It's May and this is the best time of the year for a German dividend investor as this is the month where most of Germany's companies distribute their annual dividends. As such it was no surprise that May set a new record in dividend income but I am still baffled by the amount and the growth compared to the previous year.

Having been on holidays to Greece for the best part of two weeks, I was not that active in the second half of the month but some heavy buying and selling during the first 2-3 weeks more than made up for it. I have not employed anything like "Sell in May and Go Away!" despite the ongoing rise in valuations.

Portfolio Changes | 2 new stocks, 0 sales and 20 repurchases

I spent a net total of $3,558 in May and grew the portfolio with two new stocks: JD.com (JD) and Vonovia (OTCPK:VONOY).

The dominant purchase in May was clearly Micron Technology (MU) with 21 shares and the dominant (partial) sale Gilead Sciences (GILD) with 10 shares.

Although Gilead recently missed estimates top and bottom line that was not the reason why I trimmed my shares. I understand that the progress Gilead is making is very slow as HCV sales have still not found their bottom, HIV sales showed less momentum than previously expected while the impact of the Kite acquisition will take time to materialize. I still remain very long in the stock and also remain confident that the current yield of almost 3.2% is a great long-term opportunity. However, I simply found that the opportunity that Micron is currently offering is even better and as I needed some capital to invest here I was willing to accept some tax losses with Gilead.

Micron is a stock which needs no further introduction as one of the best performing technology stocks. It is seeing tremendous growth on the bottom and top line and while some analysts are still fearing that it is a cyclical stock and will fall down back to earth as it did in 2016 burning investors massively, more and more investors believe that what we are witnessing right now is just the beginning. While the stock is offering no dividend management has announced a whopping $10B share repurchase program on its recent analyst day. Based on Micron's current market cap of $71B this represents almost 15% in market cap and will not only provide downside protection but should also further fuel the stock price when it is launched beginning in fiscal 2019. The most impressive metric about Micron is its P/E ratio of 7.5 whereas other companies in the semi-conductor/chip/memory industry like Texas Instruments (TXN), Intel (INTC) or Nvidia (NVDA) are boasting much higher multiples (between 24 and 44). Provided the rapid growth in memory demand continues there is no reason why Micron should not trade at similar multiples and thus turn into a multibagger stock.

In terms of new stocks I opened a small position in JD.com as the market sold off the stock following disappointing Q1 profits. The company is investing massively into future growth, similar to Amazon (NASDAQ:AMZN) and as a result company spending outpaced sales growth. Contrary to Amazon the market is selling off this development despite JD still guiding for revenue growth of 29-33% for the next quarter. As I love to buy stocks when market sentiment is down based on short-term expectations this was a great opportunity to start an investment in this fast-growing Chinese ecommerce giant.

