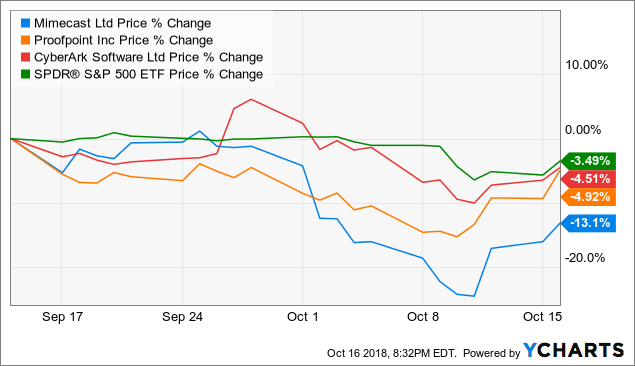

The recent correction in the market, especially seen within the technology sector, has provided a wealth of buying opportunities for opportunistic investors. One of these opportunities include Mimecast (MIME). MIME was down ~25% at the absolute low; however, it has recovered slightly over the past few days. Nevertheless, the recent correction provides a great entry point for investors who remain bullish on the long-term viability of the email security market.

MIME data by YCharts

MIME data by YCharts

The broader technology market was down big time over the past two weeks as the market experienced a small correction. Though some of these names have recovered over the past few days, I remain bullish on the email security leaders, Proofpoint (PFPT) and especially MIME. They recently reported strong Q1 results on top of two recent acquisitions, remaining one of the leaders in the email security market.

MIME data by YCharts

MIME data by YCharts

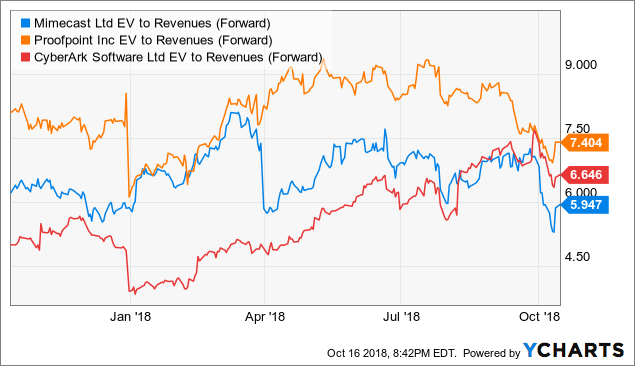

Over the past month, the S&P 500 has been down ~3.5%. The two other main competitors in the email security market, PFPT and CyberArk (CYBR), have been down ~4.5-5%. However, MIME remains an outcast of the group, declining over 13% in the same time frame. Though much of its correction is related to its relatively high revenue multiple, its valuation remains below the perceived market leader, PFPT, and the recent correction and slow recovery provides investors a great opportunity to buy shares on sale.

Q1 Earnings and Recent Acquisitions

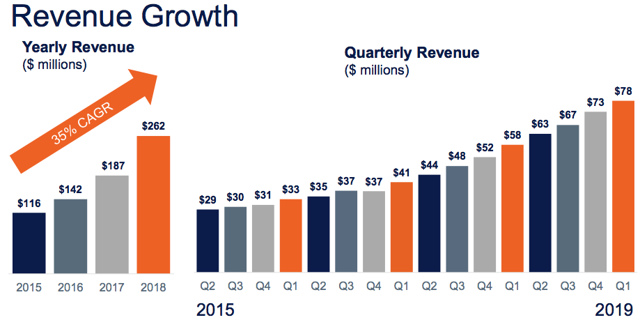

Revenue for Q1 grew 35% to $78 million. This compares to FY18 revenue growth of 40% to $262 million. Since 2015, MIME’s revenue has grown from $116 million to $262 million, representing a 35% CAGR. The consistently high revenue growth continues to remain impressive and the potential for further margin expansion provides an even greater earnings opportunity.

Adjusted EBITDA grew to $10 million, representing a 12.7% margin, up from 8.8% a year ago. As MIME continues to grow its top line and maintain its gross/operating margins, adjusted EBITDA will continue to grow. This gives the company additional flexibility when it comes to acquisitions. The email security market is constantly changing in order to match hackers’ adaptations. These two forces constantly battle against each other, and successful email security companies have the ability to invest in their company to improve their underlying technology and security platform.

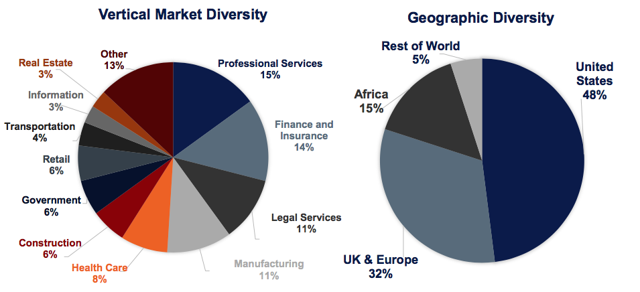

(Source: Company Presentation)

Management also provided guidance for both Q2 and FY19. For the second quarter, management sees revenue growing 28-29% in constant currency to $80.4-81.2 million (this takes into account a $0.2 million currency headwind). Without this headwind, guidance would be for ~30% revenue growth. Adjusted EBITDA is forecasted to be $9.6-10.6 million, representing a 12.5% adjusted EBITDA margin at the midpoint.

