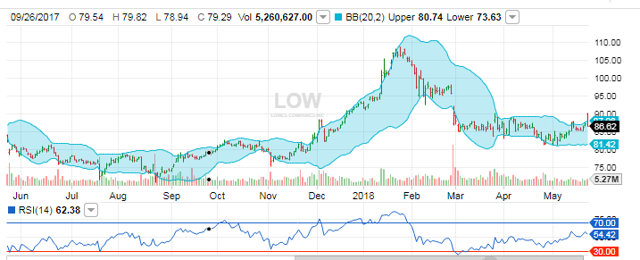

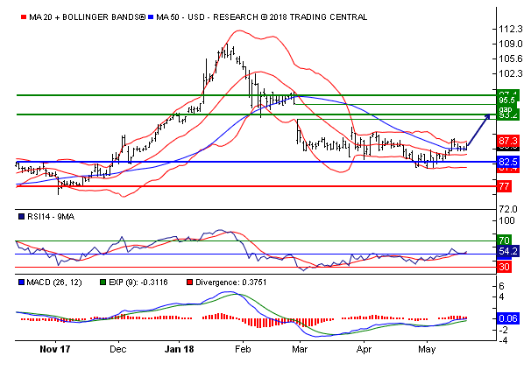

Technicals

Currently, Lowe’s relative strength index (RSI) is above 50 which is bullish. The MACD is above its signal line and positive. The stock is currently trading above its 20-day and 50-day moving averages of 84.35 and 85.57, respectively. A price point of 93.2 appears to be the next resistance level while 82.5 appears to be the support. Overall, there appears to be mid-term strength, but we will need to wait to see what happens in the short term.

Source: Trading Central

According to Recognia, Lowe’s entered the Wave 3 of its Elliott Wave cycle in mid-May signaling that the price may fall to the next Elliott Wave target price of 60.11. According to Elliott Wave theory, Wave 3 is usually the longest and most tradeable wave in the Elliott Wave cycle.

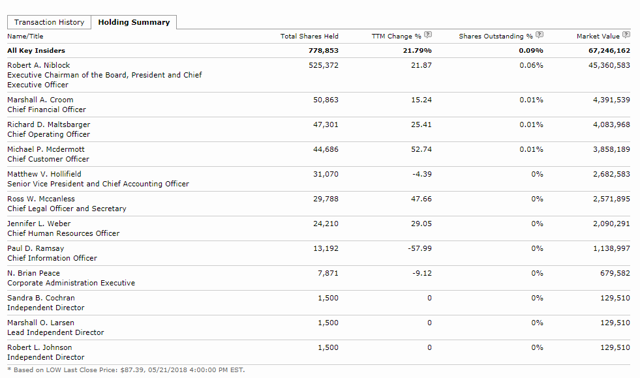

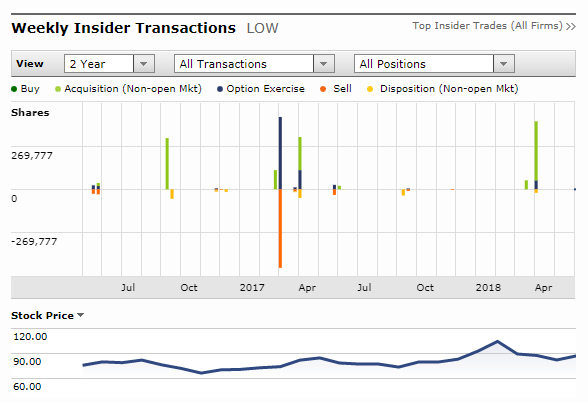

Insider Trading

While not a perfect indicator, it is interesting to view (legal) insider trading activity over time. Some investors believe there is a direct correlation to insider trading activity and the future stock performance. However, I generally do not believe that insiders are that much better than the public in determining the direction of a stock. Many times, insiders exercise shares for a number of reasons, some of which have nothing to do with where they think the stock is headed.

Shown below are insider transactions for the last two years by transaction type. Also shown is the corresponding stock prices. In addition, the top key insiders are shown detailing shares held, percentage change in ownership and market value. There does not appear to be any direct correlation between insider activity and stock price during this time.

Source: MorningStar

Source: MorningStar

Trade Idea

If you are bullish LOW, now might be the time to buy the stock. At this point, most of the news appears to be known – bad weather affected LOW’s earnings as it did with HD. Higher oil prices are with us – for how long, no one knows. There is a new boss at the helm. Longer term, I like LOW - mainly for their Smart Home line within the Internet of Things space to improve customer experience and sales. With the new CEO, margins and product lines are expected to improve at the determent of HD.

If you are bullish LOW, one might consider buying a July 87.5/95 bull call spread. That is buying a call close to the money and selling a call further out of the money. While spreads like this limit your upside potential, they also lower your risk by offsetting your entry costs.

Additional disclosure: Thank you for your time in reading the above article. I read and write on a wide range of companies on a regular basis. If you would like to stay informed with articles like these, please click the "Follow" button at the top of this report and select "Get email alerts." If you have additional insights on the topic or contrasting views, please kindly share them in the comments section.

This article is intended to provide educational information to readers and in no way constitutes investment advice. Investing in public securities is speculative and involves risk, including possible loss of principle. The reader of this article must determine whether or not any investments mentioned in this article are suitable for their portfolio, risk tolerance, and accepts responsibility for their decisions. Neither information nor any opinion expressed in this article constitutes a solicitation, an offer or a recommendation to buy, sell, or dispose of any investment or to provide any investment advice or service. An opinion in this article can change at any time without notice.