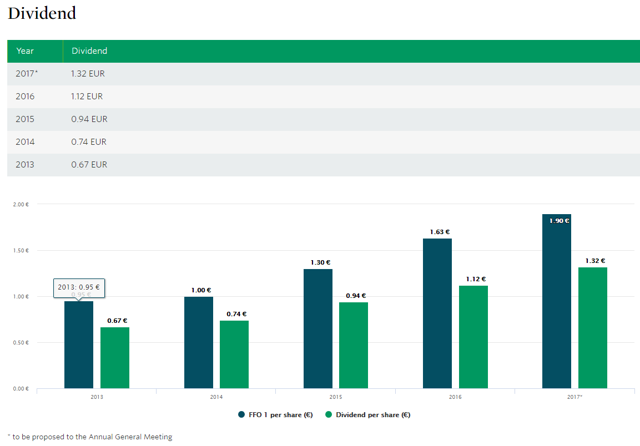

While JD.com is well known among investors (60k followers on Seeking Alpha) my other addition to the portfolio, Vonovia SE, is hardly known at all beyond Germany. It is Germany's largest and leading nationwide residential real estate company owning and managing around 394,000 residential units with a portfolio valued north of €40B. It is one of the newest members to the German DAX (since September 2015) and had its IPO in 2013. The company recently made headlines for acquiring BUWOG AG an Austrian-based property developer with almost 50,000 units across booming regions in Germany and Austria. And just a month ago it made a formal acquisition offer for Swedish property company Victoria Park. What this shows is that Vonovia is growing rapidly and possesses very lucrative assets across some of Europe's booming real estate markets. With the BUWOG transaction alone for instance Vonovia acquired 5,000 units in Berlin, Germany's capital, which has seen soaring rent and property prices over the last couple of years with no end in sight. Particularly the latter aspect was the main reason for me to purchase shares. I am living in Berlin and pay rent and with rents and prices for real estate reaching astronomic heights I wanted to hedge against that. As it is too expensive to buy property in Berlin right now but also unrealistic that rents will slow or stop their increase the only way to play this is to invest in a company which benefits from rising rents and Vonovia, as the largest public company in Germany, is the primary address here. Naturally, for a real hedge against rising rents I would probably have to by 30 times as many shares but it is a start at least. Also Vonovia offers a very attractive dividend of currently €1.32 per share (current yield of 3.2%) and has almost doubled its dividend over the last five years. The best thing is that its FFO dividend payout ratio is at a very comfortable 69% and leaves ample room for future increases, especially if rent dynamics continue.

Source: Vonovia Investor Relations

Repurchases

My repurchases break down as follows:

1) Continue ongoing monthly stock savings plans: These are routine investments between $50 and $115 each into Wells Fargo (NYSE:WFC), Visa (NYSE:V), McDonald's (NYSE:MCD), Johnson & Johnson (NYSE:JNJ), Apple (NASDAQ:AAPL) and the lesser-known Commonwealth Bank of Australia (OTCPK:CBAUF).

2) Invest in existing dividend stocks: I bought more shares in consumer stocks such as Procter & Gamble (PG) as the stock price has dropped significantly this year amid higher interest rates and an appreciating US dollar, Unilever (UN) and B&G Foods (BGS) with the latter positively surprising the markets with its Q1 earnings. I also bought more shares of Royal Dutch Shell (NYSE:RDS.B) with oil prices picking up and an additional share of Nvidia before the company reported sizzling earnings.

Chinese stock jewel Baozun (BZUN) has also seen an addition of 7 shares and right in time before its earnings catapulted the stock into new heights. The company grew service revenue by 50.3% Y/Y as is guiding for similar growth in Q2 as well. And the best thing is that although the stock has increased more than six times since its 2015 IPO the company is still only worth $3.2B and only in the beginning of its growth. Spiking almost 20% after earnings the stock is no stranger to sharp price fluctuations and so far buying every single dip has been increasingly rewarding.

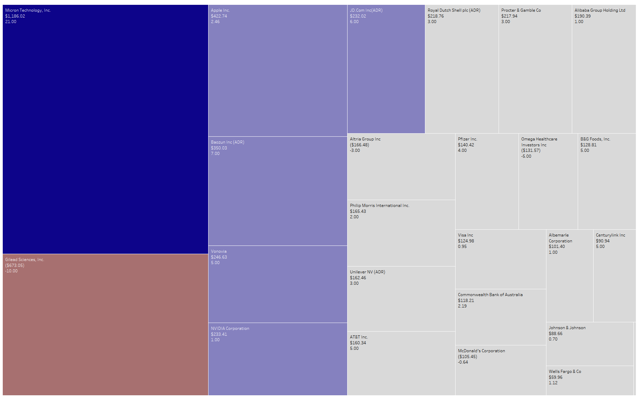

All net purchases and sales in May can be seen below:

Dividend Income: What happened on the dividend side?

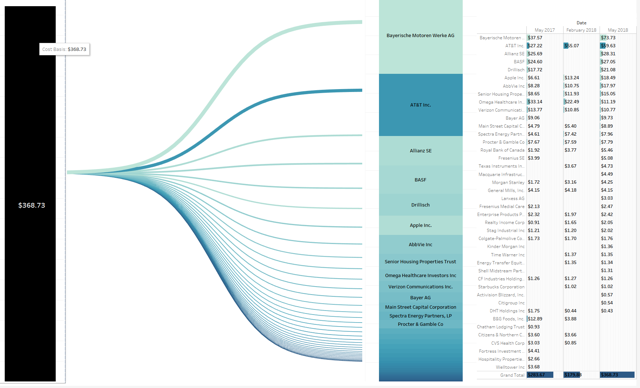

My income from 35 corporations amounted to $369 in dividends, up 109% sequentially and up 33% Y/Y.

