Investment Thesis: Honeywell International (NASDAQ:HON) could see upside to the $225-230 level based on an expected 20% annual growth in free cash flow.

Back in my last article on Honeywell International, I expressed the possibility that aerospace tariffs could adversely affect the company’s performance ahead of Q2 earnings. Moreover, I cautioned that the upcoming earnings report would be a significant telling point as to whether this company can continue to grow.

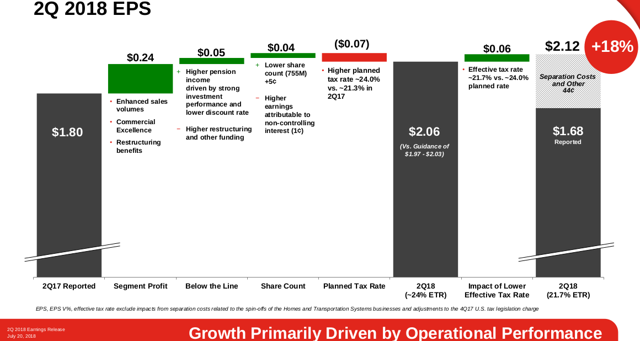

However, earnings growth was quite impressive for Q2, up by 18% from Q2 2017 to $2.12 per share (including separation costs).

Source: Honeywell Second Quarter 2018 Earnings Release

Source: Honeywell Second Quarter 2018 Earnings Release

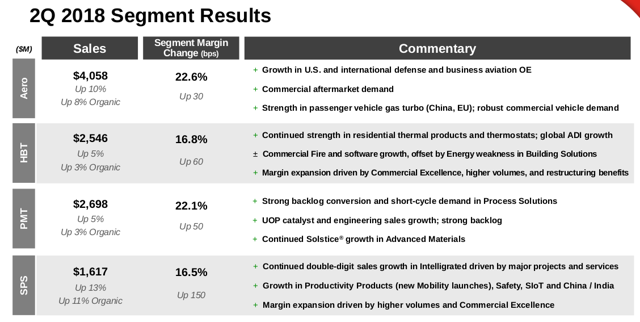

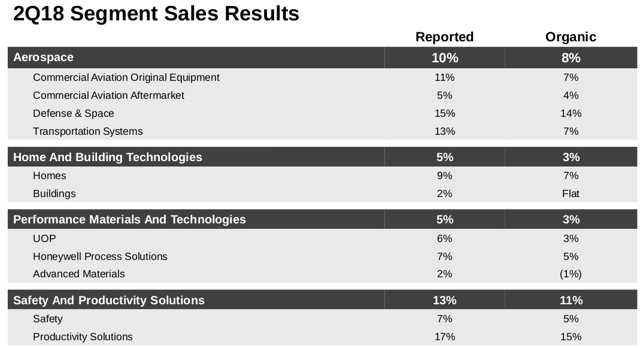

In particular, Aero sales were particularly impressive, with organic sales up by 8% along with a margin change of 22.6%:

Source: Honeywell Second Quarter 2018 Earnings Release

Source: Honeywell Second Quarter 2018 Earnings Release

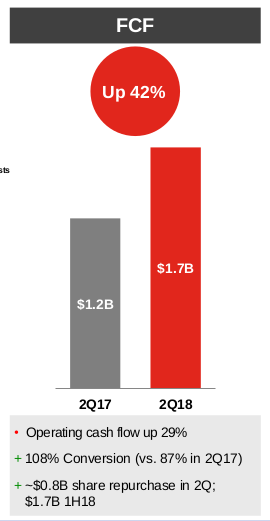

What has been particularly impressive about this company is the rate of growth in free cash flow. For instance, Honeywell International has seen free cash flow up by 42% since 2Q17, and free cash flow conversion is up from 87% to 108%:

Source: Honeywell Second Quarter 2018 Earnings Release

Source: Honeywell Second Quarter 2018 Earnings Release

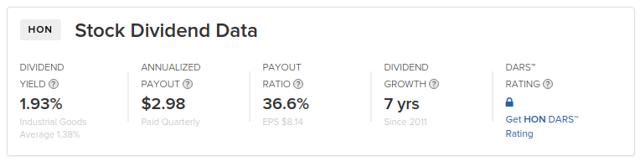

As this company has grown, it may well be the case that free cash flow is becoming a more important metric in determining its overall valuation. Free cash flow growth has been particularly impressive, and Honeywell International is also establishing a strong record of growing dividends, while concurrently paying a higher than average yield in its industry while keeping its payout ratio below 50%:

Source: dividend.com

Source: dividend.com

Previously, I calculated a target price of $204 based on a 15% per year earnings growth over a 5-year period. To supplement this analysis, I now choose to run a discounted cash flow model, using free cash flow as the primary metric to determine a target price for this company.

I make the following assumptions:

Free cash flow per share will grow by 20% per year over the next 5 years.

The discount rate is set to 7% (in line with the assumed long-term rate of return on the S&P 500).

The terminal P/FCF ratio is set to the current P/FCF ratio of 21x.

| Free Cash Flow Per Share Forecast (Year 1 to 5) | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Projected 20% free cash flow growth | 7.34 | 8.81 | 10.57 | 12.68 | 15.22 |

| 7% discount rate | 2.71 | 7.69 | 8.63 | 9.67 | 10.85 |

| Terminal P/FCF Ratio | 21 |

| Terminal P/FCF * Estimated 2020 FCF in Year 5 (Target Price) | 227.83 |

| Upside from price of $154.13 | 47.81% |

Source: Author’s Calculations

Assuming 20% free cash flow growth per year, this would yield a target price of $228, which represents a nearly 48% upside from the current price.

This is slightly higher than the estimated target price of $204 assuming 15% earnings growth per year.

Over the past 5 years, the average free cash flow growth has been just under 17% per year:

Source: ycharts.com

Source: ycharts.com

In this regard, given that we have been seeing higher rates of free cash flow conversion, I anticipate that a 20% average growth in free cash flow per share is quite realistic.

Aside from historical performance, one important caveat to be aware of is that a significant reason for the increase in free cash flow will have been due to spin-offs of its Homes and Transportation business. Therefore, there is always the possibility that the growth we are seeing in free cash flow is inflated due to these spin-offs.

That being said, it is encouraging that Honeywell is choosing to withdraw its focus from lower-performing sectors. For instance, we see that Home and Building Technologies showed a lower rate of organic sales growth than Aerospace and Safety and Productivity Solutions:

Source: Honeywell Second Quarter 2018 Earnings Release

Source: Honeywell Second Quarter 2018 Earnings Release

In this regard, I would expect that continued growth in Honeywell’s strong performing segments could well lift free cash flow to a growth rate of 20% per year. Moreover, the concern regarding aerospace tariffs appears to be unfounded thus far, and is of more concern to aircraft manufacturers themselves such as Airbus (OTCPK:EADSF) and Boeing (BA).

To conclude, I continue to remain optimistic on this stock. From a free cash flow perspective, Honeywell International appears to have more upside than I originally anticipated, and the company looks on track to continue seeing strength from its high-performing business lines.

Disclaimer: This article is written on an "as is" basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions.