(Editor's Note: Please make sure to check out Gary's podcast.)

Federal Reserve Chair Jerome Powell thinks the economy is awesome. And he has no problem telling us so.

What Powell will never discuss, however, is the "way-too-low-for-way-too-long" stimulus that the central bank engaged in to get here. In particular, the Fed has kept the neutral rate of interest far beneath the rate of inflation (CPI) for an entire decade. Consumers, corporations and Uncle Sam predictably borrowed as if there'd never be consequences.

What consequences? Asset bubbles.

Stocks, bonds, real estate, collectibles, cryptos, alternatives, everything. Straight across the Ouija board.

Perhaps ironically, we have seen this streaming video before. "Too-low-for-to-long" rate policy in the previous economic expansion (11/01-12/07) created an environment whereby the quality and the quantity of household mortgage debt became toxic.

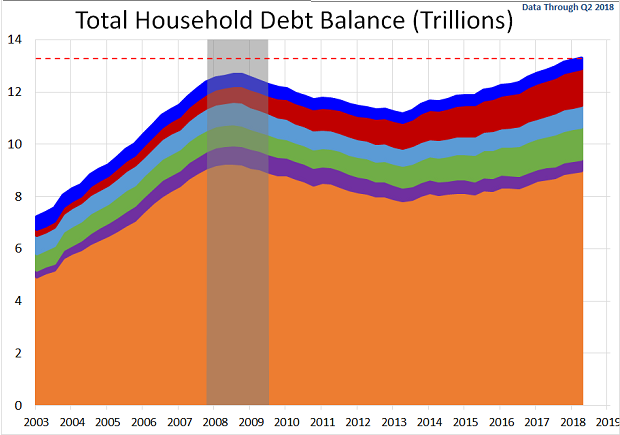

Granted, mortgage debt is less of an issue in the current credit cycle. Nevertheless, total household debt levels may not be sustainable at higher average interest costs.

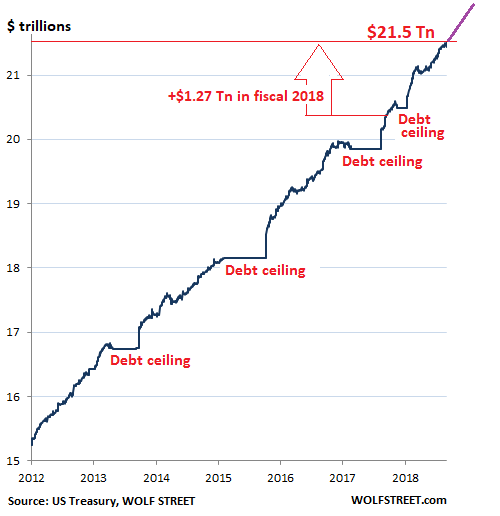

Meanwhile, the federal government is making households look downright responsible. Long after the Great Recession ended, the country averaged $1.07 trillion in deficits (2010-2017). We've now hit $21.5 trillion in our national debt.

Uncle Sammy's bar tab won't be getting smaller anytime soon. The new tax law, which has provided a near-term kick start for economic growth (GDP), will keep the trillion-dollar deficit train running for years to come.

None of this would be so ominous were it not for the rapid-fire advance of interest expense. Interest expense alone accounts for 11% of the federal budget. Just interest. No debt repayment.

Tack on higher interest rates to new borrowing needs? Pretty soon interest expense will surpass the money that goes to the Department of Defense (13.6%).

Some people maintain that debs, deficits and interest rate charges do not matter for the government. It has the power to create money and restore prosperity (That's a debate for another day).

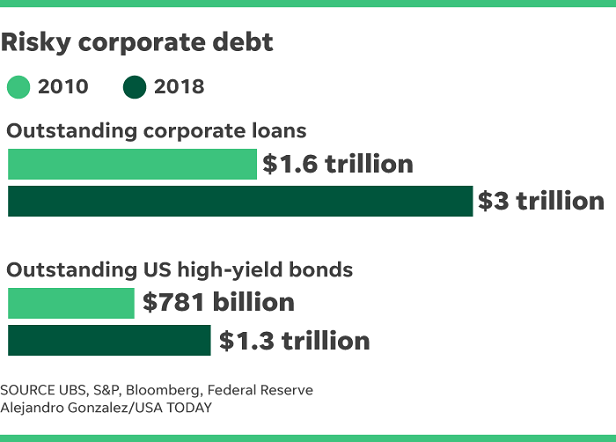

Companies, on the other hand, do not have the power to create dollars. Not physically. Not electronically. It follows that binge borrowing by corporations may, alongside rising interest rates, result in another credit collapse.

It's true that tax reform has made it possible for companies to keep more of what they earn. Paying off these debts at ultra-low-rate levels has not been hard so far.

Yet average interest on leveraged loans is 1% higher than it was a year ago. What's more, Powell is feeling confident enough to hike overnight lending rates well beyond CPI inflation. It's worth noting that leveraged loan monthly payments often reset every few months.

