Introduction

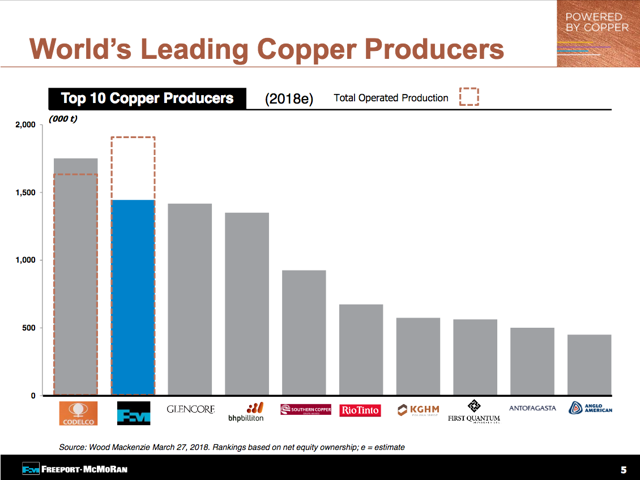

Freeport-McMoRan (NYSE:FCX) is the largest publicly-traded copper producer by attributable production and revenue. It is the world's second largest copper producer overall by attributable production after CODELCO, Chile's state-owned copper company, as shown on the following presentation slide:

Southern Copper's (SCCO) current $32 billion market capitalization ("cap") is substantially higher though than Freeport's $19.8 billion market cap. It appears that this is due to Southern Copper's exceptionally long, 63 years of reserve mine life. Freeport, Southern Copper, and Antofagasta (OTC:ANFGF; OTCPK:ANFGY) are the 3 largest pure-play copper producers available to investors.

My Structural Valuation Method

Mining companies have limited reserve lives for the metals they mine and sell. Because of this, they generally have higher capital expenditure ("CAPEX") requirements than other types of businesses and thus also tend to trade for lower price multiples. I designed my Structural Valuation method to focus on the inherent profitability of a miner's existing production assets and how this may impact its future profitability depending upon its undeveloped assets and the CAPEX required for it to maintain and grow production.

My Structural Valuation method gives me a system that allows me to stay overweight in miners when they are structurally undervalued and to reduce positions and eventually exit them entirely near the top of the cycle. In order to do this, I focus on the following components:

- conservative metals price assumptions taken from analyzing long-term charts and price thresholds below which no new production is likely to come online.

- estimate of a company's current and future earnings and/or free cash flow potential based upon its current producing mines and its near-term production pipeline and after accounting for the amount of additional CAPEX structurally needed to continue to maintain and grow production.

- price multiple based upon how fast a company can grow earnings and/or free cash flow given its structural profitability.

The second point requires some elaboration. By the "amount of CAPEX structurally needed to continue to maintain and grow production," I am referring to an estimate of how much average annual CAPEX a miner will generally require each year to maintain and keep growing production (and earnings) at a certain rate. (Later in this section, I will lay out the specific steps in detail.)

For example, assume a copper miner has the structure in place to produce 100,000 tonnes per year leading to revenues of $600 million ($6,000 per tonne copper) and free cash flow of $120 million (20% margin) after committing enough CAPEX to maintain its core level of production (100,000 tonnes) indefinitely. This miner has 100 million shares outstanding, so earnings per share come out to $1.20. Assuming everything else is constant, they would have to double their production every 7 years to double their earnings per share. If they produced 200,000 tonnes, their revenues would be $1.2 billion, net profit would be $240 million, and earnings per share would be $2.40.

Doubling copper production could require somewhere along the line of $1.5 billion in CAPEX as the upfront capital intensity of many large copper projects today generally averages $15,000 per tonne of capacity (100,000 x $15,000 = $1.5 billion). Assuming an average cycle of 7 years, I would need to account for ~$215 million in average annual expansionary CAPEX. This would be on top of the necessary sustaining CAPEX and the additional expansionary CAPEX needed to maintain the core 100,000 tonnes of production indefinitely.

Assuming the company has the growth pipeline in place or can make acquisitions to fill its growth pipeline and they have the access to capital to make the necessary CAPEX investments, I can project how fast they may be able to grow their earnings and/or free cash flow per share. I use this output in my True Vine Investments' proprietary evaluation model to assign a price multiple, such as 13 times 12-month forward-looking earnings per share, which varies based upon my outlook for various metals.

When metals and share prices get too low (like now), my Structural Valuation method will signal undervaluation and near the end of the cycle when metals and share prices get too high, my method will signal overvaluation.

To summarize, my Structural Valuation method requires the following steps:

- Determine what the core level of annual production is based upon existing mines and those that are expected to come online within a few years (e.g., within 3 years). For a copper miner, I do this on a copper equivalent basis.

- Estimate the average amount of annual net operating cash flow from this core level of production.

- Estimate the average amount of annual sustaining CAPEX required to maintain the core level of production for the remaining mine life. Some miners report this.

- Estimate the average amount of additional annual CAPEX required to extend the core level of production indefinitely through the development of new mines.

- Deduct the sustaining CAPEX requirement (#3) and the additional CAPEX requirement (#4) from the net operating cash flow (#2) to derive the net structural free cash flow. The net structural free cash flow is what the miner will theoretically have leftover to reward shareholders by paying dividends, repurchasing shares, and growing the business.

- Estimate how fast the miner can grow production with their net structural free cash flow based upon their existing resources and the estimated upfront capital intensity of new projects.

- Derive a multiple based upon how fast they can grow earnings (#6). I use True Vine Investments' proprietary evaluation model to determine the multiple.

- Apply the price multiple to my earnings per share estimate for the next 4 quarters to derive a target price.

The remainder of this article will apply my Structural Valuation method to Freeport-McMoRan. For reference, my long-term price assumptions for copper and gold are $7,000 per tonne/$3.17 per lb. and $1,300 per oz. respectively.

Sizing Up Freeport-McMoRan

Freeport is on pace for about $18.3 billion in revenue in 2018. About $16 billion is from its copper mines, mostly in Arizona, Peru, and Indonesia, with an additional $2.3 billion from its copper smelting & refining operations. The company thus segments its business into North America, South America, and Indonesia. Its largest producing mines and revenue sources are the following:

- Morenci in Arizona - 475,000 tonnes per annum ("tpa"), 72% of which is attributable to Freeport

- Cerro Verde in Peru - 485,000 tpa, 54% of which is attributable to Freeport

- Grasberg in Indonesia - 575,000 tpa, 91% of which is attributable to Freeport in 2018

Grasberg also produces a large amount of gold. It has about 22 years of life left producing about 900,000 million ounces per year.

Freeport has about 22 years of mine life remaining across all 3 of its operating segments. It has the structure in place to produce about 1.8 million tonnes of copper and 900,000 ounces of gold for about another 22 years.

Applying the Structural Valuation Method to Freeport-McMoRan

Assuming core copper equivalent ("CE") production of 2.1 million tonnes per year and 22 years of mine life, here is how to apply the Structural Valuation method:

| in $USD millions (rounded to $100 million) | Structural Financial Outlook | Notes |

| Estimated Mining Revenue | $15,400 | 2.1 million tonnes of CE production; $3.17 per lb. copper; $1,300 per oz. gold |

| Estimated Smelting & Refining and Other Revenue | $2,300 | |

| Total Revenue | $17,700 | |

| Less: Mining Costs | $6,800 | C1 Costs (Copper Equivalent Basis)* = $1.46 per lb. |

| Less: Smelting & Refining and Other Costs | $3,600 | |

| Less: Depreciation, Depletion, & Amortization | $2,400 | |

| Less: Sales, General & Admin and Research Expenses | $650 | |

| Operating Income | $4,250 | 24% operating margin |

| Net Income | $2,300 | assuming 37% effective tax rate; 13% profit margin |

| Net Operating Cash Flow | $4,700 | = Net Income + DD&A |

| Sustaining CAPEX | $1,000 | to maintain 2.1 tonnes of annual CE production for 22 years |

| Additional CAPEX | $1,400 | to maintain 2.1 tonnes of annual CE Production indefinitely (beyond 22 years); assume upfront capital intensity of $15,000 per tonne and 22-year mine life for new projects |

| Net Structural Free Cash Flow | $2,300 | 13% FCF margin |

| Earnings Per Share | $1.58 |

*C1 Costs (Copper Equivalent Basis) = Mining Production & Development Costs / Copper Equivalent Production

With 2.1 million tonnes of average annual "core" production, I estimate that Freeport is good for $17.7 billion in revenue using my long-term price targets. At this level of revenue, I estimate the net operating cash flow of $4.7 billion. They need to invest about $1 billion of this annually to sustain their current operations and an additional $1.4 billion per year to add enough projects to keep producing 2.1 million tonnes of CE production indefinitely. I have a large database of (mostly copper) development projects to help shape my estimate of an average upfront capital intensity requirement of $15,000 per tonne of production. 2.1 million tonnes x $15,000 per tonne = $31.5 billion. In other words, I estimate Freeport will need to invest $31.5 billion over the next 22 years to replace their current production profile. $31.5 billion/22 years = $1.43 billion. After deducting sustaining CAPEX and additional CAPEX from net operating cash flow, we are left with $2.3 billion of net structural free cash flow. This is the amount of average annual cash that I estimate to be available for shareholders based upon the profitability and mine life of Freeport's mines.

If Freeport paid out 1/3 of the net structural FCF ($690 million), this would give them a dividend yield of 3.4% at the current share price.

From here, I assess how fast a miner may be able to grow production by reinvesting all the net structural FCF in new projects. If Freeport were to reinvest all their net structural FCF over a 7-year cycle, this could theoretically allow them to increase CE production by 1.07 million tonnes - a 51% increase in production over a full cycle. (Calculation: $2,300,000,000 x 7 = $16,100,000,000/$15,000 per tonne = 1,073,333 tonnes). A 51% increase in production of a 7-year cycle translates to annual earnings growth potential of 6% (CAGR). In reality, this potential would be lower because the company will pay dividends (and maybe even repurchase shares).

I estimate that on a structural basis, Freeport is set up to earn $1.58 per share at my long-term target metals prices. It has the structural potential to pay a 3.5% dividend yield given a 30% payout ratio (30% of net income). Assuming 6% earnings growth potential, I would assign a multiple ranging from 7 (bearish outlook) to 13 (bullish outlook). Based on my structural analysis, I would never pay more than 13 times my 12-month forward-looking earnings or free cash flow estimate for Freeport. My multiple for a moderate long-term outlook would be 9.5 which yields a long-term target price of $15.01 ($1.58 x 13). Taking the very long-term view with a moderate outlook for copper, Freeport is currently undervalued by 6%.

The following table shows how my long-term target price would vary based upon different outlooks for copper:

| Copper Outlook | Structural Earnings Per Share | Price Multiple | Target Price |

| Bearish | $1.58 | 7 | $11.06 |

| Moderate | $1.58 | 9.5 | $15.01 |

| Bullish | $1.58 | 13 | $20.54 |

To be clear, the end goal of the Structural Valuation method is to determine how fast a miner can grow earnings based upon their net structural free cash flow. This structural earnings growth estimate is then used to determine a price multiple to be applied to my earnings estimate for the miner for the next 4 quarters.

I am presently bullish on copper, so I would use a multiple of 13 against my 2019 earnings estimate for Freeport of $1.30 per share to value the stock. This gives me a price target of $16.9 which is 20% upside from where the stock is trading now (see chart below). However, my 2019 earnings estimate is significantly lower because Freeport is guiding for a temporary reduction of production at Grasberg. I estimate the company can earn $1.79 per share in 2020 and $1.95 in 2021.

Looking out longer term, one way Freeport could perhaps increase profitability (and dividends) is by focusing new projects in the United States to take advantage of the lower tax rate. This is a good example of why U.S. corporate tax rates must be made permanent. It takes years to bring a new mine online. If companies such as Freeport see that the now lower tax rate is permanent, they may be more willing to begin refocusing their long-term strategy more towards the U.S. This is a potential strategy that long-term investors may want to consider asking the company about.

Strategic Conclusion

Given its higher debt level, Freeport is less likely to do a major acquisition for the time being. For investors to make money in Freeport in the near term, it is most likely going to have to come from higher copper prices. It will take years for incremental organic production growth to increase earnings.

Given my expectations for a renewed bull market in copper, I expect to see Freeport return to the low-to-mid $20 range within a couple of years.

Disclaimer: I am an investment advisor and owner of True Vine Investments, a Registered Investment Advisor in the State of Pennsylvania (U.S.A.). I screen electronic communications from prospective clients in other states to ensure that I do not communicate directly with any prospect in another state where I have not met the registration requirements or do not have an applicable exemption.

Any investment advice or recommendations involving securities referenced in this article is general in nature and geared towards a readership of sophisticated investors. This article does not involve an attempt to effect transactions in a specific security nor constitute specific investment advice to any particular individual. It does not take into account the specific financial situation, investment objectives, or particular needs of any specific person who may read this article. Individual investors are encouraged to independently evaluate specific investments and consult a licensed professional before making any investment decisions.

All data presented by the author is regarded as factual; however, its accuracy is not guaranteed. Investors are encouraged to conduct their own comprehensive analysis.

Positive comments made regarding this article should not be construed by readers to be an endorsement of my abilities to act as an investment advisor.

Industrial Minefinder™

I hope you found this structural valuation article on Freeport-McMoRan insightful. If you are interested in more analysis like this, including key comparisons with other miners to help you select those with the most potential, then check out my Industrial Minefinder™ Marketplace service. Industrial Minefinder™ covers the industrial metals & mining sector (everything but primary gold producers) where I present what I think are the best opportunities across the full spectrum of majors, intermediates, and juniors.

If you are interested in subscribing to Industrial Minefinder™, you can sample my work by reading my "author's picks" accessible from my Seeking Alpha profile. Do not hesitate to direct message me with any questions you may have.