Do you know that one uranium fuel pellet - about the size of your fingernail - produces the same amount of energy as 17 Mcf of natural gas, 149 bo, or 0.81 metric tons of coal? - Anonymous

Note: This article is the first in a multi-piece treatise on the uranium mining industry. In Part 1, I examine the demand-supply picture to locate where the uranium industry currently is in the cycle. In Part 2, I intend to study the competitive landscape of the uranium mining industry based on a database I have been building. Thereafter, I plan to establish a valuation framework and use it to select a number of investible targets, which will be examined in detail to come up with actionable investment theses.

Nuclear Power Generation

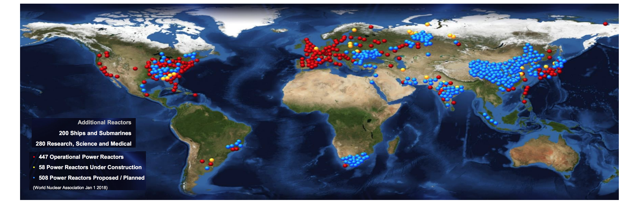

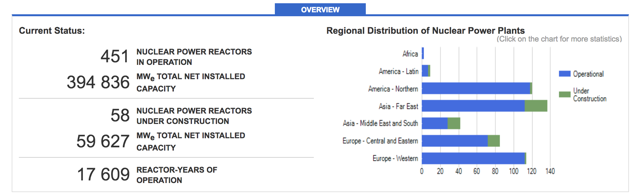

According to International Atomic Energy Agency (IAEA), there are a total of 451 nuclear power reactors currently in operation, with 394,836 Mega Watts electric (MWe) of net installed capacity. There are an additional 58 nuclear power reactors that are under construction (Fig. 1).

Fig. 1. The current status of nuclear power reactors. Source.

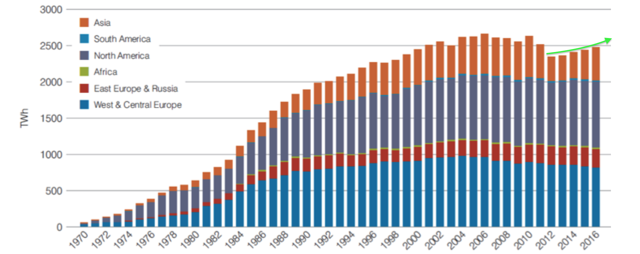

The Fukushima Daiichi nuclear disaster in Japan, initiated by the tsunami following the Tōhoku earthquake on March 11, 2011 (see here), delivered a setback to nuclear power generation.

However, merely one year after the disaster, worldwide nuclear power generation had resumed growth (Fig. 2).

- The Japanese are in the process of restarting the halted nuclear reactors, with seven having been brought back into operation as of March 2018 (see here) and 17 currently in the process of getting restart approval (see here).

- Of Japan's total of 54 reactors, some 42 are currently operable and may restart eventually (here).

Fig. 2. Historical nuclear power generation. Source.

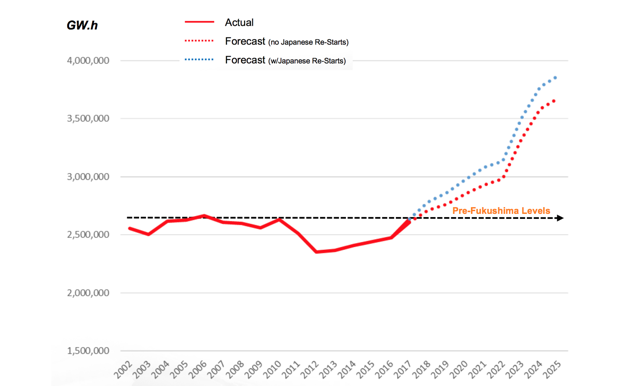

Each year, between 6 and 8 nuclear reactors are constructed, which is anticipated to increase to 10 per year after 2020 (see here). These new builds will significantly increase nuclear power generation capacity over the next few years (Fig. 3).

Fig. 3. Forecast power generation increases with reactors under construction or scheduled for construction considered. Source.