Disregarding the 100% sequential growth (due to annual dividends from five Germany companies) the yearly growth rate of 33% stands out to me. All dividends break down as follows:

This dashboard shows how the monthly dividend income breaks down into individual stocks. It also shows the change in income versus the previous quarter and year.

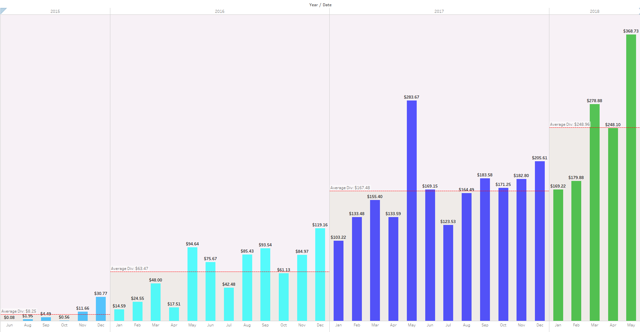

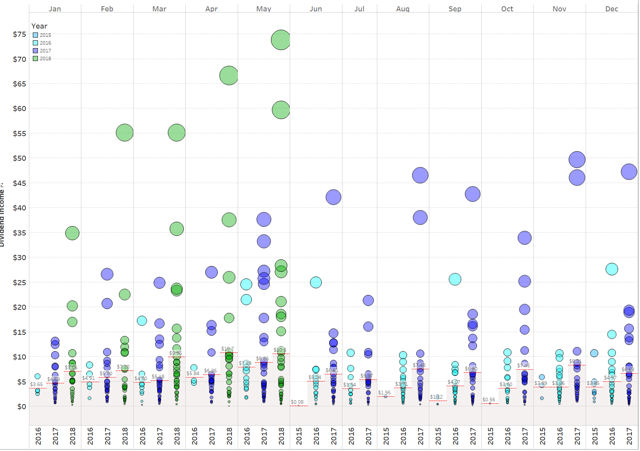

Here is a look at my favorite chart, the net dividend income development by month over time between 2015 and 2018, where you can easily see the development of my dividend income as well as the average annual dividend in a given year:

With an average of $248 in net dividend income per month over the course of almost the entire half of 2018, this shows some strong growth compared to 2017 and sets me up right on track towards my annual goal of $2,500 in net dividends. A current projection factoring in all the recent purchases over the first five months and announced dividend increases projects dividend income to cross the $3,000 mark by year-end already.

Next, I have scattered all the individual dividend payments I have ever received and colored them by year, rearranging the years side by side rather than horizontally as in previous updates:

The readability of the numbers is rather poor, as there is so much data, but the bigger picture becomes apparent regardless of these numbers. I am just looking at the size and quantity of the bubbles as they keep on climbing higher and expanding in size.

It remains fascinating to watch how all these metrics develop over time. Right now, as I am still in the early stages, these metrics are not that impressive, but the growth is truly striking, and all these instruments help me measure it and provide meaning to it.

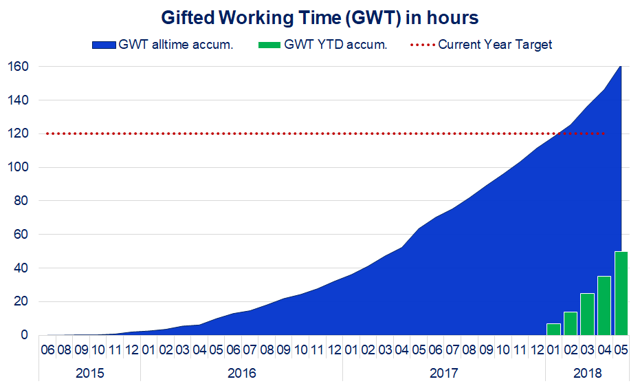

Speaking in terms of meaning, another way to express the monthly dividend income is in terms of Gifted Working Time (GWT). I am assuming an average hourly rate of $25 here. My annual target is to replace 100 hours of active work with passive dividend income. This translates to $2,500 in annual net dividends, or around $208 per month. Now that we are almost midway through 2018 this figure needs to be revised and scaled up to $3,000 by year-end representing an average of $250 in net dividend income per month.

What this shows is as follows:

- All time (blue area) - Around 161 hours, or 20 days, of active work have been replaced with passive income since the start of my dividend journey. Assuming a 5-day work week, that equals a full four weeks or one entire month of vacation funded via dividends.

