Shares of Bellerophon Therapeutics (OTCPK:BLPH) have gained just 10% over the past year- recently the company lost around two-thirds of its value when the phase 3 INOvation-1 study in PAH failed to achieve its primary endpoint.

That said, all is not lost and recent accumulation coupled with insider buying could be indicative of a comeback in the works.

Chart

Figure 1: BLPH daily advanced chart (Source: Finviz)

Figure 1: BLPH daily advanced chart (Source: Finviz)

Figure 2: BLPH 15-minute chart (Source: Finviz)

Figure 2: BLPH 15-minute chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels to get a feel for what's going on. In the first chart (daily advanced), we can see a sickening gap down as a result of negative trial news followed by a pretty surprising recovery. In the second chart (15-minute), we can see the stock price already making a 50% move higher from .80 to over $1.20 (positive price action and volume are indicative of continued accumulation).

Overview

In the case of Bellerophon Therapeutics, initial due diligence has led me to believe that despite the failed phase 3 study in PAH, the firm's INOpulse technology has significant promise in additional indications.

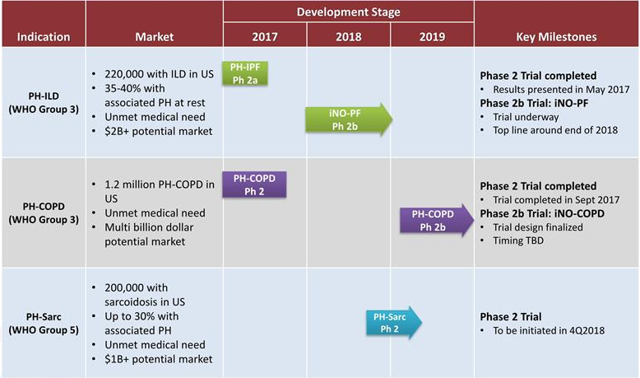

Figure 3: Pipeline (Source: Rodman and Renshaw presentation)

Figure 3: Pipeline (Source: Rodman and Renshaw presentation)

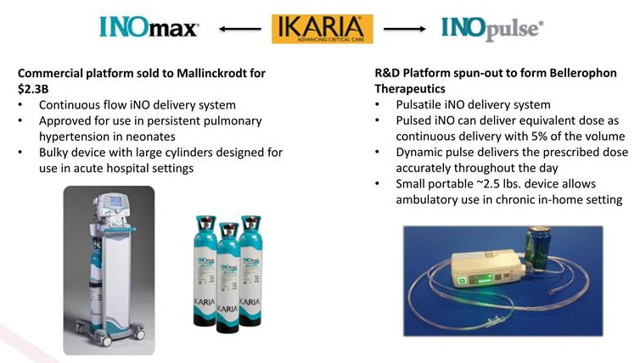

I was also initially interested by the origins of the company (spun off from Ikaria, which was acquired for $2.3 billion by Mallinckrodt), depth in its management team (including leadership from Ikaria) and elements of derisking to the story that I constantly look for. After all, it's a well-known fact that inhaled nitric oxide has already been approved for the acute treatment of persistent pulmonary hypertension and readers might be interested to know that a simplified regulatory pathway is already in place via an existing nitric oxide NDA.

Figure 4: Portability allows for chronic iNO therapy (Source: Rodman and Renshaw presentation)

Let's take a closer look at the firm's prospects (especially in the near and medium term).

Recent Developments

May 8th the company announced that it'd reached agreement with the FDA on the design for its planned phase 2b study evaluating INOpulse for the treatment of Pulmonary Hypertension Associated with Chronic Obstructive Pulmonary Disease (PH-COPD). The study would take place in the United States and utilize a double-blind, placebo-controlled format, enrolling 90 PH-COPD patients. The primary endpoint will be improvement in six-minute walking distance (6MWD) along with multiple key secondary endpoints including improvement in right ventricular function. Keep in mind that data from a phase 2a study was positive, with statistically significant increases in 6MWD demonstrated after 2 and 4 weeks of treatment with INOpulse along with a clinically meaningful decrease (19.9%, p=0.02) in systolic pulmonary arterial pressure. It should come as no surprise that the treatment had a solid safety/tolerability profile. As for the addressable market here, of the more than 12 million COPD patients in the United States it's estimated that roughly 25% have associated pulmonary hypertension (no approved treatments for PH associated with COPD).