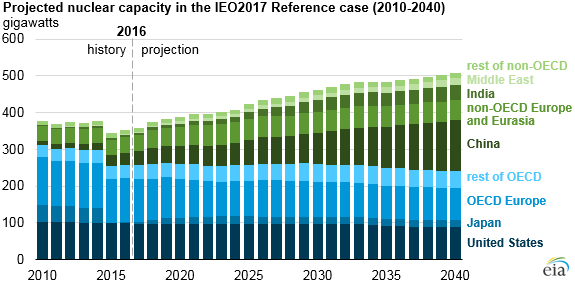

The International Energy Outlook 2017 projects that global nuclear power capacity will grow at an average annual rate of 1.6% from 2016 through 2040. China, India, and Russia are building over half of the new nuclear power reactors in the world (see here). Growth in nuclear power capacity in non-OECD countries is expected to offset declines in nuclear power capacity in the United States, Japan, and Europe (Fig. 4)(see here).

Fig. 4. Projected nuclear power generation capacity. Source.

Long-Term Uranium Demand

Uranium production from mining is used almost entirely as fuel for nuclear power plants. At any rate, the secular growth of nuclear power generation is the driver behind the rising demand for uranium in the long run. To produce 1 GWh of electricity, some 50-90 lbs of U3O8 are required depending on the specifics of the reactor. Global demand for uranium is projected to increase by 1.6-3.1% annually through 2025 (see here and here).

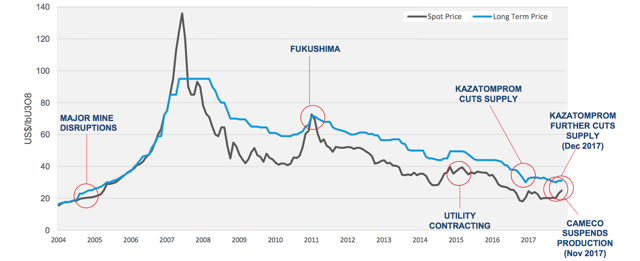

Such a demand growth, nonetheless, has not led to a lot of long-term supply contract signing in recent years because, on the one hand, the nuclear power industry could tap into the spot market where price has been much lower than the long-term contract price since 2008 (Fig. 5); on the other hand, the mining companies resisted locking-in long-term sales commitments at such low prices.

- In 2017, the U.S. nuclear power industry signed 29 new spot deals totaling 3.2 million pounds of U3O8e at a weighted-average price of $20.72/lb and only five long-term contracts totaling 1.5 million pounds of U3O8e at a weighted-average price of $21.03 (see here).

- Worldwide, there are over 1 billion pounds of U3O8 requirements in the decade between 2018 and 2027 which are not under long-term contracts (see here).

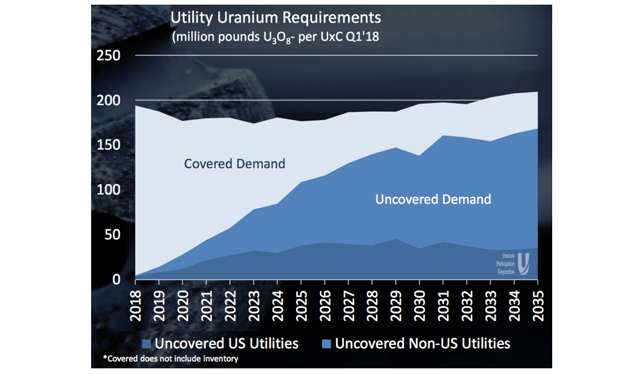

- Approximately 24% of uranium demand will be uncovered by long-term contracts by 2021, and 62% by 2025 (Fig. 6).

Fig. 5. Uranium spot and long-term price. Source.

Fig. 6. Uranium requirements of nuclear power generation (million pounds of U3O8- per UxC 1Q2018). Source.

Cyclical Uranium Mining

A secular growth in demand in uranium has not translated into a sustained high uranium price. After all, uranium is a commodity, undifferentiated from one producer to another. Nuclear power plants can shop from a global market for the lowest spot price. Without any pricing power to fall back on, the uranium miners typically undercut each other while chasing sales volume, thus resulting in production growth accompanied by a falling price.