- YTD (green bars) - Around 50 hours, or 6.2 days, of active work have been replaced with passive income in 2018 already. If the target of 120 hours is achieved by year this represents a total of 15 days or three full weeks of active work to have been replaced by passive income.

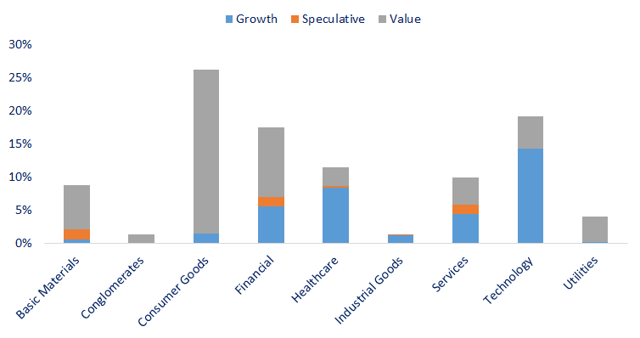

My portfolio composition

The portfolio is evolving rapidly and as end of May looks like this:

- Value: 59% (-3pp)

- Growth: 36% (+2pp)

- Speculate: 5% (+1pp)

By holding, it looks like this:

| AT&T Inc. | (T) | 6.09% |

| Apple Inc. | (AAPL) | 4.58% |

| Royal Dutch Shell Plc | (RDS.B) | 4.02% |

| Altria Group Inc | (MO) | 3.99% |

| Gilead Sciences, Inc. | (GILD) | 3.62% |

| Cisco Systems, Inc. | (CSCO) | 3.27% |

| Southern Co | (SO) | 2.82% |

| McDonald's Corporation | (MCD) | 2.79% |

| Visa Inc | (V) | 2.40% |

| Main Street Capital Corporation | (MAIN) | 2.19% |

| Commonwealth Bank of Australia | (OTCPK:CBAUF) | 2.18% |

| AbbVie Inc | (ABBV) | 2.02% |

| Unilever NV (ADR) | (UN) | 1.96% |

| Wells Fargo & Co | (WFC) | 1.92% |

| Johnson & Johnson | (JNJ) | 1.91% |

| B&G Foods, Inc. | (BGS) | 1.89% |

| Siemens Healthineers | (OTC:SEMHF) | 1.84% |

| Micron Technology, Inc. | (MU) | 1.82% |

| Bayerische Motoren Werke AG | (OTCPK:BMWYY) | 1.76% |

| PepsiCo, Inc. | (PEP) | 1.72% |

| Daimler | (OTCPK:DDAIF) | 1.61% |

| Philip Morris International Inc. | (PM) | 1.50% |

| Toronto-Dominion Bank | (TD) | 1.49% |

| 3M Co | (MMM) | 1.38% |

| Microsoft Corporation | (MSFT) | 1.36% |

| Procter & Gamble Co | (PG) | 1.30% |

| Bank of Nova Scotia | (BNS) | 1.29% |

| Honeywell International Inc. | (HON) | 1.23% |

| Verizon Communications Inc. | (VZ) | 1.22% |

| NVIDIA Corporation | (NVDA) | 1.20% |

| Canadian Imperial Bank of Commerce (NYSE:USA) | (CM) | 1.18% |

| Dominion Energy Inc | (D) | 1.08% |

| Exxon Mobil Corporation | (XOM) | 1.04% |

| The Coca-Cola Co | (KO) | 1.03% |

| BASF | (OTCQX:BASFY) | 1.00% |

| Senior Housing Properties Trust | (SNH) | 0.96% |

| Texas Instruments Incorporated | (TXN) | 0.95% |

| Baozun Inc (ADR) | (BZUN) | 0.89% |

| Spectra Energy Partners, LP | (SEP) | 0.84% |

| Morgan Stanley | (MS) | 0.84% |

| Nike Inc | (NKE) | 0.83% |

| Bank of America Corp | (BAC) | 0.82% |

| General Motors Company | (GM) | 0.81% |

| Omega Healthcare Investors Inc | (OHI) | 0.78% |

| Royal Bank of Canada | (RY) | 0.78% |

| Realty Income Corp | (O) | 0.69% |

| Advanced Micro Devices, Inc. | (AMD) | 0.69% |

| Momo Inc (ADR) | (MOMO) | 0.69% |

| General Mills, Inc. | (GIS) | 0.68% |

| Target Corporation | (TGT) | 0.63% |

| Allianz SE | (OTCPK:AZSEY) | 0.63% |

| Drillisch | (OTC:DRHKF) | 0.62% |

| BP | (BP) | 0.59% |

| Walt Disney Co | (DIS) | 0.53% |

| Stag Industrial Inc | (STAG) | 0.51% |

