WisdomTree (WETF) wants to grow its business and be a leading ETF provider in the medium-term, but its operating performance has been weak over the past couple of years and its premium valuation is clearly not justified.

WisdomTree Investments is an asset management firm that focuses exclusively on exchange-traded products (ETP), which include exchange-traded funds (ETFs), exchange-traded notes, and exchange-traded commodities. It serves retail and institutional customers throughout the world.

Its assets under management (AuM) are close to $60 billion as of July 16, 2018, being a relatively small provider of ETFs. WisdomTree has a market capitalization of about $1.4 billion and is listed on the Nasdaq Global Select Market. Its closest competitors include other ETF providers, such as BlackRock (BLK), Vanguard, or Invesco (IVZ).

Business Profile

WisdomTree is a unique asset manager, as the company specializes in ETFs, which are funds that track indexes (usually called passive investing). Most of its peers offer both active and passive investing products, enabling them to cover a broader customer base, which means that WisdomTree has a competitive disadvantage in its industry.

WisdomTree launched its first ETF in 2006 and currently manages more than 90 ETFs, which invest in domestic and international equities, currencies, fixed-income, commodities, and alternatives.

It also provides an alternative to funds weighted by market capitalization by focusing on factor investing, which are funds that invest based on fundamental metrics such as earnings, dividends, or industry beyond other factors.

Most of its funds employ this methodology and are based on proprietary indexes, while most other ETF providers use a capitalization-weighted methodology based on third-party indexes, like the S&P 500 index that is provided by S&P Global (SPGI). WisdomTree is currently the seventh largest ETF sponsor in the U.S. measured by total AuM.

At the end of 2017, it AuMs were heavily concentrated in equities (93% of total AuMs), with about half tied to international hedged equities.

This was a strong concentration of assets in only one asset class, but this has changed considerably with the recent acquisition of the European exchange-traded commodity, currency, and short & leveraged business of ETF Securities for about $600 million.

WisdomTree's AuMs are now much more diversified, with commodities representing some 25% of AuMs. Additionally, its AuMs were too much exposed to only two of its U.S. listed ETFs, namely the WisdomTree Europe Hedged Equity Fund (HEDJ) and WisdomTree Japan Hedged Equity Fund (DXJ), which accounted for nearly 36% of AuMs. Following the acquisition of ETF Securities, these two ETFs represent now 25% of AuMs, which is still a significant weight but more manageable.

The company makes almost all of its income from ETF fees, which are directly tied to total AuM. Its average fee is about 50 basis points, showing that the ETF industry is a lower margin business compared to traditional asset management.

Given its business profile, WisdomTree has two major ways to grow, namely by increasing the size of its funds through net flows or higher AuMs through positive capital market returns. This last part is outside of the company's control, thus its management should be fully focused on increasing net flows.

This means that offering a broad product range and a having a good sales channel is fundamental to its business prospects. Regarding its product set, even though it covers several asset classes WisdomTree only offers ETFs, which may not be suitable for types of clients and may constrain its growth over the long term. On distribution, the company sells its ETFs through all major channels within the asset management industry, including investment advisers, discount brokers, and online.

Growth

WisdomTree has a very good growth history, due to its small size, positive financial markets and rising popularity of ETFs over the past few years. Its AuMs have more than tripled since 2012, leading to strong fee and advisory income growth for several years.

However, in the past couple of years, its AuM have been lower than at the end of 2015 and net inflows were very weak, primarily due to outflows in its two largest ETFs. This is mainly justified by weak performances in these markets (Europe and Japan) compared to the U.S., which lead to net outflows in its two flagship ETFs.

Despite this recent setback, by being completely focused on exchange-traded products, WisdomTree is very well positioned to continue to benefit from the structural trend of money moving away from active products towards passive investing. Its goal is to become one of leading ETF sponsors in the world over the medium to long-term, an ambitious target for a relatively smaller player than current industry leaders.

Indeed, its strategy is based on the growth of investor engagement with ETFs around the world to grow its business. As ETFs have low fees and active/hedge funds returns have been, on average, quite poor since the global financial crisis, investors are gradually increasing their allocation to passive investing.

To grab a part of this growing market, WisdomTree regularly adds new ETF offerings and is expanding its global distribution network, both directly and through partnerships, to attract new customers and inflows.

