Gold remains stuck in a tight, narrow trading range just above its low for the year. The lack of a meaningful rally in the yellow metal has been a continual source of frustration to many investors, and the evidence continues to weigh against a gold bull market commencing any time soon. Instead of focusing on that, however, we'll instead further our recent discussion of the continued positive development in the gold mining stocks. I'll argue here that if this rally in the gold stocks continues it should give the bullion price at least a temporary boost.

Gold prices were slightly lower on Tuesday after China said it would retaliate against Washington's imposition of $200 billion in tariffs on Chinese goods. The U.S. dollar strengthened in response to the news, which in turn dampened enthusiasm for gold. Spot gold was 0.20 percent lower at $1,198 while December gold meanwhile was virtually unchanged at $1,203. The price of gold has lost 12 percent since April and is hovering slightly above its lowest level of the year.

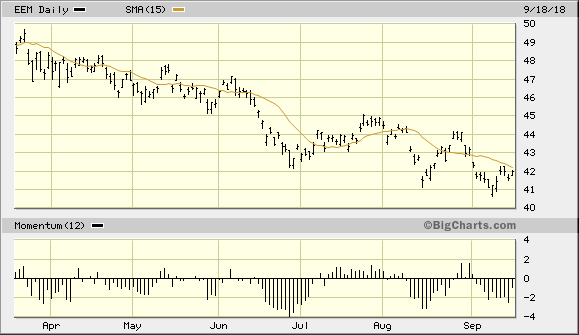

One of the main reasons for gold's woes since April has been the trade-related woes plaguing emerging markets. Shown below is the graph of the iShares MSCI Emerging Markets ETF (EEM), which is a useful representation of the turmoil which developing economies have experienced since the trade war began. EEM remains in a downward trend and can't seem to stay above its 15-day moving average, which is my favorite delineation for the immediate-term (1-4 week) trend.

Source: BigCharts

The emerging markets ETF did manage to rally 1 percent on Tuesday but still hasn't broken its pattern of lower highs and lower lows established since early this year. Until EEM at least manages to rally above its nearest peak made in August (at the $44.00 level), the downward trend in EEM will remain in force. As long as EEM remains in a downward trend, emerging markets investors will have every incentive to remain in the safety of the U.S. dollar and avoid gold.

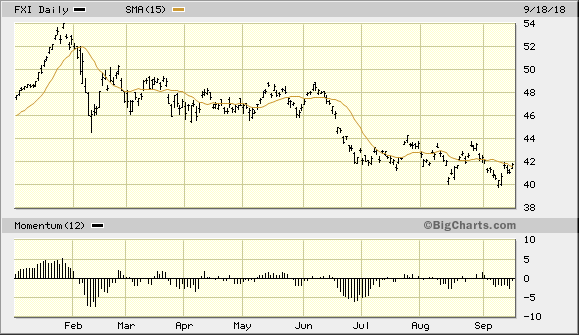

Another factors closely allied with the emerging markets downturn is the weak performance in China stocks in recent months. Below is a graph showing the iShares China Large-Cap ETF (FXI), which is one of my favorite proxies for China's stock market. FXI is also still in an established downtrend but is trying to reverse its latest slide to its yearly low. However, it still hasn't managed to establish support above its 15-day moving average which means the sellers still have control of the immediate-term trend.

Source: BigCharts

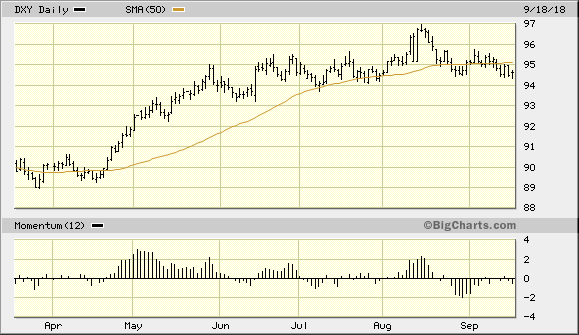

Serving as an additional weight against gold is continued weakness in the traditional safe havens, including the Japanese yen currency, as well as persistent strength in the U.S. dollar index. The As I mentioned in the previous commentary, the U.S. dollar index (DXY) remains close enough to its psychologically significant 50-day moving average to where its upward trend can be assumed to be still intact. In view of these considerations we can summarize by saying gold finds itself in need of a rally catalyst and doesn't appear to have an ally in any of the above mentioned factors.

Source: BigCharts

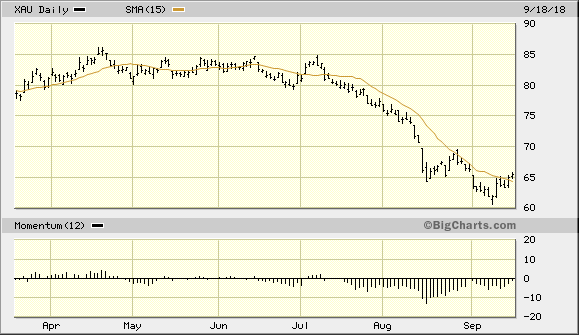

There is, however, at least one recent development which could support the gold price in the immediate term. I'm referring to the latest turnaround attempt in the gold mining stocks, which could serve to entice investors to give the yellow metal a closer look in the coming weeks. It should be mentioned that leadership in the XAU has historically served as a precursor to a gold price rally whenever the gold miners have led the physical metal. It can be assumed then that continued relative strength in the PHLX Gold/Silver Index (XAU) would eventually attract investors' attention to the neglected precious metals.

Source: BigCharts

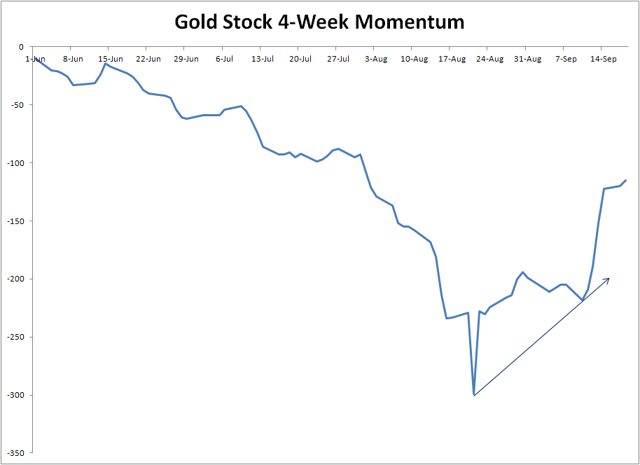

The latest rally in the gold mining stocks can in turn be attributed to the recent reversal momentum reversal we talked about last week. Specifically, there has recently been a powerful rally in the 4-week rate of change (momentum) in the new highs and lows for the 50 most actively traded gold mining and exploration stocks. This internal momentum reversal told us to expect a rally in the gold mining stocks since the 4-week momentum of the new highs-lows has historically been an excellent indication of the path of least resistance for gold stocks. This is because the new highs and lows reflect the incremental demand for gold mining shares. As long as gold stock internal momentum continues to improve, the XAU index will have additional short-term rally potential.

Source: WSJ

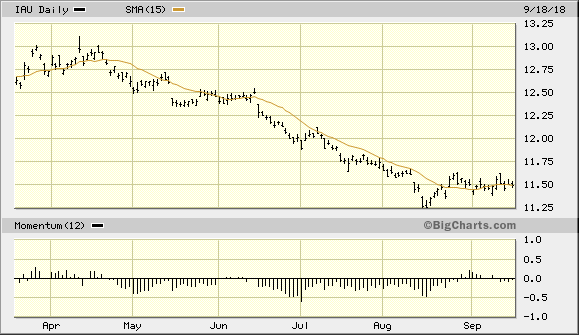

While we're waiting for the XAU rally to work its magic on gold, I would hasten to add that my favorite gold ETF, the iShares Gold Trust (IAU), still hasn't confirmed an immediate-term bottom. As you can see in the following graph, it remains below its 15-day moving average and also remains uncomfortably close to it August low. Because of this it's imperative the bulls put as much distance possible between the $11.25 level and its latest closing value. Otherwise, the sellers will be tempted to try pushing IAU to a new low in the days immediately ahead.

Source: BigCharts

While a gold short-covering rally could easily ignite at any time in the coming days, I still recommend a defensive posture for now. To reiterate my assessment from last week, the iShares Gold Trust (IAU) also must close above the $11.60 level to complete an immediate-term bottom signal per the rules of my trading discipline before it can be safely purchased. For now I recommend that investors remain in cash.