| Pfizer Inc. | (PFE) | 0.50% |

| Pebblebrook Hotel Trust | (PEB) | 0.47% |

| Fresenius SE | (OTCQX:OTCQX:FSNUF) | 0.47% |

| CoreSite Realty Corp | (COR) | 0.46% |

| Bayer AG | (OTCPK:OTCPK:BAYZF) | 0.45% |

| Sixt | (OTC:SXTSY) | 0.41% |

| Alibaba Group Holding Ltd | (BABA) | 0.40% |

| Starwood Property Trust, Inc. | (NYSE:STWD) | 0.38% |

| QTS Realty Trust Inc | (QTS) | 0.38% |

| Teekay Tankers Ltd. | (NYSE:TNK) | 0.37% |

| Colgate-Palmolive Company | (NYSE:CL) | 0.36% |

| Ares Capital Corporation | (ARCC) | 0.33% |

| JPMorgan Chase & Co. | (JPM) | 0.33% |

| Uniti Group Inc | (UNIT) | 0.33% |

| Lanxess AG | (LXS) | 0.32% |

| Kinder Morgan Inc | (KMI) | 0.30% |

| Enterprise Products Partners L.P. | (NYSE:EPD) | 0.30% |

| Macquarie Infrastructure Corp | (NYSE:MIC) | 0.27% |

| Arista Networks Inc | (ANET) | 0.27% |

| Vonovia | (OTCPK:VONOY) | 0.26% |

| Tableau Software Inc | (DATA) | 0.26% |

| JD.Com Inc(ADR) | (JD) | 0.25% |

| Starbucks Corporation | (SBUX) | 0.24% |

| Albemarle Corporation | (ALB) | 0.24% |

| Centurylink Inc | (CTL) | 0.23% |

| Galapagos NV (ADR) | (NASDAQ:GLPG) | 0.20% |

| MediGene AG | (MDG1) | 0.20% |

| Fresenius Medial Care | (NYSE:FMS) | 0.19% |

| Time Warner Inc | (TWX) | 0.19% |

| Frontline Ltd. | (NYSE:FRO) | 0.19% |

| International Business Machines Corp. | (IBM) | 0.17% |

| CF Industries Holdings, Inc. | (NYSE:CF) | 0.16% |

| Citigroup Inc | (NYSE:C) | 0.15% |

| Apollo Commercial Real Est. Finance Inc | (ARI) | 0.14% |

| Energy Transfer Equity LP | (NYSE:ETE) | 0.14% |

| Activision Blizzard, Inc. | (ATVI) | 0.14% |

| Apollo Investment Corp. | (NASDAQ:AINV) | 0.14% |

| DHT Holdings Inc | (NYSE:DHT) | 0.13% |

| Shell Midstream Partners LP | (SHLX) | 0.13% |

| Brookfield Infrastructure Partners L.P. | (BIP) | 0.13% |

| General Electric Company | (NYSE:GE) | 0.12% |

| Atlassian Corporation PLC | (NASDAQ:TEAM) | 0.12% |

| Intel Corporation | (INTC) | 0.11% |

| SUPERVALU INC. | (NYSE:SVU) | 0.11% |

| Incyte Corporation | (NASDAQ:INCY) | 0.09% |

As always, I hope that you find this update interesting and relevant. The biggest inspiration for me is reading these updates from other authors and following their progress over the years. Compared to them, I am still really at the beginning of my journey, and I would appreciate if you want to follow/continue to follow my journey as well. I hope to inspire many more readers to also start and share their journey.

Author's note: If you enjoyed this article, the only favor I ask for is to click the "Follow" button next my name at the top of this article. This allows me to develop my readership so I can offer my opinion and experiences to interested readers who may not have received them otherwise. Happy investing :)

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.