Additionally, it also has expanded its offering with the recent development of its Advisor Solutions program, which is focused on providing technology-enabled solutions to financial advisors. This includes a portfolio construction service and access to ETF model portfolios, something that should help the company to attract higher net flows over the long-term.

Beyond industry and company-specific growth initiatives, WisdomTree is also growing through acquisitions, like the recent purchase of the ETF Securities. Even though WisdomTree wants to grow in the coming years, its size is quite small compared to the largest players in the industry and I see the company as a possible target rather than a consolidator in the medium-term.

Financial Overview

Regarding its financial performance, WisdomTree has an impressive track record given that revenues and profits have increased a lot over the past few years, due to the strong rise on AuM over the past few years.

However, its growth story ended in 2015, considering that over the past couple of years WisdomTree suffered net outflows at its two most important ETFs. This led to a revenue drop of 26% in 2016 and a decrease of 67% in net profit, while in the past year it was able to recover slightly from poor results compared to 2016.

In 2017, net flows remained quite weak due to strong net outflows in its flagship European ETF, as U.S. investors shifted funds towards domestic equities. Other products had net inflows and market moves led to higher AuM, justifying higher revenue of 8.2% during the year, to $237 million.

Despite this top-line growth, WisdomTree's net profit was up by only 3.8% to $27 million, due to expense growth and one-off costs related to the acquisition of ETF Securities. Its return on equity ratio was near 14%, a lower level than some of its asset management peers.

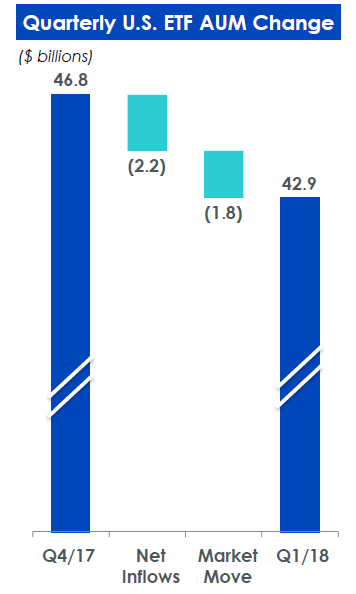

During the first quarter of 2018, WisdomTree's continued to show a weak operating performance, especially due to large net outflows at its Europe ETF and Japan ETF of about $3.5 billion, which were not offset by net inflows at other products. Therefore, its net outflows in the quarter amounted to $2.16 billion, leading to lower AuM at the end of March.

Source: WisdomTree.

Despite lower AuMs, the company's earnings increased due to lower compensation expenses, leading to a net income of $9.4 million in the quarter (vs. $6.9 million in Q1 2017).

Going forward, the company should be able to report a more stable AuM profile following the acquisition of ETF Securities, which has closed in April. WisdomTree's AUM and revenues are more diversified, while cost synergies are expected to be about $5 million. The contribution of ETF Securities to net income should be about $19 million in 2018, which should be an important factor to offset lower AuMs.

Regarding its balance sheet, WisdomTree had a net cash position but has increased a lot its indebtedness after the acquisition of ETF Securities because the company issued $200 million of new debt, leading to a gross debt leverage of 1.7x EBITDA.

Even though this is an acceptable leverage ratio, WisdomTree has recently cut its dividend by 62%, from $0.08 to only $0.03 per share, to preserve cash. Therefore, its capital return policy to shareholders has worsened a lot. Reflecting this, its current annual dividend is $0.12 per share, offering a dividend yield of only 1.30% at its current share price.

Conclusion

WisdomTree has improved its business profile with the recent acquisition of ETF Securities, but I doubt that this is enough to offset weakness in the remaining part of its business, namely the huge outflows it continues to experience at its two flagship ETFs.

Despite this bleak outlook, the company is currently trading at more than 25x earnings, at a significant premium to its peers, including BlackRock, Invesco or State Street (STT) that trade on average at 13x earnings and being the most expensive asset manager in the U.S.

This doesn't seem to be justified by WisdomTree's business fundamentals and the shares seem to be quite overvalued. Even though the company is more likely to be an acquisition target rather than a consolidator, I doubt that any competitor would launch a takeover offer at these prices, making WisdomTree a good short position right now.

A reversal of net outflows at its two flagship ETFs would be a strong reason for investors turn more bullish on the stock, but considering that Europe and Japan are delivering poor returns year-to-date, this seems to be quite unlikely in the short-term.