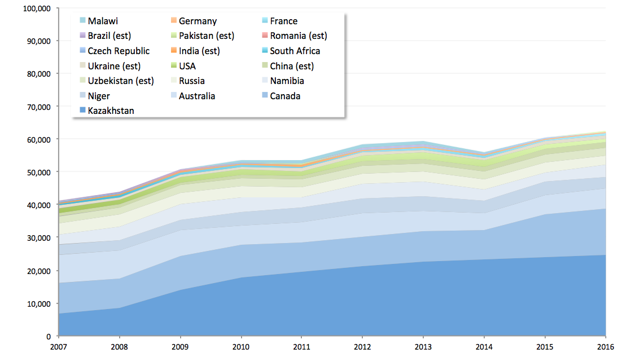

From 2007 to 2016, worldwide uranium production grew at a CAGR of 4.7% (Fig. 7). This production ramp-up was mostly caused by the Kazakhstani flooding of the spot market, which accelerated in 2009 in response to the country's transfer pricing law (see here and here). This production growth happened even in 2011 when the Japanese were forced to shut down their nuclear reactors in the wake of the Tōhoku earthquake and the Germans decided to abandon the eight older reactors in view of the Fukushima disaster immediately (and nine newer reactors by 2022)(see here). This double whammy caused serious inventory build-up. Naturally, the uranium price dropped from over $120/lb to as low as $18/lb (Fig. 5).

Fig. 7. Annual uranium production by country. The author's chart based on data sourced here.

A sustained low uranium price leads to the destruction of production capacity:

- There used to be, e.g., 585 uranium mining companies back in 2007, but only around 40 survived until today (see here).

- As the mining industry is mired in a depression, few companies want to commit capital investment. Due to lack of investment, uranium reserves are slowly depleted and, as a result, production capacity is being destroyed.

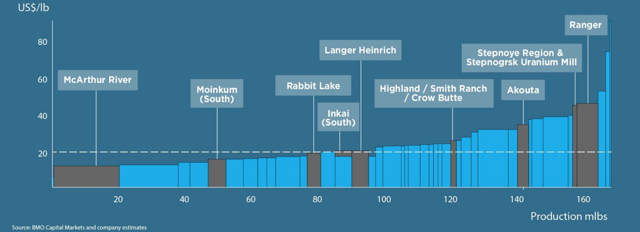

- Only those mines of the lowest operating costs can afford to continue to operate at the bottom of the industry downturn. Of the mines on the high-cost end of the cost curve, some are abandoned outright, while others are put under care and maintenance to wait for an improved market to return (Fig. 8).

Fig. 8. The cost curve of uranium mines, with the at-risk mines shown in brown. Source.

As uranium production loses steam, uranium demand, driven by secular demand growth, is steadily growing, which will eventually lead to uranium undersupply. Then, uranium inventory scattered throughout the supply chain will be used up, thus driving the spot and long-term contract markets to improve.

An increasing uranium price will incentivize new capital investment in exploration and development. Old mines are restarted to capture the rising prices and new mines are brought on stream one after another. Finally, the supply and demand reach a new balance.

Human nature being what it is, the miners will not stop here. They will continue to start up more new mines, even marginal ones with very high costs. By doing so, they will oversupply the market, thus triggering another industry downturn.

Cycles of boom and bust are universal to the entire natural resource extractive sector, from the mining industry to the oil industry. However, it can be hard for retail investors to appreciate and take advantage of such multi-year industry cycles. Immersed in daily price actions, many investors can be led to believe in either a lower forever theory, thus missing out the major reversal of commodity price, or a forever appreciating commodity price, thus losing their proverbial shirt as a commodity price crash surprises them. This is why we at The Natural Resources Hub (TNRH) set out to conduct this research.

The Current Status Of Uranium Supply And Demand

According to nuclear industry consultancy TradeTech, the nuclear power industry "at large remains in a state of oversupply and producers continue to feel pressure to reduce costs and preserve margins" (see here). However, a number of signs of change have appeared on the horizon.

Inventory drawdown

At the current low price, many producers would lose money to operate mines. To fulfill their contractual commitments, they opt to buy from the spot market.

- During 2017, 14% of the uranium purchases was from the spot market at a weighted-average price of $22.36/lb. The remaining 86% was purchased under long-term contracts at a weighted-average price of $41.58/lb (see here).

- Currently, approximately 75% of spot market purchases are made by the producers for the purpose of fulfilling contracts (see here).

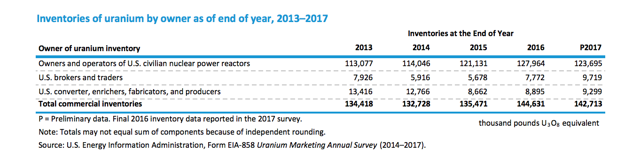

As at end-2017, the total U.S. commercial inventories including those owned by civilian nuclear power reactors, U.S. brokers, converter, enrichers, fabricators, producers, and traders were 142.7 million pounds U3O8e, down 1.3% from the previous year (Table 1)(see here). At the recent yearly consumption of around 41.9 million pounds, it takes close to three years of worldwide production halt to exhaust the U.S. inventories.

Table 1. Inventories of uranium as of year-end 2013-2017. Source.

Production restraint

Low uranium price has been forcing production halt at minor mines since 2013. The Honeymoon mine of Uranium One, a subsidiary of Boss Resources (BOE.asx), had been on care and maintenance since November 2013 (see here). On February 7, 2014, Paladin Energy (OTCPK:PALAF) put the Kayelekera mine in northern Malawi under care and maintenance (see here). In 1Q 2018, Ur-Energy (URG) suspended part of its operations at the Lost Creek mine in Wyoming (see here) (Fig. 9).

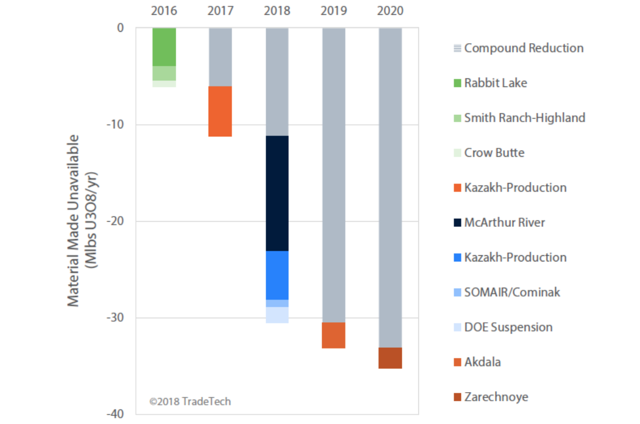

However, the announced production cuts in 2017 by Kazakhstani national uranium company NAC Kazatomprom JSC and by Cameco Corporation (CCO.tsx) (CCJ), the top two uranium producers in the world, signaled a major shift in market condition.

On January 10, 2017, Kazatomprom announced a 10% or 4.4 million pounds of U3O8e production cut. Kazatomprom said:

“While the prospects of nuclear energy continue to grow as confidently as it has been for many years, the glut of supply will be the reality of the uranium market in the nearest future. Kazatomprom and its joint venture partners had to make responsible decisions in light of these market challenges. It will be better for our shareholders and stakeholders that these strategic Kazakhstan resources remain in the bowels of the earth for the time being, rather than adding to the current oversupply situation. Uranium will instead be realized under more favorable market conditions in the coming years.”

On December 4, 2017, Kazatomprom announced its intention to enlarge the planned uranium production reduction to 20% for a period of three years starting January 2018. In 2018 alone, Kazatomprom will eliminate 8.8 million pounds of U3O8e, or 7.5% of global total, from the annual uranium production. Over the next three years, a total of 24.3 million pounds of U3O8e will be deferred (see here). Kazatomprom is reportedly planning an IPO in 2018, which could be part of the motive for the uranium giant to attempt to lift uranium price and restore market confidence (see here).

On November 8, 2017, Cameco announced that due to continued uranium price weakness, production from the 17.4 MMlb/y McArthur River mining and Key Lake milling operations in northern Saskatchewan will be suspended by the end of January 2018 for an expected duration of 10 months (see here). As of April 2016, Cameco had already put its the higher cost mines, including the 3.6 MMlb/y Rabbit Lake and 1.4 MMlb/y U.S. operations, in a care and maintenance state (see here).

Fig. 9. Global supply destruction, actual and projected. Source, original source TradeTech.

Outlook

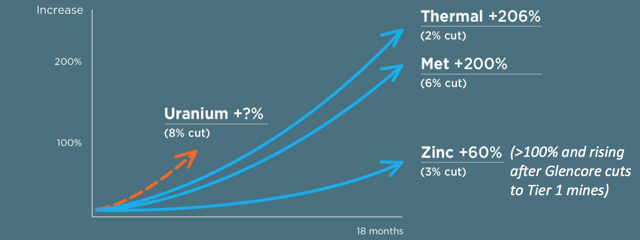

Meaningful production cuts by the dominant producers have proven to be an effective way of catalyzing commodity price uptrends. This has happened in the case of zinc and coking coal (see here and here) (Fig. 10) as well as crude oil (see here).

Fig. 10. Where will be the uranium price go? Source.

Will the production reduction implemented by Kazatomprom and Cameco be as effective as the artificial or natural production disruption of zinc, coking coal and crude oil?