In late June the company filed a $100 million mixed shelf offering, a factor which should be kept in mind when considering its current cash position and relatively short operational runway (into mid 2019 per recent management guidance).

In August the company announced the results of its interim analysis of the first 75 patients enrolled in the phase 3 INOvation-1 study evaluating INOpulse in PAH (pulmonary arterial hypertension). Unfortunately the trial was stopped for futility (insufficient change in the 6MWD primary endpoint)- that said, it's worth noting that improvement in pulmonary vascular resistance was demonstrated.

Other Information

For the second quarter of 2018, the company reported cash and equivalents of $25.9 million, down from year end 2017 cash balance of $31.8 million. Net loss of $7.4 million compared favorably to net loss of $23.1 million for the prior year, while research and development expenses rose by roughly 50% to $12.2 million as clinical activity was expanded. General and administrative costs also rose slightly to $4.2 million.

Going forward, I think Wall Street's focus will shift to the ongoing phase 2 study in pulmonary hypertension associated with interstitial lung disease (PH-ILD) where top-line data is expected by the end of the year. 40 patients have been enrolled in the double-blind, placebo-controlled trial with a primary endpoint of change in 6MWD and additional key secondary endpoints such as improvement in right ventricular function.

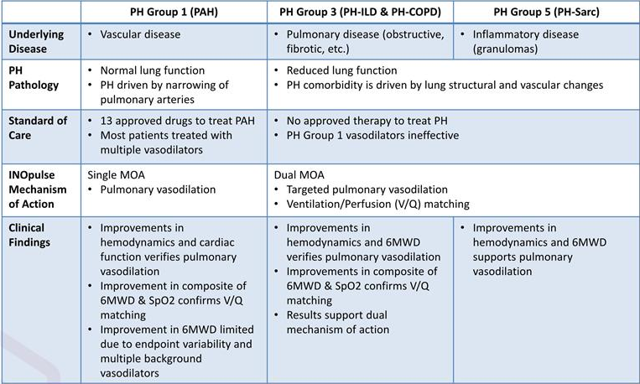

Figure 5: Differences in pathology, standard of care and MoA (Source: Rodman and Renshaw presentation)

Figure 5: Differences in pathology, standard of care and MoA (Source: Rodman and Renshaw presentation)

Management contends that the dual mechanism of action for INOpulse (allows for targeted pulmonary vasodilation in addition to ventilation/perfusion matching) is uniquely poised to address this condition, along with PH associated with sarcoidosis (phase 2 study to get underway in the fourth quarter).

When you think of Interstitial Lung Disease and the many lung diseases included in this category, IPF or Idiopathic Pulmonary Fibrosis probably comes to mind as it's the largest and most serious of these conditions. It's characterized by scarring and thickening of the air sacs and lungs and patients typically require supplemental oxygen. Around 40% of IPF patients have symptoms of pulmonary hypertension and those with PH have 3 times the risk of death compared to those who don't. This is an intriguing setting considering there are no approved treatments for this specific indication.

In terms of market opportunity, the company estimates there are around 60,000 PH-ILD patients on long-term oxygen therapy in the United States with an addressable market of around 24,000. While the company states that a $2 billion plus market opportunity awaits and is supported by pricing plus input from key opinion leaders, even if we conservatively cut that measure in half it's still a substantial number compared to the current valuation.

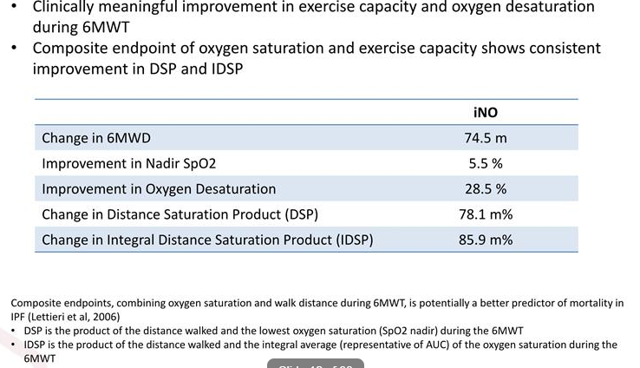

As for elements of derisking, it's interesting that a prior phase 2 study showed significant benefit in vasodilation and hemodynamics. Specifically, a 15.3% increase in blood vessel volume from baseline (statistically significant) and 14% reduction in systolic pulmonary arterial pressure were deemed clinically meaningful. Couple this with the well-known fact that chronic iNO treatment benefits exercise capacity and oxygen saturation.