Do people really believe the Fed can sell assets on its balance sheet, raise the federal funds rate (FFR) beyond inflation, and do no harm to economic growth? To stock assets? When the actions may result in borrowing costs that companies will struggle to repay?

There are those who believe that tax cut stimulus can take the longer-term reins as monetary policy stimulus fades away and ultimately becomes more restrictive. These folks may be a bit myopic.

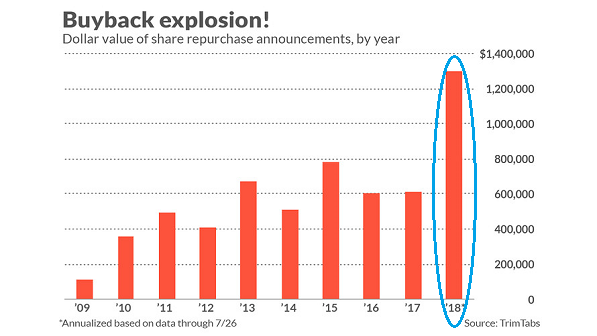

Money managers like myself already are overweight U.S. equities because of tax reform. Why? Because it opened the door to repatriated dollars that went directly into record stock buybacks.

On the other hand, tax reform also has caused the Fed to become more emboldened about rate hikes and quantitative tightening. Higher interest rates stateside already are wreaking havoc overseas. This, in turn, makes it more difficult for money managers to maintain much in the way of emerging market or developed international market exposure.

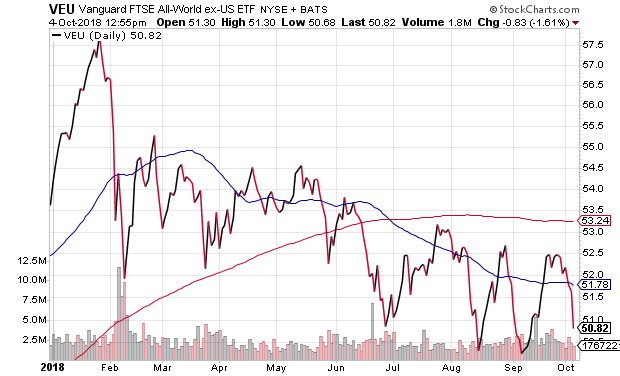

Take a look at the performance and the trend for Vanguard FTSE All-World Ex U.S. (VEU). Raise your hand if you really believe that increasingly restrictive monetary policy is having very little effect on asset prices?

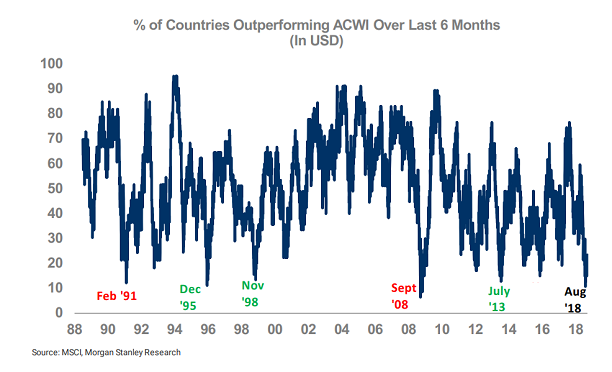

Morgan Stanley recently demonstrated that the percentage of countries outperforming the all-world index (ACWI) is near historic lows. What is the significance? Extremes correct themselves.

One possibility is that international stocks will recover in dramatic fashion. The other? The U.S. stock market craters such that it comes back in line with foreign equities.

Bottom line? As rate policy becomes more and more restrictive, and as the effects of tax reform fade, a variety of headwinds for U.S. stocks will become more apparent.

Here is a short list:

(1) Buybacks will no longer be a major factor in bolstering the fortunes of the broader U.S. stock market.

(2) Corporations with unattractive debt profiles will be called to the carpet, adversely affecting the prices of their high-yielding bonds as well as their stocks.

(3) The investment community will begin to question stratospheric stock valuations, as the low-rate "justification" defense disappears altogether.

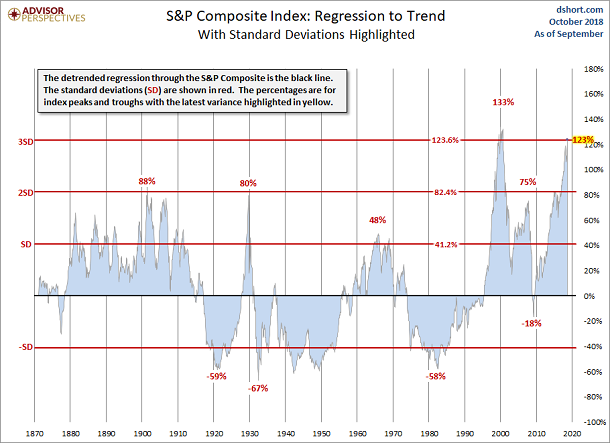

Remember Richard Russell's admonition. He wrote: "The surest rule in the stock market is… 'regression to the mean.'" Now consider the rare nature of a three sigma event (three standard deviations) and ask yourself if U.S. stocks are not getting closer to a period for bearish reconciliation.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.