So far, the uranium price movement resultant from the Kazatomprom and Cameco announcements proved to be short-lived. Nonetheless, in the aftermath of these catalysts, Global X Uranium ETF (URA), which reflects the state of being of the uranium industry, has broken above the long-term downtrend and stayed there for the last 18 months; the ETF found strong support at $12 twice over the last eight months. Apparently, a bottom building has gone well so far (Fig. 11).

Fig. 11. Price chart of Global X Uranium ETF. Source and source.

Fig. 11. Price chart of Global X Uranium ETF. Source and source.

Investor takeaways

The nuclear power industry continues its secular growth trajectory on the back of nuclear reactor construction. However, true to its cyclical nature, the uranium mining industry has experienced a decade of depression since 2007. Just as demand was being destructed in the wake of the Fukushima disaster in 2011, the mining companies, behemoth Kazatomprom in particular, ramped up production, resulting in a serious inventory build-up. As uranium price tanked, hundreds of junior miners went bankrupt and all producers suffered.

In the last few quarters, the leaders of the uranium mining industry, i.e., Kazatomprom and Cameco, have announced major production cuts, hoping to restore market strength. The discipline exercised by these two dominant players in the industry may signal a seismic change of the industry condition.

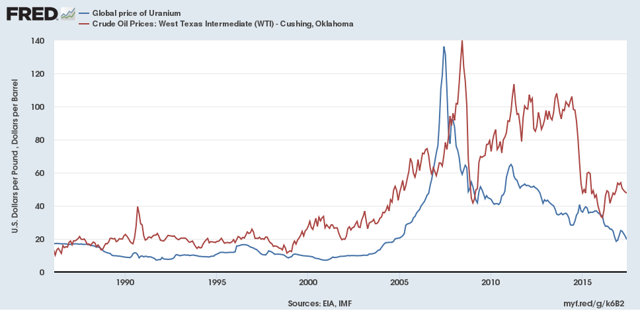

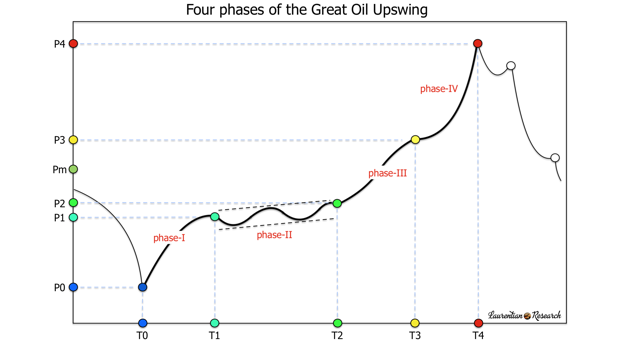

Looking ahead into the next few years, I believe the uranium mining industry may be heading for a major upswing. This upswing may echo the currently unfolding oil upswing in upside potential (Fig. 12). It may well develop in four distinct phases similar to what I outlined for that oil upswing (Fig. 13) (see here).

Fig. 12. The uranium price in correlation with WTI. Source.

- Presently, the industry appears to be still working off a large amount of uranium inventory (Phase II). It may take at least 2-3 years for the industry to restore a supply-demand balance.

- The exhaustion of the inventory will be followed by a phase of undersupply (Phase III). A rising uranium price will incentivize capital spending by major producers and the junior explorers alike. The nuclear power customers will scramble to sign long-term contracts, signifying a seller's market.

- Soon, even marginal projects with very high operating costs will be able to raise capital. Dozens or perhaps hundreds of uranium exploration and development companies will appear from nowhere, many of which will go IPO (Phase IV). But as more and more mining projects come on stream, the market will be flooded again, thus triggering another down cycle.

Fig. 13. The four phases of the Great Oil Upswing, which the uranium mining industry may follow. Source.

Notes:

1. Uranium quantities are expressed in the unit of measure U3O8 equivalent or U3O8e. U3O8e is triuranium octoxide (or uranium concentrate) and the equivalent uranium-component of uranium hexafluoride (UF6) and enriched uranium.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Free Trial at The Natural Resources Hub for limited time only. Sign up today!

In this old bull market, the natural resources sector - from oil and natural gas to minerals - is the lone space that is undervalued. The sector is so undervalued that it may be the safe haven you need right now. It doesn't hurt that the commodities supercycle has started, providing investors with a once-in-a-decade opportunity. I'd like to help you profit from this rare opportunity.

The Natural Resources Hub, the leading natural resources-focused research platform on Seeking Alpha Marketplace, invites you to sign up for two weeks of free trial to discover how you can benefit from its high-quality, actionable investing ideas in natural resources and beyond.