Figure 6: Chronic iNO treatment benefit (Source: Rodman and Renshaw presentation)

Figure 6: Chronic iNO treatment benefit (Source: Rodman and Renshaw presentation)

Upcoming data will serve to help the company finalize design for a pivotal phase 3 study and investors will be paying attention to improvements in key endpoints (6MWD, right ventricular function, activity level, oxygen saturation, etc).

Positive results would also shed light on other potential opportunities, such as PH-COPD and PH associated with sarcoidosis. For both of these conditions there are no approved therapies for treating PH in these patients. For the former, the company estimates an addressable market of around 350,000 patients and a blockbuster opportunity. For the latter, the company estimates an addressable market of around 60,000 patients.

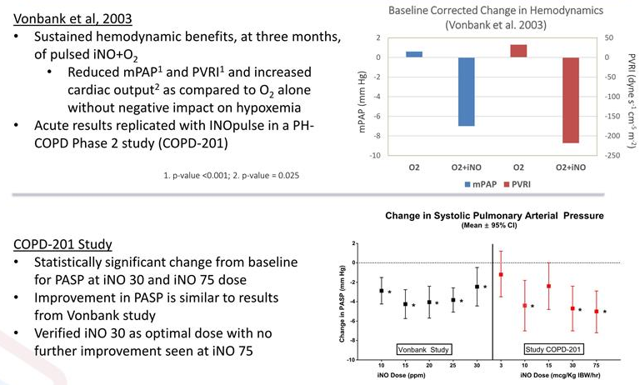

Figure 7: Element of derisking via prior data (Source: Rodman and Renshaw presentation)

Figure 7: Element of derisking via prior data (Source: Rodman and Renshaw presentation)

As for intellectual property, the company's method of NO administration patents expire in January of 2027 while other provisional patent applications could extend coverage into 2038. Also keep in mind that orphan drug designation would extend exclusivity for 7 years in the US and 10 years in the EU.

As for institutional investors of note, Puissance Capital owns over 8 million shares. New Mountain Vantage Advisors owns over 15 million shares, while VHCP Management and Boxer Capital own decent stakes. 10% owner Venrock Associates has been loading up on shares in August and September.

As alluded to previously, the management team and board has decent depth, including executives who served prior at Ikaria as well as others hailing from the likes of Amgen, Novartis and Pfizer.

Final Thoughts

To conclude, despite the risks involved and prior failed study I believe this is an intriguing turnaround play with important data coming up that will shed light on future opportunities.

For readers who are interested in the story and have done their due diligence, I suggest initiating a pilot position in the near term and accumulating weakness prior to upcoming trial results.

Risks include dilution in the near term considering the low cash position and burn rate as well as disappointing data for the PH-ILD study; the latter would result in extensive downside. The burden of proof is on management to execute and turn the ship around at this point, and it's important to keep in mind that they still have to conduct costly (and time-consuming) pivotal studies to cross the regulatory finish line.

Disclaimer: Commentary presented is not individualized investment advice. Opinions offered here are not personalized recommendations. Readers are expected to do their own due diligence or consult an investment professional if needed prior to making trades. Strategies discussed should not be mistaken for recommendations, and past performance may not be indicative of future results. Although I do my best to present factual research, I do not in any way guarantee the accuracy of the information I post. I reserve the right to make investment decisions on behalf of myself and affiliates regarding any security without notification except where it is required by law. Keep in mind that any opinion or position disclosed on this platform is subject to change at any moment as the thesis evolves. Investing in common stock can result in partial or total loss of capital. In other words, readers are expected to form their own trading plan, do their own research and take responsibility for their own actions. If they are not able or willing to do so, better to buy index funds or find a thoroughly vetted fee-only financial advisor to handle your account.

Author's note: I continually scan the markets for investing/trade ideas that fit our criteria for ROTY (i.e., element of de-risking, upcoming material events, several recent green flags, asymmetric risk/reward profile, multiple ways to win, etc.). While I publish some articles publicly on Seeking Alpha in hopes that readers find them useful (and profitable), keep in mind that the situations I feel we most have an "edge" or advantage in are published solely for ROTY members.