For the full year, management is expecting revenue to grow 26-29% in constant currency to $329.0-335.9 million (this takes into account a $1.2 million currency headwind). Without this headwind, guidance would be for ~27-30% revenue growth. Though this is slightly below the company’s 35% revenue growth CAGR since 2015, FY19 faces tougher comps due to FY18’s growth of 40%. Adjusted EBITDA is forecasted to be in the range of $47.7-49.7 million, representing a ~14.5% adjusted EBITDA margin.

(Source: Company Presentation)

In addition, management provided a sneak peek into MIME's long-term model. This includes revenue of $350-450 million during the next 3-5 year span, gross margins of 72-75%, and adjusted EBITDA of 20-22%. With F19 revenue guidance of $329.0-335.9 million, the long-term revenue model does not seem terribly difficult to achieve. In addition, gross margins have historically remained in that 72-75% range. Adjusted EBITDA margin will continue to expand as the company’s revenue growth matures and S&M expenses begin to go down.

Earlier in July, MIME announced its acquisition of Ataata, a leader in cybersecurity training and awareness. This acquisition was well needed, as PFPT recently acquired Wombat Security for $225 million. Wombat is another leader in the cybersecurity training and awareness market as email security companies look to transition their focus on employee training.

As hackers continually transform their process of getting into an enterprise’s infrastructure, there continues to remain one weak point: employees. Email has become the largest vector of attack for hackers, utilizing methods such as phishing and spoofing in order to breach into data. Employees are also becoming more mobile though cell phones, laptops, tablets and more, which places a greater emphasis on being able to properly train employees on the basics of email security.

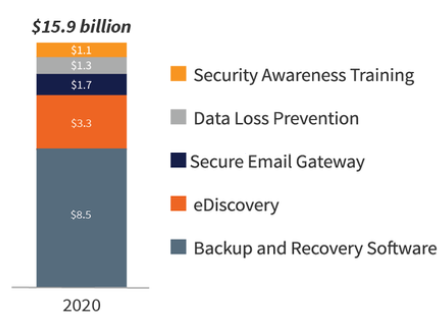

After PFPT acquired Wombat, it was inevitable that MIME would need to replicate an entry into the cybersecurity training and awareness platform in order to remain competitive in this market. The acquisition of Ataata did just that. MIME believes the TAM related to cybersecurity training and awareness could grow to more than $1.5 billion by 2021, a significant area of growth potential (Source: Company Press Release).

(Source: Company Presentation)

The more recent acquisition MIME made was with Solebit for ~$88 million. Solebit is a leader in threat detection technology, enhancing security for customers to be able to detect and prevent cyberattacks, zero-day threats and malware across email and the web in real time. This acquisition will further enhance MIME’s product offering platform; customers now on average utilize 3.0 offerings compared to 2.8 offerings last year. MIME also noted that “more than 80% of organizations have been both targeted and untargeted phishing attacks increase or stay the same over the last year” (Source: Company Press Release). This acquisition will provide another layer of protection against these attacks, as hackers constantly adapt their methods and look for alternative ways to breach an enterprise’s security defense system.

Valuation

MIME's valuation has taken a big hit over the past few weeks, now trading at a discount to CYBR, something that has not been true since July 2017 for a few months after MIME went public. Business fundamentals have not changed an in fact, with heightened regulations occurring in Europe, known as GDPR, there has been an increased focused on a company's security and data protection. With no underlying change in fundamentals, I question if MIME's correction is an overreaction.

MIME EV to Revenues (Forward) data by YCharts

MIME EV to Revenues (Forward) data by YCharts

MIME’s 98% recurring revenue, along with its 70%+ gross margins, gives investors great insight into future revenue growth and cash flow. Its two other main competitors, PFPT and CYBR, have similar qualities, which gives all of them a valuation based on forward revenue.

FY18 revenue was $262 million. Using the low end of management’s FY19 guidance range of $329 million would result in a growth rate of 26%. Given Tuesday’s closing price of $36.81, Q1 shares outstanding of 62.6 million, and net cash of $149.5 million, MIME currently has an enterprise value of $2.15 billion. If we use management’s low-end guidance of $329 million, MIME trades at a FY19 revenue multiple of ~6.5x. To further extrapolate this, let’s say its revenue growth decelerates to 20% y/y. This would mean FY20’s revenue would be ~$400 million, which is also within management’s long-term model’s revenue range of $350-450 million over the next 3-5 years. This would mean MIME is trading at a ~5.4x FY20 revenue multiple, a significant discount to both PFPT and CYBR.

MIME currently trades at a ~1 turn discount to CYBR, a rarity in terms of the valuation discount. I believe MIME is more deserving of a premium valuation compared to CYBR, though not as high as PFPT. Assuming MIME's core business fundamentals remain strong and its two recent acquisitions prove to be accretive, MIME stands to further penetrate the email security and training/awareness market, establishing themselves as one of the clear leaders.

Assuming MIME were to trade at the same multiple as CYBR, the target stock price would be ~$41, over 10% upside to Tuesday's closing price. However, this valuation difference should close over time, and as MIME continues to grow at mid-30s top line and expand its margins, its valuation should trade at an even further premium, thus providing further upside.

Risks to MIME include increased competition among not only PFPT and CYBR, but any new entrants into the market. The company noted that over 30% of its customers use O365, which could present another risk if Microsoft (NASDAQ:MSFT) built its own email security platform to be embedded within Office 365. Another risk for MIME is its valuation. Since it trades at a premium revenue multiple compared to the market, a correction in the technology sector for premium names could cause increased adversity, as recently seen.